Polymer demand scenarios: a little more conversation, a little less plastic

The impact of drivers that could accelerate sustainability initiatives on polymer demand compared to Wood Mackenzie’s base case long-term outlook using our proprietary Materials Application Platform

3 minute read

Sandheep Sebastian

Principal Data Scientist

Sandheep Sebastian

Principal Data Scientist

Sandheep brings 10 years of experience as a Principal Data Scientist working in the Polymer Demand team.

Latest articles by Sandheep

-

Opinion

Plastic demand could reduce by up to 30% in an accelerated energy transition scenario

-

Opinion

Plastic demand: sectoral overview

-

Opinion

Why the world needs global rules on polymer use

-

Opinion

The future of automotive industry polymer demand

-

Opinion

Polymer demand scenarios: a little more conversation, a little less plastic

David Buckby

Senior Analyst, Films & Flexible Packaging

David Buckby

Senior Analyst, Films & Flexible Packaging

David has almost a decade of experience in strategic market research and consultancy.

Latest articles by David

-

Opinion

Plastic demand could reduce by up to 30% in an accelerated energy transition scenario

-

Opinion

Polymer demand scenarios: a little more conversation, a little less plastic

-

Opinion

Will the EU’s flagship packaging legislation be transformative?

-

Opinion

Five pieces of the circular packaging puzzle

Matt Slutzker

Principal Analyst, PET/RPET

Matt Slutzker

Principal Analyst, PET/RPET

Matt covers PET and RPET in the Americas, analysing dynamic regional markets.

Latest articles by Matt

-

Opinion

Why the world needs global rules on polymer use

-

Opinion

Polymer demand scenarios: a little more conversation, a little less plastic

-

Opinion

Can imports solve the plastic recycling challenge?

Rob Gilfillan

Head of Polymer & Fibres

Rob Gilfillan

Head of Polymer & Fibres

Rob leads our research into regional and global markets for fibres, films and flexible packaging.

Latest articles by Rob

-

Featured

Oils & chemicals 2025 outlook

-

Opinion

Plastic demand could reduce by up to 30% in an accelerated energy transition scenario

-

Opinion

Plastic demand: sectoral overview

-

Opinion

The future of automotive industry polymer demand

-

Opinion

Polymer demand scenarios: a little more conversation, a little less plastic

-

Featured

Global challenges weigh on downstream chemical markets in 2023

Recent legislative efforts have set new targets and timelines for sustainability initiatives. The United Nations (UN) has published a draft of its global plastics agreement with broad initiatives to mitigate the effects of plastic pollution on a global scale. Key focus areas include packaging design, post-consumer recycled materials, extended producer responsibility and alternative materials. And while the UN continues to develop the framework, the European Commission’s Packaging and Packaging Waste Directive (PPWD) has outlined ambitious targets for 2040 with regard to waste reduction, recyclability and the reusability of single-use packaging.

In a recent insight, entitled Polymer Demand Scenarios in Global Single-Use Packaging Redesign and Reduction, Wood Mackenzie used its proprietary Material Applications Platform (MAP) to model the impact of end-use application trends on the single-use primary packaging sector. Our MAP model forecasts segment growth by packaging application and by polymer to 2040 and functions as the base case for our long-term outlook.

In addition to expected increases in post-consumer content, recyclable packaging and legislative initiatives, our polymer demand insight draws on our accelerated waste-reduction model to outline plausible reductions in plastic packaging waste in Europe, North America, Asia and the rest of the world compared with PPWD targets.

Fill in the form to receive a complimentary version of our polymer insight and, in the meantime, read on for a brief overview.

Our base-case polymer demand scenario

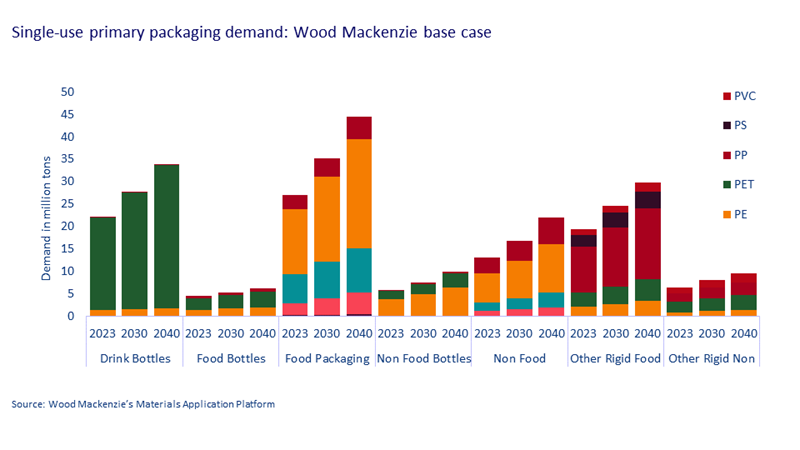

According to the Wood Mackenzie base case, global total demand for single-use primary packaging is likely to reach 156 Mt by 2040 at a compound annual growth rate (CAGR) of 2.7% from 2023 to 2040, with Asia poised to grow fastest.

China leads polymer demand growth for both polyethylene terephthalate (PET) and polyolefins. Bottles and other rigids are the fastest-growing PET demand segments, while demand for film-based packaging could drive polyolefin growth into 2040.

Under our base-case scenario, global PET resin consumption is set to grow to 47 Mt and polyolefin packaging demand to 81 Mt by 2040, with CAGRs of 2.6% and 2.8%, respectively, between 2023 and 2040. PET and polyolefin long-term demand growth is supported by demand from Asia, predominantly China and India, where urbanisation and a growing middle class are driving consumption. PET demand in China is expected to almost double to 13 Mt by 2040, similar to Chinese polyolefin demand, which is set to grow to 32 Mt.

Inventory issues, weak demand and contract volumes have affected polymer demand from packaging in Europe and North America, where PET year-on-year demand has fallen 6% and 2%, respectively, in 2023. Polyolefin demand has dropped 2% in Europe and 0.4% in North America. A recovery is expected in 2024, leading to a higher CAGR in the 2023-25 period.

The PPWD, coupled with extended producer responsibility schemes in some Latin American countries and the US, is leading to a greater focus on sustainability, which could impact future polymer demand.

Our global multi-factor waste-reduction scenario

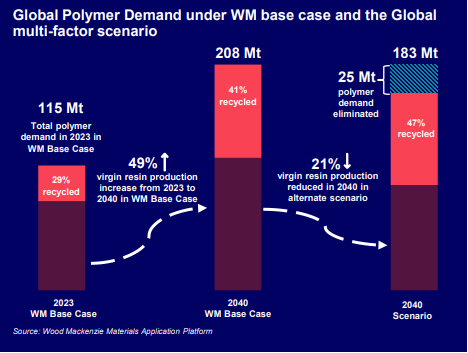

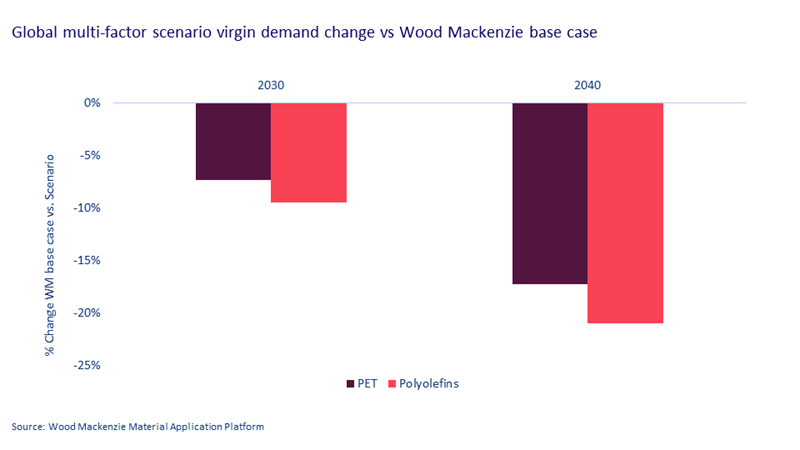

Our accelerated waste-reduction model makes use of ten key factors – mechanical recycling, brand commitments, packaging recyclability, legislation and bans, lightweighting, bio-based materials, material substitution, carbon footprint, reusable and refillable packaging, and chemical recycling ‒ also incorporating their regional impact and probability. This multi-factor scenario shows that a 21% decline in virgin polymer demand is feasible on a global basis in 2040 compared with our base case. What’s more, potential exists for a 6% increase in recycling and the elimination of around 25 Mt from all polymer demand in 2040.

While there are numerous drivers that could minimise the impact of plastics pollution, there is no one strategy that can be applied broadly, be it regionally or globally. Unique solutions will vary according to geographical, social and economic viability. Even so, the uncertainty of specific drivers will play into demand reductions. Chemical recycling, for example, faces scalability challenges today but may evolve rapidly to result in a larger demand loss. This would dampen the effects of mechanical recycling and bio-based materials, meanwhile.

Regionally, Europe is set to see the greatest demand loss, with a 46% reduction by 2040 under our accelerated scenario. Achieving consensus within the EU will prove challenging, though. Outside of the EU, there is great potential for further reductions based on the sheer volume of polymer demand. However, legislative initiatives and infrastructural developments will come up against significant hurdles when it comes to achieving meaningful progress on a global scale.

Fill in the above form to gain further insight into our polymer demand outlook to 2040.