Plastic circularity: how much will recycled plastics displace oil-based feedstock?

Chemical recycling is one route to a more circular plastics economy, with increasing interest in leveraging pyrolysis technology to produce feedstocks

2 minute read

Darryl Xu

Principal Analyst, APAC Chemicals

Darryl Xu

Principal Analyst, APAC Chemicals

Darryl specialises in aromatics, and manages our global paraxylene and benzene/styrene research in Asia.

Latest articles by Darryl

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Will Shell exit Pulau Bukom?

-

Opinion

Plastic circularity: how much will recycled plastics displace oil-based feedstock?

-

Opinion

Petrochemical feedstocks: three global trends to watch

As oil demand growth into petrochemical feedstocks continues, another trend is emerging – circular feedstocks. The boom in plastics demand, especially low-cost single-use material, has led to increased environmental issues pertaining to their disposal. The problem of plastic waste is being tackled on multiple fronts – from chemicals producers to brand owners – all with commitments to ramp up recycling efforts.

Chemical recycling is one approach, with an increasing percentage of the output geared towards the olefins industry as steam cracker feedstock. And this could have a significant impact on virgin feedstock demand.

We explored this topic in a new report from our Petrochemical Feedstocks Service. Fill in the form to download the report, and read on for an introduction.

Chemical recycling is one route to a more circular plastics economy

Chemical recycling of waste plastic is not new technology. Numerous small-scale industry players are using pyrolysis technology to thermally degrade plastic waste and convert it into fuel (mainly diesel and fuel oil). With advancements in pyrolysis technology, along with a greater understanding of the type of waste plastic feed used, the output is increasingly being incorporated by major petrochemical producers as feedstock to produce olefins.

The output pyrolysis oil, with appropriate hydrotreatment, can be sent into steam crackers together with crude oil-based feedstocks. This enables the production of circular olefins, which are then converted to various polymers.

Much of this effort has been driven by increasing demand from consumer brands for recycled content, prompted by regulatory requirements (mainly in the EU) and commitments made to stakeholders.

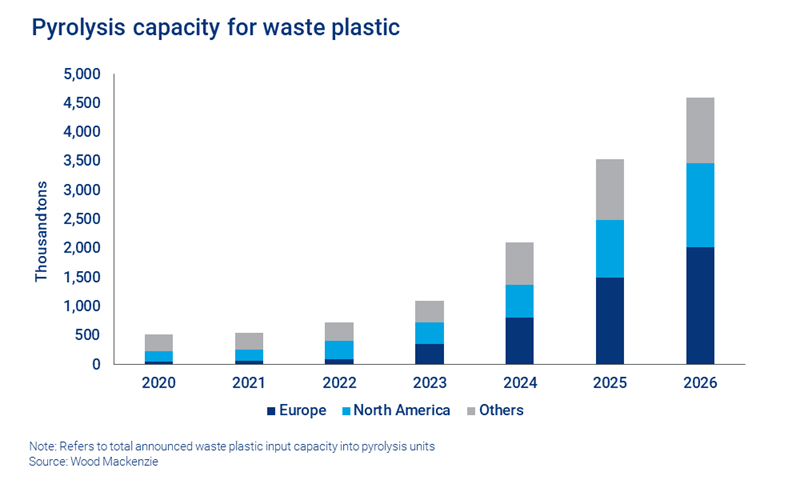

Growing interest in pyrolysis oil projects

As pyrolysis technology develops and matures, we expect more volumes of pyrolysis oil to be available to not just European olefins producers, but also olefins/polymer producers outside of the EU targeting exports of recycled resin into the EU. Changes in legislation in other regions could also drive faster development of circular production routes.

Growth in pyrolysis oil demand into olefins production displaces virgin feedstock demand. Over 300 million tons of oil-based feedstock is currently consumed into steam crackers annually. If 5% of that is replaced by pyrolysis oil, it represents a 370 kbd reduction in oil demand – the equivalent of one world-scale refinery’s throughput.

Many questions remain. Will there be sufficient circular feedstocks to meet the EU’s ambitious targets for minimum recycled content in packaging? Where will new pyrolysis oil supply be developed and where will demand for circular feedstock grow? Our report, Circular Feedstocks in the plastics sector, tackles this topic in more detail.