Could energy recovery solve the mounting problem of global waste?

With 70% of global landfill suitable for energy recovery, there is potential for serious growth in waste-to-energy (WtE) industries

5 minute read

Jom Madan

Senior Research Analyst, Scenarios & Technologies

Jom Madan

Senior Research Analyst, Scenarios & Technologies

Jom works on scenario modelling for country and global-level energy mixes across all major energy commodities

Latest articles by Jom

-

Opinion

Energy transition outlook: Middle East

-

Opinion

Energy transition outlook: Asia Pacific

-

The Edge

The coming low carbon energy system disruptors

-

Opinion

How the MENA region and its NOCs are diversifying into new energies

-

Opinion

Bioenergy: a US$500 billion market opportunity

-

The Edge

How the world gets onto a 1.5 °C pathway

Global waste is piling up. With a steady increase of 1.55% per year, annual refuse volumes are expected to swell from 2.4 billion tonnes (Bt) in 2022 to 3.4 Bt by 2050. It’s wreaking havoc on the environment – but it’s also leaving a valuable energy resource untapped.

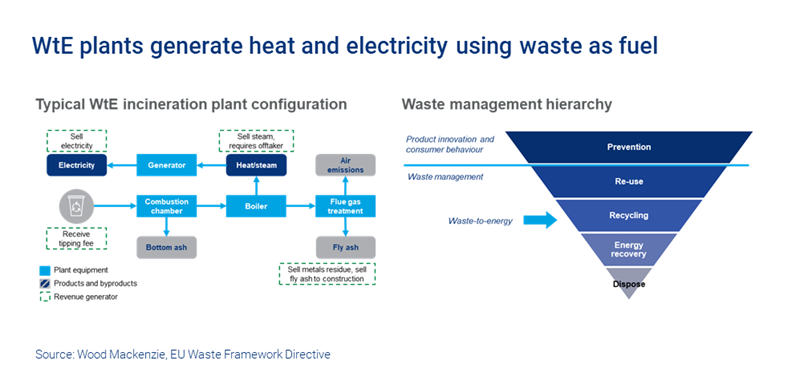

Converting waste into energy sources (WtE) seems a promising approach. Not only do processing plants reduce the volume of the waste that ends up in the ground by 90%, they can produce plenty of fuel and minimise environmental damage, too. Our new report Waste to energy landscape: projects, technologies and costs outlines the global WtE market outlook for 2050, how changing policies might affect key markets and which technologies could yield clean power.

Fill in the form to access a complimentary extract from the report, and read on for an introduction.

Waste is a largely untapped energy resource

Today’s waste management systems are inadequate for dealing with the volumes being generated around the globe. However, we expect WtE to become more significant in the coming decades. The potential for growth is startling: 70% of the global waste that’s currently bound for dumps and landfills is suitable for materials and energy recovery. Were all of today’s waste to be processed for energy, the amount recovered would be similar to solar power generation. But at the moment we are only tapping into 11% of this vast storehouse.

As WtE technologies are adopted worldwide, and government policies adapt, we may see up to 50% of waste recovered for energy by 2050 – 63.5 million tonnes of oil equivalent (mtoe). The picture varies around the world, however, and while progress is stalled in some countries, a new wave of growth is taking place in others. In APAC, for example, policymakers are exploring WtE in an effort to counter the ecological and health effects of landfilling and open dumping.

Regional approaches and challenges to WtE

With an urgent need to tackle waste management in the coming years, tightening land constraints, a focus on circularity and bans on importing waste, governments around the world are building out domestic WtE capacity.

The type of waste varies between regions, with both the volume and energy value increasing with economic development. Higher income regions tend to produce less wet food waste and more packaging and plastic, while organic waste dominates in poorer places.

In the developing world, landfill or open dumps account for 96% of disposal, compared to just 2% in wealthier countries.

Jom Madan

Senior Research Analyst, Scenarios & Technologies

Jom works on scenario modelling for country and global-level energy mixes across all major energy commodities

Latest articles by Jom

-

Opinion

Energy transition outlook: Middle East

-

Opinion

Energy transition outlook: Asia Pacific

-

The Edge

The coming low carbon energy system disruptors

-

Opinion

How the MENA region and its NOCs are diversifying into new energies

-

Opinion

Bioenergy: a US$500 billion market opportunity

-

The Edge

How the world gets onto a 1.5 °C pathway

And there are regional differences in waste treatment methods, too. In the developing world, landfill or open dumps account for 96% of disposal, compared to just 2% in wealthier countries.

The differences are not always along economic lines. Despite its wealth, only 13% of the US’s municipal solid waste (MCW) is currently used for energy recovery, with more than half (53%) being landfilled. In our analysis, market growth potential for the US is therefore negative; there is a lot of land available and very little incentive not to fill it with waste.

The UK is a better bet, with rapid growth in projects across the country, supported by high WtE tipping fees, feed-in tariffs, and collection infrastructure. Asia is enjoying a new wave of growth in WtE thanks to policy changes, and China has the most potential in Asia. In fact, China has set a target for 50% of its waste disposal to be WtE by 2030, and its government is subsidising projects generously.

As one would expect, countries with land constraints, such as Netherlands, Denmark, Japan and Singapore, tend to also have landfill taxation and subsequently much higher rates of incineration. Interestingly, Denmark also has a high incineration tax, and almost half of its waste is recycled.

Local backlash to WtE infrastructure remains a challenge. While Indonesia’s government had set a target for 200 MW WtE capacity by 2022, coupled with feed-in tariff (FiT) support, public opposition has resulted in a supreme court ban.

A variety of possible outputs

A wide range of energy options are possible with WtE technologies. Biogas can be captured from bacterial degradation of organic matter in landfill at low cost, for instance, and processed into renewable natural gas (RNG). Incineration of raw solid waste can heat and in turn generate power, and the ash can be used by the construction industry. Solid waste can be turned into combustible fuel pellets, maximising calorific value homogenising combustion properties.

This ‘refuse-derived fuel’ (RDF) is used across many industries as a drop-in low-carbon substitute for fossil fuels, with potentially exciting implications for the energy transition.

For an overview of the energy products WtE facilities can yield, fill in the form to download the report.

Getting there: WtE costs and challenges

WtE projects are immensely expensive to set up. Nevertheless, 20 GW of municipal WtE capacity is already installed, and we expect this to increase to 142 GW by 2050 to handle the increased volumes of waste. The installed asset base is worth about US$180 billion. By 2050, we expect this value to rise to US$1.3 trillion.

Our report looks at six different WtE technologies. We found incineration – which currently dominates – to be the most favourable option for large-scale waste management, given its high processing capacity and baseload potential. However, incineration is still mainly within the domain of higher-income countries, as landfilling and open dumping remain the cheaper options.

A number of things could change in the coming decades, with implications for WtE. Policies and cultural changes could have significant impacts on the waste management industry. If consumer preferences evolve in a region, for example, the composition of waste will be altered, requiring changes to processing equipment or energy products.

Similarly, if more waste is diverted to recycling, we could see a reduction in the value and volume of what’s left. New environmental policies could bring in stricter emissions standards, resulting in expensive equipment changes. And if affordable technologies emerge that are able to control waste volume while offering superior pollution control to landfills, expensive new WtE plants won’t seem as appealing.

The overall outlook is positive

Around the world, countries are facing similar issues. There is an urgent need to adapt to growing waste and escalating emissions, a reduction in readily-available acreage for landfill or open dumps – and waste import bans, forcing the problem to be dealt with domestically. WtE appears to offer an inspiring solution; clean energy as an output of waste reduction.

Waste to Energy, Landscape: Projects, Technologies and Costs draws on insight from our Energy Transition Service. The full report takes a detailed look at the market projection and clean power technologies, and a breakdown of the economics with case studies.