Get Ed Crooks' Energy Pulse in your inbox every week

Rising oil prices test US producers’ willpower

WTI above $50 means US E&Ps can hold production flat while paying down debt. But will they be tempted to go for growth?

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

The sirens in Homer’s Odyssey sing so beautifully that passing sailors can be lured to their deaths, and have to plug their ears with wax to pass by safely. As oil prices recover, US E&Ps are facing a similar test. Helped by Saudi Arabia’s decision to cut oil production by 1 million barrels a day in February and March, crude prices have risen to their highest levels since February last year.

Benchmark West Texas Intermediate crude rose to just below $54 a barrel this week, and was trading at close to $53 a barrel on Friday morning. The rebound is an enticement to ramp up activity quickly and accelerate production growth. The coming year will reveal whether management teams can resist that temptation.

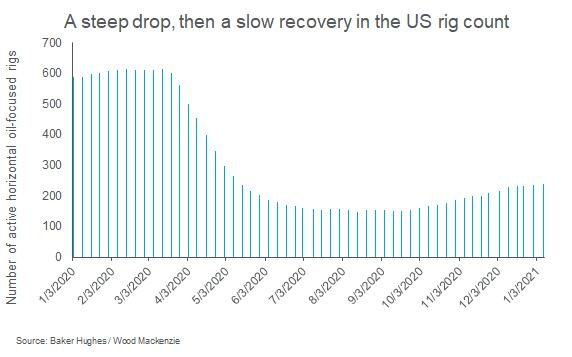

The brakes were slammed on the US oil industry last year as the Covid-19 pandemic hit and crude prices plunged. The number of horizontal oil-focused rigs active in the Lower 48 states dropped from 614 in mid-March to a low of just 147 in August, according to Baker Hughes.

With drilling and completions both slowing sharply, US oil production slumped. Output from the Lower 48 dropped from 10.3 million b/d in the first quarter of last year to about 8.9 million b/d today. And although activity has started to recover, it is coming back only slowly. The horizontal oil rig count has crept higher, reaching 239 last week, but it is still well below what it was before the pandemic, and lower than the 400+ that the industry needs to keep production flat.

Many US E&Ps have indicated to investors that they are aiming to keep production level this year. Richard Dealy, chief operating officer of Pioneer Natural Resources, told The Wall Street Journal this week: “I don’t think the world really needs the oil at this point in time, so there’s not a big reason to grow”.

Even stabilising production means that activity will have to continue to increase. Hess said last week it was thinking of adding an additional rig to the one it has working in the Bakken formation; a step Wood Mackenzie estimates it will need to take to hold its production level. But we expect the general ramp-up in activity in the US to be cautious, with tight oil production continuing to decline into the second half of the year.

That strategy of restraint would be welcomed by many investors. A group of 20 leading E&Ps would be able to keep production flat by reinvesting just 70% of their cash flows, given $50 WTI, Wood Mackenzie research found last year. The remainder of the cash would be available to be returned to shareholders or reduce debt.

That prospect has helped drive E&P shares higher, with the S&P oil and gas E&P select industry index rising 80% from its trough last October. The crucial question now is whether management teams can stick to that capital framework, and resist the siren songs luring them towards an accelerated ramp-up in activity and production growth.

There are good reasons to maintain their discipline. Even in the flat production scenario sketched out above, almost all the E&Ps would take more than 2.5 years to bring their debts down to a healthy level of about 20% gearing. And although oil demand prospects look better as vaccination rates rise, there will still be more than 8m b/d of curtailed production from OPEC+ members looking for an opportunity to come back on to the market.

Yet despite all the compelling arguments for restraint, the industry’s history suggests that increased cash flows generally get turned very quickly into new wells.

Pressure from investors means that we are in a new era for E&Ps, in which “the strategic imperative is to deliver cash to shareholders through the cycle”, say Wood Mackenzie’s David Clark and Alex Beeker. This year will test how well the industry can respond to that demand.

Equinor sets its course into US wind

When Equinor announced its change of name from Statoil in 2018, its chairman Jon Erik Reinhardsen said: “The biggest transition our modern-day energy systems have ever seen is underway, and we aim to be at the forefront of this development.” This week there was a coincidental juxtaposition that underlined how it is evolving from Norway’s national oil and gas company into a broad energy group.

On Wednesday, the Norwegian business daily Dagens Naeringsliv reported that Equinor was considering selling its Bakken tight oil assets. The company is reviewing its entire portfolio as it develops its renewable energy business, and asset sales are a possible outcome of that review.

On the same day, Equinor was selected for the largest offshore wind power award so far in the US. With its partner BP, it will supply about 2.5 gigawatts to New York state from two offshore wind projects, Empire Wind 2 and Beacon Wind 1. It already has a contract for 816 megawatts from Empire Wind 1.

Anders Opedal, Equinor’s chief executive, described the US East Coast as “one of the most attractive growth markets for offshore wind in the world”, and said the successful bids from Empire Wind 2 and Beacon Wind 1 “represent a game-changer for our offshore wind business in the US”.

Offshore wind could account for up to 20% of total group investment over the next 10 years, and provide up to 30% of overall cash flow in the 2030s, according to estimates from Wood Mackenzie analysts.

In brief

Spot prices for LNG have continued their dizzying ascent in Asia, with a report of one transaction at a price of over $39 per million British Thermal Units. On an energy-equivalent basis, that is about the same as $230 for a barrel of crude. Over the past nine months, north Asian spot LNG prices have risen 18-fold, even outpacing Bitcoin. Relief for hard-pressed consumers may be in sight, however: weather forecasts suggest the current cold spell in much of Asia will be ending soon, easing demand for gas.

Solar and wind power will together account for about 70% of the new power generation capacity added in the US, with a further 11% supplied by batteries, according to the government’s Energy Information Administration. The remainder is expected to come largely from gas-fired generation. There is also a historic moment approaching, with the first new nuclear capacity in the US in decades, Unit 3 at the Vogtle power plant in Georgia, scheduled to enter service in November.

The “number one objective” of the COP26 climate summit in Glasgow in November will be to get the countries of the world to set a goal of net-zero emissions by 2050, the British prime minister Boris Johnson has said. That would require significant policy changes from some countries. While the EU, the UK, Japan, and South Korea have already set net-zero goals for 2050, and President-elect Joe Biden wants to do the same for the US, China is aiming for net zero by 2060. Other large economies including India have not committed to any such net-zero goals.

Meanwhile, the British government has been defending its decision to allow the country’s first new deep coal mine in 30 years to go ahead.

The Norwegian government is looking at shifting from deep-water oil and gas production to deep-water mining for copper, zinc and other metals, including cobalt.

Citi has published a second report on following the recommendations of the Task Force on Climate-Related Financial Disclosures. The 58-page report is full of interesting details, including a discussion of how the bank has conducted a climate scenario modeling exercise focused on the oil and gas sector, and in particular on E&P companies. The scenario modeling was used “to test the resilience of our portfolio to global carbon pricing risk arising from increasing regulatory intervention to reduce emissions”.

Henry Paulson, the US Treasury secretary at the time of the Great Financial Crisis of 2007-09, is returning to the finance industry to become executive chairman of a new global fund, TPG Rise Climate, which will invest in low-carbon businesses in sectors including renewable energy, electric vehicles and the power grid. He was approached about the job by Bono, lead singer with U2, who is on the founders’ board of the Rise Fund, TPG’s impact investing arm. Rise this week announced an investment in renewable natural gas, an industry that has been attracting growing interest in the US, as discussed in last week’s Energy Pulse.

And finally: a fascinating slice of energy history. The world’s first energy utilities were set up in Britain at the beginning of the 19th century to supply manufactured gas, often known as “town gas” or “coal gas”, initially for lighting but later for domestic and industrial heat. Historic England has published some very interesting research on the industry, from its experimental origins in the 1790s to the restructuring of the privatised British Gas businesses in the 2000s. There are also extensive supporting materials including detailed diagrams of the process and a listing of companies that produced gas equipment. Worth reading for anyone thinking about how the lessons of past energy transitions can help us understand today’s changes. Thanks to Rose Galloway Green for pointing it out.

Other views

Gavin Thompson — 2021: Cheerful or fearful?

Gas and LNG: Why 2021 will be a defining year

Proceed with caution: exploration’s watchword for 2021

John Kemp — Big freeze exposes Asia’s underlying energy crisis

Clyde Russell — China's ban on Australian coal forces trade flows to realign

Bassam Fattouh — Saudi oil policy: continuity and change in the era of the energy transition

Alexander Kaufman — Should we spend $1 trillion a year on this climate technology? We may have to

Quote of the week

“The green agenda, the whole green industrial revolution, is not just a load of green nonsense, as people sometimes seem to suggest: extra costs for businesses and for families. If you do it right, it is the opportunity to generate hundreds of thousands of jobs for this country.” — Boris Johnson, the British prime minister, told MPs that he was becoming “more and more obsessed” about the potential for using the fight against climate change to help the economy recover from the Covid-19 pandemic, creating jobs in industries such as wind power and batteries.

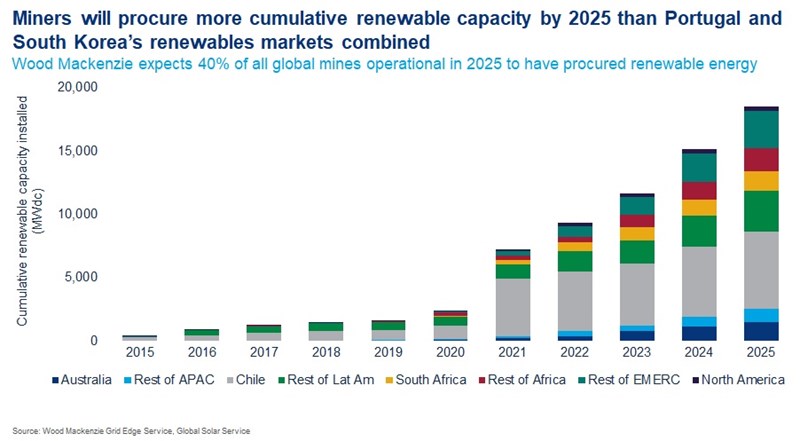

Chart of the week

This comes from a report we published last month, on mining companies’ procurement of renewable energy. A global transition towards lower-carbon energy will need significantly increased production of some metals, while at the same time mining companies are under pressure to reduce costs and cut their own greenhouse gas emissions. The result is that the use of renewable energy in the mining industry is likely to grow rapidly. By 2025, 40% of all mines operational worldwide are expected to have procured at least some renewable energy, with Chile, Australia and South Africa the biggest markets.