Scope 3 considerations in metals and mining investment

Which companies will find it easier to tackle value chain emissions in metals and mining? We explore how companies’ portfolios impact their ability to reduce scope 3 emissions, and what to consider when making investment decisions in metals and mining; from the barriers to collaboration to assessing transition risk and reward within the supply chain.

3 minute read

James Whiteside

Head of Corporate, Metals & Mining

James Whiteside

Head of Corporate, Metals & Mining

With 15 years of experience in the metals and mining industry, James leads our corperate coverage.

Latest articles by James

-

Opinion

The end of capital discipline in mining?

-

The Edge

Big Mining pivots to copper for growth

-

Featured

Metals & mining 2025 outlook

-

Opinion

Battery power play: countercyclical opportunities in raw materials

-

Opinion

Copper rush: A strategic analysis

-

Opinion

PPAs: transforming miners’ decarbonisation strategies

Driven by changing climate policy and concerns about climate change risks, leading mining companies have adopted net zero goals to be achieved by 2050 or earlier. However, there is still a lack of agreement around Scope 3 emissions reduction targets.

In our recent whitepaper, ‘Unearthing a pathway to supply chain net zero’, we explored Scope 3 factors for consideration in making investment decisions in metals and mining.

Fill out the form on the right to download a free extract from ‘Unearthing a pathway to supply chain net zero’, or read on for a summary of some of the key factors you should consider as a metals and mining investor.

Reducing producers’ and downstream partners’ emissions

Even those commodities central to transition end uses will face some transition risk from higher carbon prices. This risk, in contrast to existential threats to hydrocarbons, can be mitigated through the decarbonisation of producers’ and their downstream partners’ emissions.

But herein lies the challenge with scope 3 emissions in the mining industry: the vast majority of emissions sit with the downstream metals producers – separate from the miners themselves. Finding a way for the industry to tackle their customers’ emissions is imperative.

It’s worth noting that the mining industry has a climate mitigation track record that is often ahead of the of other industries. This is driven by carbon tax legislation in some regions, differences in commodity demand as compared to their ‘ease’ of decarbonisation, and a recognition of operational vulnerabilities to climate change.

Scope 3 targets are hindered by a lack of recognised, comprehensive pathways

Scope 3 targets are often hindered by a lack of recognised, comprehensive pathways. For example, in terms of messaging, the objective is to achieve ‘Paris alignment’. But for most metals, the broad Glasgow-adopted IPCC pathway is the only recognised pathway. This would apply to nickel, copper, lead, PGMs and more – metals with vastly different value chain emissions and demand outlooks.

These are some of the strategies being pursued by the major mining companies at the moment:

- Technology development

- Transition-focussed pivot (including M&A)

- In-house offsets

- Supply chain optimisation

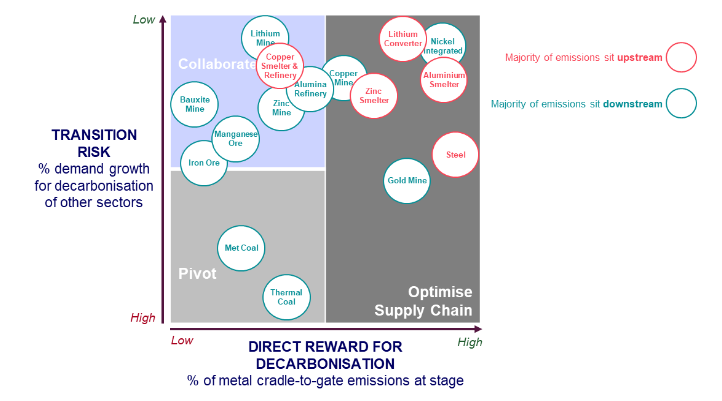

Segmentation based on risk and reward within each value chain can guide scope 3 strategy

Stakeholders recognise the different pace of ambition and approaches to tackling scope 3 emissions. We propose a framework to derive the optimal strategy for each commodity based on the transition risk-reward dynamics.

Transition risk is gauged by assessing the extent to which a commodity’s demand is exposed to the potential upsides and downsides of an accelerated energy transition. The figure below “maps” the transition risk relative to the direct reward for decarbonisation.

Scope 3 strategy risk-reward matrix

In each value chain, it's important to consider which of strategies is most appropriate:

- Supply chain optimisation: Responsible producers, especially those with higher emissions in the value chain, can strategically choose offtakers with lower emissions to optimise the supply chain.

- Collaboration: When mining operations contribute a smaller portion of emissions, there may be less bargaining power for favourable purchasing agreements. However, in cases where there is growing demand due to the transition to cleaner technologies, collaborating on technology development becomes the most effective way to produce metals responsibly and reduce Scope 3 emissions.

- Transition risk: When facing high transition risks, it might be advisable to shift focus towards commodities with lower Scope 3 emissions. In some instances, retiring certain operations may be a more effective strategy than spinning them off to achieve targets for Scope 1, 2, and 3 emissions.

Achieving the necessary scale of offsets for downstream industries will be practically impossible. Furthermore, there is a potential risk of stakeholder backlash due to the perception of lower actual emissions reduction associated with offset projects.

Mining companies and investors have demonstrated commitment to climate ambition by embracing operational net zero targets by or before 2050. It’s imperative for mining companies to meet scope 3 pressures and ensure their role in a net zero future.

By driving innovation and optimising supply chains, mining companies and investors can contribute significantly to global decarbonisation efforts, but this requires a strategic focus on transition dynamics and a combination of targeted strategies.

To find out more, fill out the form at the top of the page to download a free extract from ‘Unearthing a pathway to supply chain net zero’. Plus, click here to find out more about our Emissions Benchmarking Tool or learn more about our new Metals and Mining Corporate Service.

LME Forum 2023

Securing metals supply in a rapidly changing landscape | 11 October, in London

Register now