The five hydrogen market developments investors need to watch

Net-zero related demand growth and supportive policy are creating a strong investment opportunity.

5 minute read

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray is responsible for Wood Mackenzie’s global coverage across the hydrogen value chain.

Latest articles by Murray

-

Opinion

Hydrogen: the outlook to 2050

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what industrial players need to know

-

Opinion

eBook | Investing in hydrogen from now to 2050: what you need to know

-

Opinion

What lies ahead for hydrogen and low-carbon ammonia?

Low-carbon hydrogen has a critical role to play in the energy transition, particularly in decarbonising hard-to-abate sectors. In fact, we estimate the investable opportunity from hydrogen at up to US$2 trillion by 2050.

Having shaken off energy crisis related jitters, the sector is pushing forward with new project announcements and ambitious electrolyser manufacturing plans. So, what’s driving this renewed confidence and what do investors need to know to capitalise on hydrogen market growth?

Our ‘Q2 2023 Global Hydrogen Market Tracker’ draws on insight from our Lens Hydrogen data analytics platform to provide detailed analysis of the growing hydrogen market opportunity. Read on for a quick overview of key sector developments, and fill in the form to download a complimentary copy of the report.

1. Supportive policy announcements abound in the wake of the US IRA

The momentum created by the US Inflation Reduction Act (IRA) has helped boost related sectors globally, with low-carbon hydrogen no exception. For investors, comparing the effect of hydrogen-related policy and legislation on costs and pricing will be a key element of making informed, data-driven investment decisions.

As well as the US Department of Energy’s finalised Clean Hydrogen Strategy and Roadmap and the EU’s long-awaited Delegated Acts, numerous other countries have announced vital policy support. Canada’s inclusion of clean ammonia in its Clean Hydrogen Tax Credit stands out, and should make the country a focus for ammonia production. Other countries making recent policy announcements include Japan, Australia, India, South Korea, South Africa, Spain and Portugal.

In terms of project funding, the EU is in the lead, with around US$167 billion in financial support planned. However, Japan is the most ambitious single country, aiming to put US$107 billion into developing its hydrogen supply chain over 15 years, with money to come from both private and public investment.

2. The project pipeline continued to grow in Q2 2023

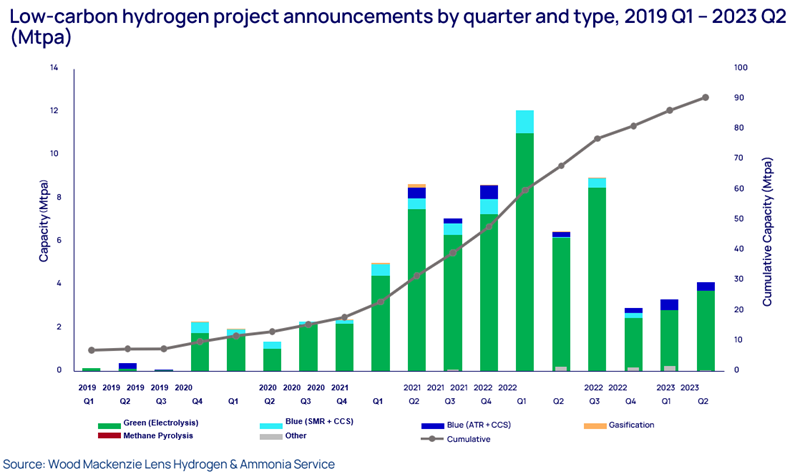

A consistent upward trend in newly announced project capacity in the first half of 2023 suggests fallout from the energy crisis has been temporary, boding well for the future. Over 4.0 Mtpa of additional capacity was announced in Q2 2023, bringing cumulative global proposed capacity to well over 80 Mtpa (see chart below).

Low-carbon hydrogen project announcements by quarter and type, Q1 2019 to Q2 2023

Green hydrogen accounted for the vast majority of growth, with more than 20 GWe of electrolysis capacity announced. Significant announcements included the 5.4 GWe China General Nuclear Bahia project in Brazil, the 5.0 GWe Amp Energy Cape Hardy Hydrogen and Ammonia project in Australia, and the 2.0 GWe LEAG Green Hydrogen Hub in Germany.

3. Europe, the US and Australia account for over half of the pipeline

Thanks to the positive impact of the IRA, the US now has easily the largest hydrogen project pipeline of any country. It currently accounts for 18% of total announced capacity, pushing Australia firmly into second place with 14%. A further 20% is in mainland Europe and 9% in the UK, so that altogether these regions account for 61% of overall capacity.

While Europe is advancing the highest number of projects, North America offers early scale, with the generous tax credits available under the IRA helping a strong flow of US projects towards final investment decision (FID).

The majority of announced projects are for green hydrogen, which is produced using renewable energy and electrolysis and is the cleanest form of hydrogen production. However, it’s also expensive, making access to cheaper power in the form of excess renewable capacity highly desirable for project economics.

It’s worth noting that the most advanced projects are dominated by blue hydrogen, especially in the US. Blue hydrogen is mainly produced from natural gas and creates carbon dioxide as a by-product, so it’s a low carbon solution, but not strictly a ‘clean’ one. However, it enjoys a significant cost advantage over green hydrogen, particularly where natural gas is cheap, as in the US and Canada.

4. Ammonia’s net zero role makes it the key end use for low-carbon hydrogen

The leading end-use for hydrogen is in producing ammonia, an incredibly versatile compound of nitrogen and hydrogen that can be used as a feedstock, fuel and hydrogen carrier in a wide range of industries.

Currently, 70-80% of global ammonia supply is used in fertiliser production. However, it’s ammonia’s potential as a source of ‘clean’ energy that may become the strongest driver of future low-carbon hydrogen demand. Tracking developments in the ammonia sector will therefore be an important element of understanding hydrogen market dynamics.

5. More hydrogen projects are needed over the long term

The increasingly supportive policy and funding environment, including clear production capacity targets for 2030 from many countries, means around two-thirds of announced projects are targeting start-up by the end of the decade.

In our base-case scenario, if all projects progress as planned, supply would be considerably higher than demand at that point. However, as the energy transition accelerates, demand is likely to increase considerably, and many projects are likely to struggle to progress at the pace required to go live before 2030 anyway.

In the longer term, based on our demand forecasts there will be a substantial need for more projects to meet demand to 2050.

Maximising the opportunity

The market for low-carbon hydrogen is evolving rapidly. To make the most of the financial opportunity it presents, investors need to keep their finger on the pulse of market dynamics. As well as monitoring announced capacity and demand growth, it will be vital to be able to analyse project economics, tracking the evolution of costs and assessing the likely trajectory of future pricing. Armed with this information, investors will be well-positioned to capitalise on the sector’s future growth.

Don’t forget to fill in the form at the top of the page to download your complimentary copy of our latest Hydrogen Market Tracker report for Q2 2023, which explores the supply and demand outlook for low-carbon hydrogen in more detail.