Get Ed Crooks' Energy Pulse in your inbox every week

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

Above all, governments have not shown much evidence of the co-operative approach needed to solve what is unavoidably a global problem.

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

In the play An Enemy of the People, by the great Norwegian dramatist Henrik Ibsen, the stubbornly independent-minded Dr Stockmann warns his town that the waters of their spa baths are dangerously contaminated with runoff from the local tannery. In something of the same spirit Eirik Wærness, chief economist of the Norwegian national energy group Equinor, was in New York this week warning of the world’s lack of progress towards achieving the goals of the Paris climate agreement.

He was presenting scenarios from Equinor’s latest Energy Perspectives report, first published in June, which gives a vivid sense of the huge challenge involved in trying to meet the Paris objective of limiting the rise in global temperatures since pre-industrial times to “well below” 2 °C. In what Equinor calls its “Renewal” scenario, compatible with that Paris goal, by 2050 global oil consumption would need to fall by a half, to 52 million barrels a day, while the proportion of the world’s electricity supplied by wind and solar power would need to rise from 7% last year to about 50%.

Equinor’s vision of a possible world in which temperatures increase by significantly less than 2 °C relies less heavily on carbon capture than some others. Wærness argues that wind and solar are likely to be more competitive options for power generation than coal or gas-fired plants that trap their emissions. In the Renewal scenario significant investment in carbon capture would be needed, however, for industrial processes that are otherwise difficult to decarbonize.

Although Equinor deliberately avoids assigning probabilities to any of its scenarios, it is clear that the world is not on track to keep the rise in temperatures to “well below” 2 °C.” Last year some of the most important trends moved too slowly, or in the wrong direction, for the Renewal scenario. World coal consumption, which would need to start falling immediately, rose last year by 1.4%, its strongest pace for five years. It has been rising again in China this year.

Global wind and solar generation capacity, which would need to grow by an average of about 250 gigawatts every year, in 2018 increased by a little under 150GW. Oil demand is continuing to grow. And as the International Energy Agency pointed out on Monday, the rate of improvement in energy efficiency slowed last year to its weakest rate since the start of the decade.

Above all, governments have not shown much evidence of the co-operative approach needed to solve what is unavoidably a global problem. The Trump administration’s confirmation this week that it had filed the paperwork to withdraw the US from the Paris agreement, a plan announced back in 2017, underlined the difficulty of persuading the world’s leaders to work together. Mike Pompeo, the US secretary of state, said in a statement that President Donald Trump had made the decision to pull out because of “the unfair economic burden imposed on American workers, businesses, and taxpayers by US pledges made under the Agreement”.

Even though the great majority of the world’s countries are still claiming fidelity to Paris, their policy commitments are often not living up to their aspirations. Their Nationally Determined Contributions, the countries’ policies on emissions curbs that are intended to be steps towards the Paris goal, would in aggregate put the world on course for 3-3.2 °C of warming, and there are few signs that governments are stepping up their commitments. As Wærness told an audience at Columbia University’s Center on Global Energy Policy on Thursday: “What I’m worried about is the lack of coherent leadership.” He added that if the world seriously wanted to stay inside the 2 degree limit, “the urgency is increasing every year”.

The key point for Equinor’s strategy, however, is that although reaching the Renewal scenario looks increasingly difficult, that may not make a huge amount of difference to the decisions the company is taking today. Even in scenarios where governments give up on the 2 °C target, there is still likely to be rapid growth in wind and solar power, because cost reductions are making them increasingly competitive sources of electricity in many countries.

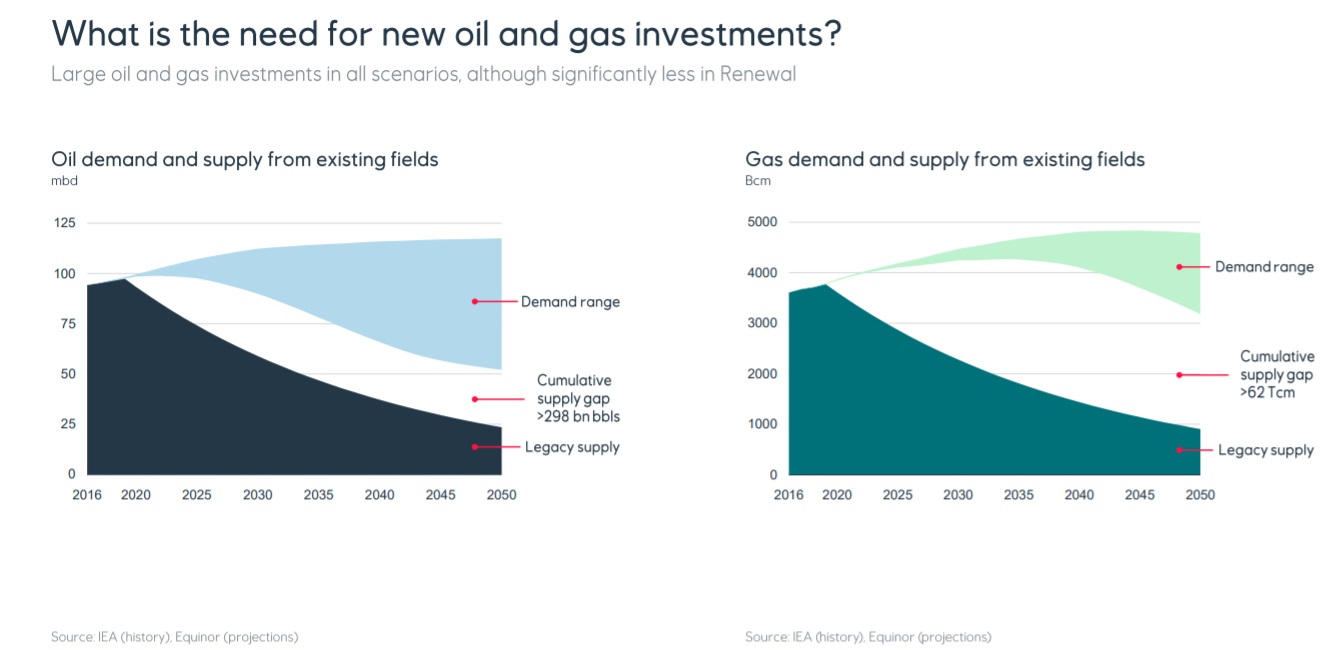

Just because the world is not presently on course for the Renewal scenario, that does not mean it cannot happen. Government policies can change quickly if a crisis becomes unignorable, and a sharp increase in the damage being done by climate change could sweep away political opposition. Equinor wants to be positioned to be ready in case such a rapid shift starts to gather momentum. And conversely, even in a world in which governments do make a serious effort to limit the rise in global temperatures, Equinor still thinks there will be a need for investment in new oil and gas production. Standard production decline rates suggest that by 2050 a wide gap will open up between output from existing oil and gas fields and demand, even at the reduced levels implied by the Renewal scenario.

The need for global policies

In Wærness’s presentation this week, he observed that success in the struggle to limit climate change could be achieved “not in Berlin, Brussels or Baltimore, but in Beijing and Bangalore”. Allowing him some leeway on geography for the sake of alliteration, his point is important: any climate plan will be worthless if it does not include China, India and other fast-growing emerging economies as active participants.

That point was echoed in a column by the Financial Times’ chief economic commentator Martin Wolf, who argued that policies to tackle the threat of global warming needed to be “effective, legitimate and global”.

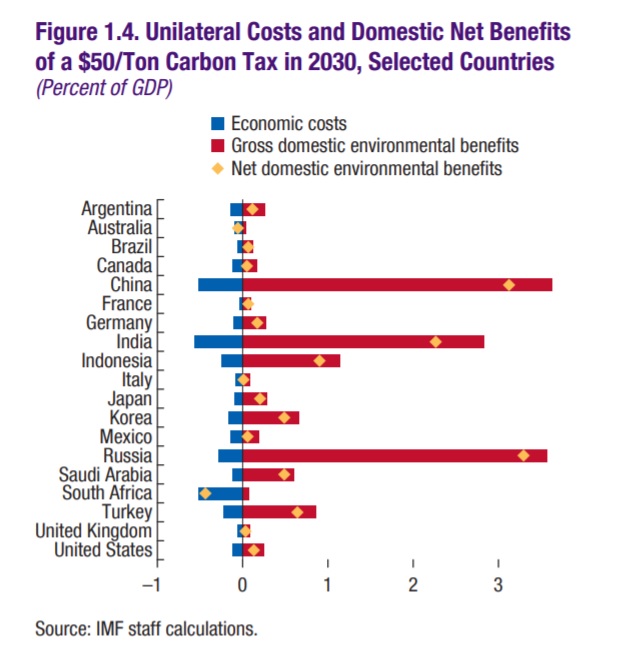

The column drew on a fascinating IMF report on the case for using carbon taxes and similar policies to help reduce the risk of climate change. The 96-page report, called a Fiscal Monitor, is well worth a look, and is full of interesting charts. This one in particular caught my eye, showing how a carbon tax could have very substantial net benefits for China, India and Russia – even ignoring its effects on climate change – because by encouraging their economies to shift away from coal it would improve air quality and reduce lung disease.

Scroll down to continue reading...

How to get Energy Pulse

Energy Pulse is Ed Crooks' weekly column, published by Wood Mackenzie every Friday. Here's how to get Energy Pulse:

- Follow us on social media @WoodMackenzie on Twitter or Wood Mackenzie on LinkedIn

- Fill in the form at the top of this page to receive Ed's column in your inbox

- Bookmark this page to have access to the full archive of Energy Pulse

However, another chart, showing the potential impact on electricity prices in various countries, was also worth studying carefully. The IMF economists calculated that a carbon price at US$75 a tonne could raise electricity prices by 64% in China, 83% in India and 89% in South Africa. Having seen what happens when people are angered by rising energy prices – in France, Ecuador and elsewhere – any government should think very carefully about whether it wants to impose that scale of increase on the public.

It is a point that a future US president, who might want to move away from Donald Trump’s rejection of climate policy, will have to bear in mind. The leading contenders for the Democratic nomination have all published climate and energy plans, and if you want to get a sense of a possible future US energy policy, it is worth having a look at the statements from Joe Biden, Elizabeth Warren and Bernie Sanders.

By a quirk of the calendar, the formal exit of the US from the Paris climate agreement is scheduled for 4 November 2020, the day after the election. Biden, Warren and Sanders have all said they would take the US back in, but Warren and Sanders have gone further, pledging to “ban fracking” to cut pollution and shift the US away from fossil fuels. That pledge will be extremely hard to deliver, for both legal and practical reasons, but it is nonetheless an important signal of how Warren and Sanders aim to break with the legacy of Barack Obama by being much tougher on fossil fuel industries. I recently explored some of the implications of their approach, and some possible tactics they might adopt.

The end of an era looms in the shale business

Aubrey McClendon, the former chairman and chief executive of Chesapeake Energy, who died in a car crash in 2016, was one of the pioneers of the US shale gas boom and one of the industry’s best-known figures. He built the company from almost nothing to the second-largest gas producer in the US, behind only ExxonMobil. So when Chesapeake announced on Tuesday that it might not be viable as a going concern if low oil and gas prices persist, it felt like a sign that the US E&P industry was coming to the end of an era. Chesapeake said it planned to cut capital spending by 30% in an attempt to conserve cash and maintain its banking covenants.

Nick Cunningham of The Fuse observed that Chesapeake’s “aggressive, debt-fueled growth” exemplified the shale bonanza more than most other companies. The question now, he added, was whether ExxonMobil and Chevron, with their ambitious expansion plans, “can succeed where a long line of shale companies have come up short.”

Last Friday brought earnings reports from both Exxon and Chevron, and both companies sounded very positive about their US shale operations. Both showed slides of production – in the Permian Basin and the Bakken for Exxon, in the Midland and Delaware basins for Chevron – that suggested they were running slightly ahead of the ambitious growth plans they set out in March.

In brief

OPEC published its annual World Oil Outlook, giving its view of the likely evolution of the industry out to 2040. One particularly noteworthy number: OPEC believes there will be a need for US$10.6 trillion of investment in the oil industry worldwide over the next 20 years to meet demand, US$8.1 trillion of that in the upstream. The group expects a 22% drop in OECD oil consumption to 32.5 million barrels a day by 2040, but a 40% rise in non-OECD consumption to 68.2 million b/d.

Hydraulic fracturing in the UK has been suspended indefinitely by the government, following fears that it was causing earthquakes.

Bankers for Saudi Aramco’s initial public offering are reportedly suggesting the company could make additional bonus payouts to shareholders, as they seek to woo cautious investors.

International oil majors have for the second time in succession snubbed an auction of offshore oil blocks in Brazil.

President Trump has nominated Dan Brouillette to be the next US energy secretary.

Renewable energy provided just over half Australia’s electricity for a short period this week.

And finally, another story from Australia. Prime Minister Scott Morrison in a speech last Friday highlighted the issue of what he called “secondary boycotts”, for example, when banks and insurance companies refuse to support businesses that are not mining companies themselves, but work with the coal industry. Morrison described these boycotts as a “great threat” to the Australian economy and promised to “outlaw these indulgent and selfish practices that threaten the livelihoods of fellow Australians, especially in our rural and regional areas”. His plan has raised concerns about the implications for free speech.

Smart Reads

- Simon Flowers – How to stay investible: the oil industry’s challenge

- Renewable electricity is on course to deliver on Europe’s 2030 climate-energy goals

- Nick Butler – Technology can help natural gas stay competitive

- John Gapper – Europe has a problem with its SUV habit

- Gillian Tett – The US- China supply chain shock

- John Kemp - Carbon taxes will be needed to reduce CO2 emissions

- Neil Hume – Depressed aluminium market tells a sorry tale of global demand

- Andy Home - Green technology revolution needs a green metals revolution

- Liam Denning - EOG’s Fracking Antidote Could Use a Booster

Quote of the week

“It’s a historical moment… Our mission is to provide our shareholders with long-term value creation through crude oil price cycles by maintaining our pre-eminence in oil and gas production.”

Amin Nasser, chief executive of Saudi Aramco, explained the company’s offering to investors as it launched its initial public offering process on Sunday.

Chart of the week

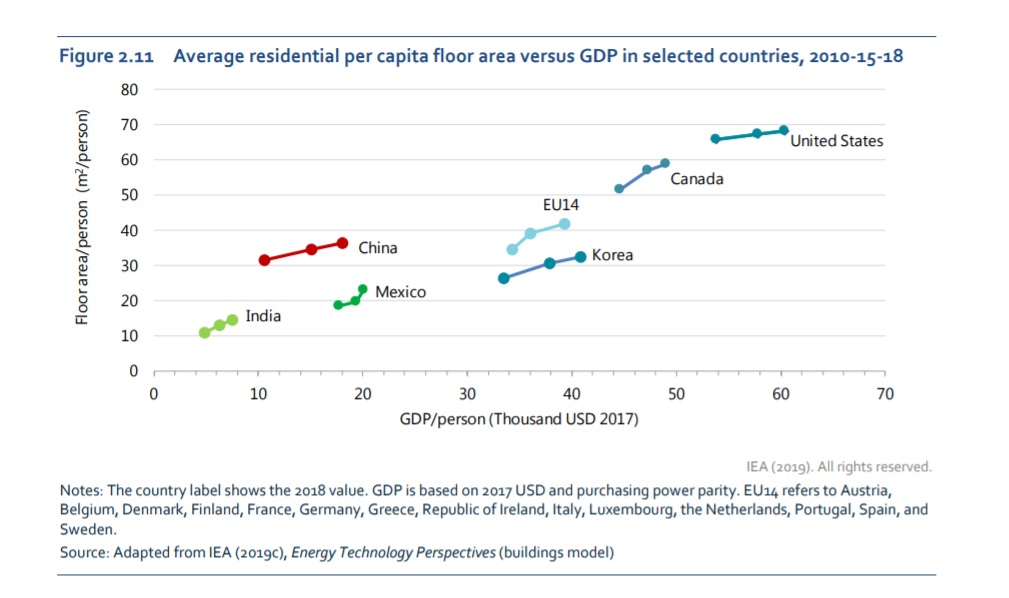

This comes from the IEA’s Energy Efficiency 2019 report, published this week. The report sounded the alarm about a slowdown in the pace of improvement in efficiency, which the IEA blames on some short-term factors, including the weather and a cyclical upturn in energy-intensive industries, and some long-term factors including the tendency for people to live in larger homes. From this chart, the correlation seems pretty clear: the richer people are, the more living space they want, wherever they are in the world.

In next week's Energy Pulse

The Wood Mackenzie energy and commodities summit Singapore is on next week, on 12 November and I will be on a panel in the morning and chairing some sessions in the afternoon. I will report back on what went on there this time next week.