Will a supply response help avoid US gas storage containment this summer?

Henry Hub gas prices have fallen as concerns of oversupply rise – a multitude of supply responses may be necessary

2 minute read

Nathan Nemeth

Principal Analyst, Global Unconventional Plays

Nathan Nemeth

Principal Analyst, Global Unconventional Plays

Nathan is focused on Canadian and Lower 48 unconventional plays research.

Latest articles by Nathan

-

Opinion

Video | Tariff turmoil: how big a cost hit will US oil and gas operators take?

-

Opinion

Will a supply response help avoid US gas storage containment this summer?

Thanks to a mild winter and record production, the 2023 US gas storage injection season is starting with a large surplus. Henry Hub gas prices have declined significantly amid mounting concern about oversupply. And while there are signs of a demand response from economic coal-to-gas displacement, a supply response to low gas prices may also be needed to avoid storage containment over the summer.

In a recent insight, Low prices are the cure to low natural gas prices, we explored what a potential supply response might entail. Fill in the form for a complimentary extract and read on for a brief introduction.

Limited US gas storage capacity could see prices fall

North America has a proven gas resource base that is both plentiful and low cost. It has a functioning supply curve: higher gas prices can bring greater volumes online and promote more development and exploration in the longer term. However, in periods of lower short-term gas prices, the high grading of core acreage exhausts the lower-cost supply base faster.

Low gas prices aside, associated gas supply will contribute to the current oversupply situation and reduce non-associated supply market requirements in the near term. New gas pipeline takeaway projects, especially in the Permian Basin, will support associated supply growth, but more will be needed in future to avoid takeaway constraints.

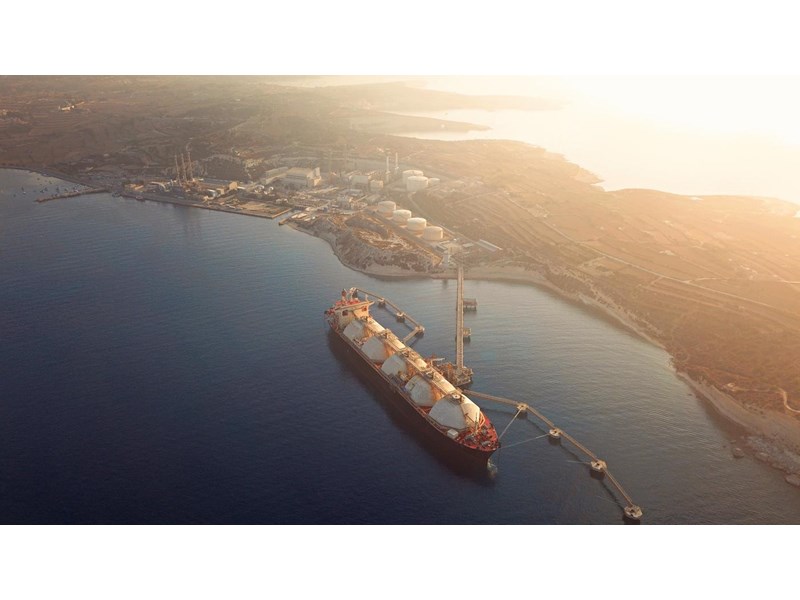

Growing liquefied natural gas (LNG) feedgas requirements will drive North American gas demand growth in the future. However, until the second wave of US LNG projects starts up, the threat of lower gas prices may persist due to limited storage capacity. An adequate supply and demand response to prices is necessary to maintain a balanced market.

Three potential operator responses to reduce US gas production

This response could come in various forms – and a combination may be necessary.

1. Drilling reductions

Producers have already announced a reduction in activity levels in Haynesville and the Northeast, which we have incorporated into our base-case view. However, due to the time lag between spud and completion, the near-term volume reduction from new drill wells will not have a material volumetric impact on summer balances.

2. Deferred completions

The NYMEX forward curve has taken on a wide contango structure, incentivising more wells to be brought online next winter when prices are significantly higher. Although this strategy would reduce near-term production volumes, even larger oversupply could occur longer term through the build-up of significant well inventory.

3. Economic wellhead shut-ins

When regional prices fall below operating costs, existing production may become uneconomic. Wells can either be shut in or choked back to cut significant volumes quickly. The wide regional summer basis makes the Northeast especially susceptible and, historically, producers have said they can shut in volumes for extended periods without endangering long-term well production.

Various supply response scenarios suggest that a combination of measures is probably needed. Our report, Low prices are the cure to low natural gas prices, digs into this in more detail.

Fill in the form at the top of the page for a complimentary extract.

Lens Gas & LNG

Our powerful data analytics solution for exploring industry data alongside leading expertise, analyses, and modelling insights to enable faster, more accurate operational and strategic planning and portfolio management decisions.

Learn More