Future energy – offshore wind

The zero-carbon technology that’s attracting big capital

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

So much of the technology to deliver a net-carbon neutral world seems distant. Green hydrogen, carbon capture and storage, and heat pumps all need R&D and heavy subsidies before they can contribute materially. Offshore wind is more ‘oven-ready’ and set to take off. Soeren Lassen, head of offshore wind research, and his team identify five reasons why it’s becoming central to energy companies’ plans.

First, the exponential improvement and innovation in the technology, led by a competitive global OEM sector. New installations are bigger, delivering huge output gains and lower costs for each MW installed and MWh produced. The average turbine size has doubled to 8 MW in five years with more to come – the latest models on order are 14 MW.

Whereas capacity factors for onshore wind average just above 30% in many markets, offshore averages 41% with some arrays already exceeding 50%. The future is stretching into deeper water to counter nimbyism and capture greater wind speeds. Fixed installations are already reaching below 50 metres, while floating units are an emerging option for ultra-deep sites.

Second, supportive policy. European governments started incentivising offshore wind more than a decade ago as part of the drive to cut greenhouse gases. The UK, Germany and Denmark led the way, while China has also been an early adopter.

Feed-in tariffs guaranteed developers a fixed price for up to 20 years. With costs falling and the appetite to invest increasing, terms are changing towards more market-based structures – though each country has its own take on it. Competitive tender processes, shorter duration contracts and lower prices are being implemented to gradually wean offshore wind off subsidies. We reckon offshore wind could break even without subsidy inside five years in some markets.

Third, there’s almost unlimited growth potential – offshore wind can work wherever the resource is close enough to market. Today, there’s just 28 GW of installed capacity (equivalent to one-third of the UK’s total generation capacity) and spread across a handful of countries with a North Sea coastline, and China. The US, Poland, Taiwan, Japan and South Korea are among those already committed to developing offshore wind.

OREAC, a partnership led by Orsted and Equinor, envisages capacity could be a massive 1400 GW in 2050 (the size of the US’s total generation capacity), supplying 10% of the world’s electricity needs. Wood Mackenzie forecasts a seven-fold increase in capacity by 2029, policy targets see an eight-fold rise to 219 GW by 2035. The industry pipeline is already above 300 GW. Government targets and the project pipeline are only going to grow.

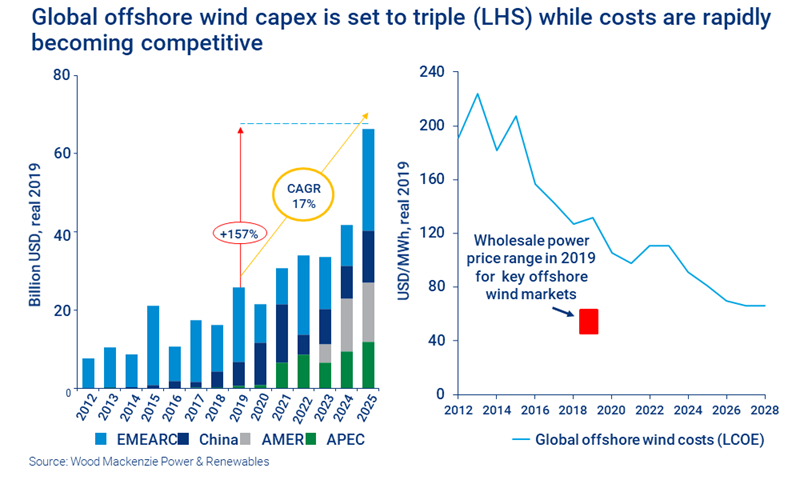

Massive investment is needed to deliver growth. We expect spend to increase from under US$20 billion in 2020 to US$60 billion in 2025 and to keep rising. There’s high visibility on these numbers, with over 80% of capacity through 2025 already awarded government-sponsored support. That contrasts with upstream oil and gas where spend can snap back quickly if the oil price falls. Investment in offshore wind is just 10% of that in offshore E&P today, but conceivably could be higher by the end of the 2020s.

Fourth, the economics. Mid-single digit returns in Europe can be boosted by innovative financing. A counterpoint to modest returns is the long-life, stable cash flows the projects deliver. Our model of Equinor’s giant, state-of-the-art Dogger Bank A project in the North Sea (due onstream 2024) delivers a nominal IRR of around 6% (unlevered). Project finance and proactive portfolio management can significantly enhance returns. In Dogger Bank’s case the next phases, B and C, will benefit from economies of scale.

Fifth, an influx of capital. The space was niche, dominated by pioneers like Orsted and a handful of utilities. But that’s changing as new players move in, including risk-averse financial investors. Big Oil will also invest in a big way. The long-life cash flow streams are more stable than volatile upstream projects, adding to the attraction of zero carbon primary production. As well as capital, Big Oil brings project execution skills; and will look for synergies by integrating renewable power with gas and trading.

Equinor, Total and Shell already have their launchpads in offshore wind. Others will follow. It’s perhaps the one segment in the zero-carbon value chain that offers Big Oil the scale, organic growth opportunity and adequate returns to kick-start new energy.

***

Learn more about Wood Mackenzie's Offshore Wind Service.