Big oil, new energy and the stock market

European green diversification versus US pure plays

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Big Oil is on the move, feeling its way into a changing energy world. There are two sides to adapting: how to decarbonise oil and gas and how to build a sustainable business around zero-carbon technology. Valentina Kretschmar, VP and Tom Ellacott, SVP of our Corporate Analysis team took me through their thinking of how company strategies are developing.

This week, BP went a step further on the first part, committing to decarbonising oil and gas. In accounting speak, tougher hurdle rates, higher carbon prices and lower oil and gas price assumptions will constrain investment in the core upstream business. Capitalised expenditure in high-cost assets that will never be developed is also being written off.

Simply, BP’s oil and gas business is going to shrink. Upstream, which has accounted for most of the company’s cash flow, will be smaller in future. That’s ultimately the fate for oil and gas companies in the energy transition. Decline, though, will be strung out over decades. And if it’s built around advantaged assets – low cost, low carbon-intensity and high margin – decline can be good business. In harvest mode, free cash flow could be material, and either returned to shareholders or re-invested into the energy transition.

There’s a green arms race underway, with companies positioning to be seen as part of the solution to climate change rather than the problem.

The European Majors are also pushing hard on the second, building a sustainable business. Indeed, there’s a green arms race underway, with companies positioning to be seen as part of the solution to climate change rather than the problem. BP (12 February), Shell (16 April) and Total (5 May), successively outlined ambitious plans to reach net-carbon neutrality by 2050. Eni, Equinor and Repsol have done much the same. BP and Eni are also fundamentally restructuring their business to take on the energy transition challenge and the others will likely follow.

There are differences in the detail, notably around Scope 3 – responsibility for customers’ emissions. Yet the strategies are much the same, centred around diversification into zero-carbon assets. Nascent new energy divisions are emerging, all based around renewables: offshore wind, onshore wind and solar. There are varying appetites for other technologies (green hydrogen, carbon capture, utilisation and storage), grid-edge technologies including EV charging, and retail customers. Integration – synergies with gas and trading – is another strategic plank.

The intent is becoming clear, but so far none has committed serious capital. Zero carbon is a big growth opportunity globally, but the Majors’ pipeline of projects is still modest. Investment may be rising proportionately as upstream spend is cut, but the US$5 billion to US$6 billion earmarked for 2020 is less than 10% of the year’s capital budget for the five European Majors.

Sizeable acquisitions, including renewables and utility companies, will be needed if they are to achieve scale in new energy, broaden reach and build capability. Total’s acquisition in Portugal last month was one of the biggest so far, but with a US$0.6 billion enterprise value tiny in the grand scheme of things.

The collapse in oil and gas prices and extreme price volatility in 2020 are starting to change perceptions of the relative risk between investing in oil and gas and new energy. Pre-FID upstream projects that worked at US$60/bbl don’t look so clever at US$35/bbl. Risk-adjusted, the more modest returns typical from renewables projects can stack up pretty well.

The Europeans have already crossed the Rubicon. In committing to building a sustainable business, they sacrifice higher exposure to any cyclical recovery in oil and gas prices – you can’t have your cake and eat it.

So far, US Majors have shown little inclination to follow. ExxonMobil and Chevron have strategies focused on oil and gas and paying out the dividends that flow from it. ExxonMobil has expressed an upbeat view of the-long term fundamentals for oil and gas and its appetite to continue to invest.

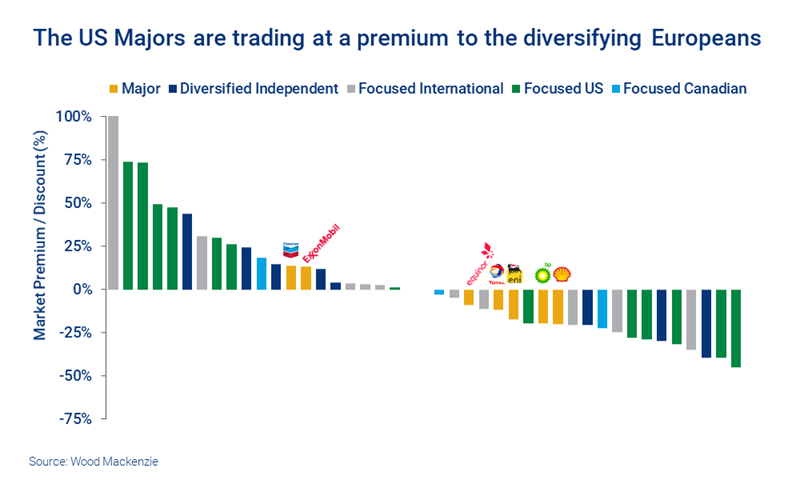

What’s apparent is that investors today will pay more for the US focus than European diversification. The US Majors’ stock market values are trading at a premium to our valuation, whereas the Europeans are at a discount. This suggests that investors see diversification as higher risk, though other factors, including the strength of the US stock market, may influence ratings.

What’s the end game? The two strategies can and will co-exist for a time. Some of the Europeans may seek to demonstrate value by spinning off new energy into separately listed subsidiaries, much as utility companies did in the 2000s. That awaits critical mass, a coherent strategy and clear growth path.

At some point in the next few years either the US focus or European diversification will deliver better returns for shareholders and win, forcing a U-turn by the other group.