Sign up today to get the best of our expert insight in your inbox.

How to rate IOCs’ resilience and sustainability

Which are best placed for market shocks and the transition?

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

The energy sector has been the saviour of many an equity portfolio in 2022. Investors have taken a pragmatic view, parking their conviction in the energy transition for now in favour of stocks leveraged to oil and gas prices. Higher cost, sometimes high carbon, plays have been among the best performing.

But transition risk for the oil and gas industry hasn’t gone away; and at some point, commodity markets will turn down again. The big question on both fronts is which companies are best placed to cope. For the answer, I spoke to Luke Parker, Vice President, Corporate Analysis, who has led the development of CoRSI, Wood Mackenzie’s proprietorial Corporate Resilience and Sustainability Indices.

How can CoRSI help companies and their stakeholders?

The oil and gas sector today is fraught with uncertainty. There’s unprecedented volatility in commodity markets. At the same time, corporate strategies are evolving rapidly as companies adapt to stay investible for the transition. Deciphering the changes underway is complex. Stakeholders and even the companies themselves are wrestling with what it means to be resilient and sustainable.

CoRSI is designed to do just that. The indices define what’s important and what ‘good’ looks like, then rate companies against the ideal. We put a number on all aspects of resilience and sustainability. There are three pillars: platform (measures of financial position and scale); portfolio (legacy business cash flow and risk); and transition (carbon exposure and transition strategy).

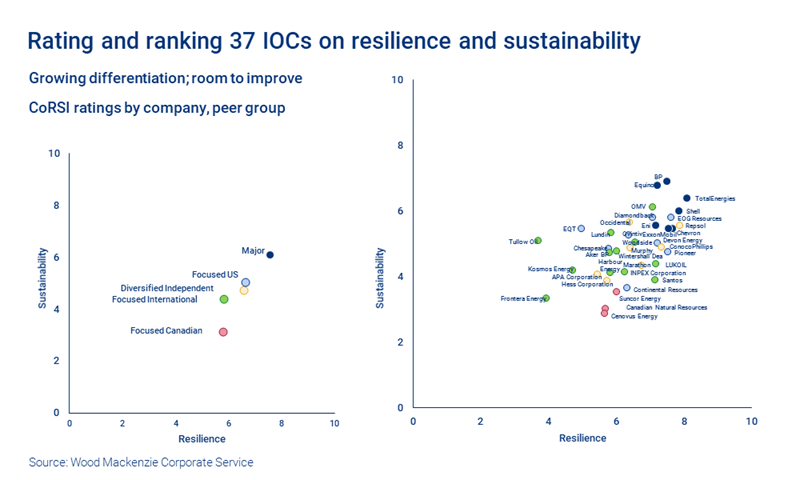

The Resilience Index assesses 37 IOCs’ ability to deal with near-term shocks; the Sustainability Index is longer term, assessing their ability to navigate the energy transition.

How does the industry score on resilience?

Most companies are well placed to handle near-term risks after the 2014 downturn forced the industry to act. Most companies since then have progressively reduced financial and operational leverage by strengthening the balance sheet, high grading the portfolio and cutting costs and investments. The industry as a whole has diligently maintained capital discipline over the last few years.

We weight resilience ratings heavily to the platform and portfolio metrics; balance sheet ratios and cash generation at low prices are among the most important. Current high oil and gas prices should allow IOCs to further strengthen resilience in 2022.

And on sustainability?

These ratings are weaker. Longer-term positioning for the transition is still at an early stage, even for the most progressive companies. Ratings for sustainability are weighted to the portfolio and transition pillars; longevity, concentration risk and carbon exposure are key.

A wide variation in ratings reflects the differing IOC responses to the energy transition.

What are the big differences between IOCs?

Three groups stand out:

- Big integrated players, mainly European Majors and Large Caps, have scale, diversification and integration. They have also been the most active in strengthening their position for the near and long term

- Tight oil players are typically concentrated in advantaged assets like the Permian Basin, with high returns and high margins; long-life, flexible and relatively low carbon exposure. Many of these companies have also made progress on transition strategies and targets in recent years

- Canadian oil sands players score weakest on resilience and sustainability. Oil sands do not work well at low oil prices (impacting resilience) and have high carbon exposure (impacting sustainability).

We do find, though, that there’s some correlation between the two indices: a good score in sustainability tends to go with a good score in resilience.

Is the ‘hard line’ on sustainability softening?

The sector has come a long way over the last 12 months in advancing transition strategy and decarbonisation targets, with, in some cases, investors forcing through change. Last year, successful activist-led AGM proxy proposals forced big changes at ExxonMobil, ConocoPhillips, Phillips 66 and Chevron. Now that the journey is underway, and given the broader picture, there is less appetite among institutional investors to wield the big stick.

Already this month, we’ve seen AGM proposals for tougher emissions targets voted down by shareholders of ConocoPhillips, BP and Occidental, with others likely to follow in the coming weeks. BlackRock has stated that it will likely support fewer climate-focused shareholder resolutions this year than it did last year. Its rationale is that many resolutions this year are “implicitly… intended to micromanage companies” and aren’t “consistent with our clients’ long-term financial interests”.

What should IOCs do next?

Don’t be diverted – strengthening resilience and sustainability ratings should be core to the strategy. Resilience ratings are at a cyclical high, but companies are right to stay disciplined and strengthen the base: shocks happen, resilience matters. Sustainability ratings are weaker and still a work in progress. Investor pressure may have eased for the time being, but risks around the transition will only increase, as will stakeholder scrutiny.

Companies are in a position to do it all in 2022. The astonishing levels of cash flow generation this year will allow them to invest, pay dividends and strengthen their resilience and sustainability credentials.