Sign up today to get the best of our expert insight in your inbox.

Oil in a decarbonising world

How a 1.5°C pathway could shape demand and price

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Oil demand is poised to reach a record high in the next year as it continues to recover from the lows induced by Covid-19 in 2020. But once past the current recession risk, what is the trajectory of demand in a world that’s decarbonising and how will that influence oil prices? I asked Alan Gelder, Head of Refining, and Ann-Louise Hittle, Head of Macro Oils, who, with their colleagues, compared the prospects for oil in WoodMac’s base case (energy transition outlook, or ETO) and our 1.5 °C accelerated energy transition scenario (AET-1.5).

How much does oil demand fall in a 1.5 °C scenario?

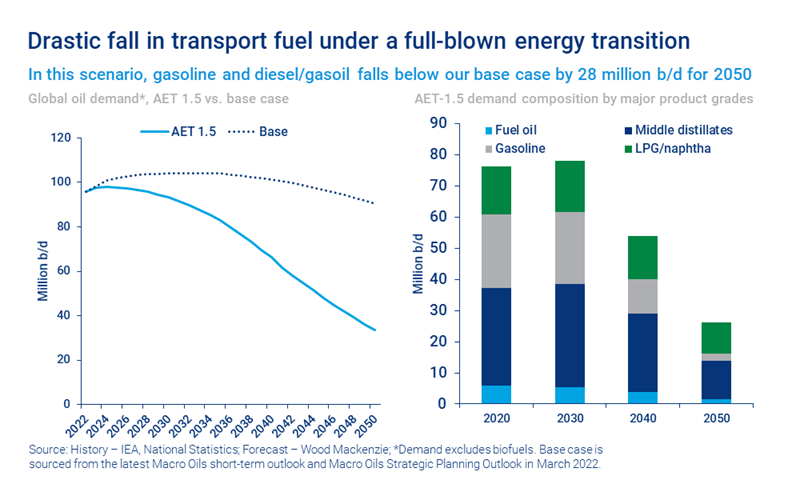

By two-thirds over the next three decades. Demand is just 35 million b/d by 2050 in the scenario, down from 99 million b/d in 2022 – that’s 60 million b/d below our current ETO forecast for 2050 of around 95 million b/d.

Electrification of transportation is the main driver in the 1.5 °C scenario. The transport sector is already changing, with electric vehicles displacing gasoline-fuelled passenger cars. In the scenario, that pace of displacement accelerates over the next two decades, supported by rapidly growing battery raw material supplies. More electrification, fuel cells, natural gas/LNG and biofuels then progressively eat into diesel and gasoil (heavy road transportation), fuel oil (shipping) and jet fuel (aviation); and non-transportation uses of oil in the industrial, commercial, agricultural and residential sectors. Naphtha, primary feedstock for the petrochemical sector, proves the most resilient oil product in the scenario buoyed by sustained demand for plastics.

What are the implications for oil supply?

The world will need far less supply in the 1.5 °C scenario than in the ETO. Even so, the E&P industry will still have to make significant investments over the next two decades to meet falling demand. We reckon that 20 million b/d of new supply will be needed by the mid-2030s to offset the decline from producing fields. Those new barrels will come from reserves growth (existing fields), other known discoveries and yet-to-find. Upstream investment will fall to around half the current annual spend of over US$400 billion a year by the 2030s and tail off thereafter.

Geopolitical risk will be ever present even in the AET-1.5 world, as supply becomes increasingly concentrated among fewer countries. Middle East producers’ market share rises dramatically from 30% currently to over 50% by the early 2040s as supply wanes from higher cost regions.

How are oil prices affected in the scenario? Over time, they will be much lower. In our ETO, Brent holds around US$80/bbl for the foreseeable future to incentivise investment in the new, higher cost supply required to meet firm demand. Not all of those higher cost barrels will be needed in the 1.5 °C scenario.

Demand falls by 2 million b/d each year from the mid-2030s in the scenario, much faster than supply. OPEC would face a near-impossible challenge if it sought to protect price by cutting volumes to balance the market.

Using our detailed oil supply tool, the price forecast for AET-1.5 is linked to the breakeven prices of future development, including reserves growth. Brent slides to US$55/bbl (real) by 2030, below US$40/bbl (real) by 2040, and never recovers.

Does 1.5 °C pose an existential threat to refining?

It will put enormous pressure on the sector. As oil demand falls, so too will refinery utilisation rates, triggering closures and rationalisation. The shift in product slate away from transportation fuels to middle distillates and naphtha will favour more sophisticated refineries integrated with petrochemicals and sites that have converted to biofuels and are embedded in the circular economy.

How realistic is the 1.5 °C scenario?

The invasion of Ukraine has underlined how dependent the world is on oil, gas and coal. Energy security is suddenly at the very top of the political agenda and with gas prices inflated, coal is back in the energy mix. Some governments, the UK included, are offering the oil and gas industry new incentives to invest in supply. The consequence is that global carbon emissions won’t fall as rapidly as hoped in the immediate aftermath of COP26; indeed, they may hold up longer as economies navigate through the crisis.

However, decarbonisation also has a crucial role in meeting energy security goals. We are seeing a simultaneous acceleration of policy to get the world onto a 1.5 °C pathway. Europe has doubled down on low-carbon targets with REPowerEU; the Biden administration’s Inflation Reduction Act promises to position the US as a transition leader in low-carbon technologies; and there is significant progress across Asia. China is electrifying passenger road transport at a rapid pace, although gasoline demand is still rising, for now.

We think this signals that the aspiration to achieve net zero remains intact. If progress this decade is a little slower, the pace of change next decade may be much faster – including disruption to oil demand.