Get Ed Crooks' Energy Pulse in your inbox every week

Deals show the enduring appeal of US gas

European companies have been cautiously adding to their upstream positions. More deals could follow

9 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

View Ed Crooks's full profileThe great investor Warren Buffett says one of his rules is “never bet against America”. There are many who share that view, including, it seems, European oil and gas companies.

Two recent deals by TotalEnergies and Equinor have underlined the continuing importance of the US for international oil and gas companies, and for the European Majors, in particular. We may well see further acquisitions of US assets by European companies, as they position themselves for long-term demand for oil and gas.

The two deals in themselves are not particularly momentous. TotalEnergies announced last week that it was buying a 20% interest in the Dorado leases in the Eagle Ford shale gas play, operated by EOG Resources. The deal will allow TotalEnergies to increase its net US gas production by 50 million cubic feet a day (Mcf/d) in 2024, equivalent to about 8,300 barrels of oil a day, with the potential for an additional 50 Mcf/d by 2028.

Then, this week, Equinor said that it was swapping its operated gas assets in the Marcellus and Utica shale formations in southeast Ohio for a 40% stake in EQT’s non-operated position in the Marcellus in northeast Pennsylvania, and making an additional payment to EQT of US$500 million. The net effect will be to increase Equinor’s US onshore gas production by about 75 Mcf/d.

But, while the deals are relatively small in terms of the assets changing hands, they point to an important trend: European companies want more upstream US gas production, in part, to support their LNG export positions.

Although the Biden administration’s pause in approvals for new LNG projects has cast a shadow over the sector, there is still rapid growth in exports already locked in from plants that are under construction. Jennifer Granholm, the US energy secretary, said last month that she expected the pause would be over within a year. Whether Joe Biden or Donald Trump is in the White House 12 months from now, the pause is likely to be lifted, opening a path for further growth in US LNG.

TotalEnergies is already a very significant player in the industry: it was the largest exporter of US LNG in 2023, thanks to its 16.6% stake in the Cameron LNG plant in Louisiana and long-term supply contracts. It is set on a strong growth path because of its investment in and long-term contracts with NextDecade’s Rio Grande LNG project in Texas. That plant will raise TotalEnergies’ US LNG export capacity from about 10 million tons a year (Mtpa) last year to more than 15 Mtpa by 2030.

Given that position, it makes sense for TotalEnergies to balance its portfolio by adding more upstream gas production in the US, says Tom Ellacott, Wood Mackenzie's senior vice president for corporate research. TotalEnergies is bullish on the US in general, aiming to increase energy production in line with its global strategy of investing in integrated LNG, advantaged oil, integrated power and low-carbon molecules.

Equinor has less need to back LNG exports with upstream production. Its US onshore gas assets were already among the largest in its global portfolio. And although it has been stepping up its position in US LNG, signing contracts with Cheniere Energy to purchase about 3.5 Mtpa in total, it is not as big an exporter as TotalEnergies. But it similarly sees the US as “a core country in [our] international portfolio”.

Other European companies have expressed similar views. Repsol acquired US unconventional assets with deals in the Marcellus shale in 2021 and the Eagle Ford in 2023. The company said in its investor presentation last month that it saw these unconventionals as “an increasingly core business platform for Repsol”.

The European Majors have a chequered record in US unconventional oil and gas. Many bought into the industry in the first decade after the breakthrough in shale gas production in 2003, and found it difficult to achieve the results they had been hoping for. Many of the assets they acquired were later sold.

In recent years, the only European oil and gas company to make a large acquisition in North American shale oil and gas was BP, which bought BHP’s US unconventionals business for US$10.5 billion in 2018.

The small scale of the latest deals reflects the European companies’ cautious approach to building up their portfolios in the US. The fact that both TotalEnergies and Equinor have bought non-operated assets is also a sign that they want to keep the risks low.

But there is clear interest in further similar deals, as the European companies seek to strengthen their positions in the US. With front-month Henry Hub gas futures trading at around US$1.75 per million British thermal units, a level that looks unsustainably low, this is a good time for companies that can take long-term views to be acquiring assets.

"We might well see more action in the future from the European Majors acquiring US gas assets, given the importance of US LNG,” Wood Mackenzie’s Ellacott says.

“The timing might work for sellers, too, with the big US gas producers looking for capital, and other Independents thinking about what comes next, once tight oil production peaks."

There is also a symbolic reason for European companies to invest in US gas and LNG. European gas prices have been rising this month because of concerns about the conflict in the Middle East, a reminder of the market’s reliance on imported LNG. That dependence is set to persist for decades, and if European policymakers fail to achieve their goals for reducing gas demand through electrification, energy efficiency and low-carbon hydrogen, those LNG imports will remain higher for longer.

By investing in LNG and upstream gas in the US, the European companies are showing that they are part of the solution for keeping the lights on, the homes heated and the factories running. Particularly if the situation in the Middle East deteriorates, it is an argument that could seem increasingly compelling.

The Biden administration looks for ways to expedite grid connections

A new “roadmap” intended to accelerate the process of connecting new generation sources to the power grid has been published by the US Department of Energy. The report, titled ‘Transmission interconnection roadmap – transforming bulk transmission interconnection by 2035’, includes recommendations such as improving data access and transparency, managing interconnection queues better and reforming cost allocation for transmission investments. The proposals build on the Federal Energy Regulatory Commission’s Order 2023, issued last year, which sets out reforms of interconnections that are similarly intended to expedite the process of adding new generation capacity.

The DoE roadmap notes that from 2000 to 2010, there were 500 to 1,000 new transmission interconnection requests each year in the US, corresponding to around 150 to 200 gigawatts a year of proposed generation. For the past decade, that has risen to 2,500 to 3,000 new requests each year, representing 400 to 750 GW a year of proposed capacity. The report sets an objective of cutting sharply the time taken for a project to go from an interconnection request to an agreement. That wait, after the interconnection study process, averaged 33 months in 2022. The goal is to cut it to less than 12 months by 2030.

The US Department of Energy has also published its first Innovative Grid Deployment Liftoff report, setting out ways to accelerate the roll-out of technologies that can quickly address some of those mounting pressures on the grid. The report uses data and analysis from Wood Mackenzie to inform its assessment and recommendations.

In brief

Oil markets remained subdued on Friday, despite Israel’s strike on Iran overnight. The attack was retaliation for Iran’s launch of more than 300 drones and missiles against Israel last weekend. On Friday morning Brent crude was trading at about US$86.50 a barrel, down about US$4 a barrel over the week.

The Biden administration was reported to have decided to block the construction of a proposed 211-mile road needed to develop metals deposits in central Alaska. The Ambler Mining District that would be served by the road could produce copper, cobalt and zinc: metals essential for the transition to low-carbon energy. One organisation representing Native Alaskan tribes said the road project “would be one of the biggest and most destructive in the state’s history”.

The first US-built vessel for installing offshore wind turbines, meeting the requirements of the Jones Act, has been launched in Texas.

Ukraine has started building two US-designed Westinghouse AP1000 reactors at a nuclear power plant in the west of the country. The move is intended to signal the country’s ambition to reduce its reliance on Russian nuclear technology.

Mario Draghi, the former prime minister of Italy who is working on an inquiry into the EU’s competitiveness, has warned about the region’s weakness in low-carbon energy supply chains. In a speech this week, titled ‘Radical change is what is needed’, he said the EU’s climate agenda “has to be combined with a plan to secure our supply chain, from critical minerals to batteries to charging infrastructure”. His report is scheduled to be published in June.

Other views

Is net zero by 2050 at risk? – Simon Flowers and Prakash Sharma

What’s next for the EV and battery value chains? – Prateek Biswas, Egor Prokhodtsev and Suzanne Shaw

New rules and frameworks in global carbon policies – Stephen Vogado and Nuomin Han

Welcome to the new PPA market paradigm – Daniel Tipping

The economic commitment of climate change – Maximilian Kotz, Anders Levermann and Leonie Wenz

Geopolitics of the energy transition: Energy security – IRENA

Quote of the week

"I think it's pretty likely the entire surface of the earth will be covered with solar panels and data centers.”

Ilya Sutskever, Chief Scientist of OpenAI, extrapolated the hype about AI and power demand to its logical conclusion.

Chart of the week

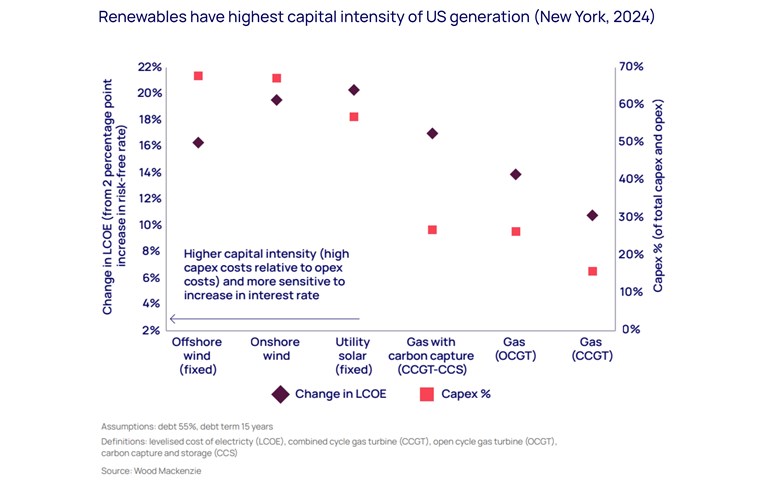

This chart is highly topical in the light of reports this week that US interest rates are unlikely to fall this year. The latest Wood Mackenzie Horizons report looks at what the end of the “zero era” for interest rates means for the energy and natural resources industries.

The report, ‘Conflicts of interest: The cost of investing in the energy transition in a high interest-rate era’, argues that higher rates are a headwind facing the transition to lower-carbon energy, raising the urgency of policy action to remove other barriers to that transition. This chart, comparing the impact of changing interest rates on the cost of electricity from different technologies, summarises the challenge at a glance. Taking assets in New York as an illustrative example, the purple diamonds show the rise in the levelised cost of energy resulting from a two-percentage point increase in interest rates, across a range of generation sources. The pink squares show capital spending as a share of total costs.

Renewable generation, both wind and solar, is more capital intensive, and the impact on costs of higher interest rates is correspondingly higher. It is sometimes said that “the most important raw material for renewable energy is money”, and the cost of that money has increased sharply in the past two years.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today to ensure you don’t miss a thing.