Get Ed Crooks' Energy Pulse in your inbox every week

Surging power demand raises questions about cost

Generators see big opportunities in the rise of AI. Politicians in the US have concerns about the impact on customers

11 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What the "big beautiful bill" means for US energy

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

The two best-performing stocks in the US S&P 500 Index this year have been server company Super Micro Computer and the chip-maker Nvidia, both beneficiaries of the excitement over the new possibilities for artificial intelligence. The third-best performer, with its shares up 130% since the start of the year, is Texas-based energy company Vistra, which is also benefiting from expectations of an AI boom.

Vistra is the largest competitive power generator in the US, with about 41 gigawatts of capacity, and so is well-placed to profit from a surge in demand for electricity driven by the rise of AI. Dan Loeb, billionaire founder of the hedge fund Third Point, argued in a letter to investors in April that because data centres for AI applications typically need a constant power supply, Vistra’s fleet of gas-fired and nuclear plants was “uniquely positioned to benefit”. Vistra itself has projected that its earnings from continuing operations will grow at an annual rate of about 18% between 2022 and 2026.

The new excitement over rising demand, and the need for baseload power to meet it, comes as the government in Vistra’s home state of Texas has been implementing its plan for subsidising investment in new generation capacity, with the aim of preventing blackouts. That plan, offering subsidies for new and upgraded gas-fired power plants, has been controversial, but is attracting a high level of interest from generators, in part because of those expectations of strong growth in demand.

However, there are signs of tension emerging in Texas, and elsewhere in the US, about the implications of adding substantial additional load to the grid to enable the rise of AI. Politicians and the public are asking questions about how the investment in new generation and other infrastructure will be paid for. It has not broken cover as a political issue just yet. But if the projected demand growth does materialise, those tensions are likely to grow.

Texas plan to support new gas-fired plants attracts strong interest

The Texas plan for supporting new generation was created in the aftermath of winter storm Uri in February 2021, when millions of people lost power, often for several days, and hundreds died. Although the causes of the blackouts were rooted in a broad-based failure of generation, including gas and coal plants, the explanation that won most favour with political leaders in Texas was that subsidies for wind and solar power had suppressed investment in new gas-fired capacity.

Texas installed more solar generation capacity than any other state in the US last year, and this year has become the top state for wind and solar generation.

The plan to create a fund to support investment in new gas-fired generation was put on the ballot as an amendment to the state constitution last November, and was supported by a large majority: 65% for, 35% against. The measure creates the Texas Energy Fund, administered by the Public Utility Commission of Texas (PUCT), with a mandate to provide loans and grants “for electric generating facilities that serve as backup power sources”, which in practice means gas-fired plants.

In May, the PUCT opened the process for making applications to the Texas Energy Fund, and earlier this month reported on initial expression of interest. The response was substantial: by the beginning of June, 125 notices of intent to apply for support had been filed, adding up to almost 56 gigawatts of new generation and almost US$39 billion of support. That is many times the initial funding of US$5 billion for the programme allocated by the Texas legislature last year.

Dan Patrick, lieutenant-governor of Texas, welcomed what he called an “overwhelming” response, saying: “We need more natural gas plants in the ground as soon as we can get them.” He added that he aimed to increase the funding for the plan in the upcoming legislative session “to keep up with our state’s incredible growth”.

Critics of the plan have raised concerns about the prospect of Texas breaking with the free-market principles that have underpinned its electricity system. As well as the Texas Energy Fund, a series of other changes are being implemented by the PUCT. These include a reliability standard, setting limits on outages, and a performance credit mechanism (PCM), giving generators a credit for being available at times when the grid is under strain. Wood Mackenzie analysts noted last year: “It remains to be seen if these disparate pieces of policy will be able to co-exist and work together cohesively to bring about grid stability.”

It was not even clear that the support for new gas-fired plants would lead to net increases in dispatchable generation capacity. Generators could just take the subsidies for new capacity and accelerate retirements of old coal-fired plants.

The prospect of strong demand growth changes that outlook. Wood Mackenzie is forecasting that about 4.3 GW of new gas-fired generation will be added to the Texas grid by 2030. In some cases, the new financial support from the state is making a difference. NRG Energy, for example, says it will build its three proposed new gas-fired units with a total capacity of 1.6 GW only if it gets timely approvals from the PUCT for low-cost loans, as well as tax breaks from local authorities.

Vistra, meanwhile, says it will seek Texas Energy Fund financing for 860 megawatts of capacity in new peaker plants in west Texas, but has not applied for support to convert an old coal-fired plant to burn gas, or for upgrades to add an extra 500 MW of summer capacity across its Texas fleet.

For Vistra, a critical factor is the regulatory framework from the PUCT, including the PCM and the reliability standard, which “is needed to provide confidence to make the long-term investments Vistra is announcing”. It also needs to see long-term wholesale power market trends that continue to support gas generation.

Rumbling signs of discontent over data centres’ demand for power

The indications are that the range of interventions proposed for the Texas grid are having the intended effect of supporting new investment in gas-fired generation. There are two possible concerns that can be raised. One is that subsidising gas plants could deter investment in wind, solar and storage and lead to higher greenhouse gas emissions from the Texas power sector. Environmental groups including the Sierra Club argued last year that that would be a consequence.

The other issue may be more pressing because it reflects concerns felt by the state’s political leaders. Having welcomed the rush of companies seeking to invest in power generation in Texas, Lt Gov Patrick last week raised concerns about what the electricity would be used for. In particular, he said there was a need to “take a close look” at cryptocurrency mining and data centres.

“They produce very few jobs compared to the incredible demands they place on our grid,” he wrote on social media. “I’m more interested in building the grid to service customers in their homes, apartments, and normal businesses… We want data centers, but it can’t be the Wild Wild West of data centers and crypto miners crashing our grid and turning the lights off.” Strong words coming from a Republican leader in a generally business-friendly state.

There have been rumblings of push-backs against data centre development in other states. Georgia’s state senate in March passed a bill suspending any new tax breaks for data centres for two years, to give time for a review by a special commission. The commission will assess the grid and generation capacity and data centres’ energy needs, and make recommendations about investment in electricity supply and where new data centres can be located.

In Virginia, the hyperscale data centre capital of the world, protests against new facilities have so far been small. But it is easy to see how, following the examples of earlier successful campaigns against pipelines, wind farms and power lines, opposition could grow. Resistance could be amplified if there is a sense that general ratepayers are being asked to cover the cost of supplying power that the big tech companies need.

As with any disruptive innovation, the rise of AI is creating new social and political tensions. Its implications for energy may turn out to be one of the most sensitive flashpoints. The tech companies, the power generators and everyone else involved in building this new industry will need to focus on not only the exciting opportunities it creates, but also the resistance that is already starting to emerge.

In brief

The world faces a “staggering” oil glut by 2030, the International Energy Agency has projected. In its latest medium-term oil market report, the IEA forecasts that world oil demand will peak at around 105.6 million barrels a day in the late 2020s, while global supply capacity is projected to be about 8 million b/d higher. The IEA says this “would result in levels of spare capacity never seen before other than at the height of the Covid-19 lockdowns in 2020,” with significant consequences for oil producers including the US shale industry.

Wood Mackenzie is also forecasting a peak in world oil demand around 2030, but at a significantly higher level of a little below 109 million b/d. The Wood Mackenzie forecast shows more of a plateau than a sharp peak, with demand declining only very slowly for most of the 2030s.

Oil prices have rebounded in the past two weeks, after being marked down sharply following the OPEC+ group meeting on 2 June. Brent crude briefly dipped to about US$77 a barrel after the OPEC+ countries announced their plan to begin a steady increase in production starting in October but had recovered to US$82.67 a barrel at the end of last week. Wood Mackenzie analysts noted at the time that the initial reaction seemed excessive, given that the OPEC+ group was clear that its plan for output growth would be implemented only if market conditions were favourable.

Longi, the Chinese solar manufacturer, has achieved a new world record conversion efficiency for a perovskite-silicon solar cell. The European Solar Test Installation has certified a power conversion efficiency of 34.6%, which is the percentage of the light energy hitting the cell that is converted into electricity. It breaks the previous record for this type of cell, which Longi also set, in November of last year. Perovskite solar cells have attracted considerable interest because of their ability to achieve higher rates of efficiency, but commercialising the technology has proved challenging.

The Mountain Valley Pipeline, carrying gas from West Virginia to southern Virginia, has started operations. It was built despite a series of holdups and legal challenges after legislation was passed last year to expedite the approvals it needed.

An arbitration tribunal based in Stockholm has agreed that Uniper can terminate its Russian gas supply contracts and awarded it more than €13 billion in damages in its dispute with Gazprom. Russian gas flows to Uniper were cut back sharply in June 2022, and stopped completely at the end of August that year. The interruption of deliveries, as European and world gas prices soared, caused Uniper to suffer substantial losses, and the German government was forced to step in to support the company. But the long-term gas supply contracts between Uniper and Gazprom were still legally in force, some of them lasting until the mid-2030s.

Michael Lewis, Uniper’s chief executive, said terminating the contracts was part of a consistent series of decisions including writing off the company’s share in the financing of the Nordstream 2 gas pipeline from Russia. Uniper has been working to diversify its gas business, building up its global LNG portfolio and pipeline supplies from other countries.

Running Tide, a carbon removals company with customers that have included Microsoft, is shutting down its global operations because it is unable to secure the financing it needs. It had originally launched with the aim of using algae for carbon sequestration, but then added a different process using waste wood.

Other views

Why higher tariffs on Chinese EVs are a double-edged sword – Max Reid and Simon Flowers

Higher LNG prices to limit Asian demand and turbocharge European gas storage levels – Lucy Cullen

Chinese companies dominate Wood Mackenzie’s solar PV module manufacturer rankings

We just broke ground on America’s first next-gen nuclear facility – Bill Gates

This coal-heavy rural co-op utility is buying its first solar plants – Julian Spector

Empirically grounded technology forecasts and the energy transition – Rupert Way and others

Solar power’s giants are providing more energy than Big Oil – David Fickling

Quote of the week

“After COP26, many large multinational companies made commitments to move towards net zero, but recently, influenced by geopolitics and various interests, some have abandoned their commitments and withdrawn from the relevant net zero alliance. This shows that it is not enough to promote carbon emission reduction by awareness alone, and we should not be too optimistic about this.

“From a micro perspective, companies still pursue profits, and listed companies still pursue market value and shareholder returns. These behaviors are unlikely to change fundamentally. Therefore, the most effective way to allocate resources in the economic system is to use prices to provide a clear incentive mechanism.”

Zhou Xiaochuan, former governor of the People’s Bank of China, made the case for developing the country’s carbon pricing system to drive emissions cuts in the electricity sector.

Chart of the week

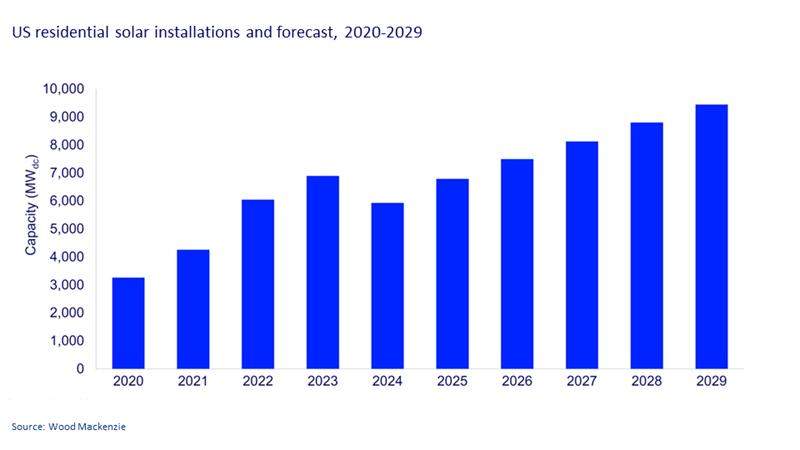

This comes from our most recent US Solar Market Insight, for the second quarter of 2024, produced by Wood Mackenzie in association with the Solar Energy Industries Association. It shows past and expected future installations of residential solar capacity in the US, annually from 2020 to 2029. The industry has been hit by a series of problems, including the surge in interest rates and the end to net metering in California, and those challenges are expected to lead to a fall in installations this year. From next year, however, we expect the upward trend to resume, and by 2026 installations could be higher than they were in 2023.

Buy the full report, with lots more detail and analysis on the outlook for US solar – or get a complimentary copy of the 15-page executive summary.