Three challenges to overseas expansion for the Chinese cathode sector

Can Chinese producers of ternary cathodes and precursors look abroad to solve domestic oversupply?

4 minute read

Yingchi Yang

Research Analyst, Battery Raw Material

Yingchi Yang

Research Analyst, Battery Raw Material

Yingchi focuses on supply of global cathodes and precursors.

Latest articles by Yingchi

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

Cathode and precursor: 5 things to look for in 2024

-

Opinion

Three reasons LFP cathode supply keeps expanding in an oversupplied market

Suzanne Shaw

Head of Energy Transition & Battery Raw Materials

Suzanne Shaw

Head of Energy Transition & Battery Raw Materials

Suzanne specialises in commodities including cathode and precursor, lithium, cobalt, graphite, rare earths and lead.

Latest articles by Suzanne

-

Opinion

How will the new US Republican government reshape the global electric vehicle supply chain?

-

Opinion

Four key takeaways from LME 2024

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

What’s next for the EV and battery value chains?

-

Opinion

Battery raw materials: tracking key market dynamics

-

Opinion

Energy transition metals: the ESG dilemma

Kane Carty

Senior Research Analyst, Cathodes and Precursors

Kane Carty

Senior Research Analyst, Cathodes and Precursors

Latest articles by Kane

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

Cathode and precursor: 5 things to look for in 2024

With multiple factors putting adverse pressure on the domestic market, many Chinese producers of ternary (nickel-based) cathodes and precursors are looking to monetise excess capacity by investing overseas. But while international expansion looks appealing, it brings its own problems.

Our latest report explores the challenges faced by China’s ternary cathode materials producers when moving into foreign markets.

Fill out the form at the top of the page to download the full report – or read on for a quick summary:

Global oversupply of nickel-based cathodes and precursors is both global and structural

A sluggish economic recovery and slower than expected growth in electric vehicle (EV) sales meant a tough 2023 for domestic Chinese cathode and precursor producers. For ternary cathodes, volatile metal prices and a ramp-up of production using lithium iron phosphate (LFP) chemistry added to the pressure.

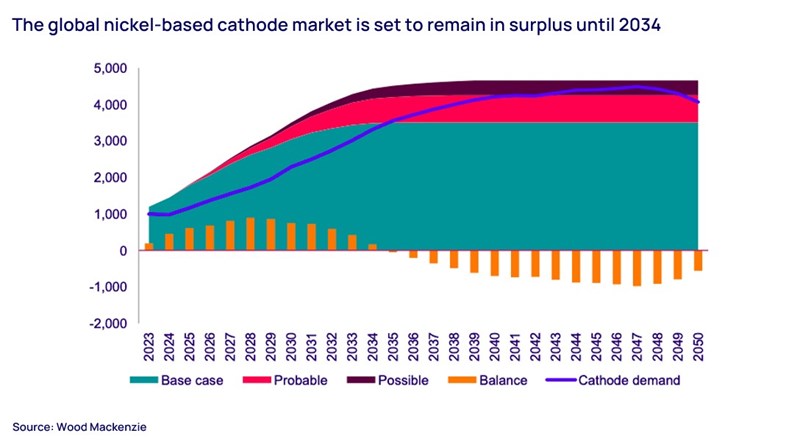

Oversupply isn’t limited to the Chinese domestic market, however. Our analysis indicates that global nickel-based cathode production will total 1,453 kilotonnes (kt) in 2024, with 464 kt of that surplus to requirements.

In our base case scenario, we expect supplies to remain in surplus until 2034, by which time annual production will have hit 3,490 kt – partly thanks to new projects in South Korea and the US (see chart below).

Global structural oversupply is not the only problem facing Chinese producers of ternary cathode raw materials and precursors who want to diversify into other markets, however.

We have identified three key challenges manufacturers need to consider and address before taking the plunge:

Challenge 1: Additional costs and delayed return on investment

A combination of factors mean that establishing production facilities for nickel-based cathode and precursor materials abroad is both costly and time consuming:

- Red tape: In many regions the requirement for comprehensive feasibility studies and stringent environmental evaluations puts the brakes on international expansion as a quick solution to slow sales.

- Uncertain EV growth: While in China EV penetration soared from 5.5% to 33.4% from 2020 to 2023, in Europe and the US, the world’s second and third largest markets, it is at only 21% and 10% respectively.

- Value chain costs: In China, producers benefit from cheap labour, efficient logistics and reliable materials sourcing; in many foreign markets, producers face additional expense for capital, labour, materials and logistics.

- Energy input: Higher energy costs and the need to set up compatible electrical infrastructure for production adds another layer of expense for Chinese manufacturers in foreign markets.

Challenge 2: Environmental, social and governance issues

To add to the obstacles, different countries and regions have their own environmental, social and governance (ESG) regimes that are often much stricter than in China:

- Environmental: Manufacturers may need to amend processes to meet stricter environmental protection regulations that require comprehensive waste management throughout the production process.

- Social: China’s efficient and flexible but labour-intensive manufacturing model involves long working hours and low wages; this approach is unfeasible where local labour laws more rigorously protect employees.

- Governance: EU rules including the Corporate Sustainability Reporting Directive (CSRD) and Battery Regulation Amendment present a challenge for Chinese companies unused to such stringent requirements.

Challenge 3: Local policy regimes

Aside from ESG-related compliance issues, the policy environment in potential host countries can present further obstacles for Chinese firms keen to establish a presence in the local market:

- The Inflation Reduction Act (IRA): Modified rules regarding eligibility for EV purchase tax credits were introduced under the US IRA; these require a significant proportion of critical minerals used in EV production to be extracted or processed within the US, in countries with a free trade agreement, or from recycling within North America.

- Foreign Entity of Concern (FEoC) rules: From 2025, new rules of origin mean EVs whose batteries contain critical minerals extracted or processed in China, or by companies with more than 25% Chinese equity, will be ineligible for the US EV purchase tax credit.

- US Department of Defence ban: The United States Department of Defense will be barred from buying batteries produced by six of the leading Chinese manufacturers from October 2027 – namely CATL, BYD, EVE Energy, Gotion High Tech, Envision Energy, and HiTHIUM Energy Storage Technology.

- Withdrawal of incentive programmes: Early withdrawal of government incentive programmes in overseas markets is likely to slow EV penetration rates, discouraging Chinese investment; for example, Germany recently ended its EUR4,500 per EV subsidy scheme early amid a budget crisis.

These and other policy changes could make it increasingly difficult for Chinese manufacturers of cathode raw materials to establish and maintain crucial business relationships with battery makers.

How should Chinese producers cope with these challenges?

Wood Mackenzie has identified several key ways for Chinese producers of ternary cathodes to stay resilient and adaptable in the face of growing geopolitical challenges and changing market dynamics.

Learn more

Don’t forget to fill out the form to download your complimentary copy of the full report, which sets out the best potential strategies for firms based on their strengths and weaknesses.