Get Ed Crooks' Energy Pulse in your inbox every week

A power-up for US renewables

If the Build Back Better Act passes, it will have a dramatic effect on the US solar industry

12 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

At the Cleanpower 2021 conference in Salt Lake City this week, Gina McCarthy, President Joe Biden’s National Climate Advisor, sketched out her views on the two key pieces of legislation that have been moving through Congress this year. The Infrastructure Investment and Jobs Act, passed with bipartisan support and signed into law by the president last month, was “a great first step” in making progress towards the administration’s climate goals, she said. However, she added: “It’s the Build Back Better Act that will accelerate us forward and drive the change that we need.”

That law is facing a difficult passage through Congress. While the infrastructure bill was backed by every Democrat and 19 Republicans in the Senate, for the Build Back Better Act the president cannot even count on the support of every senator in his own party. The bill, which was passed in the House of Representatives last month, is a sprawling piece of legislation, including provisions covering childcare, paid family leave, drug prices and corporate taxes, as well as energy.

Centrist Democratic senators Joe Manchin and Kyrsten Sinema have raised objections about the cost of the bill, and have already succeeded in getting it cut back from total ten-year spending of $3.5 trillion down to about $1.6 trillion. Even then, it still may not pass by the end of the year as the Democratic leadership hopes. There is still plenty of negotiating to come.

If the energy measures in the current version of the bill do take effect, the assessment of Wood Mackenzie analysts is that Gina McCarthy’s statement is broadly accurate: the law would provide a very significant boost to investment in renewable energy in the US. Its key provisions include extensions of the Production Tax Credit (PTC) and Investment Tax Credit (ITC) for wind, solar, geothermal and other renewable energy projects, a new tax credit for nuclear power, and an increase in the value of the 45Q tax credit for carbon capture.

Solar power is one sector that could be changed very significantly. If the bill passes, the ITC for solar power, which is currently being stepped down, would be extended to cover projects that begin construction before the start of 2027. Solar would also be eligible for the PTC as an alternative, giving developers the option to choose which credit might be more attractive, depending on the characteristics of their project. In some cases the credit could be given as a direct payment, helping developers that do not have tax liabilities they can use.

The law does also make some demands of the renewables industry, as it seeks to encourage domestic manufacturing and training to create jobs in the US. However Xiaojing Sun, Wood Mackenzie’s global head of solar research, argues that the requirements do not seem so strict as to create fundamental difficulties for developers. The key domestic content requirement is structured as a carrot, not a stick: there is an additional 10% credit available for projects that meet domestic content requirements. To be eligible, projects need to spend at least 40% of their costs on US-made equipment and components. Reaching that threshold will not be easy, given that Wood Mackenzie calculates that last year the share of domestic content in solar project hardware was just 16.2%. But even without the extra credit, the changes to the ITC and PTC would still make a big difference to the economics of many projects.

“It will make solar power more competitive, and customers at the margin will be more likely to buy it,” Sun says. Wood Mackenzie’s base case forecast, excluding any impact from the Build Back Better Act, is that US photovoltaic solar capacity installations will be on a gently rising trend through the 2020s. With the enhanced tax credits in the bill, that growth would be supercharged. By 2030, annual new solar capacity added could be over 77 gigawatts: almost double the amount expected in the base case without the new law.

With the extended tax credits helping to drive down the cost of solar, attention would be focused even more sharply on the other barriers to the industry’s growth, including land use and permitting, grid connections and the supply chain. The administration and Congress are working on tackling some of those issues: the Build Back Better Act includes an extension of the ITC to some electricity transmission projects, for example. But those challenges will have to be managed effectively to achieve the pace of growth envisaged in Wood Mackenzie’s projections.

It is also worth noting that even if the act passes, the resulting growth in renewable energy would probably not be enough to meet the administration’s objectives for cutting greenhouse gas emissions. President Biden this week signed an executive order mandating a series of measures to use the federal government’s purchasing power to support the development of low-carbon industries, and reiterated that his goals were “a carbon pollution-free electricity sector by 2035 and net-zero emissions economy-wide by no later than 2050.”

If the enhanced tax credits pass, Wood Mackenzie forecasts that total US solar capacity will be about 530 GW by 2030. That is behind the pace suggested by the US Department of Energy’s Solar Futures study, which suggested that cumulative deployment of 760 GW–1,000 GW would be needed by 2035 to achieve a 95% carbon-free grid. It is a fact that underlines the difficulty of achieving the administration’s decarbonisation goals: even a piece of legislation that is pushing at the limits of what is politically achievable today does not look like it would be enough to achieve the objectives that President Biden has set.

EQT CEO hits back at Senator Elizabeth Warren

Elizabeth Warren, a Democratic senator from Massachusetts, last month wrote to the chief executives of 11 leading US gas producers, including ExxonMobil, ConocoPhillips, BP and EQT, accusing them of “inexcusable” corporate greed in supplying gas for export while domestic prices were at their highest levels for more than a decade. Rising profits were “the results of a rigged system that enriches energy company executives and investors, and leaves American families struggling to pay the bills,” she wrote. The letters concluded with a series of questions about gas exports, “in order to better understand the actions of oil and gas companies and the rationale for decisions to export record amounts of natural gas while imposing massive price increases on Americans families and small businesses”.

This week, one of those chief executives delivered a public response. Toby Rice, who has led EQT since 2019, published a nine-page letter, with charts, rejecting Senator Warren’s charges. What was particularly interesting about his argument was that most of his points were not directly about prices and profits at all, but about climate change. Rice had been moved to reply, he wrote, because the senators’ allegations “foster a narrative that politicizes natural gas and associated infrastructure in a manner that runs counter to one of our key collective goals, one we know you share – addressing climate change.”

US LNG is “the most impactful green initiative on the planet,” he added, because of the reductions in carbon dioxide emissions available from switching from coal to gas for power generation. On his calculations, “the potential emissions reduction opportunity for coal-to-gas switching within the power sector is 50% greater than the potential emissions reduction opportunity from vehicle electrification within the transportation sector.”

Objections have been raised to this type of argument in the past, including the point that methane leakage from gas facilities can cancel out a large proportion of the benefits in reduced carbon dioxide emissions, making the overall greenhouse gas impact much less favourable. But as Rice pointed out, “methane emissions are not synonymous with natural gas”. The industry has been working to reduce the emissions intensity of its operations, and that effort continues, with companies setting increasingly ambitious targets.

“To best address climate change, it is incumbent on countries like the United States to produce more natural gas that can be used by other countries,” Rice argues, “to assist them in their efforts to replace coal consumption.” His arguments are not universally accepted. But Wood Mackenzie also sees coal-to-gas switching as one of the changes that can help put the world on a pathway to meet the Paris Agreement goal of limiting global warming to 2 °C.

Meanwhile, US gas prices have done a good job of refuting the claim that exports are the main factor raising costs for US consumers. Benchmark front-month Henry Hub futures have dropped below $4 per million British Thermal Units this week, and at around $3.80 / mmBTU are at their lowest level since the summer. Warm weather across much of the US has been the principal reason.

In brief

Ford is doing “whatever it takes” to increase production capacity for building the electric F-150 Lightning, its chief executive Jim Farley told CNBC. “Our capacity is about half of what the demand is,” he said. “We have a dedicated team right now just doing one thing: finding a way to double our capacity by finding batteries, whatever it takes.”

New Mexico’s Public Regulation Commission has blocked the planned merger between PNM Resources and Avangrid, a subsidiary of Iberdrola.

Financial officers from 15 US states, including West Virginia, Texas and North Dakota, have written to the banking industry, threatening to take “collective action” against lenders that refuse to finance the coal, oil, and natural gas industries. Their letter, seen by National Review magazine, said the specific actions taken by each state could be different, but “the overarching objective of our actions will be the same — to protect our states’ economies, jobs, and energy independence from these unwarranted attacks on our critical industries.”

Glenn Youngkin, the Republican governor-elect of Virginia, has promised to withdraw the state from the Regional Greenhouse Gas Initiative, the carbon market that covers 11 states in the northeast US. Republicans in the state legislature also aim to roll back some of the provisions in the 2020 Virginia Clean Economy Act, which was intended to advance renewable energy development in the state.

The 10% of the world’s population with the highest greenhouse gas emissions is responsible for close to 50% of the global total, while the bottom 50% produce just 12% of the total.

And finally: musicians for nuclear energy. Back in the 1979, after the Three Mile Island reactor accident, a group of rock stars including Jackson Browne and Graham Nash formed Musicians United for Safe Energy, to promote “safe, alternative, non-nuclear energy”. The campaign’s high point was probably Bruce Springsteen’s No Nukes concerts at Madison Square Garden, the source for a newly-released live album. In 2021, however, climate change is a bigger issue than reactor accidents, and we are starting to see a few popular musicians speak out in favour of the role played by nuclear plants in providing zero-carbon power. The Edge of U2 in April raised concerns about the drawbacks of renewables in terms of land use, and suggested opponents of nuclear power should rethink their positions. “We need to think very deeply about whether our current strategy of renewable energy is going to make it,” he said. “We have to open our minds to third generation nuclear energy being a possible solution.”

Then this week Grimes, the Canadian electro-pop performer who became famous to a wider public when she was the partner of Elon Musk, also spoke out in favour of nuclear power, urging California to keep open the Diablo Canyon plant, which is scheduled to close by 2025. “California is in an energy and climate crisis, and closing Diablo Canyon will make us reliant on fossil fuels,” Grimes said in a video posted on social media. “This will push the state backwards instead of forwards in its goal to be 100% reliant on clean energy.”

You might quite reasonably take the view that the opinions of pop musicians are not the most important factors to take into account when setting energy policy. But Browne, Springsteen and others arguably did play a role in helping to shape public scepticism about nuclear power. That mindset persists to this day in some places, accelerating reactor closures and making it harder to build new plants. The comments from Grimes and the Edge looks like signs that popular opinion is changing. A poll that has tracked US public opinion on nuclear power since 1983 found a record high level of support this year.

Other views

Tom Ellacott — Will 2022 be a year of radical change for oil and gas companies?

Sohaib Malik — Germany's ‘traffic light’ coalition greenlights a faster energy transition

Max Reid — False dawn for lithium-ion battery recycling?

Julian Popov — Natural gas is not a transitional fuel, so let’s stop saying it is

Meredith Angwin — Nuclear, the auctions and the grid

Sarah Miller — The millions of tons of carbon emissions that don’t officially exist.

Tom Wilson — Oil and gas majors compete to recruit talent in shift to greener future

Quote of the week

"You saw where our president asked OPEC to increase production. I never received a call from the administration about adding more rigs. We can’t, because we have an investor contract. We can’t go back on our word. People have asked me: ‘At $100 oil, at $150 oil, are you going to grow more than 5%?’ The answer is no. We’re just going to return more cash back to the investor. So I just don't think we have an obligation to grow production. Because we’ve done it twice: we’ve added too much oil at several different times over the last 10 years, and we’ve had a price collapse." —Scott Sheffield, chief executive of Pioneer Natural Resources, told CNBC that it would have been pointless for President Joe Biden to try to persuade him to ramp up activity and increase production faster.

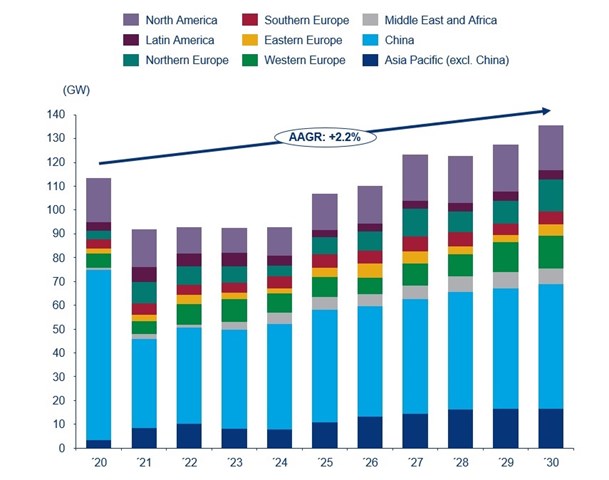

Chart of the week

This comes from Wood Mackenzie’s recent Global Wind Power Market Update for the fourth quarter of 2021. Forecasts for new wind generation capacity installations for the coming decade have been revised up, mainly because of expectations of stronger demand in China. The total global growth over 2020-30 might not look very impressive at an annual average rate of 2.2%, but it is worth bearing in mind that 2020 was an extraordinary year, as developers in China rushed to secure subsidies that were about to expire. There was about 72 gigawatts of wind capacity installed in China in 2020, almost three times as much as in 2019. This year, installations in China have dropped back again to about half of last year’s level. Driven by both government policies and continued growth in electricity demand, however, those installations in China are expected to rise at a steady average of about 5% a year from 2021 to 2030. With growth also projected for Europe, North America, the rest of Asia, the Middle East and Africa, total wind capacity added worldwide in 2030 is expected to be roughly double the 61.7 GW added in 2019.