Get Ed Crooks' Energy Pulse in your inbox every week

Breaking down the barriers to grid innovation

Technologies are available to increase capacity without building new lines. Policy support could help deployment.

11 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

“There’s no transition without transmission.” Like most popular slogans, it is a saying that is widely used because it is catchy. It also has the benefit of being true. The transition to a lower-carbon energy system will depend on shifting power generation away from fossil fuels and towards renewables and nuclear, and that will mean adding transmission capacity to connect those resources to demand centres.

The problem, particularly in developed economies, is that building new transmission lines is a complex and often drawn-out process, constrained by politics and local opposition as well as by economics and engineering. The Biden administration this week established an alliance intended to support workarounds: ways to add increased capacity to the grid without installing new lines.

The new alliance, called the Federal-State Modern Grid Deployment Initiative, brings together 21 states from California to Massachusetts, most with Democratic governors, to support the adoption of new grid-enhancing technologies. The goal is that “renewables and other clean sources of power can be integrated sooner and more cost-effectively than waiting for new transmission construction,” the White House said.

But while the potential impact of grid-enhancing technologies may be very large, there are still some fundamental obstacles that will have to be overcome for them to achieve widespread deployment in the US.

The difficulty of building new transmission lines underlines the need for innovation. Construction of new interzonal transmission in the US has been broadly flat over the past decade, rather than keeping pace with the growth of renewable generation. In the PJM, MISO, WECC and SPP markets over the period 2012-22, there were more miles of new transmission projects canceled than there were continuing to make progress.

The SunZia Southwest Transmission Project, which will connect renewables in New Mexico to markets in Arizona and California, counts as a success story in the sense that it was able to start construction last year. But it will still take two decades to come into service, from the time plans were first submitted in 2006 to its intended start of commercial operations in 2026.

The issue is not just bringing more wind and solar on to the grid. US electricity demand is now entering a period of sustained growth for the first time in two decades, thanks to new data centres and manufacturing plants, and those large loads often need additional transmission capacity to get connected to the grid.

Politicians and regulators have been attempting to expedite the build-out of new lines. The Fiscal Responsibility Act, signed into law in June of last year, included measures to streamline permitting for infrastructure projects including transmission lines. Regulations finalised by the Biden administration in April to implement that law will “accelerate the deployment of clean energy, transmission… and other crucial infrastructure,” the White House said.

The Federal Energy Regulatory Commission in May adopted rules also intended to support investment in new transmission capacity. FERC’s Order No. 1920 requires transmission companies to draw up long-term regional plans, to prevent investment in capacity that is not cost-effective and so increases costs for consumers. Willie Phillips and Allison Clements, the two FERC commissioners who supported the order, said it would make it possible “to build the infrastructure needed to ensure reliability and affordability.”

It is uncertain how effective these efforts will be. The legislation that passed Congress did not go as far as many supporters of permitting reform would have liked. States still play a key role in siting new transmission, and they can use those powers to obstruct investment. The problem of cost allocation – who pays for investments in transmission – remains deeply contentious.

So technological alternatives to building out new lines remain as attractive as ever. A useful Department of Energy paper published in April, citing Wood Mackenzie research, gives a good overview of the range of advanced technologies now available to increase the capacity and efficiency of the grid. The key technologies for transmission include:

- Dynamic line rating – Real-time calculation of a transmission line’s power carrying capacity based on local conditions

- Advanced power flow control – Redirecting power from overloaded lines to lines with available capacity

- Topology optimisation – Software to identify the optimal reconfiguration of the system to operate the grid more efficiently

The Department of Energy argues that these and other innovative grid technologies could mostly be deployed on the existing grid in under three to five years, and would offer lower cost and / or greater value than to conventional technologies or approaches.

However, there are several issues that have been holding back deployment. One is that transmission operators are, for good reasons, inherently cautious. When they are assessing whether to adopt innovative technologies, possible grid failures and blackouts always weigh heavily in their decision-making.

Another issue is that the standard US “cost of service” model of utility regulation often creates little incentive for companies to invest in cost-saving technologies. Typically, it is better for an investor-owned utility to build new physical infrastructure that can be added to the rate base, than to invest in software that makes that new infrastructure unnecessary.

The White House initiative is aiming to use the powers of federal and state governments to break down some of those barriers. It includes 20 commitments made by the 21 states and the federal government, with the shared goal of accelerating deployment of these innovative technologies.

The agreement includes a lot of language about how the governments will “explore opportunities”, “maintain the national focus” and “work collaboratively”. It is light on concrete actions. But the agreement of the shared goal and the recognition of the potential obstacles is a first step towards policy changes that could support deployment.

The states say they will explore ways to facilitate adoption of innovative grid technologies that could include “grid planning, financial incentives, performance standards, and updated cost-effectiveness criteria.” The state of Virginia has already shown what that might look like: in April it passed a bill with bipartisan support, requiring electric utilities to include assessments of the potential application of grid-enhancing technologies and advanced conductors in their integrated resource plans.

To bring about more rapid change, federal action may be needed. It is possible that FERC could act to improve financial incentives for investment in grid-enhancing technologies, using powers in the 2005 Energy Policy Act.

There have also been proposals for new federal legislation. In March a group of Democratic senators and representatives launched the Advancing Grid-Enhancing Technologies (GETs) Act, which would establish a new framework for sharing the savings from investments in innovative technologies.

Under the proposed law, the benefits of an investment would be divided between installers and ratepayers, so long as the project generated savings of at least four times its upfront cost. Under one model for how this framework could work, for smaller projects worth up to US$2.5 million, developers would take 25% of the benefits. For larger projects, there would be an open competition for potential developers to bid for the share they would take, with the aim of maximising the benefit to consumers.

It is an interesting idea that has widespread support from renewable industry associations and environmental groups. The turbulence of US politics in an election year means it is unlikely to become law any time soon. But for as long as the current system of utility regulation remains a barrier to innovations that could benefit both consumers and the industry, the pressure for change will remain.

ConocoPhillips continues the consolidation of US oil and gas

The wave of consolidation sweeping through the US oil and gas industry has continued with ConocoPhillips’ agreement to buy Marathon Oil in an all-stock deal valued at US$22.5 billion, including US$5.4 billion of net debt. The acquisition will create the third-largest producer in the US Lower 48 states, behind ExxonMobil and Chevron.

Once the deal closes, ConocoPhillips’ total worldwide oil and gas production will be about 2.3 million barrels of oil equivalent per day, which is more than TotalEnergies and nearly as much as BP.

Alex Beeker, Wood Mackenzie’s director for corporate research, said: “The addition of Marathon further solidifies ConocoPhillips in a league of its own, with few true peers.”

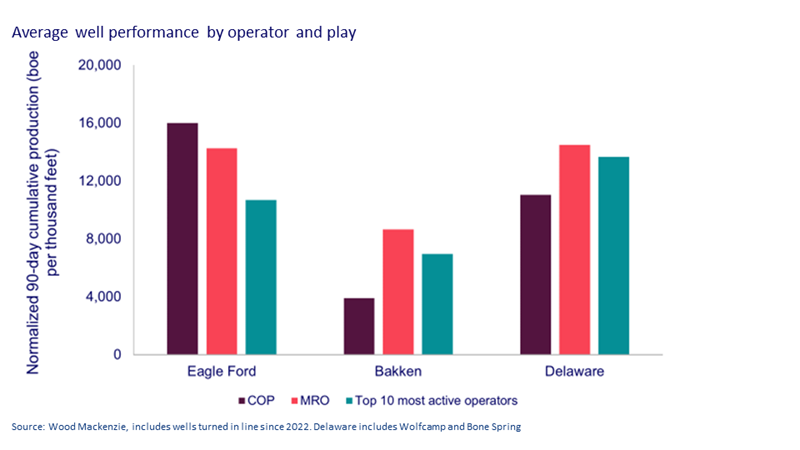

He added that Marathon would provide ConocoPhillips with optionality and assets that would immediately compete for capital. Marathon’s average well performance in the Bakken and Delaware over the past two years has exceeded that of ConocoPhillips.

As a signal of its confidence in the deal, ConocoPhillips will raise its base dividend by 34% after the transaction closes, in effect rolling the variable dividend component payout strategy into the base. That means its base dividend payout ratio will rise from 16% to 21% of operating cash flow, the highest among the US oil and gas Independents. It is moving closer to the US Majors, which generally pay out 25-30% of operating cash flow via base dividend.

Meanwhile, Chevron this week secured the approval of Hess shareholders for its US$60 billion takeover. The next key milestone is approval by the Federal Trade Commission, with a decision on that expected in the coming weeks. After that, the principal remaining issue will be the arbitration case with ExxonMobil over its claim of rights of first refusal to buy Hess’s assets in Guyana. The results from the first round of that arbitration are expected in September.

In brief

Another initiative from the Biden administration this week aimed to encourage investment in new nuclear reactors. There was a summit at the White House to discuss nuclear deployment in the US, and the administration highlighted a series of steps intended to support the business case for keeping existing reactors running and building new ones. The measures include US$800 milllion for one or two new power plants using small modular reactors, streamlined licensing and permitting procedures at the Nuclear Regulatory Commission, and a ban on importing enriched uranium from Russia without an approval from the energy secretary. The administration has also pledged up to US$2.72 billion to support new US enrichment capacity in the United States for low enriched uranium (LEU) and high assay low enriched uranium (HALEU), used for nuclear fuel.

South Korea’s government is planning for steep increases in renewables and nuclear power to meet rising demand for electricity. Its target is for the country to produce 70% of its power from renewables and nuclear by 2038.

Ministers from the OPEC+ countries will hold their next regular meeting by teleconference on Sunday 2 June. The group’s members are working towards a “complex” deal that would allow some of their current production cuts to be extended into 2025, Reuters reported. Brent crude, which has been on a downward trend since April, was trading at about US$82 a barrel on Friday morning.

Saudi Arabia plans to sell roughly US$12 billion worth of shares in Saudi Aramco.

An extreme heatwave in northern India has sent temperatures in Delhi to what may well be new record highs. The provisional recorded temperature this week hit 52.3 °C (126.1 °F). If confirmed, it would be the highest ever recorded in India.

Other views

The coming low carbon energy system disruptors – Simon Flowers and others

Global economic outlook: GDP growth upgrades, downgrades and sticky inflation – Peter Martin

China’s renewable exports grew by 35% between 2019 and 2023

The US can't be protectionist and world leader – Andreas Kluth

China’s Quixotic quest to innovate – George Magnus

No new fossil fuel projects: the norm we need – Fergus Green and others

The promises and perils for sustainability in the US military’s adoption of AI – Daniel Nasaw

Quote of the week

“Today our investors sent a powerful message that rules and value-creation matter… We expect the activist crowd will try and claim victory on today’s vote, but common sense should tell you otherwise in light of the large margin of the loss.”

Darren Woods, chief executive of ExxonMobil, issued a statement after the company’s shareholders voted overwhelmingly to support the board and reject proposals for additional climate-related action.

Chart of the week

This comes from our initial analysis of the US$22.5 billion ConocoPhillips / Marathon Oil deal, giving a snapshot of some of the potential synergies that could be available in the US Lower 48 states. In the Eagle Ford formation, ConocoPhillips’ wells have been significantly more productive than Marathon’s. But in the Bakken, Marathon’s wells over the past two years have been about twice as productive as ConocoPhillips’. There should be significant potential to transfer learning and improvements from both sides to benefit the other. Ryan Duman, director of Americas upstream for Wood Mackenzie, said he expected that would be likely to materially improve the combined company’s capital efficiency in Lower 48 assets outside the Permian Basin.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today to ensure you don’t miss a thing.