Get Ed Crooks' Energy Pulse in your inbox every week

Capital discipline raises questions about US oilfield services

Like E&Ps, oilfield services companies are prioritising cash generation and distributions to shareholders. It could be a constraint on the industry's growth

11 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

-

Opinion

Home energy storage booms in the US

-

Opinion

China’s solar growth sends module prices plummeting

-

Opinion

Everyone is worrying about rising demand for electricity. Do Microsoft and Google have an answer?

The NAPE Summit, held in Houston every year, is an event that feels like something of a throwback in the digital world. The name originally stood for North American Prospect Expo, and it acts as a marketplace where companies can take stands to advertise oil and gas assets available for sale or a farm-in, and potential buyers can wander around to see what looks interesting.

Attendance is down from the glory days of the early 2010s, but it is still a very popular event. 6400 people had turned up by Thursday afternoon, despite the disruption caused by an ice storm that hit northern Texas, and many big companies including Chevron, BP, Occidental Petroleum and EOG Resources, were represented.

Issues being discussed around the halls included the impact of the Biden administration’s policies, and especially the consequences of the generous subsidies for low-carbon energy in the Inflation Reduction Act. The renewable energy zone was well-attended, reflecting the willingness of oil and gas operators and investors to consider other opportunities if the economics are sufficiently appealing.

Another topic that is of acute interest at the moment is cost inflation and shortages in the supply chain. Rick Muncrief, chief executive of Devon Energy, said that as demand had picked up coming out of the Covid-19 pandemic, his company had faced challenges in finding both the equipment and the staff it needed.

“We found ourselves short on the ability to manufacture equipment, or replace equipment. What used to be an off-the-shelf item no longer [comes as] an off-the-shelf item,” he said.

“What used to be the ability to quickly staff up on the service side, out in the field, out in the elements: suddenly if it rains you have the 18-24 year-olds that may say: ‘I think I want to do something different’. And you have the 60 year-olds that say: ‘You know what: I’ve been through enough of these cycles, I think I’m going to stay home and do something different’. And it doesn’t take much to tilt it in that direction, when you have supply chain disruptions.”

Supply chain problems are a common issue across the industry. New Wood Mackenzie research shows that the average cost of drilling and completing a well in the US Lower 48 states rose by a “staggering” 34% last year, as prices for diesel, proppant and steel pipe hit record highs.

This year we expect that cost inflation will slow to around 10%. Diesel and proppant prices have been coming down. But the costs of drilling rigs and frac spreads — the pressure pumps used for hydraulic fracturing — are still rising.

Capacity utilisation rates for frac spreads and “super spec” high-quality rigs are running high. And the companies that provide drilling and fracking services are wary of adding additional capacity. The exploration and production companies have focused on strengthening their balance sheets and returning capital to shareholders , and — helped by the rebound in oil prices — have been rewarded with a 108% rise in the S&P 500 energy index in the past two years, far outpacing the 8% rise in the broader index.

Oilfield service companies are pursuing the same strategy of capital discipline. And industry that has been often brutally cyclical is aiming for greater stability and better performance for investors,

“E&Ps are getting some real encouragement from investors for this disciplined model, and so we have seen the service providers also consolidate… and they are being very very disciplined,” Muncrief said

“They are aiming to make sure that if there’s a bankruptcy headline, it’s not their company. So everybody is working very very diligently on their balance sheets, to make sure that they can persevere and live through the cycles.”

Capital discipline and returning cash to shareholders have been consistent themes in recent earnings reports from the listed oilfield services companies. Halliburton, for example, raised its quarterly dividend to 16 cents for the fourth quarter of 2022, up from 12 cents for the third quarter, and has resumed its share buyback programme.

In its earnings statement, Halliburton highlighted its operating margin of 17.5% in the fourth quarter, up 4.6 percentage points year-over-year. Chief executive Jeff Miller said he aimed to position the company to outperform in any conditions, “but especially to maximise returns through this upcycle”.

SLB raised its quarterly dividend by 43%, and also resumed share buybacks. This year it expects to distribute more than 50% of free cash flow to shareholders in dividends and buybacks. It has also been strengthening its balance sheet: net debt at the end of 2022 was US$9.3 billion, down US$1.7 billion over the year.

Olivier Le Peuch, chief executive, said he expected broad-based growth in activity this year, with “higher service pricing and tighter service sector capacity”.

The message from Baker Hughes is similar. In 2022 the company increased its dividend for the first time since 2017. Reporting fourth quarter earnings, chief executive Lorenzo Simonelli said the company planned to distribute 60-80% of its free cash flow to investors through dividends and buybacks.

Liberty, a US company that provides hydraulic fracturing and other services, has emphasised the opportunities in “today’s tight frac market”. It is shifting its fleets over from diesel fuel to natural gas, which means lower costs and lower emissions, but is making the transition “at a measured pace, roughly aligned with the attrition of the industry’s older generation diesel frac capacity.” For the coming year and beyond, it predicted “demand for Liberty services far beyond our capacity to supply.”

For the investors in these oilfield services companies, the emphasis on capital discipline is clearly very welcome. SLB and Halliburton shares had a turbulent week as crude prices slumped, but are still roughly double their level of two years ago. Baker Hughes is up about 40% and Liberty 20% over the same period.

For oil and gas operators, however, the oilfield services industry’s preference for capital discipline and cash distributions over investing for growth is potentially worrying. Services capacity in key markets, including North America, is a limiter on the pace of growth in oil and gas production. If equipment is run harder, breakdowns and disruption can become more frequent. Wood Mackenzie analysts emphasise the importance of operators securing the right kit and teams for their projects. Execution risk has the potential to be a more serious problem than cost inflation.

At the same time, if tight markets for oilfield services do continue to drive up operators’ costs, as we expect, then their margins could come under pressure. If the world economy remains robust and oil and gas demand continues to grow, then healthy commodity prices could allow both operators and services companies alike to achieve their goals for earnings, cash generation and distributions to shareholders. If there is an economic downturn, perhaps triggered by continued interest rate increases from central banks, then the rising tide that has lifted all boats in the past two years could swiftly recede.

Both operators and oilfield services companies will be better placed to face the next downturn because they have strengthened their balance sheets during the good times. But Andrew Thorburn, Wood Mackenzie’s global head of cost analysis, warns that the services companies could still face difficult times if they try to fight for market share in a downturn. “Current behaviour is quite impressive in that the arms race of previous cycles has been controlled,” he says. “But I get the feeling that it only takes one move for this to kick off.”

In brief

Some of the largest Western oil and gas companies, including ExxonMobil, Chevron, Shell, and ConocoPhillips reported earnings for the fourth quarter of 2022. The reports were something of a mixed bag, with the markets receiving the Chevron and ConocoPhillips earnings as slightly disappointing, but overall the picture was of an industry that is generating an enormous amount of cash, and able to distribute much of it to shareholders in dividends and share buybacks.

Behind the headlines of record-breaking cash generation, there were some significant sub-plots. ConocoPhillips said the US government’s Bureau of Land Management had concluded the Supplemental Environmental Impact Statement for the Willow oilfield development on Alaska’s North meaning that that the project “is now just a step or two away” from a final investment decision, Wood Mackenzie analysts said. The BLM said ConocoPhillips’ revised plan for the development had addressed the problems identified with its earlier proposal.

There was also some intriguing speculation about ExxonMobil, sparked by the company’s decision not to hold its usual Investor Day presentation this year. Wood Mackenzie analysts suggested one reason for the change, abandoning an event that has long been a fixture of the corporate calendar, could be that “the company [is] gearing up for a transformational M&A move”. Adding 2+2 to make 5? Quite possibly. But watch this space for further news.

BP chief executive Bernard Looney plans to “dial back” some elements of the company’s push into renewable energy, the Wall Street Journal reported. We should hear more when BP reports fourth quarter earnings next week.

The European Commission this week published more details of its Green Deal Industrial Plan, conceived as a response to the generous incentives for low-carbon energy investment in the US Inflation Reduction Act. Ursula von der Leyen, President of the European Commission, said: “We have a once in a generation opportunity to show the way with speed, ambition and a sense of purpose to secure the EU's industrial lead in the fast-growing net-zero technology sector. Europe is determined to lead the clean tech revolution.” The package includes reforms to simplify and fast-track permitting for low-carbon energy projects, and government funding to “unlock the huge amounts of private financing required for the green transition.”

Ministers on the OPEC+ countries’ Joint Ministerial Monitoring Committee held a scheduled online meeting, and agreed to reaffirm their commitment to the production limits agreed last October. Their next meeting will be on April 3.

Finally, there is some news about us. We at Wood Mackenzie are pleased to announce that we are under new ownership, after the completion of our acquisition by an affiliate of Veritas Capital. Mark Brinin, our new chief executive, said: “In Veritas, we have found a strategic partner that will enable us to realise greater value for our customers, both in mature markets we have served for the last five decades, as well as in the evolving power and renewables sector which is currently driving the global energy transition.”

Other views

Simon Flowers — The new investment cycle in energy and metals

Gavin Thompson — Australia’s deepening gas market turmoil

James Whiteside — Metals and mining: is caution the watchword for 2023?

Elena Belletti and Nuomin Han — Debut of the first EU carbon border tax

Russian refinery products will continue to flow in 2023 despite European price cap

Allegra Dawes and Joseph Majkut — Tailwinds and headwinds: the US offshore wind market

Jessica Fu — Brown gold: the great American manure rush begins

Alex Trembath — White Noise and climate anxiety

Helen Thomas — Shell is having a use-of-cash flow crisis

Quote of the week

“My first comment would be the White House needs to get its facts straight. If you look at what we’ve been doing, we’ve invested more than any of our other peers… When times were toughest, we were out there investing at a level that exceeded anybody else in our industry. And so we’ve done the hard work, we’ve made the investments. We had a keen focus on making sure that we had the production there and the products available for society when it was needed. When the call came, we answered it… And so I think we’re doing what the White House in essence is asking us to do.”

— Darren Woods, chief executive of ExxonMobil, took the opportunity of an interview with CNBC to respond to comments from the Biden administration describing the company’s profits as “outrageous” A White House spokesman had said: “Oil companies have everything they need, including record profits and thousands of unused but approved permits, to increase production, but they’re instead choosing to plow those profits into padding the pockets of executives and shareholders.”

Chart of the week

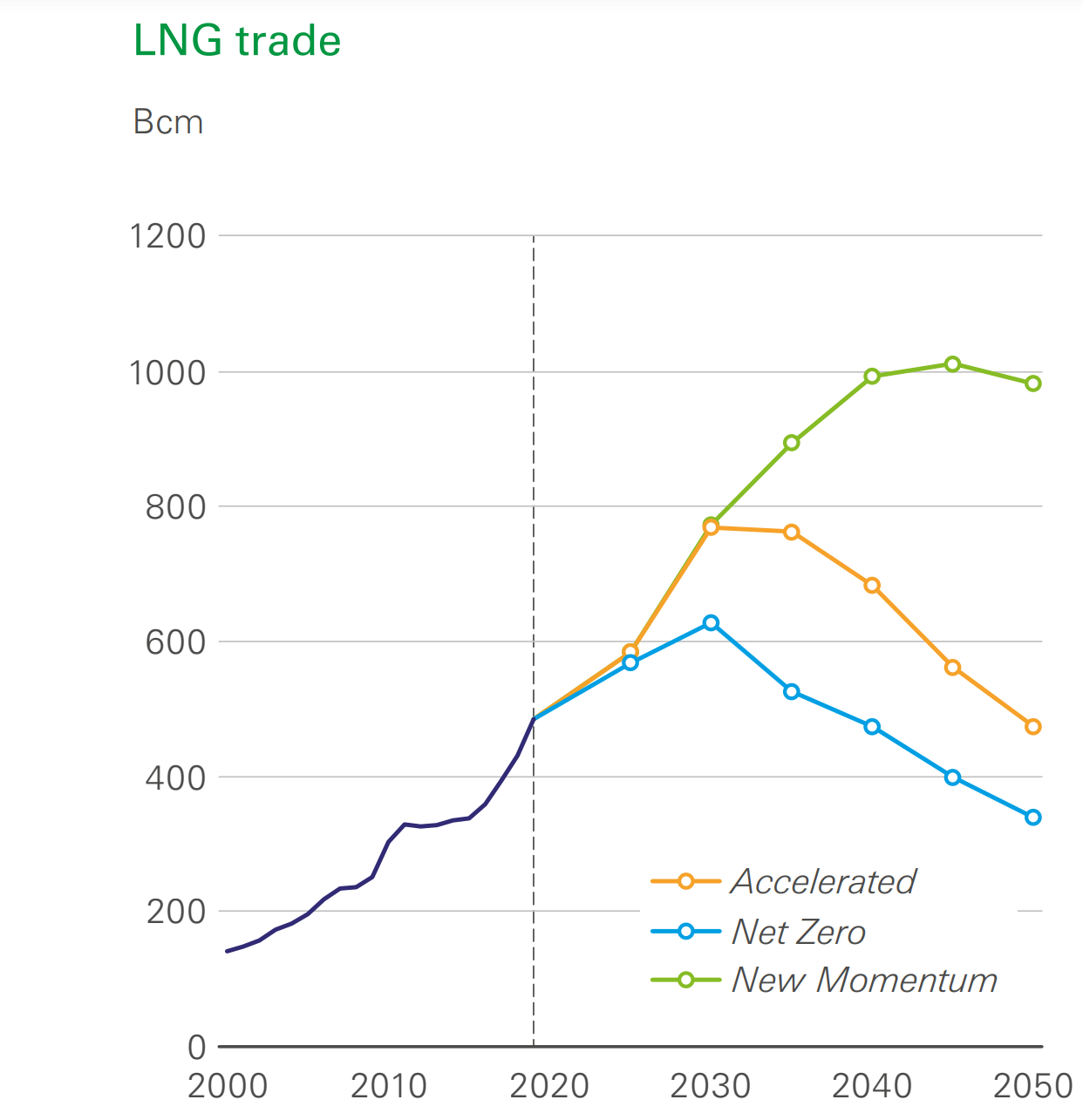

It’s not a Wood Mackenzie chart this week, but one produced by BP for its annual Energy Outlook, an always stimulating overview of the company’s expectations for the next 30 years or so. Much of the commentary about the Outlook has focused on BP’s projection that even in its “New Momentum” scenario, “designed to capture the broad trajectory along which the global energy system is currently travelling,” global oil demand starts to fall in the first half of the 2030s and is down to about 73 million barrels per day in 2050.

This chart instead shows projections for the global LNG trade. You can see that in that same “New Momentum” scenario, global LNG trade around 2040 is expected to be twice as great as it was in 2020. Even in the “Accelerated” and “Net Zero” scenarios, which are broadly in line with meeting the goals of the Paris Agreement for limiting global warming, there is still growth in LNG trade at least into the 2030s. Even by 2050, the world LNG market might be about the same size as it is today.