China’s regas capacity is on the rise – but low utilisation persists

China’s regas terminals have progressed fast recently, supporting supply diversification. But low utilisation rates are challenging business models

3 minute read

Kai Dong

Principal Consultant, APAC Gas & LNG Research

Kai Dong

Principal Consultant, APAC Gas & LNG Research

Kai focuses on China's gas market, covering market fundamentals, gas supply/demand balance and regional market analysis

Latest articles by Kai

-

Opinion

How Asia will drive global gas and LNG investment to 2050

-

Opinion

Video | Lens Gas & LNG: Exploring key trends in Asia Pacific’s gas and LNG market

-

Opinion

Asia Pacific gas & LNG: 5 things to look for in 2025

-

Opinion

Gas & LNG in Asia: the next 10 years

-

Opinion

The potential and opportunities in Guangdong LNG market

-

Opinion

China’s zonal gas transmission tariff: changes and implications

This year will see a boom in regas capacity in China. Since May 2023, four regas terminals have been commissioned: Hong Kong Offshore LNG, Caofeidian (Suntien) LNG, Wenzhou LNG and Guangzhou LNG. This brings the number of operational terminals to 28 with a total nominal capacity of 131 – comprised of 45 mmtpa in North China, 43 mmtpa in East China and 43 mmtpa in South China. In addition to these four new terminals, another two could also start operations before the end of this year, namely Zhangzhou LNG and Tianjin LNG (Beijing Gas).

So, what’s behind the regas capacity boom, and how will it change the supply landscape? And what impact will utilisation rates have on business models? This article picks out three key themes to watch. For more insight into global gas and LNG trends, read our latest market insights.

Additional regas capacity will cut China’s reliance on piped supply

The four new terminals facilitate greater supply diversification and reduce reliance on pipeline gas supplies in their respective provinces:

- Hong Kong Offshore LNG will diversify the city’s gas supplies. In our preliminary regional modelling, direct LNG imports could eventually become the dominant gas source, surpassing pipeline gas from mainland China.

- Caofeidian (Suntien) LNG could potentially offer open access to third parties after commissioning, which would alleviate reliance on pipeline gas supply.

- Wenzhou LNG provides timely capacity for Zhejiang Energy’s term LNG contract starting in 2023. With a 41% stake in the terminal, Sinopec will have an almost equivalent share of capacity access to the terminal, diversifying its regas portfolio on the east coast of China.

- Guangzhou LNG is the seventh regas terminal in Guangdong province but the first in Guangzhou city. It will supplement the pipeline gas supply and provide an additional backup supply source.

City gas companies – rather than NOCs – are leading the buildout of China’s new regas capacity

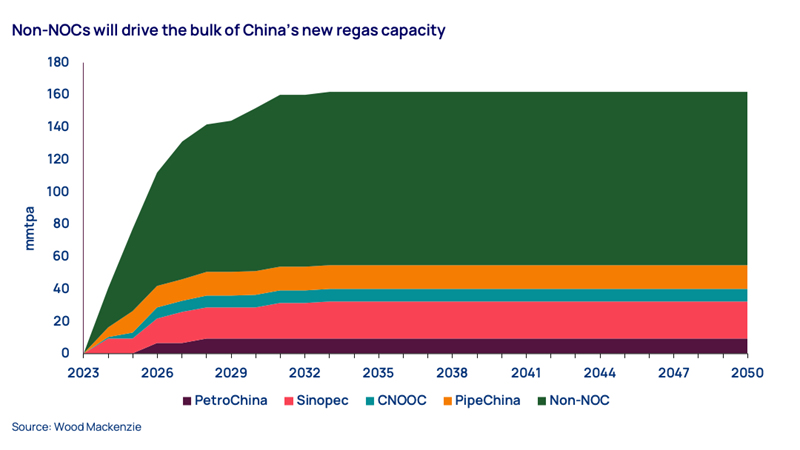

One clear trend is that non-NOCs are playing a more significant role in building regas capacity. Except for PipeChina’s Zhangzhou LNG, the other five are all majority-owned by city gas companies. And this trend will continue with new build capacity in years to come.

The capacity growth of non-NOCs is enormous. Based on equity share, non-NOC capacity is expected to grow from 67.5 mmtpa to 176 mmtpa over the next decade – 67% of total China regas capacity growth. Most of this growth is in east and south China. This new capacity allows non-NOCs to directly access the global LNG market, seize arbitrage windows and capture trading opportunities.

Along with the terminal building, contracting activity from non-NOCs is also notable. Driven by growing capacities and ongoing market reforms, non-NOCs have become increasingly active in signing long-term contracts. Since 2021, the annual contracted quantity (ACQ) of the sale purchase agreements (SPAs) signed by non-NOCs is 26 mmtpa, 46% of the total signed quantities. For example, Guangdong Energy Group and Guangzhou Gas have secured LNG contracts to be delivered when their terminals start up.

Declining regas capacity utilisation rates are impacting profitability

The massive build-out of regas terminals helps ensure gas supply security for China at the national and provincial levels and reduces dependence on neighbouring countries for pipeline imports. Despite this capacity growth story, however, utilisation rates of regas capacity are declining.

Country-level utilisation rate fell from 77% in 2020 to 57% in 2022. It may drop further in 2023 as new capacity additions are much larger than the expected demand increase.

Utilisation rates do vary across regions. South China’s utilisation rate is rising, driven by growing LNG demand. In contrast, utilisation rates in east and north China are dropping dramatically, due to expanded capacity and decreasing LNG demand. Looking forward, the ramp-up flow through Power of Siberia may further reduce utilisation in these regions.

Low utilisation rates affect a terminal’s profitability, particularly if the terminal does not have most of its capacity sold under long-term contracts. As a result, some terminals are exploring new forms of business opportunities. Dalian LNG, for example, had a utilisation rate of 22% in 2022 and 16% year-to-date in 2023 because of increased flows from Power of Siberia into the region. The terminal is therefore developing a bonded storage business to mitigate declining revenues. In addition, the declining utilisation may also result in a reduction in regas tariffs in some regions. Although yet seen, it merits more attention when making investment decisions.

Want to keep track of our latest insights into global gas and LNG? Fill in the form at the top of the page to sign up for the Inside Track.