US residential solar: why is customer acquisition still so costly?

Recent investments in new digital solutions and marketing strategies catalysed a new era for residential solar sales in the US, but challenges remain

1 minute read

Caitlin Connelly

Senior Analyst, US Solar

Caitlin Connelly

Senior Analyst, US Solar

Caitlin focuses on distributed solar and supports research and data collection.

Latest articles by Caitlin

-

Opinion

RE+ 2024: Our 7 biggest takeaways

-

Opinion

Shake-up on the US distributed solar leaderboard

-

Opinion

Competition heats up for the top three US residential solar installers

-

Opinion

US residential solar: why is customer acquisition still so costly?

Over the last several years, the US residential solar market has benefited from record-breaking industry growth and consistent system cost declines. As the industry expands beyond early adopters, one would expect that acquiring new solar customers would become easier and less expensive. However, even as consumers become more aware of the benefits of going solar, customer acquisition costs remain the most expensive and most stagnant category within the solar cost stack. Why is this? And how will installers and sales organizations evolve their strategies to meet rising demand while scaling their business sustainably?

A full analysis can be found in our US residential PV customer acquisition costs and trends 2021 report. Fill out the form to download an extract, or read on for a few key themes.

Intense US solar market competition and a complex sales pipeline result in high customer acquisition costs

The US residential solar market remains extremely fragmented beyond the top three installers, leading to stiff competition. To remain relevant and grow market share in a highly competitive environment, installers find it necessary to rack up significant marketing expenditures to win deals, ultimately resulting in stubbornly high customer acquisition costs.

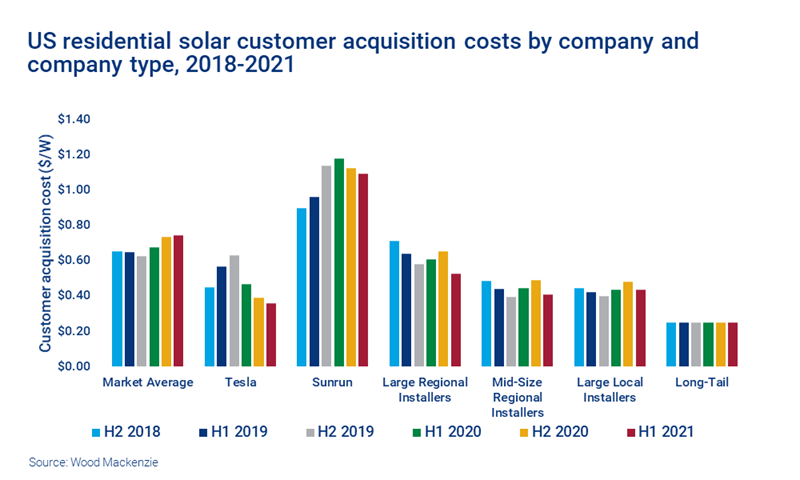

As of H1 2021, customer acquisition costs represent 23% of the total price of a residential system at US$0.75/W (US$5,250 per customer for a 7kW system). Customer acquisition costs increased 9.2% from 2018 to 2020 despite a 3.6% decline in total system prices during the same period. While installers acknowledge that there is room to optimise customer acquisition costs, they continue to tolerate elevated costs in exchange for growth.

Customer acquisition costs are not consistent across the installer landscape and vary significantly by installer size and region of operation. These differences are driven mostly by installers’ preferred sales strategies and the relative costs of each tactic. Partnerships with retailers (such as Home Depot) and door-to-door sales remain the most expensive sales channels and are most often used by national, large-regional, and mid-sized regional installers. Customer acquisition costs for these categories are well above US$0.50/W on average. Local installers, on the other hand, more often rely on low-cost referrals, organic social media, and community events, resulting in lower customer acquisition costs in the US$0.25-US$0.45/W range.

As the US residential solar industry has matured, it has also become more complex, with a growing industry of third-party sales organizations supporting solar installers. These organizations range from lead generation companies offering to sell varying qualities of leads to entire sales teams that allow installers to outsource 100% of their solar sales. The traditional solar sales pipeline has evolved into a complex web of different sales channels and potential partnerships, compelling installers into a ‘trial and error’ period to determine the best solutions for their budget and business models.

Covid-19 catalysed the adoption of digital sales solutions, but traditional sales models endure

The global Covid-19 pandemic forced many installers to face the already emerging trends in customer acquisition and invest in new sales and marketing strategies. As stay-at-home orders halted door-to-door sales and in-person consultations, many installers saw the opportunity to invest in and expand their digital offerings. These solutions range from small changes such as revamping websites and improving brand presence to larger investments in new partnerships and software.

However, the pandemic will not mark the end of in-person sales. Installers that relied mostly on door-to-door sales before the pandemic reported investing less in new digital solutions. Due to its time and labour-intensive nature, door-to-door sales are notably more expensive than online sales or appointments over the phone. But some installers still see this as their most effective sales model, especially when entering new markets.

New investments in digitalization driven by the Covid-19 pandemic resulted in a temporary spike in customer acquisition costs between 2020 and H1 2021. However, the wider adoption of digital sales and software solutions is expected to result in operational efficiencies and customer acquisition cost reductions down the line. Although some installers will shift back to in-person lead generation and consultations, there is evidence of a more permanent shift toward digitalization. Installers that invested heavily in new digital solutions beginning in 2020 reported that between 50-100% of their sales have remained entirely virtual through 2021.

Find out how financiers and installers have broadened their financial product offerings to spur customer adoption.

Software solutions are the key ingredient in the ‘secret sauce’ of future customer acquisition optimization and cost reductions

In addition to virtual sales, software tools also offer installers opportunities for operational efficiencies and improved customer experiences. Many of these tools are already on the market and help maximise the efficiency and accessibility of nearly every stage of the solar sales pipeline from lead generation to close of sale. Installers that show a willingness to explore these software solutions and diversify their sales models are building the foundation for sustainable success long-term.

Alleviating the cost burden of customer acquisition is about attracting the right kind of customers at the right time. During this shift to digitalization, more advanced software solutions will be needed to attract new audiences and better understand consumer behaviour. Software that can determine why customers are saying “no” while minimizing the time investment needed from a sales representative has the potential to radically reduce customer acquisition costs. As the US residential solar market enters another phase of growth, the continuous evolution of sales and marketing will play a pivotal role in the overall success of individual installers and the industry as a whole.

Fill out the form at the top of the page to access a complimentary extract from US Residential Solar PV Customer Acquisition Costs and Trends 2021. Interested in our research? Find out more about our US Distributed Solar Service.