Distress signals: where are the chemicals industry pain-points?

Covid-19 has created challenging economics for many petrochemicals players, leaving some at risk of financial distress

1 minute read

By Nathan Schaffer, Vice President, Petrochemicals, Guy Bailey, Head of Intermediates and Applications, and Joyce Grigorey, Principal Analyst, Aromatics.

Entering 2020, growth prospects for petrochemicals were robust. As an integral driver of future oil demand growth throughout the energy transition, the industry has been attracting significant investment. However, rapid increases in capacity had raised the risk of a supply-driven downturn in some sectors – and then the coronavirus pandemic turned up the pressure.

In a recent webinar, our analysts looked at the signs of distress in the chemicals industry, from the sharpest demand shocks to the impact on margins and profitability, and the types of assets and operators most exposed.

Got an hour? Fill in the form for a complimentary replay of ‘Commodities in Distress: What About Chemicals?’ We’ll also send you a copy of the 25-slide presentation.

Got just five minutes? Read on for a summary of the some of the most prominent pain-points across the industry.

Transportation and apparel exposure caused distress along the value chain

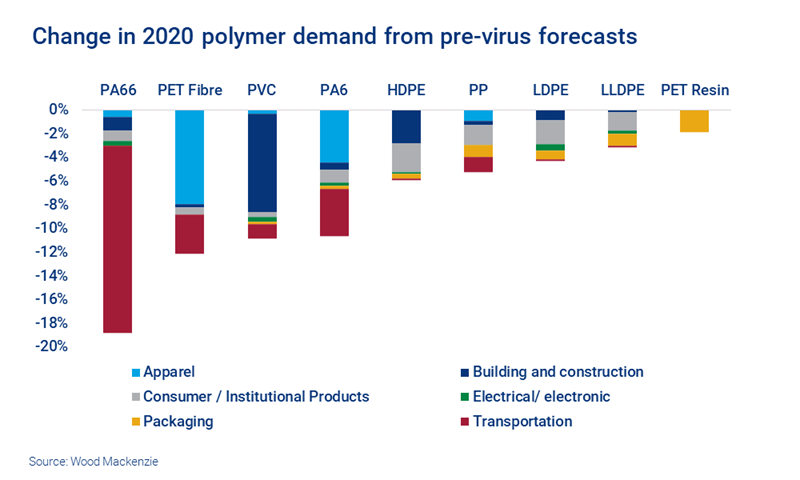

Across polymers, the total demand lost in 2020 is equivalent to about 7% of our pre-virus forecasts. Some market segments have been hit harder others. Transportation saw a very sharp drop-off. Apparel consumption collapsed, causing acute financial distress along the value chain – we’ve already seen significant Chapter 11 bankruptcy procedures for major retailers in the US.

However, the packaging sector saw a surge in demand as people stockpiled goods ahead of lockdown. Polymers with packaging exposure, such as PET resin and polyethylene (and its subgrades LLDPE and LDPE), currently have a comparative advantage.

PA66 (Nylon) is most exposed to the impact of coronavirus due to heavy exposure to the transportation sector. PET resin sees the least demand destruction, boosted by packaging demand.

What if there’s a second wave? Fill in the form at the top of the page to find out about our ‘second wave setback’ scenario, and the impact on polymer demand.

The recycling sector faces an uphill struggle for finance

The debate around plastic will become more nuanced as a result of the Covid-19 crisis – but it won’t go away. Sustainability will continue to be a long-term priority for consumers and brands, and demand for recycled PET is holding up.

Nonetheless, a sustained low oil price would challenge the economics of the recycling sector. Falling petrochemical feedstock prices could encourage plastic converters to switch to cheap virgin feedstocks. Reclaimers are already under some duress – lockdown measures have caused operational challenges, and it’s already a supply-constrained market, in severe need of investment. Those who need to raise capital may find it even more difficult in this environment.

Winners and losers from changes to the ethylene cost curve

Pre-pandemic, ethylene was entering a cyclical downturn. The outlook was for a sustained period of lower operating rates leading to capacity rationalisation. Now, with coronavirus taking a toll on demand, the challenge is heightened.

In the US, for example, a 45% surge in capacity since 2016 combined with weak demand saw spot prices fall to an all-time low in April. And the pain isn’t limited to the US. As operating rates decrease margins will be a challenge for global producers.

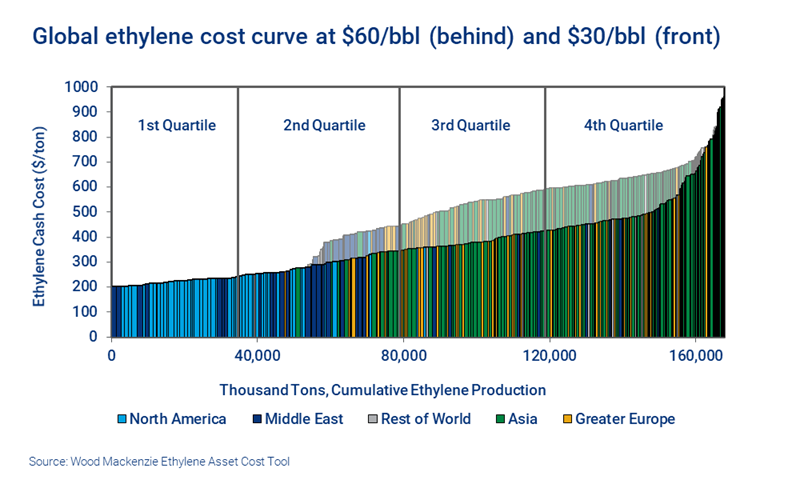

Different assets will be affected in different ways. As our Ethylene Asset Cost Tool shows, US and Middle Eastern crackers using gas-based feedstock are generally at an economic advantage. But liquids-based production (typically in Asia and Greater Europe) is more exposed to crude oil economics and gets a boost from lower oil prices. If the pandemic continues to affect oil demand and prices, it will cut margins and create more difficult economics for gas-based producers.

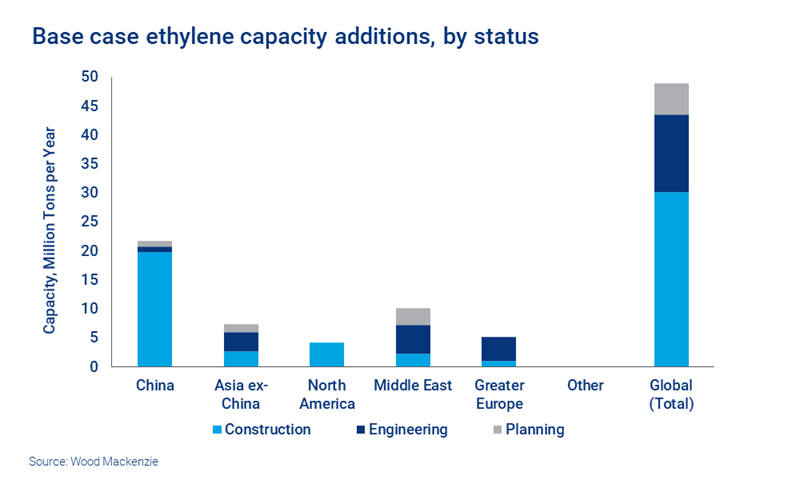

This environment will present opportunities for distressed debt investment. Around 30 million tonnes of ethylene capacity is currently under construction, and 50 million tonnes of projects were under consideration pre-pandemic. Some projects are likely to be slowed or cancelled, while some companies will seek partners to share the costs – and the risk.

To hear more about the ethylene project pipeline, and the potential opportunity for investors, fill in the form to watch the webinar replay.

Paraxylene players are under pressure

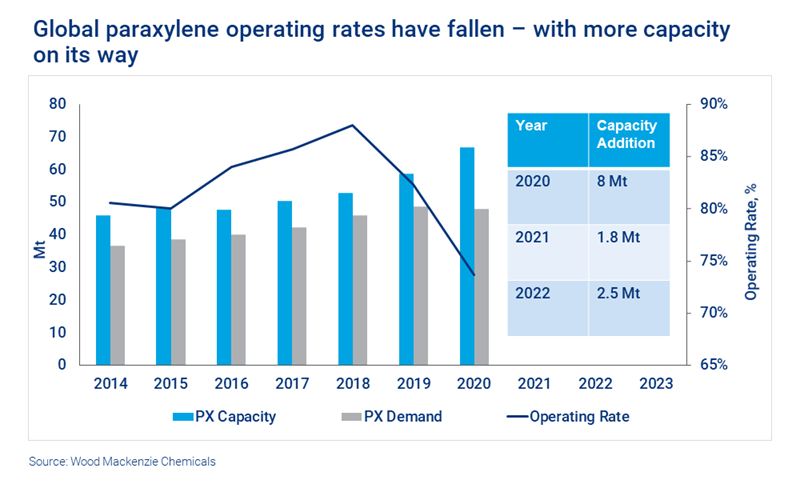

Paraxylene (PX) was heading towards the bottom of the cycle before the pandemic. Now, many producers’ margins are under significant pressure due to rising feedstock costs, lower fibres demand, and massive overcapacity.

Last year, mega-projects by Hengli and Zhejiang Petrochemical added around 6.5 million tonnes of capacity – a huge addition, given that the average annual PX growth rate is around two million tonnes a year (and this year we expect demand to fall by around half a million tonnes). As a result, we’re now seeing operating rates at 70-75% globally, some of the lowest the industry has seen – and there’s more capacity on its way.

At the start of 2019 PX prices were over US$1,000 per tonne. Fast forward to June 2020, and the price plummeted to below US$600 per tonne. Our analysis shows that half of all PX assets are currently either at breakeven or under water.

So, which PX players are most at risk of financial distress? Large-scale, integrated assets like Hengli are in the strongest position. Smaller assets, and those reliant on expensive, imported feedstock – like some Japanese and South Korean units – are in a more difficult position. And many US units are either not running or running at much-reduced rates, with imports proving more economic than domestic production.

Globally, PX producers may find they have several years to wait before demand fully recovers and healthy margins return. This could create openings for credit investors as companies look to boost their liquidity and ride out the downturn.

To hear more about the assets and operators most exposed in the current environment, watch ‘Commodities in Distress: What About Chemicals?’.

This includes:

- 60-minute webinar replay, including Q&A session

- 25-slide presentation pack download

Fill in the form at the top of the page for complimentary access.