Get this complimentary article series in your inbox

1 minute read

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Latest articles by Julian

-

Opinion

Metals investment: the darkest hour is just before the dawn

-

Opinion

Ebook | How can the Super Region enable the energy transition?

-

The Edge

Can battery innovation accelerate the energy transition?

-

Featured

Have miners missed the boat to invest and get ahead of the energy transition?

-

Featured

Why the energy transition will be powered by metals

-

Featured

Could Big Energy and miners join forces to deliver a faster transition?

Miners are in rude health, benefiting from economic stimuli, the post-pandemic recovery and associated supply constraints. Initially the Ukraine war also helped tighten markets, boosting prices further.

However, the outlook is now not so rosy with inflation and interest rates rising, economic activity slowing and prices falling. With margin contraction a growing issue have the miners missed the opportunity to lock in future growth and returns?

Miners maintain discipline despite record free cash flow

Despite the pandemic and a war in Europe, investors in mining stocks have enjoyed record returns over the past 18 months. Collectively, the balance sheets of the miners have never been stronger. This reflects tight financial discipline, record industry margins and strong market fundamentals.

Holding to a rigid dividend policy, boosted by share buybacks, and limiting capital investment means investors have been well-rewarded. Cash on the balance sheets of the majors is growing, with debt at all-time lows. The longer miners deliver to shareholders, the more distant the memories of capital destruction between 2012 and 2015 become.

What is the rationale to start ramping up investment capex?

I have been calling for miners to start investing more aggressively for a few years now. My rationale was then and remains: this will enable companies to deliver the free cash flow and continue the dividend stream that investors have come to expect when markets inevitably normalise. Repairing the leaking roof while the sun shines, in other words. Necessarily, this means investors forgoing ‘windfall’ profits generated by pandemic-induced stimulus, supply chain constraints and the start of the low-carbon revolution.

Unfortunately, this has not happened. Commodity markets have turned downwards during Q2 as demand falters, the global economy wobbles and supply continues to rise. Surpluses are rising and deficits are falling. Has the industry already missed the boat? Not if, as we believe, the energy transition will be a multi-decade process. But it seems likely that the opportunity for windfalls by mid-decade has been lost.

Have the big five Western miners started to tilt to growth?

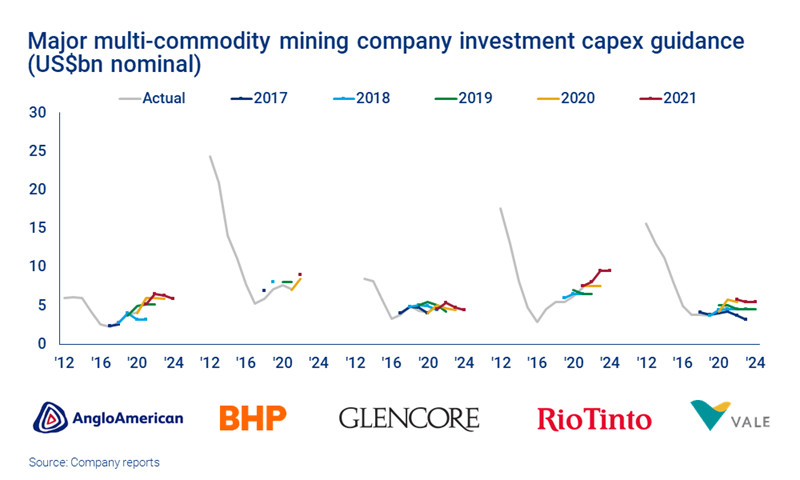

Anglo American, BHP, Glencore, Rio Tinto and Vale have been slowly nudging up capex guidance for the past three to four years, but it remains at well below the absolute levels of the peak of the last cycle in 2012. Commodity markets are typically 25% to 50% larger in 2022 than in 2012. What’s more, after taking inflation into consideration, capex in real terms is flat at best, or declining.

This is hardly leaning into the energy transition or a growth story. Miners are doing what their shareholders want – being responsible in capital allocation and focusing efforts on the decarbonisation of their operations rather than pushing significant investment in the metals that will deliver decarbonisation.

If we strip out iron ore, there is minimal growth in the portfolios of the major houses. Of the five majors, Anglo stands out in raising guidance which will, if delivered, more than double annual capex over the next two years compared with the lows seen in 2016. Significantly, Rio Tinto has also started to tilt towards growth, albeit tentatively, with guidance for 2024 set to more than double that of 2016. However, this still leaves the company spending at half the 2012 level.

These companies would argue that they are delivering balance sheet discipline and doing what their shareholders require. And this is true. But in not tilting now into the energy transition-focused metals, the majors will be hostages to the price cycle, with little to mitigate the downside in terms of increased volumes.

If the multi-commodity listed majors are not stepping up, who is sanctioning investment?

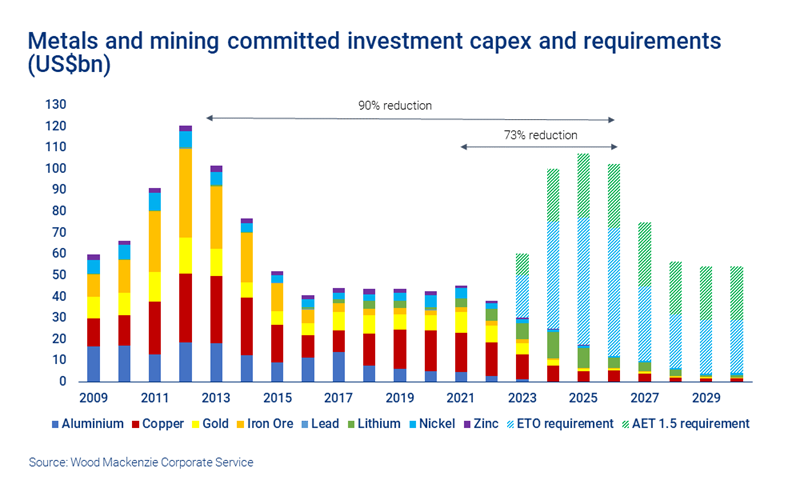

Based on our tracking of over 3,000 assets and myriad corporates, their collective committed capex spend is sobering from a growth perspective. Far from tilting into the transition, the investment capex has essentially flat-lined since the lows of 2015. The Majors may not be stepping up yet but China – including the mid-tiers and single commodity-focused players – certainly is. But is it enough?

Of even greater concern is the forward trajectory over the next few years, with total capex set to fall by over 70% to 2026. Without the contribution from lithium, the fall is even more dramatic, dropping by over 80% over the next five years. Excluding lithium would leave capex in 2026 at just 6% of the 2012 total.

The prevailing market environment will hamper the room to manoeuvre for miners and their investors. This puts their ability to deliver the necessary metals for the energy transition at extreme risk. Some US$400 billion needs to be mobilised by 2030 and it needs to be front-end loaded, given industry lead times. It all seems implausible at best, and impossible at worst.

Is now the time for investors to be bold?

Voices arguing that we are in the midst of a climate crisis are growing and getting louder as relative inactivity continues. The need for decarbonisation and vastly higher investment in energy transition-focused metals won’t go away.

Investors need to make stark choices now. Do they continue to demand dividends and share buybacks that deliver the returns they and their shareholders want in the short term? Or do stakeholders decide to forego dividends today, tomorrow, next year and into the medium term to allow miners to spend the capex needed to deliver faster decarbonisation?

It’s easy to lay the blame for miners’ inability to spend the capex needed on shareholders. But who are these stakeholders? It’s us – the public, the investors in funds. We want it all, returns today and forever. We say we want decarbonisation – but only as long as someone else pays for it.

Investors should heed Winston Churchill’s advice to his fellow Brits during WWII: “This is no time for ease and comfort; it is time to dare and endure.”

Get unique metals and mining insight in your inbox

This article is part of a series exploring opportunities and challenges in the world of metals and mining. Fill in the form at the top of the page to be alerted to new articles as they are published.