Three reasons LFP cathode supply keeps expanding in an oversupplied market

The lithium iron phosphate (LFP) cathode market will demonstrate a surplus until 2035 – but demand will eventually catch up

3 minute read

Yingchi Yang

Research Analyst, Battery Raw Material

Yingchi Yang

Research Analyst, Battery Raw Material

Yingchi focuses on supply of global cathodes and precursors.

Latest articles by Yingchi

-

Opinion

Three challenges to overseas expansion for the Chinese cathode sector

-

Opinion

Cathode and precursor: 5 things to look for in 2024

-

Opinion

Three reasons LFP cathode supply keeps expanding in an oversupplied market

The LFP cathode has experienced a rapid market share increase in recent years, drawing much attention in the global market.

LFP batteries are used in two major applications: electric vehicles (EVs) and energy storage. In EV batteries, LFP materials are the cathode active materials for various models of pure electric or plug-in hybrid new energy vehicle power systems. In energy storage, it is mainly adopted in the batteries for 5G base stations, new energy generation and storage, and replacing the lead-acid market in power for lighting.

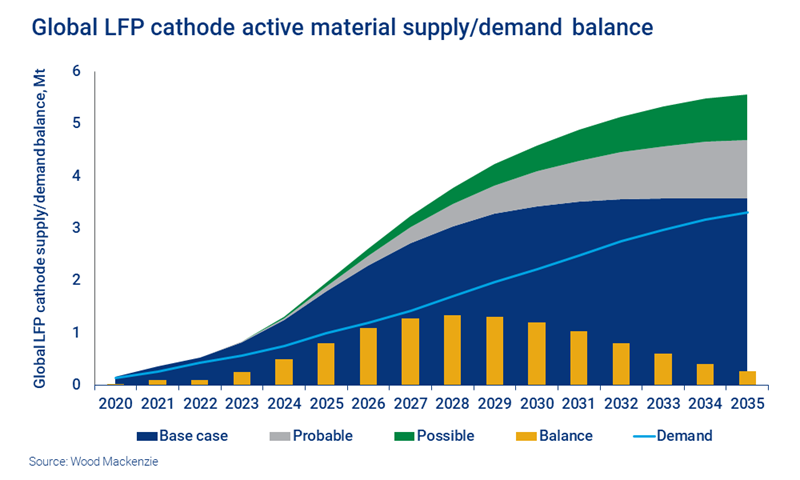

Our base case analysis shows that global LFP cathode production will increase by 42% year-on-year to 685 kt in 2023 and see steady growth at a compound annual growth rate (CAGR) of approximately 13.8% per year for the next ten years.

We also believe the LFP cathode market will demonstrate a surplus until 2035. Despite this surplus, the supply expansion is hard to stop. We estimate that LFP cathode will take the most significant proportion in the global market from 2026. Additionally, in the first three months of 2023, some major LFP cathode makers have either commissioned new capacity or announced expansion plans.

This wild expansion of LFP cathode production may seem incongruous – but the driving forces mean the surplus won’t be as problematic as it might appear. Drawing on insights from our Electric Vehicle & Battery Supply Chain Service, we look at three drivers:

1. LFP cathodes are cost-effective and safe

Battery chemistry is changing and lithium iron phosphate (LFP) cathodes have gained popularity due to their low cost and thermal stability. Unlike nickel-based cathodes, LFP cathodes do not contain expensive metals, such as cobalt and nickel. That makes them an attractive option for manufacturers looking to reduce costs.

At the same time, the thermal stability of LFP cathodes increases their safety in comparison to other types of cathodes.

2. LFP cathodes are attracting government support

The Chinese central government is very supportive of energy transition and EV supply chain localisation, especially the LFP cathode which is more environmentally friendly than its rivals.

Local governments have to implement and enforce national policies, and the lower environmental impact of iron contributes to a more sustainable battery supply chain and brings huge economic benefits to the local governments.

That means local governments will offer financial incentives to attract and support manufacturers of batteries and battery raw materials. These incentives include tax breaks, grants, land subsidies and financial assistance. Some local governments have even established specialised industrial parks for the EV and battery industries. These parks provide infrastructure, land and logistical support to entice manufacturers, suppliers and research institutions. LFP cathode producers now have a comfortable environment to expand production or attract new investors to join the game.

3. There is huge growth potential for LFP cathodes in the energy storage system (ESS) sector

Increased demand for LFP cathodes has also come from the ESS sector. The unique advantages of the LFP cathode – such as high safety, long cycle life and minimal maintenance – give the battery tremendous application in grid connection for renewable energy power stations and peak load shaving for power grid and emergency power systems.

This adaptability will contribute to the growth opportunities for the LFP cathode market even if the EV market matures in the long term. We forecast that the share of the installation rate of Fe-based Li-ion batteries in energy storage systems will reach 52% among all other batteries by 2030.

The increased demand for LFP cathodes means that market participants, including suppliers, can have high expectations for the future of the LFP market.

Get closer to the detail

This article draws on a recent insight, Why is the LFP cathode supply expanding even in an oversupplied market? Visit the store to read it in full.

This topic was also explored at our recent Future Facing Commodities Forum. To see a replay of our presentation on Cathode and anode: trends in vital battery materials, fill in the form at the top of the page for complimentary on-demand access.