Get Ed Crooks' Energy Pulse in your inbox every week

Why iridium could put a damper on the green hydrogen boom

Demand for the rare platinum group metal, used as a catalyst, is set to soar as the hydrogen industry develops

12 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

Iridium is one of the rarest naturally occurring elements: it makes up only about 0.00000003% of the weight of the Earth’s crust, according to the UK’s Natural History Museum. The richest concentrations are found in geological strata laid down when the Chicxulub asteroid hit the earth about 66 million years ago, wiping out the dinosaurs. And although iridium has a range of uses, mostly in high-performance alloys, worldwide production is only about 7 tons per year. So it is potentially a problem that iridium is one of the critical inputs for a key fuel in a low-carbon energy system: green hydrogen, produced by electrolysing water.

Catalysts made from iridium and platinum — today typically 65% iridium and 35% platinum — are essential for what is currently the most popular electrolyser technology, known as a proton exchange membrane (PEM) system. My colleague Julian Kettle, Wood Mackenzie’s Vice Chair for Metals and Mining, likes to say that “the energy transition will be built with metals.” That is true not only for the obvious high-volume commodities such as steel, copper, and lithium, but also for lesser-known metals such as iridium.

The uncertainties in the demand outlook for iridium are large, reflecting a range of possible outcomes for hydrogen producers’ growth rates and technological choices. But companies’ plans for green hydrogen projects suggest there will be a steep increase in demand over the coming decade. Meeting just the EU’s goals for green hydrogen production could by 2030 lead to demand for iridium for electrolysers that is several times current global supply.

The Biden administration has acknowledged that supplies of platinum group metals (PGMs), including iridium, were a critical issue for the development of the low-carbon hydrogen industry that was endorsed in the bipartisan infrastructure bill passed last year.

President Joe Biden last month issued a series of executive orders invoking powers under the 1950 Defense Production Act to stimulate production of clean energy technologies, including electrolysers and PGMs. The administration’s statement argued that support for PGM catalysts “will enhance national and energy security by reducing US reliance on imported fossil fuels, particularly Russia (the world’s second-largest producer of PGMs) and China.”

Jennifer Granholm, the US energy secretary, this week announced a new partnership with Australia, intended to accelerate progress towards a net-zero emissions energy system. The two governments’ joint statement highlighted “the crucial role critical minerals and materials will play in the energy transition” and in enabling the deployment of technologies such as hydrogen production. The partnership with Australia is focused on lithium, cobalt, and rare earth elements, however. For PGMs, hydrogen producers will have to look elsewhere.

World iridium supply is currently dominated by South Africa, as a by-product of platinum and palladium production. In 2018 South Africa accounted for 87% of global iridium production, with a further 8% coming from Zimbabwe and 3% each from Russia and Canada, according to the US Geological Survey. South Africa also has the great bulk of the world’s PGM reserves: about 91%, followed by Russia with about 6%, Zimbabwe with about 2% and the US with about 1%, again according to the USGS.

Dependence on a handful of sources for critical materials for low-carbon energy is different in some respects from dependence on fossil fuels. If the flow of PGMs were cut off, the electrolysers already in operation would be able to continue producing hydrogen. But the green hydrogen industry is aiming to grow rapidly, and a materials supply chain that is rooted almost entirely in southern Africa and Russia looks like a critical vulnerability.

Melany Vargas, Wood Mackenzie’s head of Americas hydrogen consulting, said: “From an energy security perspective, there is certainly the potential for disruption to supplies that would be a constraint on the growth of green hydrogen production.”

Wood Mackenzie analysts have been modeling the outlook for PGM demand, to give a sense of the potential impact of the green hydrogen industry. The likely increase in demand for platinum looks manageable, but iridium could be much more of a challenge. Total world iridium production this year will be about 255,000 ounces, says Roger Emslie, Wood Mackenzie’s principal metals and mining consultant. In a high case scenario based on our forecasts for green hydrogen production and current loadings for catalysts, demand for iridium for PEM electrolysers could be many times that by 2030.

Lower demand for PGM catalysts is possible. Hydrogen producers could shift to increased use of the two alternatives to PEM systems: alkaline and solid oxide electrolysers. Most of the green hydrogen projects that have declared technology choices so far are using either PEM or alkaline systems, with solid oxide accounting for only a small minority, although its share is expected to grow over time. A shift towards alkaline and solid oxide electrolysers would curb demand for catalysts.

Manufacturers may also be able to improve catalyst efficiency, reducing the metal needed for a given volume of hydrogen production. The green hydrogen may grow more slowly than is projected in Wood Mackenzie’s base case forecast. But the market dynamics clearly indicate that iridium is an issue that hydrogen producers, consumers and policymakers need to be aware of.

For rare earth elements, another small but strategically critical commodity sector, the Biden administration has already begun to use its powers to secure supplies. The Department of Defense in February announced an award of $35 million to MP Materials, to separate and process heavy rare earth elements at its facility in Mountain Pass, California. The administration said the move would establish “a full end-to-end domestic permanent magnet supply chain”. Then last month, the department signed a $120 million contract with Lynas Rare Earths, to build a first of its kind in the US heavy rare earths separation plant, in Texas. Meanwhile, the Department of Energy has committed $140 million to support a demonstration project for extracting and separating rare earths and critical minerals from mine waste.

Given that iridium is a critical input into a critical technology for the Biden administration’s vision for US energy, it would be no surprise to see the government making similar moves to secure supplies wherever it can.

Shocks from the energy crisis reverberate around the world

Europe faces a “really tough” winter as a result of soaring energy costs, and “in a worst-case scenario” may have to ration fuel, Shell chief executive Ben van Beurden warned on Thursday. Emmanuel Macron, president of France, echoed that message, saying the country would have to reduce consumption to get through the winter. European natural gas prices for Winter 2022 have hit record highs as a result of disruption to imports from Russia. In the first ten days of July, European gas imports from Russia were running 55% below last year’s levels.

Canada said it would return a turbine needed for the Nord Stream gas pipeline from Russia to Germany. The turbine, used at the Portovaya compression station, had been sent to Canada for maintenance by Siemens, and was then blocked from leaving by sanctions imposed following the invasion of Ukraine. Gazprom had cited the missing turbine as a reason for the sharp reduction in flows through Nord Stream that began last month. The question of whether or not to return the turbine had been debated by the G7 countries, with Germany urging Canada to send it back. The Ukrainian government protested vehemently at the Canadian decision.

Flows through Nord Stream were this week cut to zero. After the announcement that Canada would return the Portovaya turbine to Russia, Gazprom issued a statement suggesting it would not rush to restore the flow of gas. “Gazprom does not have a single document that allows Siemens to bring back a gas turbine engine from Canada,” it said. “In these circumstances, it is not possible to draw an objective conclusion about the further development of the situation on ensuring the safe operation of the Portovaya [compression station], which is a critical facility for the Nord Stream gas pipeline.”

The rising cost of natural gas has driven European power prices to new record highs. German baseload power futures for the fourth quarter of 2022 have been trading this week at around €450 per megawatt hour. European governments have been attempting to limit the impact on consumers. Germany has launched a €5 billion plan to support energy and trade intensive companies, which has been approved by the European Commission. France plans to take the energy group EDF fully into state ownership.

In the UK, soaring electricity and gas prices mean consumers face steep increases in energy bills when the regulated cap is next adjusted in October. Analysts have suggested the annualised bill for a typical domestic customer could rise by about 60%, from about £2,000 a year currently to about £3,200 a year. A focus group convened by the BBC’s Newsnight programme talked about “deep foreboding about the winter ahead and economic catastrophe”.

The difficulties with energy supplies in Europe are being exacerbated by unfavourable weather. A historic heat wave is boosting demand for electricity for cooling, while low wind power output has also added to the upward pressure on power prices. The hot and dry conditions have meant that the water level in the Rhine has fallen sharply, making it more difficult to move coal for power plants and other essential supplies by barge. Forecasts suggest the river could be closed to shipping if water levels continue to decline.

Meanwhile, coal prices have also been surging as a result of flooding that has stopped rail deliveries to the port of Newcastle, Australia. Newcastle 6,000 nar coal has risen from about US$390/tonne at the start of July to about US$450/tonne this week.

Investments in renewable power generation have been helping offset the impact of soaring fossil fuel prices. New renewable capacity added in 2021 could reduce worldwide electricity generation costs in 2022 by at least $55 billion, according to Irena, the International Renewable Energy Agency.

In brief

Joe Biden has been making his first trip to the Middle East as president, visiting Israel and Saudi Arabia. In an opinion column for the Washington Post, he explained his reasons for visiting Saudi Arabia, a country that in 2020 he said he wanted to make into a “pariah”. He highlighted the kingdom’s key role in meeting global oil demand, saying it was “working with my experts to help stabilise oil markets with other OPEC producers”.

Crude prices have continued to decline as evidence mounts that demand is being eroded. Brent crude dropped below $100 a barrel for the first time since April, to trade at about $98.50 a barrel at the end of the week. Brent has now dropped more than 20% from its recent peak above $124 a barrel last month.

US data from the Energy Information Administration showed that high prices for fuel and other essentials were having a clear impact on demand for gasoline. Product supplied, a measure of consumption, for gasoline in the week of July 8 was just 8.062 million barrels per day. That was the lowest weekly total since early January, and the lowest for the time of year since 1996. It was also the lower than consumption in the equivalent week of 2020, when measures to fight the Covid-19 pandemic were at their height.

Gasoline prices have been declining along with crude. New York Harbor RBOB gasoline front month futures this week dropped below $3.20 a gallon, pointing the way to further declines in retail prices. The average retail price of gasoline in the US on Thursday was $4.586 a gallon, according to the GasBuddy website. Average retail prices are now down below $4.15 a gallon in states including Texas, Georgia, Louisiana and South Carolina.

Other views

Julian Kettle — Have miners missed the boat to invest and get ahead of the energy transition?

Simon Flowers — What’s driving energy investors?

Gavin Thompson — Asia’s decarbonisation ambition isn’t matching reality

Sarah Brown — Coal is not making a comeback: Europe plans limited increase

Karen Elliott House — Saudi Arabia prepares to host a humbled Joe Biden

Roby Chavez — In Louisiana, orphan wells seen as an ‘accident waiting to happen’

Martin Sandbu — Why a price cap on Russian oil is a bad idea

Quote of the week

“For more than a year, leaders in Washington have ignored the serious concerns raised by myself and others about the rising cost of inflation. While Washington seems to now understand this reality, it is time for us to work together to get unnecessary spending under control, produce more energy at home and take more active and serious steps to address this record inflation that now poses a clear and present danger to our economy. No matter what spending aspirations some in Congress may have, it is clear to anyone who visits a grocery store or a gas station that we cannot add any more fuel to this inflation fire.” — After US consumer price inflation hit 9.1%, its fastest rate for more than 40 years, Senator Joe Manchin of West Virginia, a centrist Democrat, issued a statement setting out his conditions for supporting any fresh economic legislation. His call to “produce more energy at home” will be worth watching.

Chart of the week

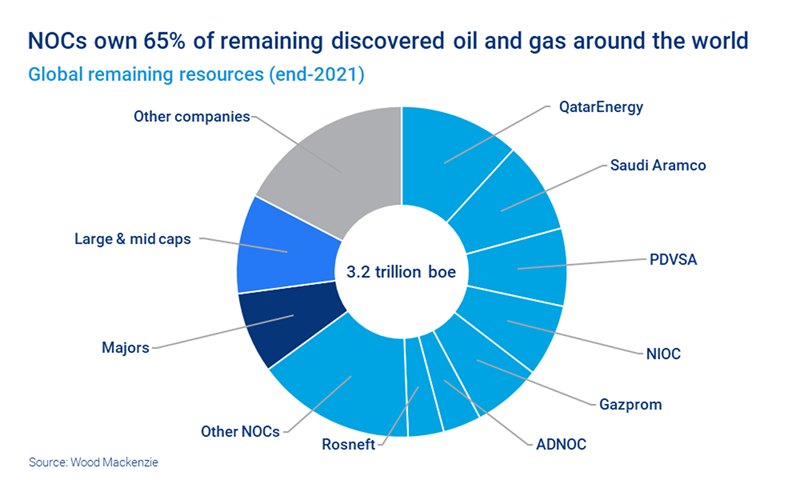

This comes from a fascinating note by Wood Mackenzie’s Tra Ho, a senior research analyst in our Upstream Service for Southeast Asia, and Jamie Taylor, a senior product specialist for our Lens platform in the Asia-Pacific region. The note looks at the evolving exploration strategies of National Oil companies, explaining questions including how their discoveries differ from those of the US and European Majors. It also highlights the differences between NOCs from importing and exporting countries. As the report explains, “a decade from now, for every five barrels that importing countries’ NOCs produce, one will come from the fruit of exploration done in the past 10 years”. The chart shows the essential background: the ownership of discovered oil and gas resources around the world. The dominant position of the NOCs is obvious: they account for about two-thirds of remaining known resources. In fact, just seven NOCs from the Middle East, Russia and Venezuela between them control half of the world’s oil and gas resources.

Energy Pulse will now be taking a summer break for a few weeks. Many thanks for reading: I hope to see you all in September.