Sign up today to get the best of our expert insight in your inbox.

Low-carbon tech: can direct air capture rise to the challenge?

DAC could get the energy transition on track

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Peter Findlay

Director of CCUS Economics

Peter Findlay

Director of CCUS Economics

Peter leads the economics and project valuation function for CCUS projects globally.

Latest articles by Peter

-

Opinion

Carbon management frequently asked questions part 3: CCUS

-

Opinion

Black gold to green future? Incentives uncertainty clouds Pathways Alliance economic feasibility

-

The Edge

Low-carbon tech: can direct air capture rise to the challenge?

-

Opinion

Seven key questions on the CCUS outlook

-

Opinion

What’s shaping CCUS project costs?

Rohan Dighe

Research Analyst, CCUS

Rohan Dighe

Research Analyst, CCUS

Rohan focuses on developing financial models of North American CCUS projects, analysing market and regulatory trends.

Latest articles by Rohan

-

Opinion

Can ExxonMobil make attractive returns from its US CCUS portfolio?

-

The Edge

Low-carbon tech: can direct air capture rise to the challenge?

Right now, the world is on track for 2.5 °C warming above pre-industrial levels. To limit warming to 1.5 °C, we would need a sizeable contribution from carbon dioxide removal (CDR), the net removal of already emitted atmospheric CO2.

Most decarbonisation is point-source abatement: reducing high concentrations of newly emitted CO2, such as replacing fossil fuels with renewables and the capture and storage of industrial emissions (CCUS). CDR’s primary role, then, will be to hoover up the rest of society’s emissions, including historical emissions lingering at low concentrations in the atmosphere.

CDR comes in many forms, from engineered solutions like bioenergy with carbon capture and storage (BECCS) to nature-based solutions like planting new forests. Direct air capture (DAC) is an umbrella term for technologies used to remove CO2 directly from ambient air. Collecting emissions is location-agnostic, but the plant must be close to the carbon storage site. Like many emerging low-carbon technologies, DAC is expensive today (and tiny, under 0.05 Mtpa capacity worldwide) but could become a big deal in time. In our Net Zero Scenario, it accounts for up to 2 Bt of CO2 emissions reduction, compared with 6 Bt for CCUS.

Although still in its initial stages of development, investors are attracted to DAC by its advantages over alternative solutions. Paired with subsurface CO2 sequestration, DAC offers permanence, measurability and additionality – three attributes that ensure long-term, verifiable removal but are difficult to prove with other CDR methods, like afforestation. So far, DAC has raised over US$3 billion of public and private funding through M&A, carbon credit purchases, project financing and government grants.

Our DAC experts, Rohan Dighe, Peter Findlay and Rachel Schelble, identify the key trends shaping the outlook in their three-part analysis.

First, low-cost DAC is some way off

Each of the different DAC technologies has benefits and drawbacks. Those further along in technology readiness are being constructed at commercial scale today. Industry heavyweights Climeworks and Carbon Engineering/1PointFive are both expected to start up their first commercial-scale plants in 2025. Our valuations show these first-of-a-kind plants to be expensive – projects operating today have levelised costs of around US$1000/tCO2. But as DAC is scaled up, we expect costs to fall.

However, DAC’s high energy intensity (up to 800 kWh/tCO2) limits how low costs can go. Next-generation technologies promising lower energy intensity are at an even earlier stage of development. Current-generation DAC platforms, therefore, have a first-mover execution advantage – though, in time, could be leapfrogged.

Second, incentives are critical

High costs mean DAC is an expensive niche in carbon abatement today. The industry relies on both voluntary carbon offsets and government incentives to drive development and scale up, including, in the US, Infrastructure Act DAC hub funding and Inflation Reduction Act enhanced 45Q credits.

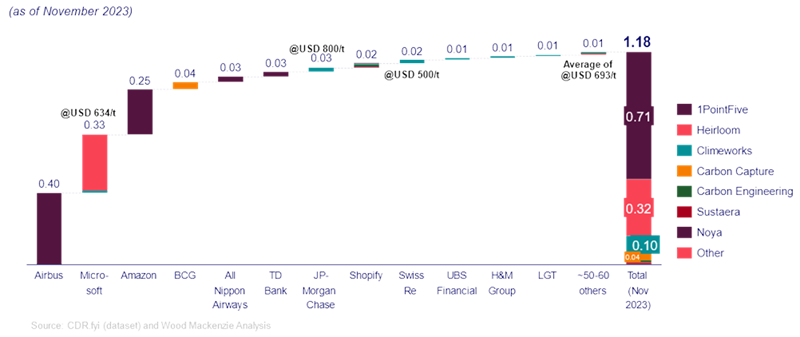

Major companies have been willing to pay premium prices for voluntary carbon offsets for DAC. The market is small (1.18 Mt as of 2023), but offsets have traded upwards of US$600/tCO2, multiples of the price of alternative offsets. Buyers in hard-to-abate sectors such as aviation are patently keen to support the market development of DAC.

Short-term incentives from the public and private sectors are essential to crowd in the capital to develop and deploy their technology at scale, especially for next-gen DAC technologies where the path to deployment is longer.

Third, execution risk and uncertain carbon prices add risk

Building DAC at scale needs low construction costs and a stable, long-term carbon credit value.

First-of-a-kind DAC plants at scale will require serious capital – over US$1 billion versus tens of millions for the technology development phase. The pivot from innovation will inevitably expose gaps in knowledge and the supply chain. Moreover, competition will intensify from alternative decarbonisation pathways as soon as large-scale DAC plants go operational, forcing the industry to redouble efforts to lower costs.

As costs fall so, too, will the price customers pay for DAC credits. If these fall out of step with one another, a stable DAC credit market will fail to materialise, and DAC plants will rely on public funding or be forced to cease operating.

Some investors in DAC appear to have strategic advantages to overcome these risks. Oxy/1PointFive has secured capital from major investment funds and government grants. Startups, including Climeworks and Heirloom, are partnering with dedicated carbon sequestration ones to overcome knowledge gaps.

At the same time, a promising, if inchoate, carbon market is forming around companies willing to finance the early stages of DAC development with the promise of low-cost DAC in the future.

It remains to be seen if demand for DAC credits will persist for decades — our valuation of 1PointFive’s Stratos project shows profitability relies heavily on these uncertain DAC credits during a 25-year project life. But if developers can construct at-scale plants at low-enough costs, it could be DAC that gets the energy transition back on track.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.