Sign up today to get the best of our expert insight in your inbox.

How a changing steel market is forcing iron ore supply to adapt

Falling demand and a bigger price premium for higher grades

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

David Cachot

Research Director, Iron Ore

David Cachot

Research Director, Iron Ore

David has more than 15 years of experience in market research and trading across bulk commodities.

Latest articles by David

-

Opinion

Iron ore: 5 things to look for in 2024

-

The Edge

How a changing steel market is forcing iron ore supply to adapt

The iron ore boom, one of the great commodity runs of the 21st century, is coming to an end. Demand has more than doubled since 2000, but the industry is bracing for structural change as China’s demand tails off and global steel makers transition to greener feedstocks.

What does this mean for future investment? Who will deliver high-grade supply? And how will this impact prices? David Cachot, research director in our Metals & Mining team, provides the answers.

Why is demand for iron ore set to fall?

China is the headline story. The country’s monumental transformation over the past four decades was built with steel. But the boom couldn’t last forever. Slower economic growth and the shift to a service economy are already tempering China’s steel demand.

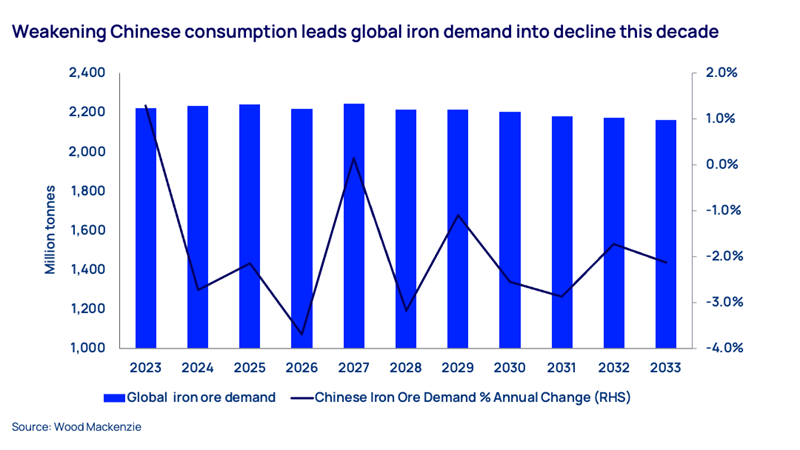

Declining iron ore demand at China’s steel mills is inevitable. A combination of falling hot-metal production from blast furnaces and the increased use of scrap will cut around 270 Mt of Chinese iron ore demand over the next decade, equal to 20% of the country’s current consumption.

With China accounting for over 60% of the global iron ore market, this is a big deal. We now expect total iron ore demand to contract by 62 Mt, or 3%, over the next 10 years.

Are there demand bright spots?

It’s certainly not all doom and gloom, with India and Southeast Asia set for robust growth in iron ore consumption well into the future. For major producers, this good news is offset to some extent by India’s demand being largely met from domestic mines. The country will only become a net importer by the mid-2030s, with imports reaching around 35 Mt by 2050, a tiny fraction of China’s current level of over one billion tonnes.

What does this mean for investment in supply?

Massive investment in new supply between 2011 and 2014 had already ensured ample iron ore output for decades to come. Combine this with weaker demand and investment in iron ore projects is set to drop significantly. We now expect mine investment to fall by 35% through to 2033 compared to the past 10 years.

As China’s demand falls, its domestic iron ore production is expected to halve over the next 10 years due to rising costs and lower-grade resources. And while existing supply capacity will be sufficient to meet this shortfall, buyers will be turning from quantity to quality.

What’s fundamentally changing investment in iron ore projects is the push for greener steel.

How will demand for green steel change the supply outlook?

The long-term transition towards green steel puts suppliers of high-grade, low-impurity ores in pole position.

This structural shift is already impacting capital investment decisions, with developers showing a clear preference for high-grade iron ore resources. Brazil looks well positioned, while Guinea’s giant Simandou project is set to become the most significant addition of high-grade iron ore supply in recent history, notable both for its planned production capacity (up to 180 Mtpa) and quality (high-grade 65% Fe fines iron ore with combined silica and alumina lower than 4%).

The transition towards green steel poses a challenge for producers of lower-grade ores, notably Australia. We forecast Australia’s iron ore exports, currently around 60% of the global total, peak in the next two years before entering gradual long-term decline. Australian miners are responding to the changing market by investing in technology to make their iron ore suitable for direct reduced iron (DRI) processes and decarbonising existing production.

What does this mean for prices?

In the changing outlook for iron ore, the quality differential will be the key to future pricing. We expect rising demand for high-quality lump and pellets and supply constraints will drive a growing premium for these products over the long term. Meanwhile, prices for low-grade ore delivered to China will fall by around a third by the early 2030s as Chinese demand softens.

Our forecasts for high-grade pellet prices to rise by over 20% through the same period are an indication of how the push for green steel is disrupting the market.

Upcoming: For more thought leadership on changes to the iron ore sector, look out for this month’s Horizons which takes a closer look at the impact of decarbonisation on the iron and steel industries.