Sign up today to get the best of our expert insight in your inbox.

How NOCs compare with IOCs on energy transition strategy

There’s more than one route to resilience and sustainability

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Luke Parker

Vice President, Corporate Research

Luke Parker

Vice President, Corporate Research

Luke is Vice President of Corporate Research with a specific focus on the Supermajors.

Latest articles by Luke

-

Opinion

Beyond ESG: measuring corporate sustainability in an uncertain world

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

Are NOCs prepared for the energy transition?

-

The Edge

How NOCs compare with IOCs on energy transition strategy

-

Featured

How can Big Oil stay investible through the energy transition?

Positioning for the energy transition isn’t just a matter of decarbonising the value chain and diversifying into low-carbon technologies. Oil and gas companies have to ensure their portfolios and balance sheets can weather the market volatility that will inevitably be part of the transition. They need to get to a position where they can make money at the low point of a cycle as well as the high.

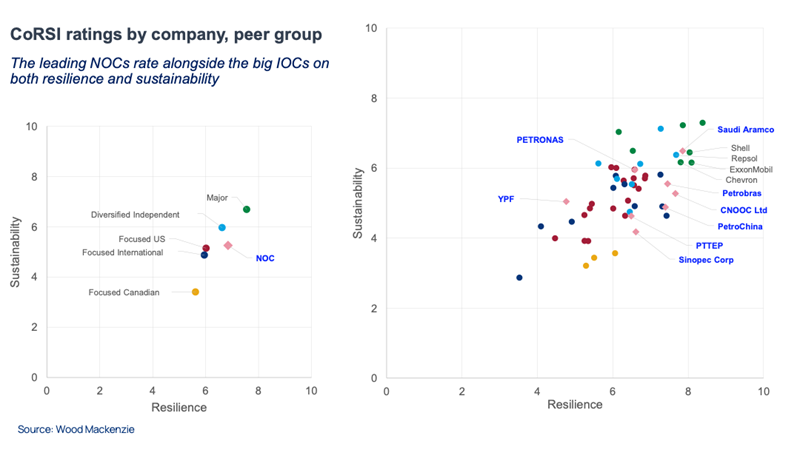

But how to gauge which companies are headed in the right direction? We introduced CoRSI, WoodMac’s Corporate Resilience and Sustainability Index, in late 2021, initially covering the oil and gas sector’s largest IOCs. CoRSI fills an important gap for stakeholders, providing a holistic, quantitative framework spanning all aspects of resilience and sustainability. There are three CoRSI pillars: platform (financial position and scale); portfolio (legacy business cash flow and risk); and transition (carbon exposure and transition strategy).

We’ve just added eight national oil companies (NOCs) to the CoRSI, which together account for 16% of global liquids production and 8% of gas. The resilience index benchmarks NOCs on their ability to deal with near-term shocks; while the sustainability index is a longer-term assessment of their ability to navigate the energy transition. I quizzed Luke Parker, Vice President, Corporate Analysis, about how the NOCs shape up.

Is it fair to pit NOCs against IOCs on resilience and sustainability metrics?

Absolutely. The NOCs may be different beasts in terms of strategy and portfolio – generally operating within the constraints of a strict government mandate, and overwhelmingly concentrated in their home countries. But they are exposed to the same risks, their outlook determined by much the same factors, and ultimately they will be judged on the same metrics. The eight NOCs now included in CoRSI from WoodMac’s Corporate Service are the most IOC-like among the wider NOC peer group in terms of structure, ambition and disclosure.

There is huge value for NOCs in understanding how they compare with IOCs, and vice-versa. A central tenet of CoRSI is that there is more than one route to resilience and sustainability. The NOCs’ ratings prove that point.

How do the NOCs score?

Quite favourably as a group, though individual company scores vary widely. The NOCs’ peer group average score is below the Majors but similar to the best of the rest of the IOC peer groups. NOCs’ resilience score is second only to the Majors. Recent high oil and gas prices have strengthened balance sheets and cash flow; the high scores also reflect the huge scale of some NOCs.

Factors that reduce resilience scores are high portfolio concentration in the home country, less investment flexibility compared with IOCs (largely due to a lack of exposure to short-cycle unconventional assets) and, for some NOCs, regulatory controls that limit downstream margins.

NOCs’ sustainability ratings on average are weaker than the Majors’ and versus other peer groups, though scores vary. The leading NOCs, including PETRONAS and Saudi Aramco, rank alongside the Majors on measures of portfolio sustainability; but transition ratings across the NOC group are low – few have made much progress on decarbonising portfolios or diversifying into low carbon. The NOCs have been relatively slow to act on the risks posed by climate change and the opportunities presented by the energy transition.

Which NOCs stand out?

Saudi Aramco ranks first among the NOCs on resilience and sustainability, alongside companies as diverse as Chevron, Repsol and Shell. Aramco’s position is differentiated by the quality, longevity and risk profile of its legacy upstream oil and gas business.

Besides Aramco, CNOOC Ltd, Petrobras and PetroChina all score highly on resilience, on a par with the Majors and leading Independents. In contrast, YPF’s weaker financial position and current phase of heavy investment put it in the bottom quartile.

Should NOCs look to improve their CoRSI scores?

Yes, and they already are. Many of the strategic moves the NOCs have made in the past year or so have been made with sustainability in mind. These include high-grading and diversifying upstream, downstream expansion and integration; tackling operational emissions; strengthening governance and targets; and moving tentatively into CCUS, hydrogen and even renewables.

The NOCs weren’t as quick off the mark as some of the big IOCs – it’s still early days, and the sheer scale of some of these companies makes it hard to move the needle. But all are increasingly committed to strengthening resilience and sustainability.

The industry is built on partnerships and, as the transition gains momentum, oil and gas companies will get increasingly fussy with whom they will partner. Choosing a partner with low CoRSI scores carries potential financial and reputational risks. High CoRSI ratings will increase an NOC’s partnering opportunities with IOCs and vice versa. It may indicate an NOC’s ability to access capital markets.

Any government’s ultimate expectation will be that its NOC maximises the value of the country’s oil and gas resources and pays its dues to the shareholder. But the current elevated levels of cash generation from firm oil and gas prices should allow NOCs to invest, pay dividends and strengthen their CoRSI credentials for resilience and sustainability.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world. Sign up today using the form at the top of the page to get The Edge delivered to your inbox.