Sign up today to get the best of our expert insight in your inbox.

The new investment cycle in energy and metals

Policy is tilting the playing field in low carbon’s favour

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

The world is hungry again for more energy and natural resources. A new investment cycle is underway for commodities to meet the growing demand from both a recovering global economy and the energy transition.

It’s not quite boom time yet – investment will increase only modestly in 2023. But accelerating policy initiatives suggest that investment in low carbon energy will be much higher this decade. For certain metals critical to the electrification of the planet, we could soon begin a new super-cycle.

For the first time, we present Wood Mackenzie’s global outlook for investment in supply across oil and gas, power generation and renewables, and metals and mining. The data is drawn from our comprehensive database of developed and pre-FID assets across each of the sectors. Brian Gaylord (P&R), James Whiteside (Metals and Mining) and Fraser McKay (Upstream) highlight three main themes.

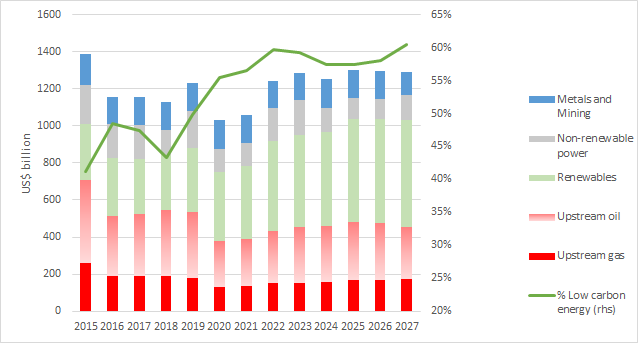

First, global spend has moved into an upcycle in the last two years as investment recovers from the trough of 2020. We forecast growth of 5% in 2023 across the three sectors with spend climbing to US$1.3 trillion, up 26% from the cyclical low of 2020/2021 and the highest annual total for eight years.

The modest growth in 2023 reflects, in part, a challenging external environment – notably, supply chain inflation and the rising cost of capital. Corporate strategies are also limiting investment. Oil and gas companies are determined to stick to the capital discipline that has restored balance sheets and investor confidence in the last few years. Miners have much the same approach.

Second, power and upstream, which together account for 90% of that US$1.3 trillion total, will grow by 3% and 8% respectively in 2023. Power’s share of total spend increased from one-third in 2015 to over half last year for the first time, driven by the rampant growth of renewables. We expect a brief slowdown this year and next, due to rising costs and supply chain bottlenecks as well as regulatory obstacles for wind and solar, including permitting and transmission infrastructure and interconnection queues. The inexorable upward trend in renewables kicks off again in 2025.

Capital spend in upstream oil and gas continues to recover. We expect investment to rise to around US$470 billion in 2023, lifting the sector further above the cyclical low of US$370 billion in 2020. Most E&P players are still adopting a hyper-cautious approach to spend, despite record cash flows last year. Around half of the increase this year is inflation-related, with supply chains tight in major markets. The spectre of windfall taxes is another deterrent. Out of a healthy pipeline of 60 large potential project FIDs, we think only 30 will proceed in 2023.

That said, the medium-term outlook is better than a few years ago. The global economic bounce-back post-Covid has highlighted the world’s reliance on oil and gas and the need for sustained investment in new supply.

Meanwhile, metals and mining investment spend will rise to US$149 billion in 2023, 3% up on last year with copper to the fore. Unlike oil and gas where spend is well above cyclical lows, metals and mining investment is still barely above the lows of a downcycle that’s lasted the best part of a decade. There is little sign yet that the mining majors are prepared to loosen the shackles and embark on a new phase of organic investment in the new capacity critical for the transition – copper, cobalt, lithium, nickel and aluminium among them.

With cash flow squeezed by lower prices and rising costs, and dividends sacrosanct, there could be downside risk to discretionary spend in 2023. Even big miners’ much-vaunted plans of a year ago to invest in decarbonisation are coming under scrutiny.

Third, there needs to be a massive change in the allocation of capital from fossil fuels into low-carbon energy and transition metals if the world is to get onto a net zero pathway by 2050. There’s enough spend, but not in the right fuels and technologies.

Fossil fuels are proving hard to shift. Investment in coal, oil and gas supply has fallen from 60% of total energy spend in 2015 to 40% in 2023. Yet fossil fuels still deliver 80% of the global primary energy supply mix today. In fact, fossil fuels’ share of investment could rise further over the next few years to bolster energy security in the wake of Russia’s invasion of Ukraine before declining as the transition gathers pace.

The flip side is that renewables, nuclear, hydroelectric and low-carbon hydrogen still only contribute 20% to the energy mix. If the world is to achieve net zero by 2050, based on Wood Mackenzie’s AET-1.5C scenario, investment in low-carbon power, already at record levels, needs to at least double and stay there for the foreseeable future. And that’s to say nothing about the expansion in grid infrastructure that’s also required.

The low-carbon investment story goes far beyond renewables. Next-generation technologies – such as small modular nuclear reactors, advanced geothermal, tidal power and long-duration battery storage – also need policymakers’ and investors’ attention.

There are reasons to be optimistic. Accelerating policy should speed the pace of change towards a low-carbon-dominated energy mix. The Biden administration’s Inflation Reduction Act, introduced only last year, is a game-changer for the country’s low-carbon push. It is also the major factor behind the 50% to 100% increase in investment in our latest forecasts for US solar, wind and energy storage capacity. The EU has indicated this week it will act to ensure the bloc’s incentives help it to achieve its ambitious goals for low-carbon energy.