Get Ed Crooks' Energy Pulse in your inbox every week

Green signals but no sharp turns expected in Brazil

Lula’s victory in the presidential election means a stronger emphasis on curbing emissions, but no radical changes in energy policy

8 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

When Luiz Inácio Lula da Silva was declared the winner in Brazil’s presidential election, the tone of his victory speech was not exactly euphoric. “I am here to govern the country from a very difficult situation,” he said. “But I have faith that with the help of the people we will find a way out for this country.”

He was referring to what he said was the task facing him: making Brazil a “democratic, peaceful” country. But his remarks sounded like a more general warning to his supporters not to expect too much radical change too quickly.

For the energy industry, the new administration is likely to mean adjustments at the margin, not a radical upheaval.

Lula won the presidential election by a slender margin: he received 50.9% of the votes counted, compared to 49.1% for the incumbent Jair Bolsonaro. In the elections for Congress on October 2, Bolsonaro’s Liberal party was the biggest winner, gaining seats in both houses. With left-leaning parties in the minority in both the lower house and the Senate, Lula will need support from other parties to pass any legislation, including changes to taxation.

For the global climate, the most important consequence of Lula’s election is likely to be a slowdown in the destruction of Brazil’s rainforest. Deforestation slowed sharply during Lula’s first period in office, from 2003-10, and bottomed out in 2012-15. It had started to pick up before Bolsonaro became president in 2019, and accelerated after he came into office.

In Lula’s victory speech, he called on the country to “fight for zero deforestation”, and said his government would be “open to international co-operation to preserve the Amazon,” providing Brazil did not have to give up its sovereignty.

That international co-operation has already started to pick up. Norway said it would resume aid payments into the Amazon Fund that it halted under Bolsonaro. Espen Barth Eide, Norway’s environment minister, told AFP that his country “had a head-on collision with Bolsonaro, whose approach was diametrically opposed when it came to deforestation”. The government of Germany, which also suspended payments into the Amazon Fund in 2019, said it wanted to resume them.

Brazil’s federal supreme court ruled last week that the Amazon Fund, which was suspended by the Bolsonaro administration in 2019, should be reactivated.

A change of strategic direction for Petrobras, including an end to the asset sale programme

Petrobras has been pursuing an extensive programme of asset sales, announcing deals worth a total over US$41 billion over 2015-21. Under President Lula, there is a good chance that the divestment strategy will be halted, according to Raphael Portela, a senior analyst in Wood Mackenzie’s corporate team for Latin America.

In 2019, Petrobras announced plans to sell its entire stakes in eight refineries, and so far two deals have been completed and contracts have been signed for two more. The sales of the remaining four are unlikely to go ahead, Portela adds, in part because of shrinking appetite among potential buyers due to uncertainty about Petrobras's pricing policy.

The most contentious element of Petrobras’s strategy has been its move in 2016 to link domestic fuel prices to international prices. Lula has vehemently criticised the alignment with international benchmarks, and earlier in the year pledged to break the link if elected. Internal governance and compliance controls have so far proved resilient to government meddling, and even President Bolsonaro could not bypass them when oil prices soared earlier this year. But over time, that pricing policy could be modified.

Petrobras shares have dropped by about 25% from their recent peak last month despite strong earnings reported last week.

Another change may come in Petrobras’s approach to low-carbon energy. Its asset sales in recent years have included all of its wind power operations, and its decarbonisation strategy has been focused on reducing the emissions from its own operations. Its low-carbon energy projects include investments in renewable diesel, biofuels for aviation and shipping, and technologies such as carbon capture, utilisation and storage that have “a longer term horizon”. Lula has indicated that he wants Petrobras to take a more active role in developing low-carbon energy, and its strategy is likely to shift in that direction over time, although we do not expect any change in the company’s next business plan, scheduled to be announced in late November.

No radical changes in sight for the power sector

In Brazil’s electricity industry, the Lula administration is not expected to set a radically different direction for policy, says Javier Toro, Wood Mackenzie’s senior research manager for Southern Cone gas and power. In June the government sold shares in Eletrobras, the country’s largest power generation and transmission company, to take its stake below 50%. Lula was fiercely critical of the sale, but we do not expect him to attempt to retake control of the company. The government will be likely to intervene in the power sector at times of crisis, as it has done in the past.

Brazil has an active market for renewables, and regulated auctions organised by the government no longer drive capacity additions. Under a Lula administration, local content policies for new technologies such as offshore wind and green hydrogen will be back on the agenda. The public banks such as BNDES, which in the past have been used to support those local content policies, will have a more active role in many sectors. But in the power industry, those public banks no longer dominate the market, and private banks and debt markets are more important sources of finance.

The most significant shifts may come from increased participation in global policies to curb greenhouse gas emissions, as signaled by Lula’s pledge that “Brazil is ready to resume its leading role in the fight against the climate crisis”. Initiatives such as the local market for International

Renewable Energy Certificates (I-RECs) are likely to be accelerated. Better relations with other world leaders over deforestation and climate policy in general could attract more foreign investment.

COP27 begins, with climate loss and damage on the agenda

One early signal of intent from Lula’s team is that he intends to attend the COP27 UN climate talks in Sharm el-Sheikh, Egypt, even though he does not take office until January 1.

The talks began on Sunday with a plenary session of climate envoys and delegates. Sameh Shoukry, Egypt’s foreign minister who was formally elected president of the talks, said the current energy and food crises “should be no reason for delaying our collective effort to fight climate change.”

Wood Mackenzie analysts have prepared a comprehensive briefing on what to expect from COP27 and what it will mean for the energy industry. Key issues to watch for will include progress on the global pledge, joined by more than 100 countries last year, to cut methane emissions, and the development of rules for international carbon markets.

The big news from the weekend at COP27 was that is referred to as the “loss and damage” from climate change will be formally on the agenda for the first time at one of these COP meetings. The significance of that is that the issue could underpin a new mechanism for payments to countries suffering from the effects of global warming. The potential payments are sometimes referred to as “climate reparations”.

However, agreeing to discuss the issue is still some distance away from agreeing to establish the fund or facility that would make those payments. As Wood Mackenzie’s analysts point out, the developed economies are already failing to deliver on the agreed goal of US$100bn annual climate financing that they signed up to at COP15 in Copenhagen in 2009. According to some studies, the cost of adaptation alone will be closer to US$400bn a year.

Even if there are new pledges to pay compensation for climate loss and damage, there will still be a challenge in making sure those promises are kept.

In brief

Another 22 US independent E&Ps reported earnings last week, and 15 of them announced increases to their capital spending for 2022, by an average of 6%. Only three companies decreased their guidance: EQT, Chord Energy and Civitas.

Several companies also gave early indications of their plans for 2023. Apache sees a 15% increase, mostly driven by activity. EOG plans to add two to three rigs next year.

The US Department of Justice says it has smashed a “national network of thieves, dealers, and processors” who conspired to steal catalytic converters from vehicles, extract the palladium, platinum, and rhodium inside them, and sell them to a metal refinery. In California about 19,000 catalytic converters were reportedly stolen last year. The black-market price for converters can be more than $1,000 each.

Other views

Offshore CCS projects could breathe new life into the Gulf of Mexico

The Observer View — Britain’s urgent need to commit to nuclear power

Jessica Rawnsley — Plastic recycling: green necessity or waste of effort?

Quote of the week

"Russia's invasion of Ukraine and contemptible manipulation of energy prices has only reinforced the importance of ending our dependence on fossil fuels. We need to move further and faster to transition to renewable energy, and I will ensure the UK is at the forefront of this global movement as a clean energy superpower." — Rishi Sunak, who took over as Prime Minister of the UK last month, set out his views on the energy transition in remarks he planned to give at COP27 on Monday.

He had initially decided not to attend the meeting, but changed his mind after facing widespread criticism.

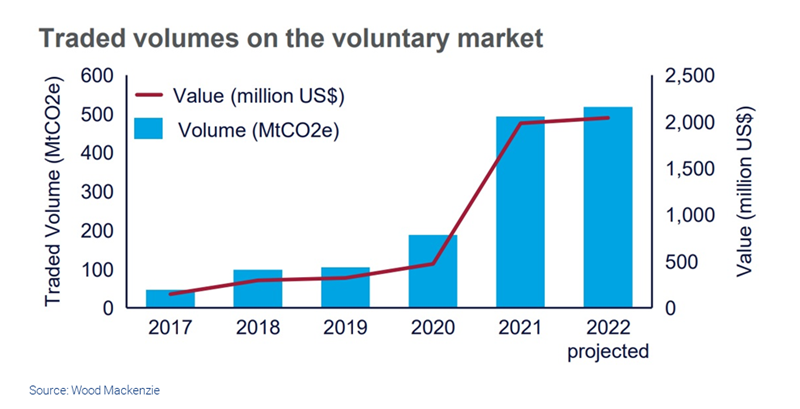

Chart of the week

This comes from the Wood Mackenzie briefing on COP27 mentioned above. It shows the rapid growth of the voluntary carbon market: trading activity almost tripled between 2020 and 2021, helped by progress at COP26 last year on implementing Article 6 of the Paris Agreement. That article establishes a framework for buyers in one country to pay for emissions reductions delivered in another, making greater climate ambitions possible at a lower cost. Agreeing on the final remaining details for implementation could be an easy win for COP27, advancing climate action while steering away from more controversial topics.