Get Ed Crooks' Energy Pulse in your inbox every week

The EV boom depends on policy support

Manufacturers are betting big on the rapid growth of EV sales in the US. Political and legal uncertainty is the greatest risk

11 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

LG Energy Solution, which makes batteries for electric vehicles, IT equipment and stationary storage, has been having a good year. When the company made its debut on South Korea’s stock market back in January, its shares closed up 68% at KRW505,000 after a hectic first day’s trading, and the company’s subsequent performance has vindicated that excitement. This week the shares were trading at about KRW530,000, up 5% from that first day, while South Korea’s benchmark KOSPI index has dropped 14% over the same period. While the energy crisis of the past year has sparked discussion about whether the transition to lower-carbon technologies could be on pause, or going into retreat, there has been no sign of it in the market for batteries.

LGES’s third quarter earnings, reported this week, underlined its increasingly optimistic outlook. The company raised its guidance for expected revenues, for the second time this year, and now expects sales of KRW25 trillion (US$17.5 billion) in 2022, up 14% from the projection of KRW22 trillion that it announced in July. EV sales have been growing strongly around the world, and LGES has been riding the wave. In the US, for example, Wood Mackenzie projects that battery electric vehicle (BEV) sales will roughly double this year, rising from 541,000 in 2021 to about 1.03 million in 2022.

It is in North America that LGES is placing its biggest bets for the future. This year North American plants account for about 7% of LGES’s battery production capacity of 195 terawatt hours per year. In 2025, that global capacity is set to have more than doubled to 520 TWh / year, with 45% of it in the US, including new or expanded plants in Ohio, Michigan, Tennessee, Arizona and Ontario. Many of those plants will be in joint ventures with General Motors, Honda and Stellantis.

China is by far the world’s largest market for EVs today, and is set to remain so. But over the coming decade, North America will be the fastest-growing major market, in LGES’s view. It expects a compound annual growth rate out to 2030 of 33% in North America, compared to 26% in Europe and 17% in China.

However, Wood Mackenzie’s road transportation analysts warn that there are significant political risks to the outlook for the US EV market. Like LGES, we are also projecting strong growth, with BEV sales rising eight-fold between 2021 and 2030. But that projected growth is heavily dependent on a supportive policy environment, including tighter vehicle emissions and fuel economy standards, the incentives for EVs introduced in the recent Inflation Reduction Act, and the planned bans on most internal combustion engine cars being introduced by California and at least four other states. All of those are subject to challenge by politicians and in the courts.

Ram Chandrasekaran, Wood Mackenzie’s head of road transportation, describes the US EV sales outlook as poised “on a knife edge”.

In its statement this week, LGES highlighted “the US government's new policies toward clean energy” as important factors in its strategic orientation towards North America. It argued that the Inflation Reduction Act and fuel economy standards were “reshaping the global battery industry” by increasing the share of manufacturing of EVs that is done by the auto-makers themselves, heightening the importance of having factories in the US, and encouraging the development of local supply chains for battery raw materials.

LGES is planning that by 2025 it will source 72% of the critical minerals it uses in North America either locally, or from countries that have free trade agreements with the US. Last week LGES announced a Memorandum of Understanding with Syrah Resources on partnering to evaluate natural graphite anode material from Syrah’s facility in Louisiana, which is scheduled to start production next year. It is the sixth such agreement that LGES has signed to secure key raw materials for EV battery production in North America.

The midterm elections on November 8 are likely to mark a change in the political alignment of the US government, however. The Republicans are seen as likely to win control of the House of Representatives, and stand a good chance of taking control of the Senate as well. While Democrats remain in the White House, radical shifts in policy are unlikely. But if the Republicans retake the presidency in the 2024 elections, then the new administration would be expected to follow the strategy pursued by President Donald Trump, including easing vehicle fuel economy standards and removing California’s ability to set its own emissions standards and ban internal combustion engine vehicles.

Such a strategy would doubtless be challenged by California and other states in the courts, leading to potentially prolonged legal battles and uncertainty over the outlook for EVs in the US. Chandrasekaran says: “In June, the Supreme Court issued a ruling curtailing the ability of the Environmental Protection Agency to regulate emissions from power plants under the Clean Air Act. The framework that allows states to ban sales of internal combustion engine vehicles is also based on the Clean Air Act, and could be similarly at risk.”

Unlike smart phones or jet airliners, EVs do not offer a radically superior consumer experience when compared to existing technologies. They can be more fun to drive, and lifetime costs of ownership are often lower than for gasoline-fueled equivalents. But they can create “range anxiety’ about the availability of chargers and the time taken to charge, and their up-front costs are often higher.

Where EVs are clearly superior is in their potential to help reduce emissions and strengthen energy security. But those are benefits that do not flow directly to their owners, and so have to be addressed by policy. If EVs are to achieve the full potential hoped for by LGES and others in the industry, policy in the broadest sense will have to remain supportive.

If you want to hear more on Wood Mackenzie’s views on the EV outlook and its implications for raw materials and the power grid, join us at our 2022 Energy and Natural Resources Summit in Houston on November 3. Click the link or see below for more details.

A warm autumn leads to negative gas prices on both sides of the Atlantic

I wrote last week about the increasingly close linkages between North American and international gas market. This week, negative prices for natural gas emerged at two trading hubs about 5,000 miles apart on opposite sides of the Atlantic. There was no direct causal connection between them, but the underlying dynamics at work were quite similar.

In Europe, the outlook for gas through the winter depends crucially on the weather. Fortunately for consumers, temperatures across Europe have been well above average. Germany, France and Spain are on course for their hottest Octobers on record. The UK’s Met Office said temperatures this week had been “closer to what we would typically see in late August than late October”.

The warm weather, along with steep cuts in industrial demand, has prevented a run-down in European gas inventories. As of this week, Europe’s gas in storage was about 23% higher than a year ago, and about 7% above its five-year average.

As a result, European gas prices have been plunging. Back in August, the November contract for benchmark TTF gas was trading at about €350 per megawatt hour. This week, it was down to about €104 / MWh, roughly equivalent to $30 per million British Thermal Units. For a short time, next-hour TTF prices even turned negative, reflecting the bottlenecks that have become an increasingly significant feature of European gas markets.

Meanwhile in the US, the weather has also been warm in major gas heating load regions such as the East and Midwest, and the National Weather Service is forecasting a relatively mild November. Its seasonal temperature outlook for December, January and February also did not indicate any high likelihood of significant cold.

The weather has contributed to steep declines in US natural gas prices. In August, benchmark Henry Hub front-month futures peaked at about $10 per mmBTU. Last Friday the November 2022 contract fell below $5 per mmBTU before its expiry yesterday at $5.186 per mmBTU. Larger than expected late season injections into storage have meant that risk premia have fallen off “fast and furious”, as Wood Mackenzie’s Eugene Kim put it.

In west Texas, the downward pressure on prices was exacerbated by takeaway constraints including short-term maintenance issues on the Gulf Coast Express (GCX) and El Paso Natural Gas (EPNG) pipelines. Combined with low local demand and growing production, that drove gas for next-day delivery at the Waha hub to negative prices for a while.

The emergence of negative prices in some regional markets, while month-ahead gas in the Netherlands has still been trading at $30 / mmBTU, is Exhibit A in the case that there is an urgent need for investment in new gas infrastructure, for both intra-national and international transport.

In brief

The International Energy Agency published its 2022 World Energy Outlook, which for the first time ever is projecting a peak or plateau in demand for all fossil fuels in a scenario based on governments’ current policies. In the IEA’s Stated Policies Scenario (STEPS), showing “the trajectory implied by today’s policy settings”, use of coal falls back within the next few years, natural gas demand reaches a plateau by the end of the 2020s, and oil demand levels off in the mid-2030s before starting to decline slowly.

Fatih Birol, the IEA’s executive director, struck a positive note, arguing that although the world was “dealing with a crisis of unprecedented breadth and complexity… [it] promises to be a historic turning point towards a cleaner and more secure energy system.”

The UK government has reaffirmed its national ban on hydraulic fracturing, even though MPs voted last week to scrap it. The vote was held amid chaos in Parliament, hastening the departure of prime minister Liz Truss. The new prime minister, Rishi Sunak, has decided not to attend the COP27 climate summit in Sharm el-Sheikh, Egypt, which begins on November 6.

Shell reported another set of bumper earnings, with underlying profits of US$9.45 billion for the third quarter more than double the US$4.13 billion reported for the same period of 2021. The company committed to repurchase another US$4 billion of shares in the fourth quarter, and announced plans to increase the fourth quarter dividend by 15%. The company is on course to make 2022 a record year for shareholder pay-outs, exceeding the previous peak in 2019.

When President Joe Biden visited Saudi Arabia this summer, his top aides thought they had reached an agreement for the kingdom to boost its oil production through to the end of the year, the New York Times reported. Instead, Saudi Arabia earlier this month announced a cut in production, as part of an agreed move with the other members of the OPEC+ group to tighten global oil markets.

ExxonMobil announced two more discoveries in the prolific Stabroek block in offshore Guyana.

The state government of North-Rhine Westphalia in western Germany has urged the power company RWE to drop its plan to take down wind turbines to make way for the Garzweiler lignite mine. One turbine has already been taken down at the Keyenberg wind farm, which came online in 2001, and the remaining seven turbines are expected to be taken down by the end of next year.

Other views

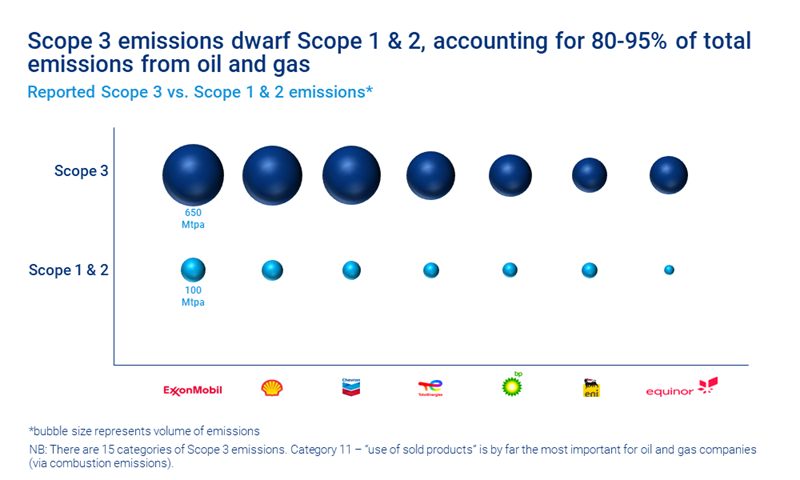

Tom Ellacott — How will oil and gas companies get to Scope 3 net zero?

Fahimeh Kazempour — Inflation Reduction Act tailwinds and other tales from the grid edge

Peter Osbaldstone — European power: why reliance on gas is a hard habit to break

Zoë Gaston — Will rising interest rates curb the dominance of the US residential solar loan market?

Chris Giles — The end of Europe’s energy crisis is in sight

(Time here for the usual reminder that posting a link doesn’t mean I endorse the argument of the piece. But it is an interesting analysis that is worth reading.)

Event of the week (next week)

Wood Mackenzie is hosting its 2022 Energy and Natural Resources Summit in Houston on November 3. We have a great line-up of speakers including our own analysts and leading figures from the world of energy, representing companies including Microsoft, Chevron, BP, EQT and Morgan Stanley. Follow the link for full details on how to attend, whether in person or online.

Quote of the week

“For every $1 invested in low carbon energy supply, $1.10 is invested in fossil fuels. Go figure. The math and the science unequivocally make clear we just cannot hit our [climate] targets unless we dramatically change that ratio. So we need private sector financial institutions to recognize the financial risks associated with a disorderly, chaotic, but inevitable transition to net zero, if we don’t manage it more effectively.” — John Kerry, President Biden’s special envoy for climate, spoke in an interview at the Council on Foreign Relations previewing the upcoming COP27 climate talks. He acknowledged that there had been “a few signs of a little ripple of discontent” recently among financial institutions that signed up to net zero goals last year. But he aimed to persuade them that “this sprint to a net zero, resilient future actually represents the greatest investment opportunity of our lives, and maybe of all time.”

Chart of the week

This is a powerful illustration of the challenge involved in the more ambitious emissions reductions goals set by oil and gas companies. It comes from a new paper by Tom Ellacott, Wood Mackenzie’s senior vice-president of corporate research. As he says, net zero targets for Scope 1 and Scope 2 emissions, directly from operations and from purchased energy, are now industry standard for oil and gas companies. Net zero targets for Scope 3 emissions, from a company’s supply chain and from the use of its products, are much less common. This chart is one indication of why that is: as well as often being outside the direct control of the oil and gas companies, Scope 3 also typically accounts for 80-95% of their total emissions along the value chain.