Get this complimentary article series in your inbox

1 minute read

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Latest articles by Julian

-

Opinion

Metals investment: the darkest hour is just before the dawn

-

Opinion

Ebook | How can the Super Region enable the energy transition?

-

The Edge

Can battery innovation accelerate the energy transition?

-

Featured

Have miners missed the boat to invest and get ahead of the energy transition?

-

Featured

Why the energy transition will be powered by metals

-

Featured

Could Big Energy and miners join forces to deliver a faster transition?

Demand for mined commodities exceeded pre-pandemic levels in 2021. Despite macro-economic headwinds over the next few years, growth seems assured and could be supercharged by a faster decarbonisation pathway. Supply constraints and disruptions continue and are likely to be exacerbated by economic sanctions on Russia. High energy prices and an increasing drive to reduce emissions, combined with pandemic-related labour shortages will also weigh heavily. Prices are at record levels, albeit only in current dollar terms. Analysts are lining up to advise that markets for mined commodities are in uncharted waters.

But history has a knack of repeating itself. Whenever market fundamentals are strong, the focus on metal exchange stock levels rises exponentially. A narrative that industry stocks will ‘run out’ has been gaining traction and will now be an increasing concern.

The conflict in Ukraine and Russia’s role in the metals and mining supply chain only serves to illustrate the importance of understanding stocks. So, where do industry stock levels stand now and how low will they go?

Reported metal stocks are not the whole story

As a seasoned (old) analyst, it’s easy to raise an eyebrow at this focus on exchange stocks. Recurring stock drawdowns or increases tell part of the story in terms of market fundamentals. Exchange stocks are (or should be) a market of last resort. Most of the metal, while priced with reference to the exchanges (typically, LME or SHFE), never goes anywhere near an exchange warehouse. The natural order is for metal to be produced and shipped to consumers. The same is true of metal stocks. Stocks held outside the exchanges – by producers, traders, stocks holders, distributors and consumers – dwarf those held on the exchanges.

Yet there is often a myopic focus on exchange levels when markets are tight or structurally oversupplied. When reported stocks are at lows, analysts often use this as a justification for high prices and price forecasts. Exchange stocks are reported daily so they are highly visible and verifiable. The focus is understandable. But a better measure of the dynamics of the industry is on total industry stocks expressed in days of consumption.

Total stock assessments are made by analysts using a combination of supply-demand imbalances and an assumption around an historical starting stock. By their nature, they are opaque, infrequent and unverifiable since counting all the stocks in the system is impossible.

Stocks in days of consumption removes the uncertainty around the absolute level of stocks and enables an historical comparison to measure stress in an industry. After all, the only guide to the future is through the lens of history. Extremes can be assessed to guide our thinking about how undersupplied or oversupplied markets really are.

Where do metal stocks stand now and where are they headed?

Industrial metals have their own supply chain dynamics, which dictate variation in average stock levels. Variance from long-run observed averages highlights whether an industry is undersupplied or, indeed, oversupplied.

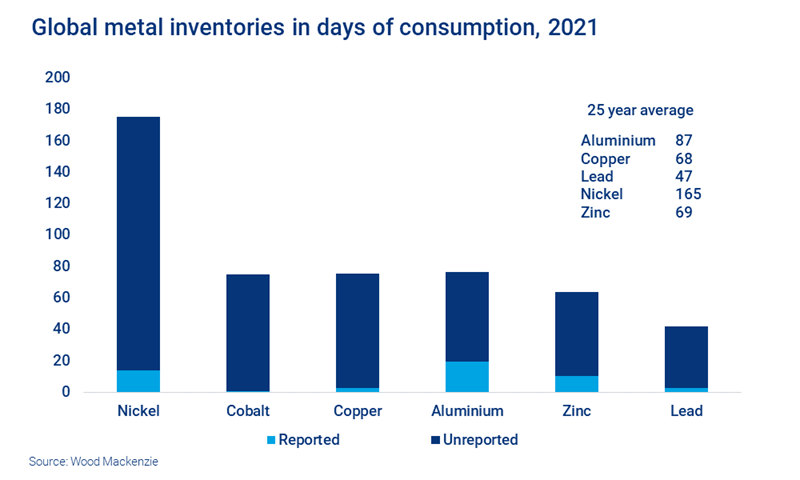

All the major metals under review in the chart above are running with stock levels in days of consumption close to their long-run 25-year trends. This raises questions as to how fundamentally tight these markets are. Importantly, reported stocks represent a very small proportion of total stocks; focusing too much on these can be misleading.

Applying our assessment of future supply-demand imbalances to current stock levels allows us to determine future over- or undersupply relative to long-run stock levels.

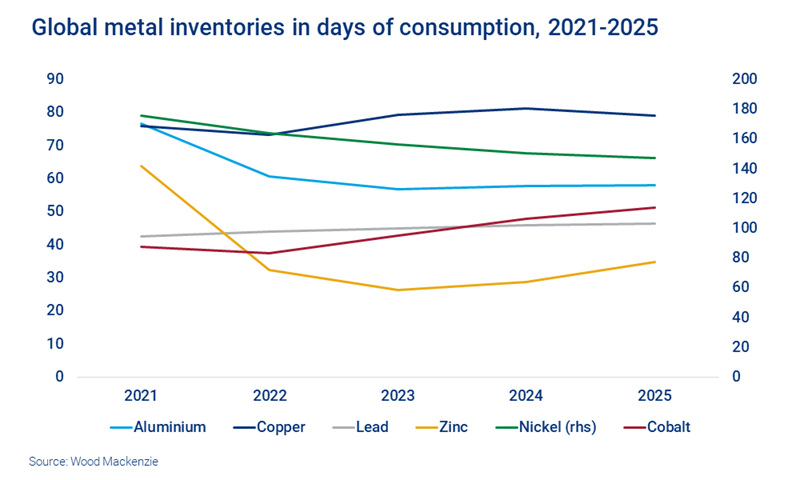

Over the next five years, the trends in total stocks indicate that it’s very much a mixed bag. This has obvious implications for prices. Nickel and zinc will experience significant stock drawdowns, with stocks falling to well below historical averages. This points to a significant price run-up if that has not already been factored into analyst expectations. Aluminium will see stocks falling, although we do not anticipate previous lows of 55 days will be reached. For the remaining commodities, stocks are on a rising trend in absolute and relative terms, which suggests that prices will come under downward pressure.

While reported stocks are one small measure of market dynamics, a far more comprehensive view of total stocks can better illuminate the fundamental outlook for markets.

Get unique metals and mining insight in your inbox

This article is part of a series exploring opportunities and challenges in the world of metals and mining. Fill in the form at the top of the page to be alerted to new articles as they are published.