Get this complimentary article series in your inbox

1 minute read

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Latest articles by Julian

-

Opinion

Metals investment: the darkest hour is just before the dawn

-

Opinion

Ebook | How can the Super Region enable the energy transition?

-

The Edge

Can battery innovation accelerate the energy transition?

-

Featured

Have miners missed the boat to invest and get ahead of the energy transition?

-

Featured

Why the energy transition will be powered by metals

-

Featured

Could Big Energy and miners join forces to deliver a faster transition?

Inflation is back with vengeance. The 2014/15 slowdown and the early part of the Covid-19 pandemic had largely eliminated it. But natural resource commodities are a major contributing factor to the current inflationary spiral. Commodity prices have been on fire since early 2020 – a result of constrained supply, pent-up demand, supply chain issues, re-stocking and stimulus programmes.

With slower demand growth expected for many mined commodities in 2022 and 2023, stocks will be on a rising trend. The fundamentals point to weaker prices for most metals, and a margin squeeze could be ahead. Will investors be willing to fund the expansion necessary to deliver the green revolution? And is a commodities supercycle inevitable?

Transition year ahead as market deficits decline or surpluses build

Certainly, 2022 looks to be a transition year. Markets are starting to turn to balanced or surplus positions as demand slows and supply continues to rise, prompted by strong prices and margins in 2020/21. Several factors will temper demand:

- Higher interest rates, which will increase borrowing costs

- The unravelling of quantitative easing

- Rising tax take to pay down debt and fund public services

- Squeezed household disposable income as goods and services costs rise

With market fundamentals deteriorating for many mined commodities, the result will be flat or lower prices, with an obvious impact on margins.

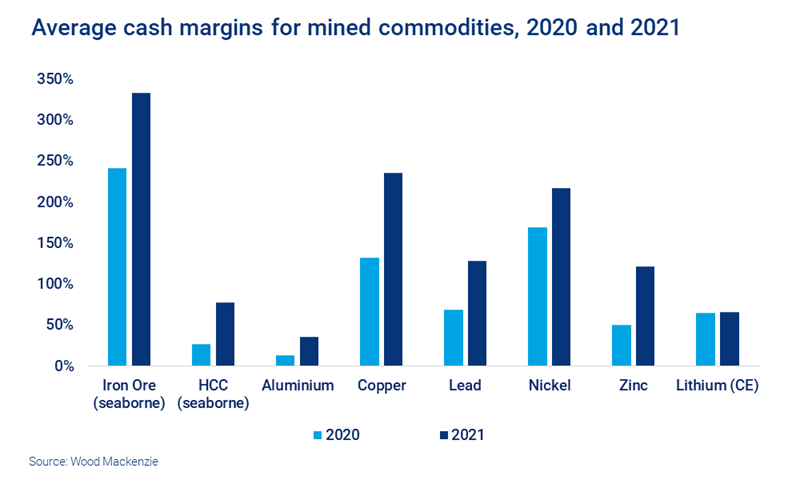

Margins increased in 2021 on strong commodity prices but look set to fall in 2022/23

Cost inflation for miners and metal producers was something of a mixed bag in 2021. But such has been the strength of commodity prices that all commodities saw average margins rise compared with 2020. In part, this was due to high by-product credits which have offset rising costs elsewhere. Most other cost categories increased in 2021, although lead and zinc miners saw much lower treatment and refining charges (TC/RCs).

Our concern is that costs will rise further in 2022/23 as energy prices rise and inflation-related wage demands feed through into higher costs. The relative strength of the US dollar will also be a major influence. Of concern to miners will be a weakening of the dollar due to its inflationary impact on local currency-based costs. Dollar strength and commodity prices are inversely correlated, which could be an offsetting factor.

Capital costs look set to rise due to a shortage of labour resulting from the Omicron surge, as well the knock-on effect of higher subcontractor costs. In its recent earnings call, Teck noted that it expects capex costs to rise by 50% to 83% in 2022, compared with its initial estimates. It is unlikely to be alone in this.

Energy price inflation and the potential for exchange rate movements to inflate costs will all make their mark on miners’ bottom line. The key issue for miners will be how to constrain inflation and ensure that it is a transient rather than a structural issue.

The spectre of continued cost inflation is real and, together with a softer price environment, points to lower margins. Investors, having reaped rich rewards in rising share prices and record dividend pay-outs, will have little patience for lower returns.

An acceleration of capex deployment needed to meet energy transition requirements

I have opined on the challenge of supplying the mined commodities to meet our base case energy transition outlook (ETO) by 2030, given the current shortfall in capital investment. Our ETO assumes a 2.5 to 2.7 °C global warming trajectory. At the mine level, we think it will be a struggle to meet the combination of rising demand and falling supply. From 2025 onwards supply gaps open for many commodities, which will require additional commitments of about US$300 billion. Although challenging, we believe that the industry can deliver against these supply gaps – but it will need to rapidly accelerate the sanctioning of projects.

Factoring in the additional demand for mined commodities arising from a 2 °C trajectory (our accelerated energy transition, or AET-2 scenario) places huge strains on project developers and the capital required. An additional US$$500 billion will need to be invested by 2030 – and the sooner, the better.

The supercycle looks baked in from mid-decade whatever happens to prices in 2022/23

The key issue the industry faces today is not that miners do not understand the challenge of supply development and preventing structural shortages emerging from mid-decade onwards. It’s that investors have been hooked on dividends and are unwilling to forego returns today on the promise of returns several years hence.

Despite a demand slowdown, prices may continue to be strong, prompted by the promise of rampant energy transition demand and constrained supply. This would provide the additional cashflow to enable the dividends at levels investors have become accustomed to. It would also provide the financial headroom to sanction projects to meet accelerated energy transition pathways, at least partially.

An alternative view is that producers in 2022/23 spend less capital to maintain dividends. This keeps investors happy – but starves the industry of the necessary investment to meet the AET demand. What follows is a period of rapidly rising prices from mid-decade onwards as structural deficits emerge for several key commodities. With prices moving higher than costs, producers continue to deliver dividends and invest in growth. But it will be a case of too little too late for an accelerated decarbonisation pathway.

The supercycle feels inevitable so the only real question is around its timing. Whichever way we look at it, the next supercycle looks baked in from mid-decade onwards, particularly if COP26 pledges are quickly translated into policy.

Get unique insights on metals and mining in your inbox

This article is part of a regular series exploring opportunities and challenges in the world of metals and mining. Fill in the form at the top of the page to make sure you are notified of new articles as they are published.