Get Ed Crooks' Energy Pulse in your inbox every week

Capital is still flowing into the US oil and gas industry

The US oil and gas industry has been a challenging sector for investors for years, and the fall in oil prices in 2020 has added to its difficulties. But recent bond issues by US E&Ps have shown that debt markets are still open for some

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Jigar Shah returns to the Energy Gang

-

Opinion

Emissions rules for US power pose some difficult questions

-

Opinion

Is there an energy transition?

-

Opinion

Making low-carbon hydrogen a reality

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

Robinhood is a company that offers commission-free trading in shares, options and exchange-traded funds, with the goal of making investment “more affordable, more intuitive, and more fun”. As share prices have soared in the past three months, despite the weakness of the world economy, the platform has increasingly come under scrutiny for the effect it may be having on capital markets in the US.

One consequence of Robinhood’s “mission to democratise finance for all” appears to have been that money from the US government’s economic stimulus programme has flowed directly into the stock market. When the government started sending out stimulus cheques in April, people earning $35,000-$75,000 a year increased their stock trading activity by 90% the week after the money arrived, according to financial data company Envestnet Yodlee.

Some of the small investors putting money into the stock market seem prepared to gamble on the riskiest situations. Hertz car rental filed for bankruptcy four weeks ago, but for a while was trying to raise up to $500 million by selling new shares, even while warning potential investors that the reorganisation process “may render our common stock worthless”.

That plan has been put on hold after the Securities and Exchange Commission raised concerns about the sale. But the mere fact that Hertz even thought about it seriously, to the extent of issuing a prospectus, is a sign of the highly unusual market conditions we are in now.

Strange days in the stock market have been affecting some energy companies, too. Whiting Petroleum went into bankruptcy in April, but its shares have shown continuing signs of life, rising four-fold in the space of four days earlier this month before plunging back again. Shares in Chesapeake Energy, which is expected to file for bankruptcy soon, have shown similar volatility, spiking for six days from June 4 to June 10.

But investor interest in US exploration and production companies is not confined to gamblers trying their luck on Robinhood. Some companies have been able to raise funds in the bond market this month, including Endeavor Energy Resources, WPX Energy, and Comstock Resources.

Comstock increased its sale of senior notes from $400 million to $500 million, reflecting healthy interest in the offer. “Upsizing the offering by US$100 million shows there is still some investor demand for yield, even from low rated issuers,” said Robert Polk, principal analyst in Wood Mackenzie’s corporate analysis service. “At the moment, there is still capital there for anyone that is willing to pay for it.”

The US Federal Reserve is playing a key role in helping to sustain those flows of capital. It is operating two facilities with a total value of up to $750 billion to support corporate bonds: one to invest in new issues, and one to operate in the secondary market. The Fed announced on Monday that the secondary market facility would from now on be able to buy individual companies’ bonds, whereas before it had only been able to invest in bond funds. The effect is to provide a “funding backstop” to stop companies running out of cash, and to stop bond markets seizing up.

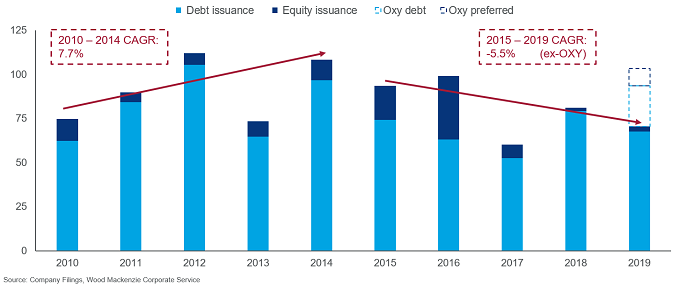

There were signs that the flow of capital into the US E&P sector was slowing even before the coronavirus pandemic hit. New equity issuance had dried up almost completely, and bond issuance was generally on a downward trend. But even after the plunge in oil prices this year, the flow has not stopped altogether.

The flow of capital into the US E&P sector is being closely watched because of fears that companies will take the money and immediately use it to drill and complete more wells, slowing the rebalancing of the global oil market. So far, at least, that does not look like a problem. Most of the recent bond sales have been used to refinance existing debt to extend maturities, or to pay down bank loans, rather than to finance increased activity.

The active rig count in the US is continuing to decline, and production is still falling. US oil output compared to March levels was down 1.9 million barrels per day in May, and 2.6 million b/d in June, according to Wood Mackenzie’s Genscape service.

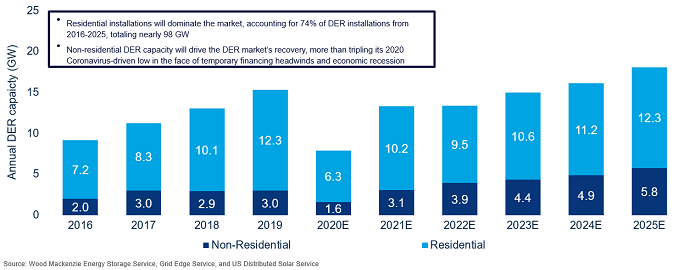

Distributed energy takes a hit from coronavirus in the US

The market for distributed energy resources such as rooftop solar, battery storage and smart thermostats had been booming in the US in recent years, but has slumped in 2020. The first edition of a new Wood Mackenzie publication, the United States Distributed Energy Resources Outlook, explains how restrictions on businesses to curb the spread of Covid-19 and the sharp downturn in the economy are expected to cause a steep decline in investment in distributed energy this year.

The market is expected to rebound next year, but it may not be until 2024 that new capacity additions exceed their level in 2019.

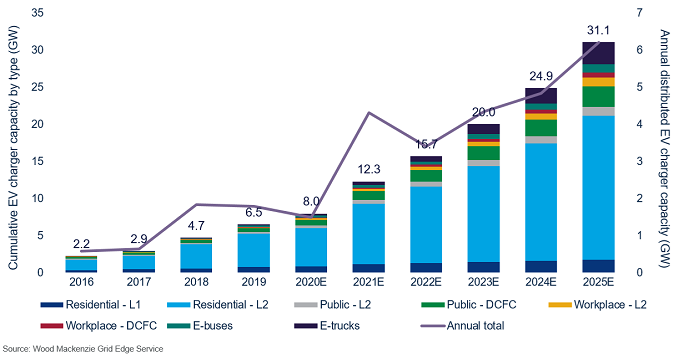

One important point in the forecast is that from next year, electric vehicle infrastructure is expected to take over from residential load management as the fastest growing distributed energy resource: a reminder that the adoption of EVs means not just a change in road transport, but in an entire energy system. There are detailed forecasts, along with a wealth of other information, in the full report.

US coronavirus cases ticking up

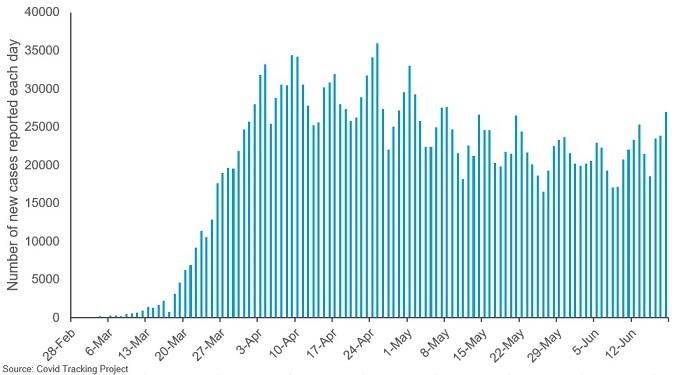

For a few weeks now the picture of coronavirus cases in the US has shown a rising trend in some states, including California, Texas, Florida and Arizona, offset by declines in others, with the net effect that the total number of new cases reported nationally each day remained broadly stable. In the past week, however, there have been signs that the number of new cases reported each day may be trending higher. There are also signs that the increase in recorded cases is not solely a result of increased testing: the proportion of test results that has been coming back positive has also ticked up recently. This will be an important indicator to watch in the weeks to come.

In China, a new outbreak of the coronavirus in Beijing prompted a rapid response from the authorities this week. Hundreds of flights have been cancelled, schools have been closed, and entire communities have been locked down with residents not allowed to leave. An investigation into the source of the outbreak has pointed to seafood stalls at a wholesale food market.

In the US, state governors generally seem determined not to go back into lockdown. Governor Ron DeSantis of Florida this week gave a robust defence of his plans to keep reopening the state, promising: “we’re not rolling back”. He added that the priority would be protecting at-risk groups such as people in nursing homes.

In brief

BP announced that it would be taking non-cash impairment charges and write-offs of $13 billion – $17.5 billion for the second quarter, reflecting the impact on its asset valuations of assuming a lower price of oil and a rising cost of carbon. It has cut its long-term oil price assumption to an average of about $55 a barrel for Brent crude over 2021-50, and is using a price on emissions of $100 per tonne of carbon dioxide equivalent in 2030.

Bernard Looney, BP’s chief executive, said in a statement: “I am confident that these difficult decisions – rooted in our net zero ambition and reaffirmed by the pandemic – will better enable us to compete through the energy transition.”

Luke Parker, Wood Mackenzie’s vice-president of corporate research, commented: “This is about BP’s strategic shift away from oil and gas. While that will be a multi-decade affair, BP is already getting to grips with the idea that its upstream assets are worth less than it believed as recently as six months ago.”

BP also this week published its latest annual Statistical Review of World Energy, an excellent source of data on all energy sources, in some cases going back to the 1960s. Looney said the review presented a picture of the world at a “pivotal moment”, with renewable energy growing rapidly, but global greenhouse gas emissions also up 0.5% last year.

The International Energy Agency this week published its plan for tipping the world from that pivot towards lower emissions. The “Sustainable Recovery Plan”, launched in co-operation with the International Monetary Fund, sets out proposals for investments in sectors including electricity, transport and buildings totaling $1 trillion a year over the next three years. The IEA argues that spending on that scale would both add 1.1 percentage points to annual global GDP growth, and mean that 2019 would be the peak year for global greenhouse gas emissions, setting the world on course to meet the goals of the Paris climate agreement. Fatih Birol, the IEA’s executive director, said the world’s governments had “a once-in-a-lifetime opportunity to reboot their economies and bring a wave of new employment opportunities while accelerating the shift to a more resilient and cleaner energy future.”

Saudi Aramco has formally concluded its US$69 billion acquisition of a 70% stake in Sabic, the chemicals and materials group. It has also been cutting jobs, although Reuters reported an estimate that only about 500 jobs were being cut from its workforce of about 70,000.

Ford’s new F-150 trucks will reportedly have sleeper seats that recline into flat beds, like in a business class cabin on an aircraft. “You can basically live in the truck,” a source told Reuters.

The ride-sharing network Lyft has pledged to have an all-electric fleet on its platform by 2030.

Modern shale wells are likely to cost about $300,000 each on average to plug and abandon safely, much more than the standard estimates of $20,000-$40,000, according to the Carbon Tracker Initiative.

The Vatican has urged Catholics to sell their investments in fossil fuel industries and the arms industry.

Two US senators and one member of the House of Representatives from Alaska have written to Jerome Powell, chairman of the Federal Reserve, and other financial authorities, urging them to “consider regulatory action” against banks and other institutions that have said they will not finance oil and gas projects in the Arctic or the Alaska National Wildlife Reserve. Five banks, including Citigroup, Goldman Sachs, and Morgan Stanley, pledged last year to stop lending to such projects. Alaska’s congressional delegation argues that the banks that have made those commitments are “openly discriminating against some of the most economically disadvantaged regions of America”, and could be breaking laws including the Community Reinvestment Act and the Equal Credit Opportunity Act.

State and local governments in coal-dependent US regions in West Virginia, Wyoming and elsewhere face “important revenue risks” from policies to tackle climate change, researchers from the Brooking Institution and Columbia University have warned.

New Jersey’s Governor Phil Murphy has unveiled plans to build America’s first port to serve the offshore wind industry. The New Jersey Wind Port is expected to create thousands of jobs and “establish New Jersey as the national capital of offshore wind,” Murphy said.

US renewable energy organisations, backed by Bill Gates’ Breakthrough Energy group, have launched a new campaign called the Macro Grid Initiative, which will work to strengthen the country’s electricity transmission network. Its goal is a “transmission Macro Grid”, which would “connect centers of high renewable resources with centers of high electric demand, enhance grid resiliency and dramatically reduce carbon emissions”.

From California, there is a spectacular illustration of technological progress in wind power over the past 37 years. The Mesa Wind Project in Palm Springs, built in 1983, currently has 460 turbines, most of them no longer operational. The project’s owner Brookfield Renewable plans to replace them with just 11 new turbines, with the same total capacity of 30 megawatts. The new turbines will be much larger than the old ones, and the repowering project has faced opposition from local residents.

The logistics group A.P. Moller-Maersk says the second quarter of 2020 is turning out to be “more favourable than originally expected”. Volumes are now expected to be down 15%-18% in the quarter, compared to initial guidance of a drop of 20%-25%.

As cities across the US debate policies to discourage developers from fitting gas connections in new buildings, the industry is taking to Instagram to fight back. Industry groups have been paying Instagram influencers to extol the benefits of cooking with gas.

And finally: the enduring power of a great marketing slogan. Boris Johnson, the UK prime minister, said this week that he wanted EU leaders to “put a tiger in the tank” of negotiations over a new trade deal between the two economies. It was a throwback to the highly successful slogan used for decades by the Standard Oil Company (New Jersey), which became Exxon in 1972, to sell its Esso, Humble and Enco fuel.

The call for motorists to “put a tiger in your tank” was the brainchild of a Chicago-based copywriter, Emery Smith, in 1959, and it became a cultural phenomenon. When the company produced fake tiger tails for drivers to stick on their fuel tanks, it sold 2.5 million in the US alone. Willie Dixon wrote a song for Muddy Waters called ‘Tiger in Your Tank’, adopting the slogan for suggestive effect, and Waters performed it in his legendary set at the Newport Jazz Festival in 1960. Six decades later, it remains resonant enough for Johnson to be confident that a good proportion of his audience will still remember it.

Other views

Simon Flowers — Building upstream portfolio resilience

Gavin Thompson — How will the Asia Pacific upstream sector emerge from the crisis?

Rory McCarthy — Power system flexibility is key to Europe’s net zero targets

Martin Kelly — What investors want to know about energy and natural resources

Farid Ahmed — Lead is not dead

Josh Agenbroad and Cyril Yee — Why we need faster climate tech innovation

Jude Clemente — The world’s biggest energy problem: access

Quote of the week

“In Europe today we are more optimistic because we are getting out of the lockdowns… In electricity, in power supply, we were down 20%. We are back almost to normal market levels, [down] 3% only. And in our fuels business, we are still not to a standard level, but [down] only 15%. So it is coming back quite quickly.” — Patrick Pouyanné, chief executive of Total, explained his reasons for growing optimism about the outlook for the energy industry. He was speaking at the Virtual Abu Dhabi CEO Roundtable, a forum convened by the Abu Dhabi National Oil Company that brought together oil and gas industry leaders from around the world.

Chart of the week

This is another chart from Wood Mackenzie’s new United States Distributed Energy Outlook, discussed above. Electric vehicle charging infrastructure is expected to be the fastest-growing type of distributed energy resources from next year, and this chart shows just how rapid that growth looks. The bars show EV charging capacity in the US, which is expected to grow almost five-fold between 2018 and 2025.