Sign up today to get the best of our expert insight in your inbox.

How and why big oil is strengthening its oil and gas exposure

Comparing the portfolios and strategies of the Supermajors and NOCs

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Neivan Boroujerdi

Director, Corporate Research

Neivan Boroujerdi

Director, Corporate Research

Neivan leads Wood Mackenzie's global corporate NOC coverage.

Latest articles by Neivan

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

ADNOC doubles net hydrogen production through stake in ExxonMobil’s Baytown project

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Benchmarking the Middle East NOCs against the supermajors

-

The Edge

How and why big oil is strengthening its oil and gas exposure

Tom Ellacott

Senior Vice President, Corporate Research

Tom Ellacott

Senior Vice President, Corporate Research

Tom leads our corporate thought leadership, drawing on more than 20 years' industry knowledge.

Latest articles by Tom

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Featured

Corporate oil & gas 2025 outlook

-

The Edge

The complexity of capital allocation for oil and gas companies

-

Opinion

Ten key considerations for oil & gas 2025 planning

-

Opinion

Can ExxonMobil make attractive returns from its US CCUS portfolio?

-

Opinion

How do integrated companies position themselves in the changing downstream landscape?

Size usually matters in oil and gas. Eight of the sector’s biggest companies feature in WoodMac’s benchmarking analysis – the five Supermajors and Saudi Aramco, ADNOC and Qatar Energy. These Middle East NOCs are stepping beyond their domestic asset base and are now talking – and acting – like IOCs. I picked out five themes with Neivan Boroujerdi and Tom Ellacott from our Corporate Analysis team, highlighting the big differences – and similarities – between the peer groups.

First, the Supermajors and NOCs all want more exposure to upstream. These giants together already produce one-quarter of global liquids supply and one-fifth of gas. Yet far from decreasing output as the energy transition gains momentum, all are seeking either to increase or at least to extend oil and gas production volumes through the next decade.

The giant acquisitions of Pioneer Resources by ExxonMobil and of Hess by Chevron signal their belief in the durability of oil and gas demand. TotalEnergies’ consistent approach to business development has secured a production profile with robust growth. Shell and BP, in contrast, have been outliers, having planned to reduce production before a strategic pivot a year ago. Both are now expected to strengthen medium-term production.

Saudi Aramco and ADNOC, both top three global oil producers, are nearing the end of a major phase of capacity expansion. QatarEnergy (QE) is scaling up its huge gas production capacity even further. It’s launched the latest phase of the development of Qatar’s huge gas resource, aimed at consolidating its position as the world’s biggest LNG producer.

Second, as they continue to derisk upstream for the transition, the two peer groups start from vastly different places. The Supermajors already have well-diversified portfolios even after a decade of rationalisation, which saw them sell out of smaller, geographically stranded or higher-cost assets and regions. Organic investment through this period has tended to focus on core low-cost, low-carbon-intensity resource, complemented by M&A activity. ExxonMobil’s doubling down on Permian tight oil via its Pioneer acquisition is a prime example. Chevron’s acquisition of Hess, on the other hand, is about accessing advantaged oil growth in deepwater Guyana.

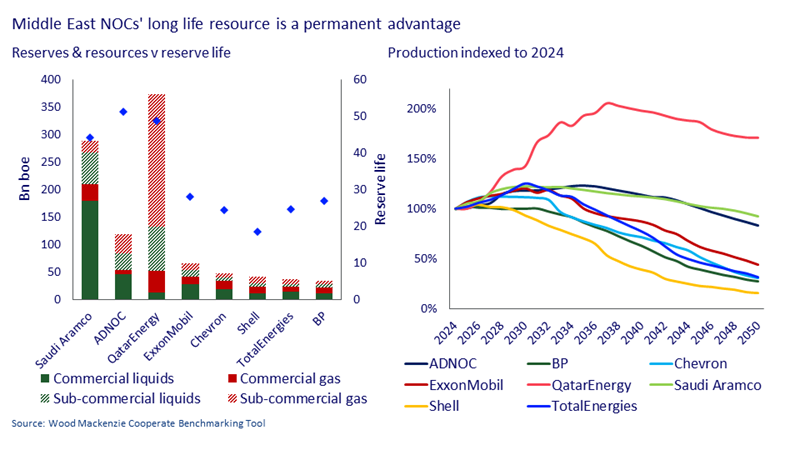

Aramco and ADNOC continue to invest in domestic, advantaged oil resource, which contributes around 85% of their total production. These fields are among the industry’s lowest cost and lowest carbon intensity, meaning both are well placed to outlast other producers. They are also exceptionally long-life – double that of the Supermajors. Both Aramco and ADNOC have recently established seed positions in international gas and LNG to initiate some portfolio balance and to access growth markets.

QatarEnergy is 65% weighted to Qatar gas production and climbing. Its international diversification is comparatively recent and highly differentiated; an exploration-led strategy that leverages its equity partners in the Qatar LNG projects. It’s paid off handsomely with a sizeable and potentially commercial 2019 gas discovery in Cyprus (operator ExxonMobil) and two giant play-opening oil discoveries in Namibia in 2022 (operators TotalEnergies and Shell).

Third, unlike the Supermajors, all three NOCs are very ‘short’ downstream compared with oil production and have been actively building their refining and petrochemicals exposure. Saudi Aramco has used downstream M&A over the years to secure offtake for its crude in key growth markets, mainly in Asia. This is less pressing for ADNOC (high-quality crude grade) and QE (LNG). But all three NOCs are also expanding domestically and overseas in petrochemicals, expected to be one of the last growth segments among petroleum products.

Fourth, commitment to low-carbon energy varies widely. Capital expenditure across both peer groups may be heavily weighted to oil and gas, but all eight companies are investing in low-carbon technologies. The Majors lead, aiming to allocate an average of 25% of 2023-27 budgets to low carbon, with BP (35%) highest and Chevron (5%) lowest.

For the NOCs, decarbonisation – rather than diversification – has been at the heart of transition strategies so far. The three NOCs average ‘only’ 15%, but ADNOC’s planned US$4.5 billion is behind only BP in terms of absolute spend.

Finally, the modest pace of the transition so far has suited these companies. Record cash flow, buoyed by high oil and LNG prices, is enabling them to ‘do it all’ – seize opportunities in oil and gas, build some low-carbon exposure and deliver exceptional returns to shareholders and governments.

Analysis of the portfolios and investment plans suggests cash generation from oil and gas will remain the backbone of all eight companies for the foreseeable future. But there’s no guarantee that oil prices will stay high, underlining the need to keep a laser focus on low-cost (and low-carbon) oil and gas resource.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.