Get Ed Crooks' Energy Pulse in your inbox every week

The debate over US hydrogen tax credits is coming to a head

Treasury guidance on tax credits for low-carbon hydrogen has divided the industry. Clarity over the rules would benefit the whole sector

9 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

Football games are reliably among the top-rated television broadcasts in the US, and advertising time during the breaks is priced accordingly. So when competing arguments about the implementation of tax credits for low-carbon hydrogen were aired during football games shown in the Washington DC area last year, it was a sign of how high the stakes were.

Out of the many tens of thousands watching, perhaps only a few dozen would have even known what the debate was about, let alone had the power to affect it. But it was worth spending the money for the companies involved to try to influence those few key decision-makers.

The final rules for implementing the 45V tax credits for low-carbon hydrogen, which were introduced in the Inflation Reduction Act of 2022, will determine how the industry develops in the US. Some companies and industry groups want tighter, more restrictive rules, while others favour a more generous interpretation that would widen eligibility.

Beyond those arguments, however, there is a fundamental issue for the entire hydrogen industry. For as long as the debate drags on, companies and investors will face uncertainty and projects will find it hard to make progress. Some outcomes for implementing the tax credits would be better than others. But indefinitely prolonged uncertainty would be the worst outcome of all.

The Treasury published its proposed guidance for implementing the 45V credits on the last working day before Christmas last year, and companies and industry groups quickly moved to stake out positions for or against the proposals.

Supporters of the Treasury’s plan include Air Products, Acciona and Nordex Green Hydrogen, CWP Global, EDP Renováveis, and Hy Stor Energy, as well as groups such as the Clean Air Task Force. Those expressing concerns include the American Council on Renewable Energy (ACORE) and Plug Power. There is a 60-day period for comments, and many other companies and industry and environmental groups can be expected to weigh in before the deadline. Already, however, the outlines of the debate are becoming clear.

The Inflation Reduction Act created tax credits for hydrogen production at four tiers, based on the carbon intensity of the process, starting at 60 US cents per kilogram and going up to US$3/kg. The Treasury guidance gives companies the details of how they can qualify for those credits, based on factors such as the power sources used to make electrolytic hydrogen.

For example, until 2028 producers will be able to claim the tax credit based on matching their power demand with additional local renewable generation through a year. After 2028, all projects will have to shift to hourly matching, meaning that their assessed carbon intensity will be based on the associated emissions of the power they are using hour by hour.

Wood Mackenzie analysts said the rules as proposed were strict, but would not “smother the embers of the burgeoning hydrogen industry in the US”. However, they added, the proposals would mean slower development than under a more generous set of guidelines, keeping costs “higher for longer” as EPC contractors would not learn so quickly how to deliver projects.

Supporters of the Treasury’s proposals have argued that the rules need to be strict, to make sure that the growth of the hydrogen industry does actually reduce emissions. Air Products, for example, applauded the Treasury’s guidance and said strong implementation was “essential to delivering real emissions reductions, creating the stimulus for broader investments across the hydrogen value chain, and cementing the US’s global climate leadership.”.

Opponents of the proposals, however, argue that the stringent standards planned by the Treasury would stifle the development of the hydrogen industry in the US. Ray Long, President and CEO of ACORE, said in a statement: “We are concerned with the lack of flexibility in the proposed rule and the impact it may have in jump-starting a hydrogen industry at scale… We remain hopeful the final rule ultimately released has the needed flexibility to support the scale and role that hydrogen can play in achieving our decarbonisation goals.” His group backs the sustained use of annual matching of power supply and demand to determine the carbon intensity of electrolytic hydrogen.

Senator Joe Manchin, a centrist Democrat from West Virginia whose vote was crucial for getting the Inflation Reduction Act passed, issued a blistering statement, accusing the administration of “kneecapping” hydrogen projects.

“Today’s proposed rules on the IRA’s hydrogen production tax credit will only make it more difficult to jumpstart the hydrogen market, which will be a critical part of our secure energy future,” he said. “Make no mistake, obstructing hydrogen development in our country is the short-sighted goal of the far-left advocacy groups who lobbied the Administration for these restrictions because they oppose all energy sources other than solar and wind.”

The vehemence of some of the opposition suggests there is a good chance the guidance will be revised by the Treasury before the final rules are issued. Fundamentally, there is agreement across the industry about the ultimate destination: a large-scale hydrogen sector with very low emissions. The disagreement is about the best route for getting there: whether it is better to build out a hydrogen industry as quickly as possible and then work on driving down its emissions intensity over time or to ensure that the industry develops with the lowest possible emissions from its very early stages.

It will never be possible to keep everyone happy, but given that fundamental alignment, it ought to be possible to find a compromise that is broadly acceptable.

Probably the most damaging outcome would be a protracted legal battle over the rules, which would drag out the uncertainty for developers, investors and customers, leaving them unable to commit to projects because they cannot be sure what their eligibility for tax credits will be. Because the stakes are high, the temptation to resort to the courts will be strong. But the whole industry could end up losing.

Oil markets shrug off attacks in the Red Sea

Crude oil prices have remained subdued this month, despite Houthi attacks on shipping in the Red Sea, and retaliation by the US and UK. On Thursday, US forces launched a fifth found of strikes against Houthi targets, after a US-owned bulk carrier was reported to be hit by a drone on Wednesday.

President Joe Biden acknowledged that the US action had not stopped attacks on international shipping in the Red Sea. “Well, when you say working, are they stopping the Houthis? No,” President Biden said. “Are they going to continue? Yes.”

Despite the continuing fighting, oil prices have barely moved this week. Brent crude was trading at about US$79 a barrel early on Friday morning, about US$1 a barrel higher than at the start of the week.

Mike Wirth, chief executive of Chevron, said he was surprised that the oil market had not reacted more strongly to the attacks on shipping, and warned that US production would not be able to trespond quickly to offset supply shocks.

“Certainly, US supply growth has surprised people to the upside, and I think it has helped calm markets a little bit,” he told Bloomberg News at the World Economic Forum conference in Davos. “But it has no ability to cover up a big disruption in the Middle East. That will fundamentally change the supply dynamics in the world, if you were to see shipping halted, disrupted or seriously disturbed. And so I do think that the US supply has helped calm markets over the longer cycle, but there’s no capacity to respond in the short term to an interruption like that.”

In brief

Shell has agreed to sell its Nigerian onshore subsidiary to a consortium of local and international companies for US$1.3 billion, reducing its exposure to security risks and the greenhouse gas emissions intensity of its production. The deal implements a plan to sell the business that the company first announced in 2021. Shell will also receive additional payments of up to US$1.1 billion, primarily related to receivables and cash balances in the business.

The sale will bring to an end the 68-year history of Shell’s upstream onshore business in Nigeria, going back to its first successful well in the country, which was drilled in January 1956. But Shell will retain a significant presence in the country, in deepwater and integrated gas. Zoë Yujnovich, Shell’s Integrated Gas and Upstream Director, said in a statement: “Shell sees a bright future in Nigeria with a positive investment outlook for its energy sector.”

BP has appointed its new chief executive: Murray Auchincloss, its former CFO and acting CEO following the unexpected departure of Bernard Looney. Auchincloss said in a statement that although the company’s top leader might have changed, its strategic direction would not. “Our strategy – from international oil company to integrated energy company, or IOC to IEC – does not change. I’m convinced about the significant value we can create,” he said. “Now, more than ever, our focus must remain on delivery – operating safely and efficiently, executing with discipline, and always focusing on returns.”

The British government is preparing to extend subsidies for burning biomass at the Drax power plant, despite opposition from environmental groups, the Financial Times reported.

Other views

Mauro Chavez – European gas and LNG: six things to look for in 2024

Melvin Backman – The United States is drowning OPEC in oil

Martin Sandbu – China’s green tech surge could turn global climate politics on its head

David Gelles – Davos puts climate on the back burner

Quote of the week

“Ultimately, peak oil supply has never come to pass, and predictions of peak oil demand are following a similar trend. Time and again, oil has defied expectations regarding peaks. Logic and history suggest that it will continue to do so. It all underscores the need for stakeholders to recognize the need for continued investment into the oil industry, today, tomorrow, and many decades into the future.” – Haitham Al Ghais, secretary-general of OPEC, argued in an article on the organisation’s website that forecasters had been predicting “peak demand” for oil for at least a decade, and those calls were becoming as discredited as earlier prophecies of “peak supply”. Not only had peak demand not yet materialised, he said, it would not materialise in the future, and certainly not before the end of the current decade.

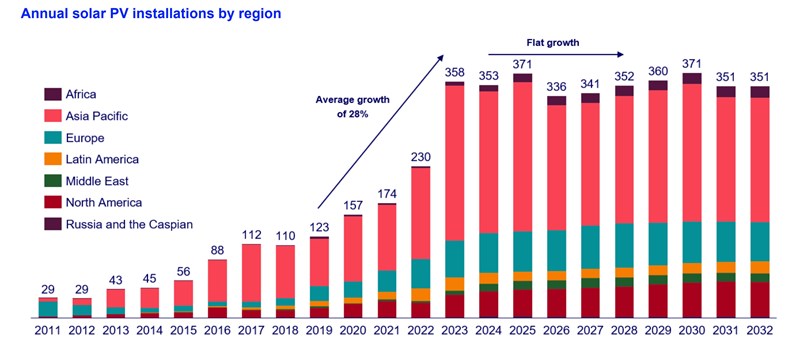

Chart of the week

This comes from a new report setting out three big predictions for the solar industry, from our head of global solar Michelle Davis. In the first one, she puts some numbers behind the call that she included in my lookahead to 2024 at the end of last year: starting from 2024, solar will shift from a high growth industry to a slower-growing, mature industry.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today using the form at the top of the page to ensure you don’t miss a thing.