Discuss your challenges with our solutions experts

Decarbonising global shipping

Can alternative fuels set the global maritime trade on a course for net zero?

1 minute read

Iain Mowat

Principal Analyst, EMEARC Refining and Oil Product Markets

Iain Mowat

Principal Analyst, EMEARC Refining and Oil Product Markets

Iain brings extensive knowledge of global energy markets to his analysis of energy and petroleum demand.

Latest articles by Iain

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

-

Opinion

Full steam ahead: the changing outlook for global marine fuels to 2050

-

Opinion

Will international shipping be net zero by 2050?

-

Opinion

Decarbonising global shipping

-

Opinion

Could alternative marine fuels decarbonise shipping?

COP26 focused global attentions on the urgency of net zero targets. Since, the International Maritime Organization (IMO) has come under pressure to go beyond its initial target of halving emissions by 2050, towards a commitment to zero emission shipping.

Maritime transport is responsible for about 940 MT of CO2 annually and approximately 2.5% of global greenhouse gas (GHG) emissions. Without mitigation measures, there are concerns that shipping’s share of carbon could increase. International shipping is also on the rise: global maritime trade is expected to expand by nearly 50% by 2030 in comparison to 2015 levels.

Achieving the current target to cut emissions by 50% will already be a major challenge. A much greater shift to low and zero carbon fuels will be required than what is currently forecast in our base case outlook. And if the IMO does commit to net zero by 2050, then even more will need to be done, even faster.

Our report IMO 2050: setting sail towards decarbonisation considers the role alternative fuels can play in meeting emissions targets and explores the outlook for maritime fuels as the sector grows. Head to the store to access the full report. Or read on for an introduction.

Oil marine bunker fuel demand set to peak by 2025

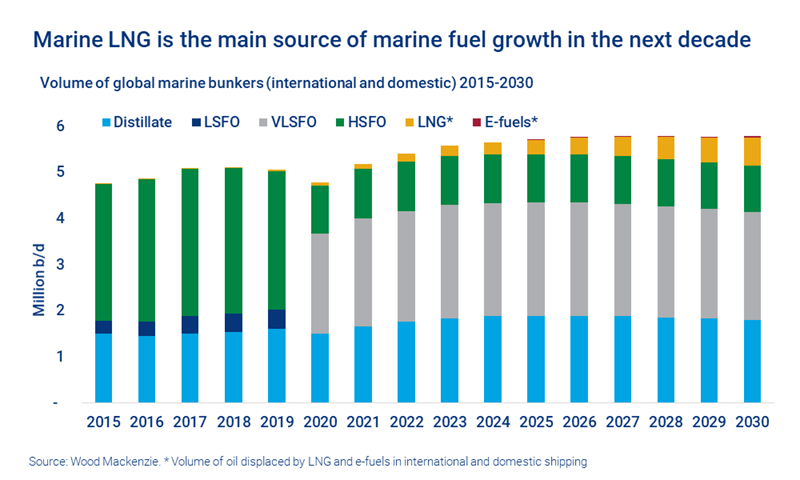

Although the shipping sector is growing, the increase in global marine fuel sales – 20% between 2015 and 2030 – will be substantially lower than the increase in maritime trade.

The IMO’s energy efficiency requirements for new and existing vessels mandate improving fuel efficiency, which will begin to erode demand. Meanwhile, synthetic e-fuels will start to replace traditional varieties.

Oil marine bunker fuel is expected to peak in 2025, while marine LNG will be the main source of market growth in the longer term. It should displace nearly 0.6 million b/d of oil bunkers by 2030. However, the impact of Russia’s war with Ukraine on European gas prices could put pressure on the transition to LNG in Europe over the next few years.

In the early 2030s, the global marine fuel market should start to decline. Synthetic e-fuels should become more widespread after 2040, when green hydrogen capacity will be more readily available.

Will the IMO’s efficiency regulations be enough to reach current emission targets?

In short, no: not on their own.

The IMO’s Energy Efficiency Design Index has been a key mechanism to ensure improvements in energy efficiency in the global shipping fleet. It was introduced for new build vessels in 2015, but will now also apply to existing vessels from 2023 onwards. All ships will need to establish an annual operational carbon intensity indicator (CII), which links carbon emissions to the amount of cargo that has been carried over the distance travelled.

Emissions will need to decline at a much faster rate after 2030 if the sector is to meet its target.

Iain Mowat

Principal Analyst, EMEARC Refining and Oil Product Markets

Iain brings extensive knowledge of global energy markets to his analysis of energy and petroleum demand.

Latest articles by Iain

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

-

Opinion

Full steam ahead: the changing outlook for global marine fuels to 2050

-

Opinion

Will international shipping be net zero by 2050?

-

Opinion

Decarbonising global shipping

-

Opinion

Could alternative marine fuels decarbonise shipping?

But those measures will not be enough to decarbonise the sector. The IMO target to halve overall emissions by 2050 will be a major challenge, and tough new fuel efficiency standards will be required. Emissions will need to decline at a much faster rate after 2030 if the sector is to meet its target. If the IMO commits to net zero, even more will need to be done.

MEPC 78 – the 78th session of the IMO’s Marine Environment Protection Committee to be held in June this year – will consider proposals to revise the initial GHG strategy. A revised strategy will be considered at MEPC 80 next year.

A huge shift towards low and zero carbon fuels is required

Initiatives such as using smaller engines, deploying wind and solar power and waste heat recovery could be helpful in the sector’s efforts to cut emissions; however, many of these technologies have high marginal abatement costs. The most attractive energy efficiency measures are hull shape optimisation and engine derating, as they are both highly cost effective.

The industry needs to shift to low and zero carbon fuels if it is to achieve its decarbonisation goals. Some biofuels could directly replace distillates and could provide a new source of supply in the longer term. However, this is not a perfect solution. While trials are taking place and biofuel technology is developing, supply availability is a key constraint. Shipping will also have to compete with aviation, which is likely to be a bigger source of future demand growth.

Synthetic e-fuels that are derived from green hydrogen could be the ultimate renewable shipping fuel. Versions of diesel, methanol and ammonia are all possibilities; however, production costs are currently high.

Read the full report for more on:

- Global marine fuel sales forecasts to 2050, including distillate, LNG and e-fuels

- Analysis of the changing global maritime trade patterns

- Comparison of LNG costs in North America, Europe and Asia

Visit the store to find out more.