Get Ed Crooks' Energy Pulse in your inbox every week

Reopening America

As US states ease restrictions, there is no evidence yet of a surge in coronavirus infections. But there is still a way to go before the economy and energy demand are back to normal

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

“Our focus is to keep you safe, while also restoring your ability to get back to work: to open your businesses, to pay your bills, to put food on your tables.” With those words, Governor Greg Abbott of Texas on Monday announced the start of phase two of his plan for opening the state up for business again. The new regulations permit restaurants to increase occupancy to 50%, up from 25% in phase one, and allow offices, manufacturing plants and gyms to reopen. The coronavirus remains a real danger, Abbott said, but “our goal is to find ways to coexist with Covid-19 as safely as possible.”

All 50 US states have now announced some relaxation of the restrictions put in place to curb the spread of coronavirus infections, and energy demand is beginning to recover. The early evidence on reopening America has been encouraging in some respects, but has also highlighted some of the harsh realities of coexistence with Covid-19.

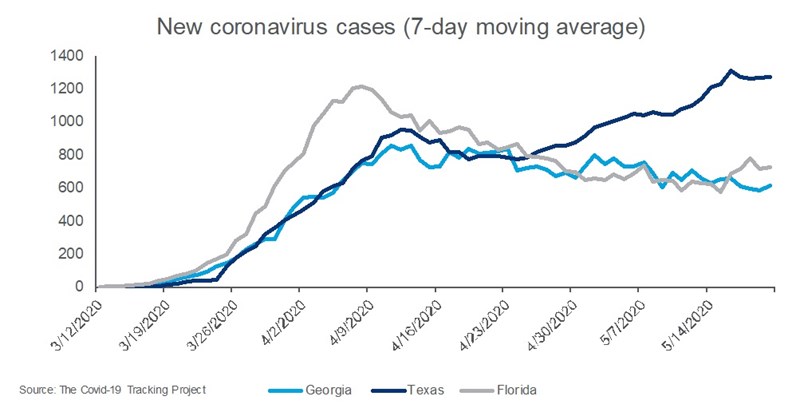

The good news is that the states that have been reopening have not shown any clear signs of a surge in infections. Georgia began easing its restrictions on businesses on April 24, Texas on May 1 and Florida on May 4, and cases have not started running out of control in any of them. Texas has recorded a steady rise in cases in May, but that appears to have been a result of a sharp increase in testing.

There are important issues of data quality with these numbers. Texas and Georgia are both reportedly combining results for two quite different tests: the viral test for whether you have an infection right now and the antibody test for whether you have ever had it in the past. That makes the statistics more difficult to interpret. The incubation period of up to 14 days between infection and first symptoms of Covid-19 also means that these early indications from the reopening states should be treated cautiously. There have been reports of “hot spots” of cases flaring up in some parts of those states.

Still, the trends so far look encouraging.

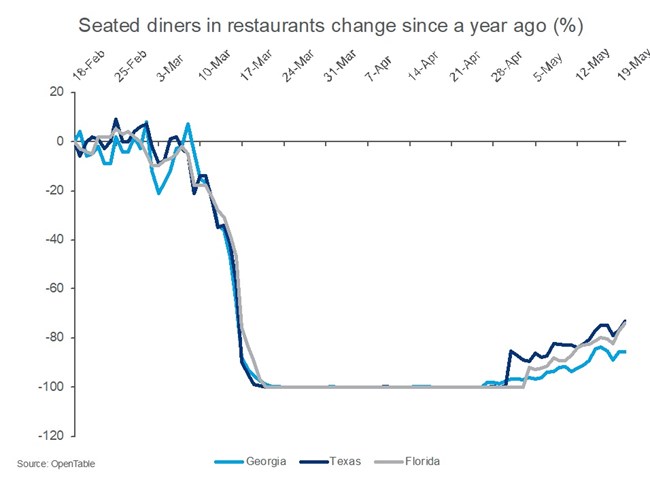

The less good news is that the number of new coronavirus cases may be remaining subdued because life in the reopening states is still far from normal. Many people are still being careful, and many businesses such as restaurants still face restrictions. Data from a sample of 20,000 restaurants using OpenTable, the online booking service, show that the number of people dining out in Georgia, Texas and Florida this week was down 73%-89% from its levels of a year ago.

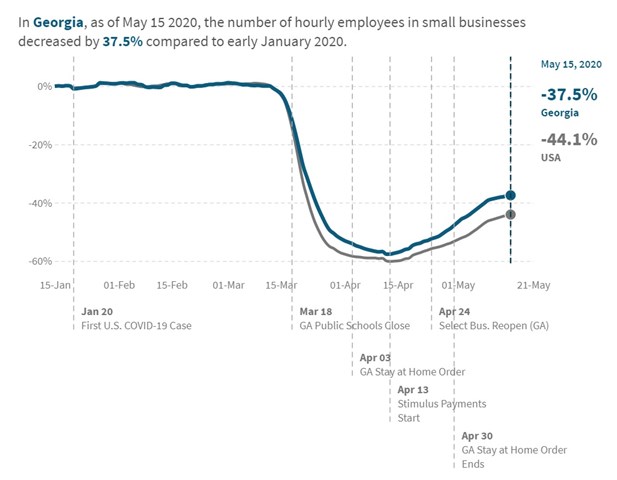

As a result, the economies of even the reopening states are still very weak. The Opportunity Insights Economic Tracker showed that the number of people employed by small businesses in Georgia last week was down 37.5% from its level in January. Spending has been going to online retail and large chains, while small businesses’ sales have slumped.

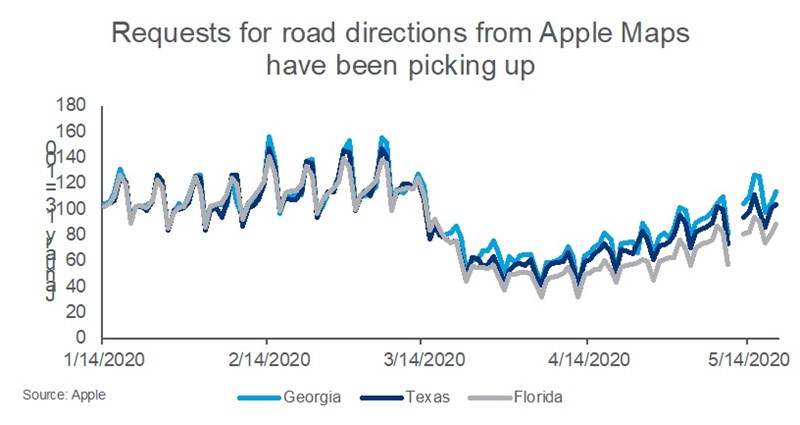

Despite the hammer blow to the economy, however, Americans are getting out and on to the roads again. Data on requests for directions from Apple Maps show that in Georgia, Texas and Florida, activity has been getting close to its levels in January.

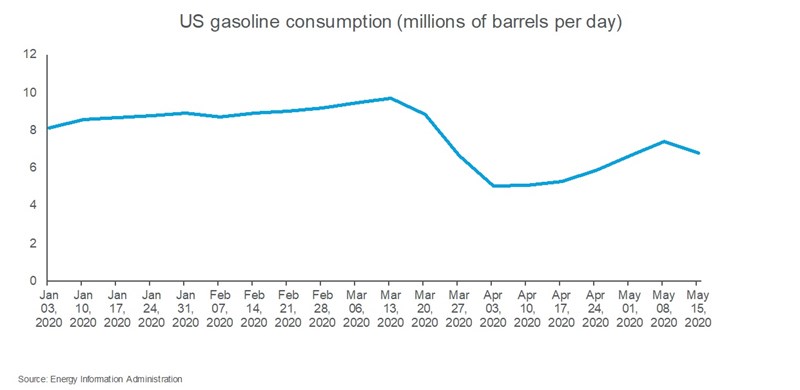

And as a result, gasoline demand has been picking up strongly. In the week to May 15, US gasoline consumption of 6.79 million barrels a day was up about 35% from its low point in early April, although it was still down 28% from its level of a year ago, according to the Energy Information Administration.

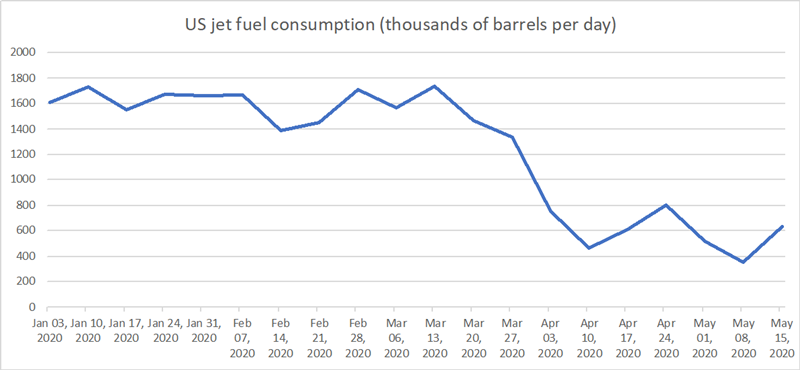

For jet fuel, meanwhile, the recovery has barely begun. US jet fuel consumption in the week to May 15 was down 59% from the equivalent week in 2019, the EIA data show.

As state governments continue to ease restrictions and economic activity picks up, US oil demand can be expected to continue to grow. It will take time for consumers to regain their confidence, however; and even longer if unemployment remains high. And if Covid-19 cases do flare up in any of the states that are reopening, it is likely that lockdowns will be brought back again. In assessing the outlook for demand in the US, watching the data for coronavirus cases, and understanding what those cases mean, will be crucial.

Further reading

Wood Mackenzie’s weekly Coronavirus Impact Briefing has a lot more detail on the Covid-19 pandemic and its implications for energy.

In brief

As the US struggles to recover from the impact of Covid-19, it could face another blow this summer and autumn: a worse than usual hurricane season. The National Oceanic and Atmospheric Administration said this week that it saw a 60% chance of an “above normal” Atlantic hurricane season this year, and only a 10% chance of a below normal season. It expects six to 10 hurricanes, including three to six major hurricanes, this year. An average season has six hurricanes, three of them major.

Warmer than average sea surface temperatures in the tropical Atlantic and the Caribbean Sea are among the factors increasing the likelihood of an above-normal hurricane season. The lack of an El Niño phenomenon, which tends to suppress Atlantic hurricane activity, is also a factor.

In a move that could be significant for energy companies operating in the US, President Donald Trump has signed an executive order intended to offer wide-ranging relief from federal regulation. The order says federal government agencies should “address this economic emergency by rescinding, modifying, waiving, or providing exemptions from regulations and other requirements that may inhibit economic recovery”.

The administration has also moved to help several oil and gas companies that operate on federal lands, approving cuts in royalty rates for up to 60 days.

China’s oil demand has recovered to close to its levels before the lockdowns in the first quarter.

Germany’s cabinet agreed to apply a carbon price of €25 per tonne of CO2 to the heat and transport sectors from the start of next year. The aim is to encourage consumers to buy lower-emitting cars and heating systems.

Eskom of South Africa, the continent’s largest energy utility, has been forced to cut jobs and investment as a result of a steep drop in demand for electricity during the country’s lockdown.

Production at the Tengiz oilfield in Kazakhstan could be shut down because of an outbreak of Covid-19 among the workforce, the country’s chief health inspector has warned.

Buyers that agreed deals for oil assets before the coronavirus hit have been seeking to renegotiate prices, or simply walk away.

Renewables have generated more power than coal in the US for 40 consecutive days.

A first of its kind green hydrogen plant is planned for Los Angeles County.

Several cities have been using the disappearance of cars from their streets as an opportunity to think about how to keep traffic down in the future. Others have been enjoying the empty roads in other ways. Several people have broken new records for the Cannonball Run, a time trial at illegal speeds across the US from New York to California.

And finally: Tesla has attracted some adverse attention recently over its battle to reopen its Fremont factory in California, but it still has a flair for publicity. The Golden Driller in Tulsa, Oklahoma, is one of the tallest statues in the US at 76 feet, a monument to the state’s oil and gas workforce. This week the driller acquired a Tesla logo on his chest.

Other views

Simon Flowers — How gas bounces back from the coronavirus lows

Gavin Thompson — The outlook for renewable generation across the Asia Pacific region remains bright

Renate Cakule Featherstone — How green can steel go?

Sarah Sinjab — Making sense of the TCFD draft recommendations

Michal Meidan — China’s mixed message to the oil market

Quote of the week

“OIL (ENERGY) IS BACK!!!!” — President Donald Trump tweeted his welcome for the rebound in crude prices. Brent ended the week at about $34.50 a barrel, with WTI at about $32.

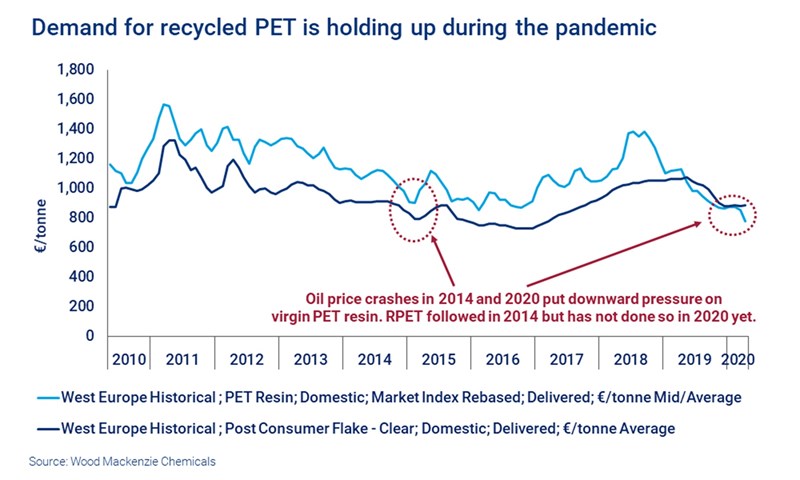

Chart of the week

Since the Covid-19 pandemic hit, there has been widespread speculation about how far the need for disposable barriers such as personal protective equipment will slow or reverse the shift away from single-use plastics. This chart, included in a recent note by Wood Mackenzie’s Andrew Brown and Chloe Kinner, shows that there is still healthy demand for recycled plastic. The lighter blue line shows the price of Polyethylene terephthalate (PET) resin from virgin feedstocks, while the darker line shows the price of shredded flakes of recycled PET. You can see that as the price of virgin PET has fallen this year, the price for the recycled flake has held up. As Brown and Kinner explain: “early signs suggest that brands are continuing to source premium recycled materials” because of their commitments to address plastic waste, and that has been helping to hold up the price.