Get Ed Crooks' Energy Pulse in your inbox every week

The historic decline of US coal

Cheap gas and weak power demand have driven coal’s share of US power generation to its lowest since the 19th century. They are also accelerating its long-term downtrend

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

The first commercial power plant in the US was Thomas Edison’s coal-fired Pearl Street station in lower Manhattan, which started operating in September 1882. Later that same month, the country’s (and Edison’s) second commercial power plant was started up: the Vulcan Street hydropower station in Appleton, Wisconsin. The race between the two technologies did not last for long. Within three years, coal had become the most-used energy source in the US, overtaking renewables including hydropower and wood.

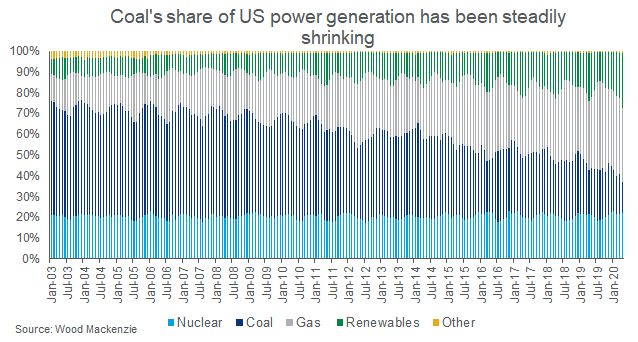

In the past 15 years, however, coal’s share in the US power mix has been in steep decline. In April, coal provided just 15% of all the electricity used in the US, less than either renewables or nuclear power, according to the Energy Information Administration.

The EIA said this week that in 2019 more US primary energy came from renewables than from coal for the first time in over 130 years. That calculation actually overestimates the contribution of coal, because it compares the energy content of thermal coal, only about 33% of which is available as useful electricity, to the power provided by solar, wind and hydro. Even so, it is another milestone in the decline of coal and the rise of renewable energy in the US.

The latest downturn in coal started in the autumn of last year as the US went into an unusually mild winter, and it has been exacerbated this year by the coronavirus pandemic. As power demand has fallen, it has been coal-fired plants that have borne the brunt of the reduction in output.

US power generation was down 5% in total in April compared to the same month of 2019. Within that, gas-fired generation was up 1% and renewables up 8%, but coal-fired generation was down 32%. In many parts of the US, coal-fired plants are a more expensive technology for power generation than gas, wind or solar, meaning that many generation companies will look to shut them off first.

The way that utilities have begun to operate their coal plants has also changed, according to Matt Preston, Wood Mackenzie’s research director for North America coal markets. Previously, many utilities, particularly in the Midwest, chose to self-dispatch their coal units even when they were not the lowest-cost generation available, on the grounds that cycling the units’ output up and down increased maintenance costs. Recently that has changed, and coal plants are operating much more as the marginal units on the grid.

Global demand for all energy sources, including coal, is already starting to recover as lockdowns are eased. But in the US and Europe, at least, it looks as though the pandemic has accelerated the decline of coal. The outlook for coal demand now depends on policy decisions in large emerging economies, and particularly in China.

There was a sharp difference between the first half and second half of May, Wood Mackenzie analysts say. In the first two weeks, global demand was still soft, and the price of benchmark 6000 kilocalorie per kilogram Newcastle coal dropped to its lowest since February 2016. Since mid-May, however, there has been a marked improvement, with markets starting to tighten and prices rising. In China, the largest power generation companies in the coastal region are consuming coal at above last year’s levels, and in India power demand is rising.

As demand recovers, both China and India have taken steps to help their domestic coal producers. India has relaxed restrictions on the ash content of coal burned in power plants, while in China some generators have reportedly been told to stop importing Australian coal. Wood Mackenzie’s analysts said the move was “targeted at stemming the flow of surging imports into China, in a bid to boost domestic prices”.

In the US, power companies have this year announced plans to shut down another 13 coal-fired plants, with closure dates between now and the 2030s. Two more will be converted to burn gas. The latest announcement was Alliant Energy’s decision to close its loss-making Sheboygan coal-fired plant in Wisconsin. The company said the closure would save it $200 million in near-term costs. Plants that run less often because of weak demand and competition from cheap gas face a greater risk of being shut down

Moves by several US and European banks and other financial institutions to reduce their exposure to coal are also encouraging utilities to accelerate retirements of coal-fired plants. Georgia-based Southern Company in 2007 sourced 70% of its power generation from coal-fired plants. By the fourth quarter of last year, that was down to 22%. Southern said this week that it was on track to cut its greenhouse gas emissions by 50% from 2007 levels by 2025, and was aiming for “net zero” by 2050. It joined other US utility groups including Xcel Energy, Duke Energy, Dominion Energy, NRG and PSEG, which have made similar announcements.

Meanwhile in Europe, low gas prices have similarly meant that coal generation has been squeezed. Austria and Sweden closed their last coal-fired plants last month, and European governments have been working on compensation plans for workers losing their jobs at power stations and in the mining industry. Dale Hazelton, Wood Mackenzie’s head of thermal coal, said he expected to cut forecasts for Europe’s consumption in the 2030s, as countries bring forward the dates when they expect to stop burning coal. Look out for the full forecast when it is published in July.

For global coal demand, though, the most important uncertainty is still over China. As Frank Yu from Wood Mackenzie’s China Power and Renewables team discussed recently, “there is now robust debate within China on the future [electricity] supply mix.” Already this year there has been a pick-up in the pace of final investment decisions for new coal-fired plants, and support is growing for a new wave of construction. The upcoming 14th five-year plan will be critical in determining the course of coal consumption for China and the world.

The IEA issues a warning on energy investment

At the start of the year, the International Energy Agency thought that worldwide investment in the industry might edge up by 2% this year; the strongest performance since 2014. The coronavirus pandemic has forced a sharp reset of everyone’s expectations, however, and the IEA is no exception. In its new “World Energy Investment 2020” report, published this week, the agency predicted a drop in energy investment of about 20%, or about US$400 billion, this year compared to 2019 levels.

The decline is projected to be particularly sharp in the oil and gas industry, with a fall of 32%, but even the less exposed power industry is expected to see a drop in capital spending of 10%. Investment in oil and gas supply has been running roughly neck and neck with investment in power, but this year power is expected to pull significantly ahead. Global investment in oil and gas, the IEA notes, has been on a “rollercoaster”, while power investment is relatively stable.

One potentially important point in the analysis is the possibility that the downturn in investment may mean the industry does not have sufficient capacity to meet future demand as the world economy recovers. The IEA warns: “There is a risk that today’s cutbacks lead to future market imbalances, prompting new energy price cycles or volatility.”

This is a prospect that Wood Mackenzie analysts have also been highlighting. In our latest Macro Oils Long Term Outlook, published on Thursday, we forecast that after 2025, oil supply growth from non-OPEC countries slows significantly because of cutbacks in exploration and investment in new production.

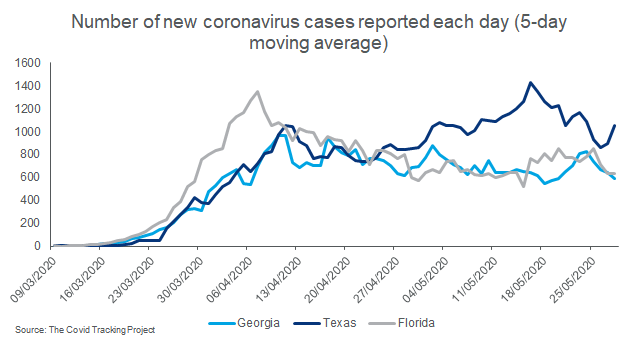

Coronavirus cases steady as the US reopens

In last week’s Energy Pulse, I looked at US states’ moves to ease the restrictions on businesses and the public that were imposed to slow the spread of Covid-19. We now have another week of data, and the message from three key states that relaxed their lockdowns relatively early — Georgia, Texas and Florida — is still about the same. There has been no surge in new cases, which some people had feared, but nor have there been signs that the virus is disappearing.

The picture in terms of mobility and economic activity also seems similar to the position a week ago. Requests for driving directions from Apple Maps have returned to their January levels, but car use still seems to be well below normal. Gasoline demand in the week leading up to the Memorial Day Holiday was still down about 23% from last year.

Data from a sample of 20,000 restaurants using OpenTable suggest that on Memorial Day itself, May 25, the number of diners compared to the same day of 2019 was down 61% in Texas, 70% in Florida and 71% in Georgia. The numbers suggest that it is not just the lockdowns, but also fear of infection and the huge hit to employment and incomes over the past three months, that are holding back consumer spending.

In brief

ExxonMobil and Chevron held their annual meetings online on Wednesday, with both companies facing shareholder proposals relating to climate change and governance that were opposed by their boards. Investors in ExxonMobil rejected all four of the shareholder proposals put to them, with none achieving support from more than 38% of the shares voted. The advisory proposal for the company to split the roles of chairman and chief executive in the future was backed by 32.7% of the shares voted, which was weaker support than similar resolutions had achieved in recent years, even though BlackRock, the world’s largest fund manager, voted in favour. BlackRock also opposed the re-election of two board directors, but all the directors were backed by at least 93% of the shares voted.

At Chevron, however, there was a proposal that did achieve majority support. A call for the company to produce annual disclosures on its lobbying payments was backed by investors speaking for 53% of the shares voted. A call for Chevron also to split the jobs of chairman and chief executive was supported by just 27% of the shares.

Chevron plans to cut its workforce of 45,000 by 10%-15%.

The COP-26 climate summit, originally scheduled for this November, has been postponed for a full year. It will be held on November 1-12 2021, in Glasgow. The meeting is being billed as the most important for international climate policy since the 2015 talks that led to the Paris Agreement. Countries are being asked to submit more ambitious plans for cutting their greenhouse gas emissions than they set out in Paris.

The second ever horseshoe-shaped horizontal well has been drilled in US shale, by Chesapeake Energy. The first was drilled by Shell.

A 500,000-pound transformer imported from China to Houston and intended for use in Colorado was commandeered by US federal officials last year, in a sign of the Trump administration’s concerns about grid security.

Trafigura, the trading house, is planning a steep increase in its investments in renewable energy.

Ohio has approved North America’s first freshwater offshore wind project, but with one very significant condition. The turbines in Lake Erie will have to stop rotating at night from March to October, to minimise the harm done to birds and bats.

Eight EU member states from eastern and southern Europe have published a joint paper calling for natural gas to have a continuing role as the union moves towards “net zero” emissions in 2050.

Low and sometimes negative power prices in west Texas have become a persistent issue at times when wind generation is high and demand is low, and it was only a matter of time before someone saw the commercial opportunity in that. Now cryptocurrency firm Layer1 is installing dozens of computers out there to use the cheap power to mine for Bitcoin. Its demand is flexible, so when temperatures rise and the grid is under strain, it can shut down its operations to allow the power to be used by other customers. In effect, Layer1 will be paid not to mine Bitcoin.

Wind has been harnessed for ship propulsion for thousands of years, but solar energy not so much. Now that is changing, with the launch of a new $500,000 solar-powered yacht. The manufacturer says it offers “limitless cruising with no fuel costs, no noise or vibration, no smells, no polluting emissions and no disturbance of marine life”.

Meanwhile, a modified all-electric Cessna Grand Caravan aircraft had its first flight this week. The batteries on board meant it had no room for passengers, highlighting the fundamental challenge of electric aviation.

Uber has been widely criticised for sending tens of thousands of electric bikes to the scrapyard, after offloading its Jump bike and scooter business to rival Lime.

There was considerable excitement among space enthusiasts hoping to watch SpaceX’s first crewed rocket launch this week. Unfortunately, bad weather meant the launch had to be postponed, but at the time of writing there were still hopes that it could go ahead on Saturday.

And finally: a book recommendation. I have been reading Emily St John Mandel’s novel “Station Eleven”, and it is well worth picking up if you want a diversion. It is a story about the effects of a deadly pandemic, so it is not exactly pure escapism, but I think a lot of Energy Pulse readers would enjoy it. She writes brilliantly about the miracles made possible by modern energy, which most people barely register today, but would definitely notice if they were gone.

Other views

Simon Flowers — How the price war is hurting US tight oil

Gavin Thompson — Forget the lack of a GDP target, China is ready to go it alone

Ellen Wald — Doomsday predictions for US oil just aren’t realistic

David Fickling — Australia’s Carmichael mine many never make a profit

Hartmut Winkler — The case for turning South Africa’s coal fields into a renewable energy hub

Clyde Russell — Australia shows how policy can stifle the renewable energy future

John Kemp — Tiny steps towards normalising home-working could become a stampede

Quote of the week

“Over the years we’ve had to respond to natural disasters, international crises., and market disruptions. As a capital-intensive commodity business, we’ve successfully weathered the ups and downs of price cycles, and often emerged stronger than before. However, we’ve never experienced anything like what the world is now seeing: a global threat to public health and a significant global economic downturn, resulting in a commodity price collapse.” — In his opening remarks at ExxonMobil’s virtual annual meeting, chief executive Darren Woods did not pull his punches when describing the challenges faced by the company, and by the energy industry in general.

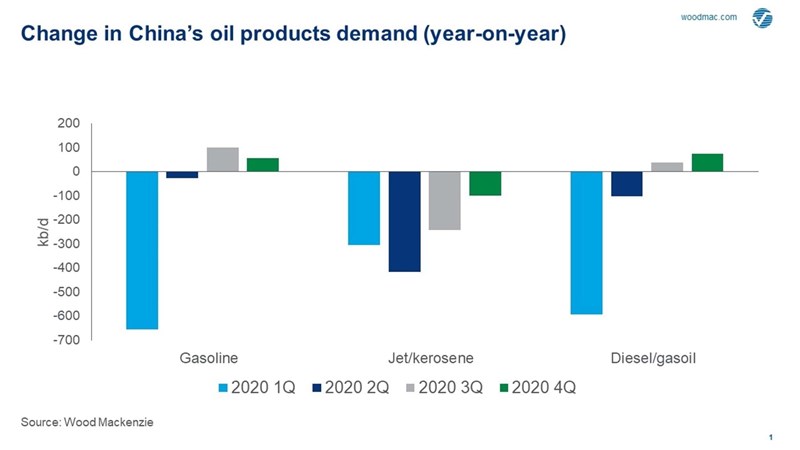

Chart of the week

This shows the shape of the downturn and the expected recovery in China’s demand for oil products. The declines in the first quarter were steep, but there is a robust recovery underway. By the second half of this year, we expect gasoline and diesel demand to be above last year’s levels. Demand for jet fuel, however, seems likely to stay weaker for longer.