Australia and the Majors – is change on the horizon?

M&A opportunities from portfolio high-grading

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Australia has risen to an exalted position in upstream portfolios, second only to the US in value terms for some Majors. Gas has been the main attraction, predominantly giant long-life LNG projects providing stable cash flow and portfolio resilience for decades to come. The stable investment environment Down Under is another factor.

The Majors are looking to boost returns by portfolio high-grading and have embarked upon a phase of divestment. Everywhere is under the spotlight, including Australia. Which assets might the Majors look to sell?

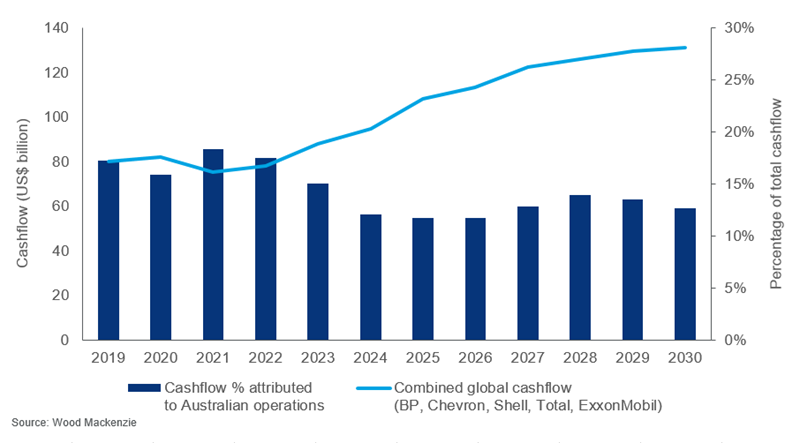

Gas-rich, giant resources, a stable investment environment and a trusted LNG supplier – Australia has been good for the Majors. For Shell, ExxonMobil, Chevron, Total and BP, upstream and LNG assets in the country account for almost US$130 billion of value. That’s equivalent to 16% of their combined global upstream portfolios and, as it happens, of their combined cash flow in 2019.

Several long-life, high-margin Australian LNG projects – including Gorgon and Wheatstone – remain core to Big Oil, in some cases underpinning free cash flow for decades. And with an increasing emphasis on the energy transition and emissions, Australian gas fits corporate strategies.

But, today, portfolio engineering is central to improving upstream returns as companies seek to focus around core, advantaged positions. To achieve this, the Majors have announced plans to divest around US$70 billion worth of assets through 2023, primarily mature, non-core and low cash margin.

What does this mean for Australia?

Gavin Thompson, vice chair for Asia Pacific Energy, takes a closer look.

Portfolio restructuring and the Majors’ global divestment targets are bringing mature and non-core assets to market and Australia is not immune.

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

What will define LNG’s three phases of market growth?

-

The Edge

The coming low carbon energy system disruptors

-

The Edge

Could US data centres and AI shake up the global LNG market?

Portfolio restructuring and Australia

The Majors’ global divestment programmes are bringing all non-core assets into the spotlight and Australia is no exception. ExxonMobil’s recently announced plans to sell its mature Bass Strait project in the Gippsland Basin fully aligns with a strategy of portfolio rationalisation. Finding a buyer willing to deal with abandonment costs will be an issue but, given high gas prices on the east coast of Australia, it’s undoubtedly an attractive time to sell.

Looking across Australia, Eni stands out among the Majors with a mature portfolio of almost ‘token’ value at S$0.6 billion NPV,10 (just 1% of its global upstream value). Its stake in Darwin LNG will be immaterial once Bayu-Undan ceases production in 2022; and Eni has no equity in Barossa-Caldita, the plant’s next source of gas supply. The company has bigger (LNG) fish to fry in the Middle East and Mozambique so could exit its residual Australian position.

At the other end of the scale, Total is fully invested in Australian LNG with a combined NPV,10 of US$16.8 billion in the GLNG and Ichthys LNG projects. Both are onstream, early in their producing life and will be generating cash for the next two decades or more. Each, though, is non-operated and has disappointed on reserves and returns. Recent moves into Arctic LNG-2 and Mozambique LNG, as well as US LNG offtake, mean Total is long on new gas supply with heavy capital commitments. Total has already sold down 4% of Ichthys and might be inclined to offload more.

Legacy LNG, new challenges

The North West Shelf (NWS) LNG project, which began production in 1989, will soon need new gas to continue to operate at full capacity. New volumes will have to be sourced from third parties, triggering a very different dynamic for the six JV partners – a switch from high upstream value to infrastructure tolling. There will also be daunting challenges to align stakeholders on the provenance of future supply. Some participants may ponder the merits of remaining in the JV.

Could Shell and BP review their positions, particularly if Woodside’s 14-tcf Browse project moves forward as backfill? Both Majors are acutely conscious of their carbon footprint. The high CO2 in the reservoir is exacerbated by the NWS infrastructure, among the world’s oldest and least-efficient LNG projects. An alternative could be to explore for cleaner and cheaper alternatives to Browse. Success for BP drilling the multi-tcf Ironbark prospect next year might do the trick and keep participants committed.

Advance Australia Fair

Portfolio restructuring and the Majors’ global divestment targets are bringing mature and non-core assets to market and Australia is not immune. It’s far from the whole story. Australian capital investment by the Majors may have long peaked, but early-life projects such as Gorgon and Wheatstone now provide tremendous high-margin cash flow. In a world of change, the sun isn’t setting on the Majors’ Australian adventure anytime soon.