How has Covid-19 changed the metals and mining outlook?

Tracking the impact on metals, bulk commodities and battery raw materials

1 minute read

The world has changed in 2020. The global pandemic ground economies to a halt, disrupted trade and devastated demand. But what has that meant for metals and mining?

Our global metals and mining research teams are closely tracking the impact on base metals, bulk commodities and battery raw materials. Fill in the form for a complimentary preview of our latest long-term outlooks. Or read on for a snapshot of key themes for:

|

|

Aluminium

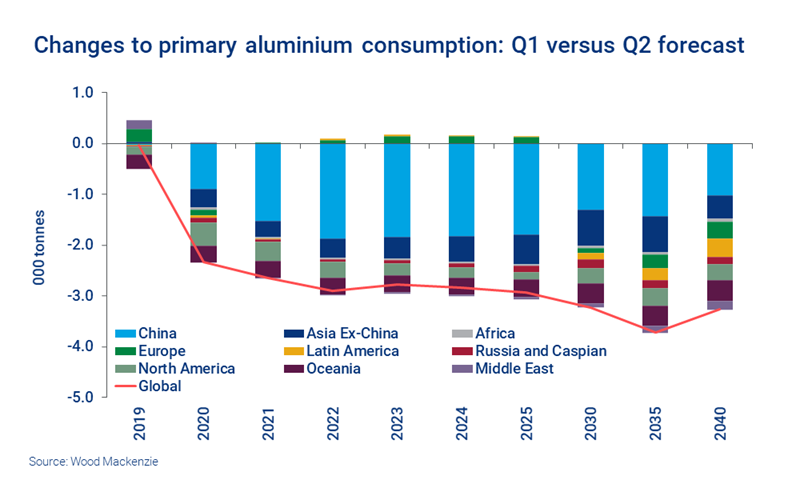

Ripple effects from the pandemic will be felt across the aluminium value chain well beyond the next few years. We’ve revised our demand forecast down by an average of 3.2 Mt per year for 2020-2040. A market surplus in the coming years looks unavoidable.

The fall in primary demand will be partly offset by greater use of secondary material. Increased use of the existing pool of scrap will be set against the backdrop of the pursuit of a lower carbon footprint across the pit-to-product value chain – scrap requires 95% less energy per tonne of aluminium than virgin metal.

Visit the store to find out more about this report.

Copper

After several years of deficit, 2020 marks a turning point for copper as mine supply overwhelms demand. Metal market surpluses are expected to reach a peak in 2021.

The path to a rebalanced market will be gradual and heavily reliant on stimulus measures. Demand in China, for example, will be supported by the government’s commitment to invest in copper-intensive “New Infrastructure”, including 5G networks, ultra-high voltage power grids and electric vehicle (EV) charging stations, as well as auto and home appliance subsidy plans.

Expansions in semi fabricating capacity in the US, Russia and across Asia will underpin demand over the medium to long term – but this will be from a lower base.

Visit the store to purchase this report.

Gold

At the start of the year, we expected a slight increase in total gold production in 2020. We weren’t expecting a global pandemic to shutter or disrupt nearly 80 gold mines around the world. So while peak gold supply was already a real possibility, the summit is now in sight.

To avoid a perpetual decline in supply, project development must increase. We estimate that the industry must invest $37bn by 2025 to maintain 2019 production levels. This investment will need to be made against a backdrop of complex ESG issues and risk-adjusted value propositions.

Find out more through our Gold Research Suite.

Lead

Lead supply has been hit hard in 2020. Virus containment measures restricted the flow of scrap and curtailed production in some key lead-mining countries.

Demand also took a sharp downturn. However, the resilient nature of lead markets means that a significant proportion of the impact will be demand deferral, rather than demand destruction. Losses in automotive original equipment batteries, for example, come with some direct upside consequences for increased replacement batteries.

And while the outlook for automotive demand is generally weaker, industrial batteries offer opportunities for growth, especially in energy storage systems for renewables.

Purchase this report in store.

Nickel

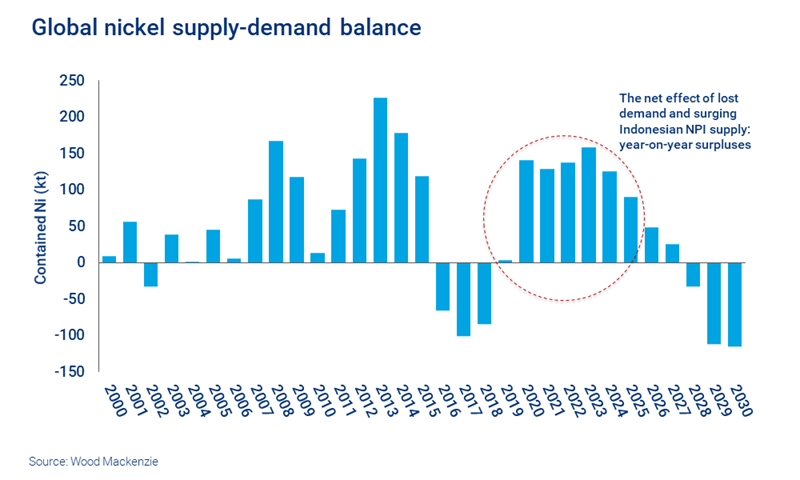

As with almost all other mined commodities, extensive cuts to our nickel demand forecast have moved the near-term market from deficit to surplus. The ongoing ramp-up of nickel pig iron (NPI) production in Indonesia has amplified the projected surpluses, and the prospect of lower prices.

Global nickel demand will fall 6% in 2020, to 2.29 Mt. After recession, we expect demand to increase to 2.86 Mt in 2025. This will be mostly driven by China, due to its dominant positions in both the stainless steel and battery precursor segments.

Visit the store to find out more about this report.

Zinc

The medium-term outlook for the zinc market has been transformed by coronavirus. Mine output has fallen in most regions, and globally by around 10%, although it’s set to rebound strongly in 2021. Global consumption is set to contract by 7.7% or 1.1Mt.

We forecast recovery in 2021 with growth of 3.9% and modest growth will continue in subsequent years. However, we don’t expect consumption to surpass its pre-pandemic high of 14.2Mt in 2017 until 2024.

Longer term, the key issues are little changed and are on the supply side. Additional mine production will be required to replace mines that are forecast to close, and to meet increased demand for concentrate.

Visit the store to purchase this report.

Iron ore

2020 is shaping up to be an extraordinary year for iron ore. Prices exceeded our expectations in H1 due to strong Chinese demand and weak seaborne supply – though we expect both drivers to moderate in H2.

Seaborne supply and demand will become more closely aligned from 2021. And as the current market tightness dissipates, supply will need to respond to weaker demand. Non-core ‘swing supply’ may be forced to withdraw from the market as prices cut into the seaborne cost curve.

Visit the store to get the full report.

Steel

We forecast an 8% year-on-year fall for global steel demand this year. For the world excluding China, it’s a fall of 16%. By contrast, at the height of the global financial crisis, global steel demand fell by just 5%.

Production has responded quickly to demand declines. Crude steel production will not return to 2019 levels of output for two to three years. By then, Chinese output will be in decline and so global steel supply will plateau for some years.

Hot-metal production will take decades to recover as 2020 accelerates the shift towards greener steelmaking technologies in key regions.

Visit the store to find out more about this report.

Thermal coal

Thermal coal demand plummeted as countries went into lockdown. This exacerbated an already-brewing oversupply, sending prices to multi-year lows. Seaborne trade will fall by more than 60 million tonnes in 2020, and while the market will grow as global economies emerge from the crisis, it won’t reach the 1.0 billion tonne mark again.

Government policy will determine the future of thermal coal and the world continues to diverge in the near-term. Europe and the Americas will accelerate their energy transitions using stimulus packages to grow the renewables sectors. Much of Asia is a different story though, with the major importing countries, China and India, investing further into coal.

Visit the store to get the full report.

Metallurgical coal

After a solid start to the year, the pandemic knocked the metallurgical coal markets off their feet and reset demand and growth at a new lower level. Our lower steel demand forecast drives down metallurgical growth to 404 Mt compared to 422 Mtpa, a 5% drop from our last update.

Looking ahead, the story of metallurgical coal demand is three-fold: near-term recovery from the pandemic to a lower base of growth, peaking and then declining Chinese hot metal production near to mid-term, and steady and substantial growth in India long-term.

Visit the store to find out more about this report.

Battery raw materials

The near-term outlook is bleak. Lockdown measures, lower oil prices and tightened household budgets saw our forecast for global EV sales in 2020 drop from healthy growth of 20% to a 13% contraction. Particularly challenging for lithium and cobalt, which were already contending with oversupply.

However, there has been no shortage of voices calling for a greener post-coronavirus economy, which will fuel EV adoption. Furthermore, a reassessment of the risks of global supply chains could help to fast-track regionalised battery ecosystems. The EV market could actually emerge from the crisis stronger than ever. The longer-term challenge may still centre around whether battery raw material supply can keep up with demand.

Get a comprehensive view of demand, supply, costs and prices with our Battery Raw Materials Service.

The long-term outlook in detail

Our H1 2020 long-term outlooks present the latest data from our research teams, with analysis of the effects of the pandemic on supply, demand and prices. This includes:

- Mine and operation disruptions

- Government stimulus to prevent or limit demand destruction

- Accumulated surpluses and the impact on prices

- Risks to the timing of the energy transition.

Fill in the form at the top of the page for a complimentary preview.

Unique insight into the changing world of metals and mining

In a new article series, Julian Kettle tackles the industry's most pressing questions. Such as:

- What does a global recession mean for demand, prices and costs?

- Which commodities offer the best opportunities in a low-carbon, ESG-compliant world?

Julian Kettle, Vice Chairman, Metals & Mining