Get this complimentary article series in your inbox

1 minute read

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Latest articles by Julian

-

Opinion

Metals investment: the darkest hour is just before the dawn

-

Opinion

Ebook | How can the Super Region enable the energy transition?

-

The Edge

Can battery innovation accelerate the energy transition?

-

Featured

Have miners missed the boat to invest and get ahead of the energy transition?

-

Featured

Why the energy transition will be powered by metals

-

Featured

Could Big Energy and miners join forces to deliver a faster transition?

Throughout 2021, I have been quite vociferous in my view that prices for copper (along with several other mined commodities) do not reflect fundamentals – the dynamics of supply, demand, stocks, costs and their empirically-observed relationships. My 35-year career following and opining on markets is grounded in my belief that prices ultimately do reflect fundamentals, but I have never endorsed the idea that ‘if the facts don’t fit the theory, change the facts’.

I am therefore prepared to challenge my own theories and ask: is it different this time? For me, the answer always lies in the data.

In the first part of this two-part exploration of record-high copper prices, I looked at the risk of substitution. In this follow-up, I’ll look at whether there’s actually a case for even higher prices.

Copper demand growth: robust or set to relapse?

Demand thus far in 2021 is undeniably strong but recovery is usually robust in the bounce-back from recession. Post-pandemic demand will undoubtedly wane, and economic activity will likely slow from 2022. Interest rates will rise to stave off inflation. Taxes will have to be raised to start to pay down the extraordinary debts built up by governments during the pandemic and quantitative easing will start to be unraveled, albeit slowly.

We don’t doubt that ’build back better’ strategies will pick up the growth baton. Demand will be driven higher by the energy transition, for some markets spectacularly so – the key question is how much and how quickly?

Our assessment of demand growth over the next three years highlights the slowdown noted above, as well as a lag in energy transition growth. The speed at which the energy transition can proceed will be determined by the ability of the mining sector to deliver tonnes out of the ground. Risks to demand from the energy transition are on the upside if supply can meet requirements.

In the short to medium term we believe there is sufficient copper supply to support faster growth in demand. However, record price levels, if maintained, will start to impede that growth.

Looking at electric vehicle (EV) batteries as an example, the holy grail for battery costs is US$100/KWh, to deliver cost parity with internal combustion alternatives. It is assumed that technology and scale will drive battery costs down. However, what this means is that the proportion of the battery cost determined by commodity prices rises from below 50% to ~70%. Prices for a number of battery metals have moved significantly higher during 2021. Compared with the average for 2020, cobalt is up 50%, copper by over 40%, while nickel and aluminium are up by close to 30%. If prices remain at elevated levels, or indeed move higher still, this means that battery costs will not fall as far and as fast as predicted and indeed may actually rise.

What’s more, if forecasts of sustained even higher prices are realised this could slow demand for EVs on economic grounds.

Supply outlook: unconstrained or unable to grow?

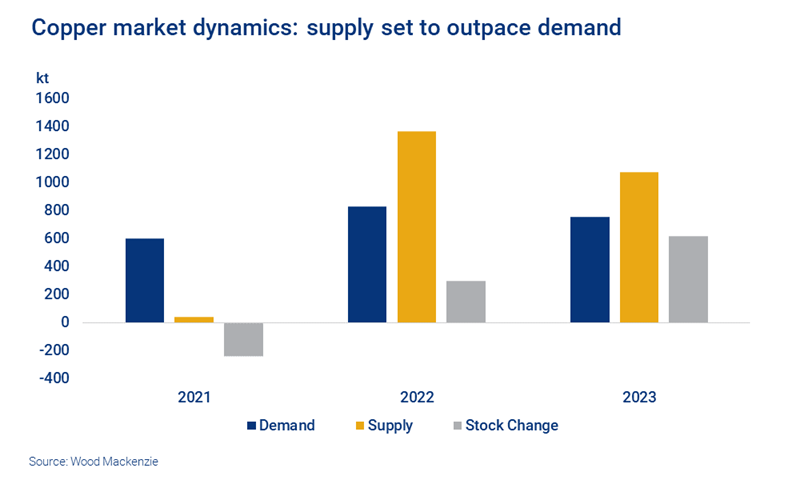

We believe that there is more than enough copper supply to meet medium term requirements. With mine expansions coming on-stream in 2021-2023, and no shortage of smelting capacity, we expect small but significant surpluses.

While the supply side could support demand growth of ~4-4.5% per annum in 2022 and 2023, this would draw down stocks to under 60 days by the end of the period. This is below ’normal’ levels of ~65 days but would still be some 10 days above the consistently low levels seen during the last supercycle. This is hardly supercycle territory.

The conclusion we draw is that if fundamentals re-assert themselves copper prices will hit an air pocket before rising again as structural deficits start to appear from mid-decade onwards. But only if producers hold off from investment in required supply.

Record prices: enough to spur investment?

It’s not getting any cheaper to develop mines. But I question whether it is necessary for prices to rise and remain at US$15,000-20,000/tonne to incentivise development.

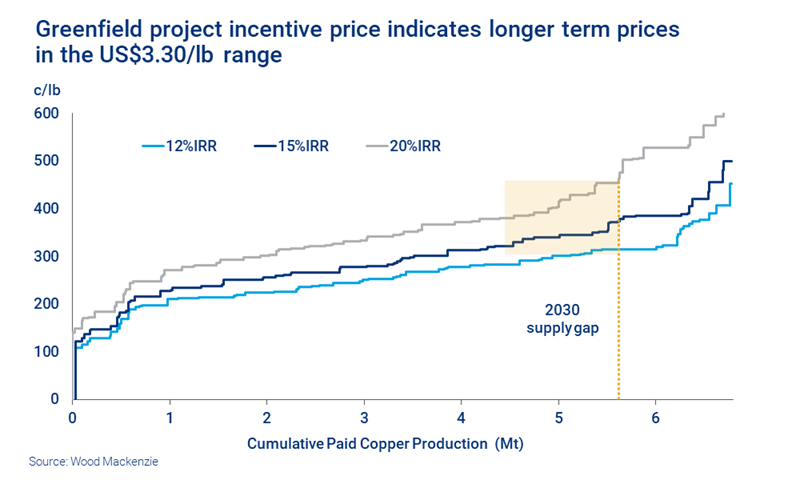

Conventional analysis of incentive prices works on the principle of the price required to incentivise the marginal greenfield project to meet requirement 10 years hence. Admittedly this analysis is fraught with uncertainty. What is the greenfield mine supply gap? What are the capital and operating costs? What are the required returns? How do you account for risk? And what assumptions are used for scrap availability and use?

We allow for all these factors and arrive at a long-term price of ~US$3.30/lb real. This is, in our view, the price required to incentivise the development of ~5.7 Mt of greenfield mine capacity by 2030. And as it is half the level some commentators consider to be the required incentive price, it provides food for thought.

Of course, one can play tunes on all of the assumptions used to arrive at that price – not least the requirement for mine supply. Our accelerated energy transition scenario (AET-2) is one interpretation of how the Paris Agreement goal to limit global warming to 2 °C could be achieved. If demand for copper accelerates in line with the AET-2 scenario, it would add a further 7 Mt to the requirement for mine supply – taking the total to ~13 Mt by 2030. This would drive the need to develop far more speculative resources.

So, by their nature, there is huge uncertainty around all the factors that influence incentive price.

To conclude, have I changed my perspective that copper prices don’t reflect market fundamentals? I am still of the view that prices have moved too far, too fast and that heady forecasts of prices doubling or even tripling from current levels in the medium term are ’punchy‘. While I don’t wish to paint myself as the villain of the copper story, talking the price down, prices do appear to be out of kilter with fundamentals. Yet conventional analysis on incentive pricing starts to break down when we consider the possibility of our AET-2 scenario demand.

I am, therefore, minded to quote Commodus, the villain of the piece in the movie Gladiator: “It vexes me, I’m terribly vexed”. Maybe it is different this time!

Track our latest thinking on copper markets through our Copper Research Suite, or via the store.

Get unique views on metals and mining

This article is part of a regular series exploring opportunities and challenges in the world of metals and mining. To make sure you don't miss out, fill in the form at the top of the page to get this complimentary series in your inbox.