Get Ed Crooks' Energy Pulse in your inbox every week

Policy changes threaten California’s solar industry

New rules proposed to the utilities commission would make the tariffs much less generous for electricity customers who export power to the grid

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

The actor Mark Ruffalo, probably best known as the Hulk in the Marvel movies, has impeccable credentials as an environmental activist. He was a leading figure in the campaign to ban shale gas production in New York State in the early 2010s, and has been a vocal opponent of oil and gas development in the US and internationally. So it was surprising last week when he came out with public criticism of the Natural Resources Defense Council, one of the leading US environmental groups.

The issue that provoked his rebuke of the NRDC was the proposed reform of the California Public Utilities Commission’s regulations for rewarding individuals and businesses who produce their own power and export it to the grid. The possible changes, which are waiting for a final decision by the CPUC, could have a huge impact on demand for rooftop solar in California, the largest solar market in the US.

The case for reform of the present system is clear: it is very generous to customers who install solar systems. The big question is whether the specific changes now under consideration push the pendulum too far the other way.

The proposed decision from an administrative law judge for the next phase of regulation, known as Net Energy Metering (NEM) 3.0, has divided environmental campaigners. Ruffalo and other Hollywood stars including Edward Norton and former state governor Arnold Schwarzenegger have been speaking out against the planned changes, describing them as a new “solar tax”. Schwarzenegger’s piece in the New York Times was headlined: “We put solar panels on 1 million roofs in California. That win is now under threat.”

The NRDC, however, has been emphasising the need for reform of the current rules, and has been trying to knock down what it describes as “myths” used to argue against the CPUC proposals. It argues that the existing policy, NEM 2.0, is not sustainable because it subsidises homeowners with solar panels, who tend to be better off, at the expense of customers who don’t. The reform proposals in front of the CPUC are “the first step toward an equitable solution,” the NRDC says.

In a sign of the sensitivity of the issue, the CPUC has decided to delay its decision on the proposals, which had originally been scheduled for this week. Earlier this month Gavin Newsom made it clear he was not happy with the plan. “Do I think changes need to be made? Yes, I do,” he said.

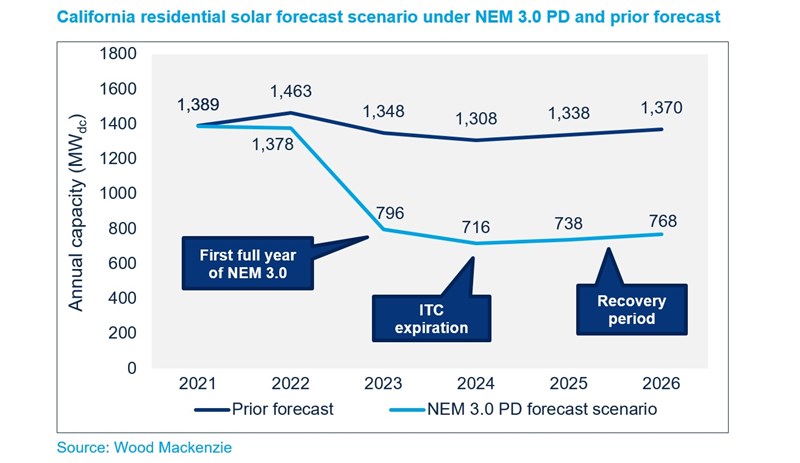

The latest version of NEM 3.0 would undoubtedly have a significant impact on California’s solar market. Last year the state added almost 1.4 gigawatts of residential solar capacity. If NEM 3.0 takes effect in its present form, that could drop to just 716 megawatts added in 2024, according to Wood Mackenzie solar analysts Michelle Davis and Bryan White. The scheduled expiration of the federal Investment Tax Credit for solar, which will take effect unless Congress votes for an extension, will also hit demand at the same time.

But although this near-halving of the residential market looks like a disastrous outcome for California, and a serious setback in its pursuit of ambitious goals for emissions and renewable energy, the existing system seems hard to defend. Under the current rules, utilities have to pay customers for the power they generate, at the same price the customers pay for electricity from the grid. That is a great deal for the customer, in a couple of key respects. Their bills do not fully reflect the value of being connected to the grid, or the fact that solar generation is generally less valuable when the sun is at its peak in the middle of the day

The proposed decision from the administrative law judge addresses both of those issues. Customers with solar systems would have to pay a fixed “grid participation charge” of $8 per kilowatt per month. And the amount they are paid for power exported to the grid would be based on a complex calculation of “avoided cost”, representing the incremental cost to a utility of obtaining the power from another source. The proposals would bring California closer into line with incentives elsewhere, including some countries in Europe and other US states, although the proposed charges for grid connection are significantly higher than in places such as New York and South Carolina.

The change would dramatically increase the payback periods for residential solar systems. Under the present system, a typical residential solar projects built this year will cover its costs in about five or six years, depending on the utility. Under the proposed NEM 3.0, that would rise to 14-15 years, Davis and White calculate, transforming the economics of going solar.

Ben Hertz-Shargel, Wood Mackenzie’s head of grid edge, says that if the proposed rules are implemented, the only value in having a residential solar system will be for customers to consume the power they generate or to use battery storage to store it and export it to the grid in the evening. Exporting power to the grid during the day would generate less revenue than the fixed cost that grid participation charge imposes: a losing proposition.

Arguably that would both make the system fairer, and incentivise increased investment in storage, which would help relieve the strains on the grid caused by the growth in solar power. But it could also be seen as an “over-correction”, Hertz-Shargel says. The existing system was made generous intentionally to encourage investment in solar power, and if the state refuses to pay customers a penny more than they deem solar electricity is worth, regulators risk undermining that wider policy objective.

When the CPUC does finally get to rule on the issue, the outcome seems likely to be a compromise: something less generous than the current system, but less punitive than the latest proposals. Wood Mackenzie’s White suggests that one lesson from the whole debate is that it is dangerous for renewable energy industries to become reliant on over-generous policy regimes, because eventually those policies will be unsustainable. “Would it have been better for California’s solar industry to have accepted a less generous system in NEM 2.0?” he asks.

“If you are hell-bent on maintaining the status quo, you run the risk of facing a sharp change. If you have an even-handed regulatory framework, that is easier to defend in the long term, and you can have a more sustainable industry. It’s much better than going up and up and then falling off a cliff, and having to rebuild.”

Brent crude hits $90 on concerns over Russia and Ukraine

Russia is the world’s second-largest gas producer, after the US, and one of the big three oil producers alongside the US and Saudi Arabia, so it was inevitable that the prospect of a potential major conflict involving Russia would roil global energy markets. Brent crude futures hit $90 a barrel this week for the first time since 2014, as concerns about a possible Russian conflict with Ukraine remained high.

The White House reported on Thursday that President Joe Biden had held a phone call with his Ukrainian counterpart Volodymyr Zelenskyy, and “reaffirmed the readiness of the United States along with its allies and partners to respond decisively if Russia further invades Ukraine.” Speculation about Russia’s intentions has been running high because of a build-up of troops on Ukraine’s borders. Negotiations between senior officials from France, Germany, Russia and Ukraine, aimed at defusing the crisis, continued this week and are scheduled to reconvene next month.

Oil prices have been on a rising trend since the first half of 2020, as global demand has recovered, and have been further boosted by other factors recently including shortfalls in OPEC production and concerns that ESG considerations are limiting investment in the industry, sowing the seeds of future supply shortages.

Most recently, however, the biggest factor in the market has been the Ukraine crisis, which helped push crude above $90 a barrel on Thursday. Ann-Louise Hittle, Wood Mackenzie’s head of Macro Oils, said prices were being driven higher by concerns that a conflict would disrupt supplies to world markets. “Some of Russia’s oil exports to the west pass through a branch of Druzhba pipeline system in Ukraine,” she said. “And if the US and EU impose new financial sanctions, that could obstruct customers’ ability to pay for Russian oil.”

However, she added: “Among the various options under consideration by US, sanctions against Russia’s oil exports are low on the list.”

Meanwhile, President Biden has also been trying to shore up gas exports to Europe, in case flows from Russia are disrupted. US LNG plants are operating at full capacity, limiting the potential for increased exports, beyond the additional volumes from Venture Global’s Calcasieu Pass, which is scheduled to start shipments very soon. But the administration has been talking to other gas producers around the world in an attempt to persuade them to increase supplies.

The administration has also been looking at ways to provide additional encouragement for LNG cargoes to go to Europe, from the US and other suppliers.

One early response to a conflict is likely to be a move to prevent the new Nord Stream 2 gas pipeline coming into service. Both the US and Germany have indicated that, in the words of the US State Department: “If Russia invades Ukraine one way or another, Nord Stream 2 will not move forward.”

In brief

US natural gas markets have not been subject to the same kind of price moves that have hit European markets over the past six months, but on Thursday they did experience a flicker of volatility of their own. The February Henry Hub contract, which expired that day, briefly spiked up in the final hour of trading to about $7.40 per million British Thermal Units, having started the day at about $4.30. It fell back down, but still closed up about $2 to settle at $6.265 / mmBTU. The price spike appeared to have been driven by traders needing to cover short positions as February weather outlooks turned colder. Eugene Kim, research director on Wood Mackenzie’s Americas gas team, pointed out that the price in the Henry Hub physical market had been much calmer, trading at $4.44 /mmBTU.

The Edison Electric Institute, the leading industry group representing investor-owned US power utilities, has submitted an amicus brief in a critical case before the Supreme Court on the limits of the Environmental Protection Agency’s ability to regulate greenhouse gas emissions. The institute, in a joint submission with the National Association of Clean Water Agencies, argues that it is of “critical importance” that the EPA’s ability to regulate should be upheld, to avoid harming consumers, businesses and the economy. The industry groups say: “While it may seem counterintuitive that the nation’s investor-owned electric companies, in particular, should favor EPA regulatory authority, the alternative could be the chaotic world of regulation by injunctive fiat.”

The most recent oil and gas lease sale in the US Gulf of Mexico has been annulled by a judge in the DC district court, on the grounds that the Bureau of Ocean Energy Management and the Department of the Interior “acted arbitrarily and capriciously” in its assessment of the impact of the sale on greenhouse gas emissions. Lease Sale 257, which attracted $192 million in total high bids, will now be send back to the government. The BOEM and DoI will have to decide whether to abandon the sale, or to draw up another environmental impact statement, answering the court’s concerns about the consequences for greenhouse gas emissions of oil produced in the Gulf and consumed outside the US.

Ørsted and Eversource have chosen regional vessel operators to serve their offshore wind projects in the northeast US. The contracts will result in five new service vessels being built at yards in Rhode Island.

And finally: the place to look if you want to laugh at renewable energy. The Sunion is a new-ish satirical website, produced as a sideline by some people who work in the industry and can see the funny side of racking systems and zoning applications. It’s hit-and-miss, but some of the items did make me laugh. And some cast a clearly well-informed and jaundiced eye on the industry’s foibles.

Other views

Simon Flowers — Upstream: short-term spend and long-term trend

Leila Garcia da Fonseca — Why 2022 will be a record year for Latin American power and renewables

Julian Kettle — Could ‘greenflation’ stall the electric vehicle revolution?

Meghan O’Sullivan and Jason Bordoff — Green upheaval: the new geopolitics of energy

Meghan O’Sullivan and Jason Bordoff — Russia isn’t a dead petrostate, and Putin isn’t going anywhere

Morgan Bazilian and Brad Handler — Crediting emissions saved in plugging oil and gas wells

Jeremy Symons — Biden’s 2022 climate test

Quote of the week

"We're in trouble. I hope everyone understands that… Most countries have the ability to deploy very significant additional amounts of renewables and they're not choosing to do that.” — John Kerry, President Biden’s special envoy on climate change, took a downbeat view on the pace of the transition to low-carbon energy. He was speaking at an event looking ahead to the COP27 climate conference in Egypt in November.

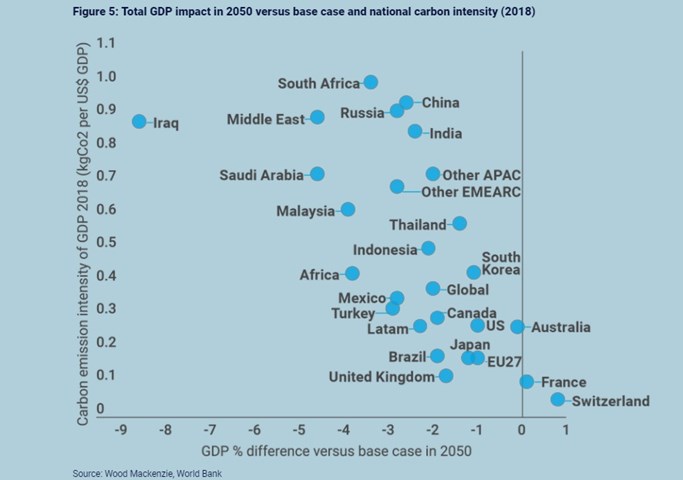

Chart of the week

This comes from our latest Horizons report, written by Wood Mackenzie’s Peter Martin and Yanting Zhou. It shows the countries that are the potential relative winners and losers from an accelerated transition to low-carbon energy, delivering net zero emissions around the middle of the century. Based on a review of existing economic studies, we estimate that limiting global warming to 1.5 °C, a goal of the Paris agreement, would shave 2% off our base-case gross domestic product (GDP) forecast for 2050. Within that average impact, however, the effects are likely to vary widely between countries. Some would benefit quickly from more aggressive climate policy. Other countries, including those that have lower incomes and a greater reliance on fossil fuels, could be hit much harder. You can see from the chart there is a tendency for the more carbon-intensive economies to face bigger hits to their economies from an accelerated transition, but there is considerable variation driven by other factors, including their potential for developing more low-carbon energy. With low-income countries generally facing bigger proportionate losses, the numbers underline why achieving a just transition is so important. If the world’s poor are made to the bear the greatest burden as the global energy system changes, building a global consensus on addressing the threat of climate change will be much more difficult.