Get Ed Crooks' Energy Pulse in your inbox every week

Russia sanctions begin to threaten energy flows

The US administration has suggested possible restrictions on imports of Russian oil. “Self-sanctioning” is already starting to have an impact

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

The sanctions imposed on Russia have so far included specific exemptions to allow energy transactions to continue. Russia is too important to world oil, gas and coal supplies for its exports to be cut off without causing severe difficulties for energy consumers. As a White House statement announcing a fresh round of sanctions put it last week: “The United States and our Allies and partners do not have a strategic interest in reducing the global supply of energy – which is why we have carved out energy payments from our financial sanctions.”

Over the weekend, however, US secretary of state Antony Blinken suggested that strategy might change. He told CNN that the US was in a “very active discussion” with its European allies over possible restrictions on imports of oil from Russia. “We are now talking to our European partners and allies to look in a coordinated way at the prospect of banning the import of Russian oil, while making sure that there is still an appropriate supply of oil in world markets,” he said.

Legislation proposed in Congress last week with bipartisan support would ban US imports of Russian crude, oil products, LNG and coal. Administration officials had last week been pressuring some Democratic senators not to support that legislation, Axios reported. Now it seems that its position may be shifting. The impact of a unilateral US ban would not be very great: Russia accounted for only about 8% of US imports of crude and oil products last year. But import bans agreed by a wider group of countries could lead to a significant rerouting of global flows of crude and refined products.

When the oil market opened on Monday morning, the response was dramatic. Prices leaped higher, with Brent crude at one point briefly trading at over $139 a barrel for the first time since the July 2008. US WTI crude went over $130 a barrel. Both prices quickly fell back. Olaf Scholz, Germany’s chancellor, came out firmly against sanctions on Russia’s energy exports, saying: "At the moment, Europe's supply of energy for heat generation, mobility, power supply and industry cannot be secured in any other way.” But by morning trading in the US, Brent was still around $121 a barrel and WTI around $118, up $3-$4 from their levels on Friday.

The earlier rounds of sanctions have already started to affect Russia’s energy exports, despite the exemptions intended to allow sales to continue. One of the key reasons is “self-sanctioning”: international customers choosing not to do business with Russian suppliers either for reputational reasons, or because there is too much uncertainty over transactions, particularly around the legal position for buyers making payments to Russian companies.

That effect has had a significant impact on prices. Russian benchmark Urals crude has in recent years typically been selling at a small discount to Brent of about $2 a barrel. That widened last week to more than $20 a barrel.

The Biden administration seeks relief on fuel prices

As fuel costs continue to rise, the Biden administration has been looking for ways to ease the pressure on American consumers. The OPEC+ group, which includes Russia, has so far shown no inclination to support those efforts. The group’s ministers held their regular monthly video conference last week and agreed to raise their production limit by 400,000 barrels a day, sticking to the schedule they set last year. The decision was widely expected, and had little impact on oil prices. The Biden administration is reportedly considering a possible visit to Saudi Arabia in the few months, to encourage the kingdom to increase production more rapidly.

Oil-consuming countries, meanwhile, tried to use their strategic reserves to take some of the heat out of the market. The International Energy Agency announced on Tuesday that its 31 members had agreed a coordinated release of 60 million barrels of oil from their reserves “to provide stability to oil markets”. Half of that is coming from the US Strategic Petroleum Reserve. The coordinated reserves release is a tool that the IEA does not use often: there have been only three previous examples, in 1991, 2005, and 2011. But its initial impact seemed limited. Crude prices rose after the announcement.

One measure that the administration could use to put downward pressure on oil prices is supporting faster growth in US production. Questioned about that at a White House briefing, President Biden’s press secretary Jen Psaki dismissed the idea that the administration could be doing more to help the US oil industry. “There are 9,000 approved oil leases that the oil companies are not tapping into currently,” she said. “You think the oil companies don’t have enough money to drill on the places that have been pre-approved?... I would point that question to them.”

Rick Muncrief, chief executive of Devon Energy, told Bloomberg he was “mystified” that President Biden had not been in touch to discuss ways to boost oil output to control prices. Leading listed independent oil and gas companies such as Devon have been under pressure from investors to maintain capital discipline, prioritising debt reduction and distributions to shareholders ahead of growth. Muncrief said: “If [the administration] were to reach out and maybe be a little more collaborative, it might provide some cover" for ramping up investment and production.

That move does not seem to be on the administration’s agenda at the moment. Psaki said the president’s answer was instead to press ahead with low-carbon energy. “What we can do over time… [is] reduce our reliance on oil. The Europeans need to do that, we need to do that,” she said. “If we do more to invest in clean energy, more to invest in other sources of energy, that is exactly what we can do to prevent this happening again in the future.” She added more detail to her argument in a Twitter thread on Sunday.

The big question for the administration over the coming months will be whether that gradual shift to electric vehicles “over time” will need to be augmented by more urgent measures to help the great majority of consumers who have not yet made that transition.

More international oil companies plan to exit Russian assets

ExxonMobil and Shell have followed BP and Equinor in announcing they are exiting assets in Russia. ExxonMobil said it was beginning the process to discontinue operations and exit the Sakhalin-1 joint venture, and would not make any new investments in Russia.

Shell said it would exit all of its joint ventures with Gazprom, including its 27.5% stake in the Sakhalin-II LNG facility. It also intends to end its involvement in the Nord Stream 2 pipeline project to bring Russian gas to Germany. The pipeline is waiting for certification from Germany, and that process was suspended last week.

The IPCC assesses the impact of climate change

While the world had been focused on the crisis in Ukraine, there was a reminder from the Intergovernmental Panel on Climate Change about the longer-term threat from global warming. In 2021-22 the IPCC is publishing its sixth Assessment Report, intended to sum up scientists’ current understanding of climate change, updated the fifth report published in 2013-14. The assessment is divided into three parts: Working Group I, looking at the physical science of how the climate is changing, published its report last August. This week Working Group II published its section, looking at the impact of that changing climate on ecosystems and human communities.

The headlines from the report’s summary for policymakers were that climate change is already causing widespread damage, and that the threat of more severe impacts will grow as temperatures continue to rise. If global warming even temporarily exceeds 1.5°C — the limit set as the stretch goal of the 2015 Paris climate agreement — “then many human and natural systems will face additional severe risks, compared to remaining below 1.5°C,” the report warns. The risks cited include the loss of land and assets in small islands and coastal communities, droughts, and the degradation of coral reefs.

The report also highlights the interactions between climate change and other threats such as local pollution and unsustainable use of natural resources, and warns: “Vulnerability is higher in locations with poverty, governance challenges and limited access to basic services and resources, violent conflict and high levels of climate-sensitive livelihoods (e.g. smallholder farmers, pastoralists, fishing communities).”

The Working Group’s conclusions were criticised by Roger Pielke Jr of the University of Colorado Boulder, author of The Climate Fix. He pointed out that some of the warnings of threatened damage from global warming were based on a scenario with very high greenhouse gas emissions, which is increasingly seen as unlikely. That scenario, sometimes referred to as RCP8.5, showed the world on course for average global warming of about 4.3 °C by the end of the century. Wood Mackenzie’s base case forecast, showing our view of the most likely outcome, puts the world on course for about 2.6 °C of warming.

As an illustration of the differences, the risk of “large, abrupt and sometimes irreversible changes in systems caused by global warming”, such as ice sheet disintegration or a slowdown in ocean circulation, is described in the report as “very high” in an RCP8.5-type scenario, but only “high” in the scenario close to Wood Mackenzie’s base case. If global warming could be limited to 1.5 °C, the assessed risk of those large and irreversible changes would be reduced to “moderate”. Wood Mackenzie recently published our updated 1.5 °C scenario, showing the rapid transformation of the global energy system that would be required to meet that goal.

The blowout offshore wind auction for the New York Bight

The auction of offshore wind lease areas off the coast of New York and New Jersey last week attracted an eye-popping $4.37 billion in high bids. That not only shattered the previous record of $405 million for a US offshore wind lease sale, set in 2018, but was also more than had ever been raised from a US sale of oil and gas leases. Wood Mackenzie’s offshore wind team, led by Søren Lassen, has been digging into the details of the auction to explore some of the key conclusions for the industry.

One key point is just how competitive the auction was. Of the 14 consortia that started bidding, 12 were still active into the third day, as the maximum price per acre headed towards ten times the previous US record. Allowing for the fact that the New York Bight leases last for 33 years, compared to 60 years for the US, they are the most expensive acreage in the world in terms of dollars per square kilometre.

Many of the big names in global offshore wind were involved. Winners of the six lease areas included a consortium of Ocean Wind and GIP; another of Shell and EDF, and TotalEnergies. BP, Equinor, Iberdrola and Ørsted were among the unsuccessful bidders, opting to keep their powder dry for future sales. Even after the auction, Ørsted and Iberdrola remain the largest players in US offshore wind.

The winning bidders say they could develop a total of 12.7 gigawatts of capacity in the new lease areas. That represents a 34% increase in the US offshore wind pipeline to a total of 50 GW, well above the Biden administration’s target of having 30 GW online by 2030. Lease sale activity is set to remain high through the year, with five more auctions expected in 2022: three in Europe and two in the US.

Meanwhile, the Biden administration said it would not appeal against a court decision in January that invalidated oil and gas leases in the Gulf of Mexico that were sold last year. Green campaign groups argued that the lease sale had been based on a flawed environmental impact statement from 2017, which had failed to address properly the implications for climate change.

Other views

Simon Flowers — How the world gets to a 1.5 °C pathway

Gavin Thompson — China’s net-zero target could dent Russia’s export ambition

Quote of the week

“Hopefully, it is now extremely obvious that Europe should restart dormant nuclear power stations and increase power output of existing ones. This is *critical* to national and international security.” — Elon Musk, founder and chief executive of Tesla, made the case for nuclear power as the answer to concerns about energy security in Europe.

Chart of the week

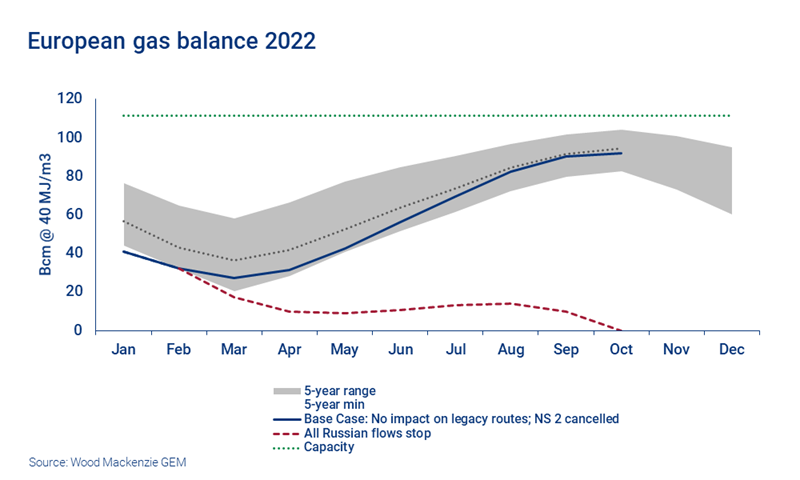

This is a chart that was presented this week by Massimo Di Odoardo, Wood Mackenzie’s vice-president of global gas and LNG research. It shows the projected level of European gas storage out to the end of the year, in two possible future states of the world. The solid blue line is our base case forecast, projecting that storage levels will rise to healthy levels by the autumn, in line with the five-year average. However, if all flows from Russia were to be cut off, we could be in the world shown by the red dotted line, with storage levels dropping to zero by October.

Di Odoardo points out that Europe will have some alternatives. It could push for increased supply from the Netherlands, Norway and Algeria. And it could look to resumed mothball coal plants domestically and persuade Asian countries to use more coal themselves to free up LNG. But even if it was successful in pulling all these levers, it might only get to about half the storage required to get through the winter.