Sign up today to get the best of our expert insight in your inbox.

Does the bull market in oil rigs signal a slower transition?

Deepwater hot spots drive up demand for drilling

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Leslie Cook

Principal Analyst, Upstream Supply Chain

Leslie Cook

Principal Analyst, Upstream Supply Chain

Leslie is a principal analyst and project manager for Wood Mackenzie's portfolio of drilling and rig products.

Latest articles by Leslie

-

The Edge

Is consolidation changing upstream’s appetite for investment?

-

Opinion

Headwinds to tailwinds: are deepwater rig companies ready for a modernised upstream industry?

-

The Edge

Does the bull market in oil rigs signal a slower transition?

Andrew Latham

Senior Vice President, Energy Research

Andrew Latham

Senior Vice President, Energy Research

With his extensive exploration expertise Andrew shapes portfolio development for international oil and gas companies.

Latest articles by Andrew

-

Opinion

Geothermal energy: the hottest low-carbon solution?

-

The Edge

Low-carbon tech: is geothermal close to a breakthrough?

-

Opinion

Can Asia Pacific’s upstream adapt for a more sustainable future?

-

The Edge

Does the bull market in oil rigs signal a slower transition?

-

Opinion

What is the future of oil and gas exploration?

-

Featured

Proceed with caution: exploration’s watchword for 2021

The offshore drilling rig market fell into a prolonged slump a decade ago, with overcapacity compounded by falling oil and gas prices and a collapse in upstream investment. The Paris Agreement in the early stages of the downturn, signalled a shift to a low-carbon future and seemed to reinforce the perception that drilling offshore exploration and development wells was a business in terminal decline. Rig owners were losing money hand over fist and with demand at a low ebb, hundreds of rigs and drillships were put into ‘cold stack’ or scrapped.

Yet today, demand for deepwater rigs is booming again, the market for the best ones all but sold out. Leslie Cook, Principal Analyst, went against the prevailing wisdom in 2019, predicting a strong recovery. She and Dr Andrew Latham, SVP Energy, took me through what’s driving the resurgence.

First, the medium term outlook for oil and global LNG prices is rosier, while the upstream industry is generating huge amounts of discretionary cash flow and starting to spend more. Critically, the war in Ukraine has underlined how much the global economy depends on oil and gas – demand isn’t going to fall off a cliff this decade at least. New discoveries and developments will be needed to offset natural decline and meet growing demand.

While E&P spend is on an upward trajectory from the 2020 low, the upstream industry is still ruled by capital discipline. Companies are highly selective on what and where they will commit investment dollars. The focus is on advantaged resources – exploration prospects and new projects that are low cost and have low carbon intensity.

Offshore, that means deepwater and the Golden Triangle – Latin America (Brazil, Guyana and Suriname); North America (US Gulf of Mexico, and Mexico) and Africa (Atlantic Margin and East Africa gas). These three regions plus the eastern Mediterranean account for 75% of global deepwater rig demand.

Namibia’s giant discoveries in 2022 lie in water depths of around 2,000 to 3,000-plus metres. Not only have these finds re-ignited interest in the West African margin, but they will lead explorers into plays further out on the slope, at water depths few rigs are capable of operating. ExxonMobil’s recent application for four blocks in Liberia is an indicator of the scramble that’s already underway for new deeper water acreage.

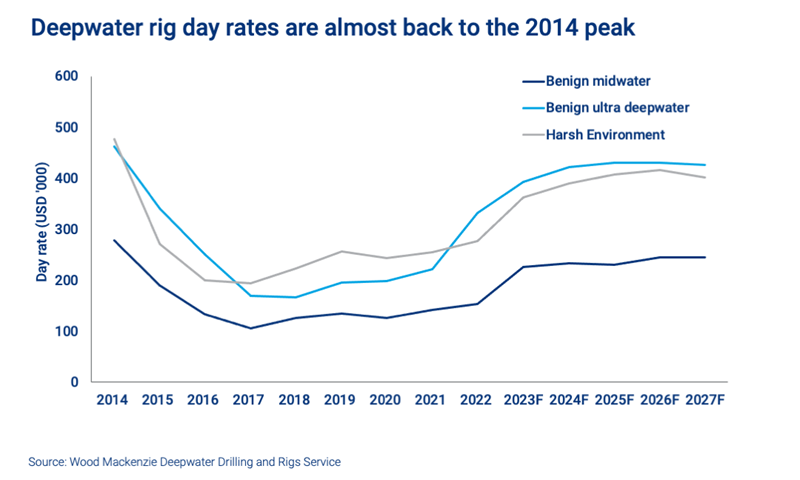

Second, there’s already a bull market in deepwater rigs. Active floating rig utilisation has rebounded from the low of 65% in 2018 to over 85% in 2023, the number of contracted benign ultra-deepwater rigs has returned to pre-Covid levels and day rates for best-in-class floating rigs have doubled in two years. Rig owners are making money again.

Day rates for floating rigs have increased by 40% in the last year. Utilisation rates for the largest operating class, benign ultra-deepwater, hit 90% in the last few months with current day rates of US$470,000/day – both only marginally below the 2014 peak. Demand momentum is still strong, and we forecast day rates will head higher still through 2025.

There’s a persuasive argument in favour of new builds. The latest eighth-generation rigs can deliver in ultra-deepwater, improve drilling efficiency and reliability, and help meet the industry’s goal to reduce emissions. We reckon current rig rates support new build economics.

However, while we expect to see some new orders, there are plenty of reasons why this upcycle will be more restrained than those of the past. As drilling costs rise, we expect operators will delay investment and reconfigure less advantaged new projects. Drilling companies, for their part, will be loath to commit to new builds without long-term contracts, which operators are reluctant to offer. Many rig owners will continue to manage and enhance margins on their existing fleet, while taking the lower-risk option of reactivating the most capable and viable stacked rigs under firm contracts.

Third, the industry’s appetite for drilling will be tempered by uncertainty around future demand. Deepwater exploration wells drilled in 2023 will, if successful, lead to new oil supply around 2030 with payback from perhaps 2035, at best. Investment horizons for deepwater gas exploration are even longer dated.

We expect global oil demand to peak in the early 2030s in our base case (approximating a 2.5 °C pathway), gas demand a decade later. However, in our accelerated energy transition scenario (AET-1.5), the peak for both comes much earlier.

Even so, today’s rig market is a warning that the energy transition is moving slower than what is needed to limit temperature increases to below 1.5 °C.