The drive for decarbonisation: seven key charts from the Metals & Mining Forum

From the green steel challenge to the role of scrap in the future of copper

5 minute read

An accelerated energy transition trajectory will put metals supply under extraordinary pressure – while also dialling up the pressure on the industry to decarbonise.

Our recent Global Metals & Mining Forum explored the journey ahead, tackling critical questions such as:

- How will bulk commodities navigate the rising need to lower their carbon footprint?

- What is the carbon cost of base metals and crucial energy transition metals’ support for the energy transition?

- How much investment is required to drive industry-wide decarbonisation?

Missed the forum, or looking for a recap? Fill in the form to access Andrew Mitchell’s presentation on Nickel: will ESG issues stimy nickel's growth agenda? And read on for our experts’ pick of seven key charts from across the event.

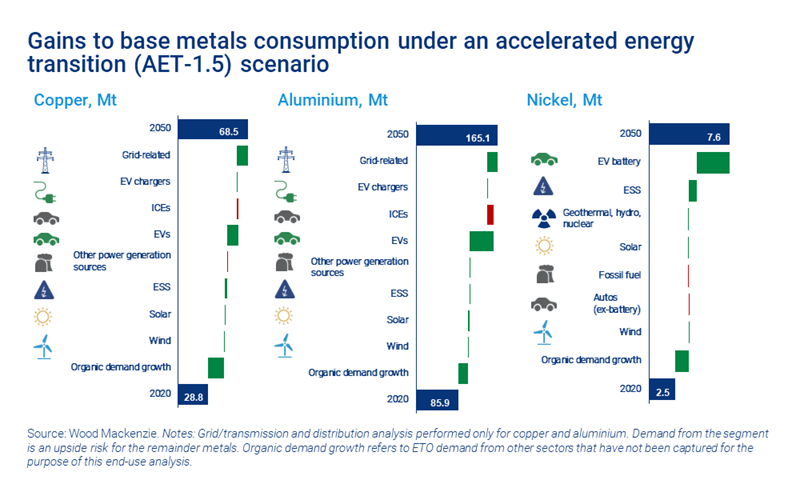

1. Electric vehicles, energy storage and the grid will be key demand drivers for base metals

Bhavya Laul, Senior Research Analyst, Base Metals Markets

Recent analysis indicates that under our accelerated energy transition 1.5 degree scenario (AET-1.5) aluminium, copper and nickel consumption will reach an estimated 165.1 Mt, 68.5 Mt and 7.6 Mt, respectively by 2050.

Some of this demand will come from conventional end-uses, but a significant contribution will be from energy transition sectors. Two key areas of demand growth will be electric vehicles (EVs) and the grid.

As EV penetration increases more metals will be used in batteries, as well as for the rest of the vehicle. Meanwhile, the grid and energy storage systems will be required to support greater electrification and use of low-carbon energy generation sources.

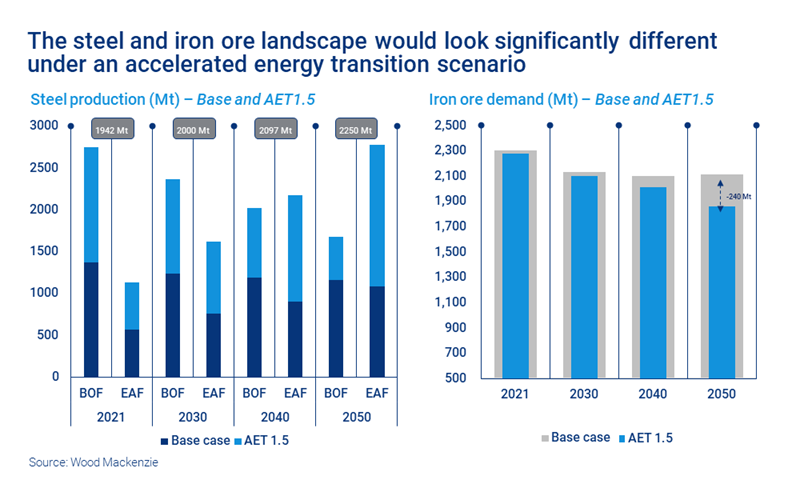

2. Green steel is a staggeringly big challenge – and a US$1.4 trillion investment opportunity

Malan Wu, Head of Steel & Raw Material Markets and Isha Chaudhary, Principal Analyst, Steel & Raw Material Markets

A green-lift to the iron and steel sector will require emissions to decline more than 90% by 2050. A plethora of strategies are necessary for success – resource and energy efficiency, commercialisation of alternate raw materials (hydrogen and greening existing raw materials) and deployment of more electric arc furnaces (EAFs).

EAF technology using zero-carbon electricity will dominate the steelmaking landscape. Its share of production surges to 76% by 2050 in AET-1.5, compared to 48% in our base case. Global iron ore consumption would suffer more, with the world needing 240 Mt less than in our base case forecast by 2050. But, on the sidelines, the green pellet and pellet feed market will increase fivefold on a 1.5 °C pathway.

Miners and steelmakers will be presented with more opportunity than risk. To find out more about this, read Pedal to the metal: iron and steel’s US$1.4 trillion shot at decarbonisation.

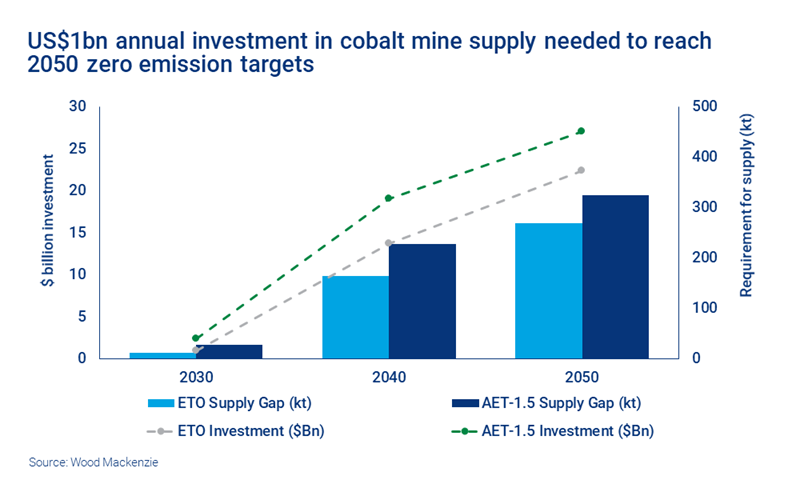

3. An accelerated energy transition will widen the cobalt supply gap

Ying Lu, Senior Research Analyst, Energy Transition & Battery Materials Markets

Cobalt is a critical enabler for the energy transition. Developments in electric vehicles, power generation and energy storage systems will create new growth opportunities over the coming decades.

To reach zero-emission targets, an additional US$30 billion investment is required by 2050 to build up both mining and recycling capacity. Consumers must make hard decisions between security, sustainability and affordability to secure supply.

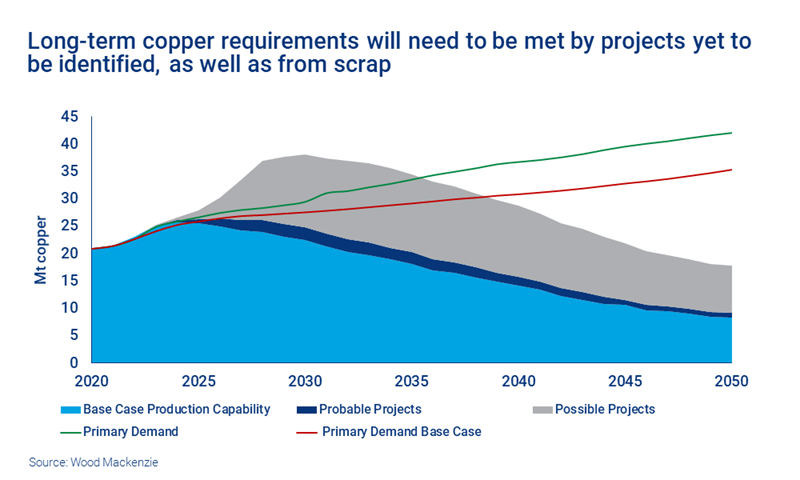

4. Scrap will play an important role in meeting future copper demand

Eleni Joannides, Principal Analyst, Copper

Copper’s property as an electrical conductor will fuel long-term demand. Nearly two thirds of global demand growth over the next 20 years is linked to electrical network and transport end uses, with the bulk of this related to fulfilling the world’s decarbonisation needs.

The key challenge facing the copper industry will be the requirement for mining projects to be brought onstream to meet this demand. The capital investment will be significant and must match the peak level of investment that we saw in the last boom period between 2012 and 2016.

The difference now is that that level of investment, which we estimate to be around US$23 billion per annum, must be sustained over the next 30 years if there is to be enough supply to reach the zero emissions target by 2050. Given this challenge, the future requirement for copper will also need to be met from scrap.

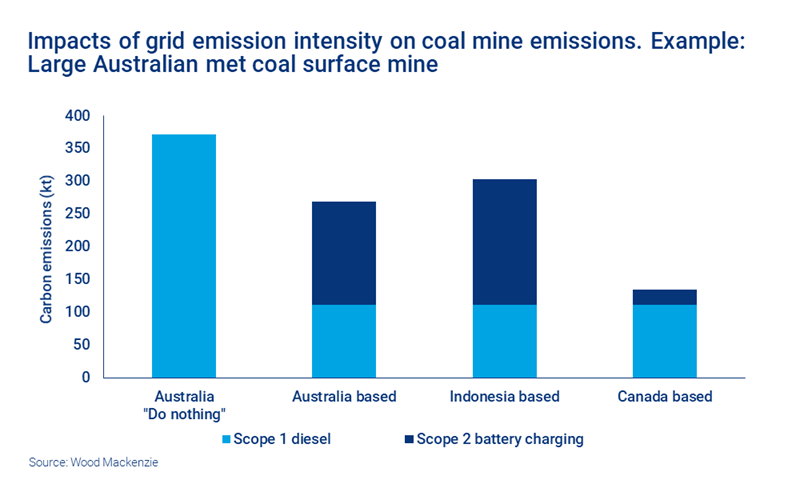

5. Mine location and electricity source make a world of difference in the decarbonisation of coal

Anthony Knutson, Principal Analyst, Coal

Battery EVs could be a significant benefit to reducing coal mine emissions. However, this depends on the operation’s electricity source, as incremental Scope 2 emissions could be a problem.

In countries with carbon-intensive electricity grids, signing a renewable PPA or considering ‘behind the fence’ electricity supply may be necessary for low-to-no emission mine equipment to make sense in a comprehensive emissions profile.

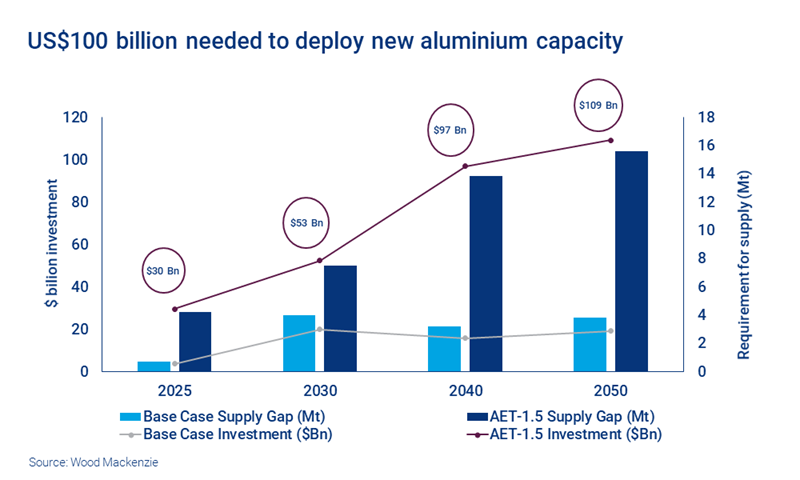

6. Aluminium faces stiff competition for vital investment

Ami Shivkar, Principal Analyst, Aluminium Markets

The rapid uptake of aluminium-intensive clean technologies, such as solar and EVs, will underpin future aluminium demand. This will augment growth from conventional end-uses in construction and packaging.

The capital investment needed to deliver new projects will be much higher than the peak investment seen through previous cycles. The challenge will be to secure this investment in a world where there will be intense competition for funding. The aluminium smelting sector’s track record of delivering consistently above-industry returns is poor.

We estimate that an extra 15 Mt of aluminium capacity is needed, at a cost of over US$100 billion.

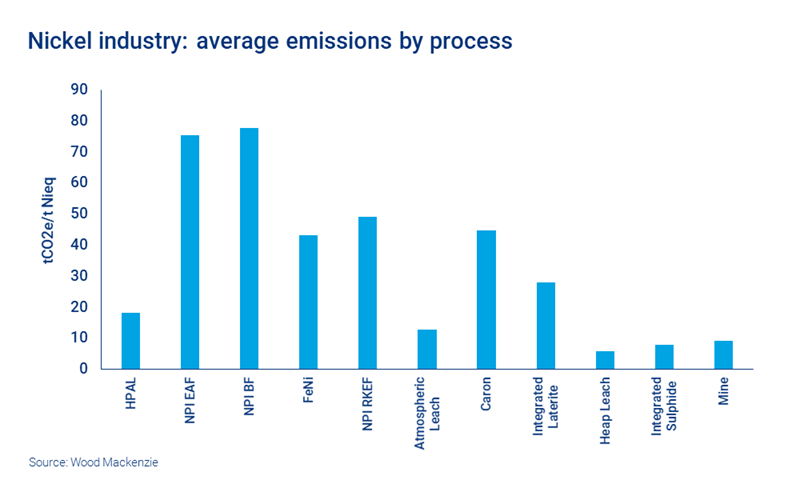

7. ESG issues could impact nickel’s growth – the scale of the challenge varies by process type

Andrew Mitchell, Director, Nickel Research

The production of nickel can be very energy-intensive, with a large CO2e footprint. However, emissions intensity varies greatly by process and ore type.

The high moisture content of laterite ores requires them to be dried prior to them undergoing any smelting process. Consequently, the production of nickel pig iron (NPI) and ferro-nickel (FeNi) is very energy intensive. Sulphide smelting on the other hand benefits from the fact that nickel concentrates have far less moisture and the sulphur acts as a fuel in the smelting process. This reduces the requirement for fossil fuels to be used in the reduction process to produce a matte.

Want a closer look at the future of nickel? Fill in the form at the top of the page for complimentary access to Andrew Mitchell’s presentation on Nickel: will ESG issues stimy nickel's growth agenda?