Get Ed Crooks' Energy Pulse in your inbox every week

US LNG export restrictions underline the case for blue ammonia

The Biden administration’s pause in LNG project approvals points to new political risks for US gas exports. Blue hydrogen and its derivatives could be a solution

9 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

The Haber-Bosch process for producing ammonia from hydrogen and nitrogen has been described as the most important invention of the 20th century, because it enabled large-scale use of fertilisers to feed a rapidly increasing global population. In the wake of President Joe Biden’s moves to restrict US LNG exports, the process may also turn out to be very useful for anyone seeking to monetise North American natural gas resources in world markets.

If restrictions on LNG exports become a long-term feature of US policy, for economic or environmental reasons or some combination of the two, then companies seeking to access export markets will have to look for other options. Converting the gas into blue hydrogen, using carbon capture and use or storage (CCUS), and then into blue ammonia, could be one of the few routes for reaching customers overseas.

The Biden administration last week announced a “pause” in approvals for LNG projects to export gas to countries that do not have a free trade agreement with the US. The new policy will not affect any US projects that are currently in operation or under construction, and so does not make any difference to Wood Mackenzie’s forecasts out to 2028 of strong growth in LNG exports.

Beyond that, everything depends on how long the pause lasts. Former President Donald Trump has already indicated that if he wins another term, he would immediately bring the pause in approvals to an end.

“I will approve the export terminals on my very first day back,” he told a rally in Las Vegas last weekend. “This stuff has been worked on for years. I approved many of them. We got many built in Louisiana and other places. But he stopped it.”

If President Biden wins a second term, the future of LNG export approvals is uncertain. The administration has said the purpose of the pause is to allow the Department of Energy to “update the underlying analyses” for its decisions on export authorisations to take into account factors including “potential energy cost increases for American consumers and manufacturers… the impact of greenhouse gas emissions… [and] risks to the health of our communities”.

Many environmental campaigners argue that the reassessment of the climate impact of LNG exports should result in a permanent ban on authorisations for new plants. Bill McKibben, one of the leading voices among US climate activists, wrote: “If the administration backtracks, it will be a disappointment of [such] epic proportion that I can’t imagine them doing it.”

If he is right, then even if the Republicans retake the White House and control of Congress in this year’s elections, LNG exports will again be an issue in 2028 and for any future Democratic administration.

The growing political risk in LNG exports from the US could be a factor tipping the balance in favour of blue ammonia as an alternative. As explained in a Wood Mackenzie Horizons report last year, gas resource holders seeking a route to overseas markets are increasingly able to choose between the well-established route of LNG and the emerging pathway of blue ammonia.

That report concluded that while LNG clearly remains the primary option for gas resources around the world, the US is a particularly attractive location for blue ammonia production, thanks to its supportive policy framework of tax credits and other incentives.

There have already been about two dozen blue hydrogen-to-ammonia projects announced in the US. Some are quite speculative, but some are making real progress. ExxonMobil is working on a blue hydrogen project at its Baytown refinery in Texas that could take a final investment decision this year and be in operation in 2028. SK of Korea is seeking to import blue ammonia from the project and has signed a heads of agreement with ExxonMobil. OCI started construction on its blue ammonia project in 2022, also in Texas, and is aiming to start operations next year.

The status of ammonia under US law has been much debated, but exports seem unlikely to face the same issues that are now causing difficulties for LNG. The Department of Energy’s definition of products that are subject to export controls under the 1938 Natural Gas Act includes “liquefied natural gas (LNG), compressed natural gas, compressed gas liquids, etc.” It seems clear that ammonia, although it uses natural gas as a feedstock and can also be used for energy, is different.

The Biden administration sees low-carbon hydrogen as a crucial element in its strategy for developing a clean energy economy, and any future Democratic administration can be expected to share that view.

Hearings on the administration’s pause in authorisations are scheduled in both the Senate and the House of Representatives for next week. The political battles over the issue are set to last through to the November elections and beyond. And however the debate plays out in the short term, the salience of LNG as a political issue has been raised in the US, in a way that is unlikely to be reversed.

Low-carbon hydrogen and ammonia still face many challenges, particularly in the uncertainties over demand from end-users and eligibility for government support. They need tax credits and other incentives such as the EU’s Carbon Border Adjustment Mechanism to be economically viable.

Nutrien, the fertiliser group, last year stopped development of what would have been the world’s largest blue ammonia plant, in Geismar , Louisiana, citing rising capital costs and “continued uncertainty on the timing of emerging uses for clean ammonia”.

But despite all these issues, interest in low-carbon hydrogen and ammonia remains high among policymakers around the world. The increased uncertainty over the outlook for US LNG exports creates another factor that could help the industry to develop.

In brief

The Saudi Ministry of Energy has instructed Saudi Aramco to abandon its target of raising oil production capacity to 13 million barrels a day, instead maintaining it at its current level of 12 million b/d. The goal of increasing capacity was set in 2020 and it had been expected to be achieved by 2027.

Wood Mackenzie analysts said costs for expansion projects had increased substantially since the pandemic, and it made less sense to pursue them at a time when Saudi Arabia did not see opportunities to increase production significantly and oil prices were under pressure. As a result, the analysts added, this was “an astute time to abandon the 13 million b/d capacity target”.

LNG tanker traffic through the Red Sea and the Suez Canal has stopped completely, following attacks on merchant shipping by Houthi militias in Yemen. Despite US and UK strikes on Houthi targets in recent weeks, commercial shipping overall on that route has roughly halved, the BBC reported.

Shell reported solid results for the final quarter of 2023, with adjusted earnings up 17% on the previous quarter and well ahead of consensus estimates. Performance was helped by another “exceptional” end to the year in LNG trading and optimisation. ExxonMobil and Chevron also reported fourth quarter earnings that were above expectations.

A US$55.8 billion pay package for Elon Musk, chief executive of Tesla, has been struck down by a court in Delaware, on the grounds that the company was paying him an “unfair price” for his services. The work Musk did for the company, and its ambitious growth record and future plans “do not justify the largest compensation plan in the history of public markets,” the court said.

The court ruled that in the process of setting his compensation plan, Tesla’s board had been “starry eyed by Musk’s superstar appeal,” and had not asked the US$55.8 billion question: “Was the plan even necessary for Tesla to retain Musk and achieve its goals?” In response to the judgment, Musk said he wanted to relocate Tesla’s state of incorporation away from Delaware to Texas, adding that he would seek shareholder approval for the move “immediately”.

Other views

A long-term pause in new US LNG investment could transform the market

Biden’s pause on US LNG export approvals: four questions answered – Mark Bononi

Navigating uncertainty: the impact of pipeline dynamics on North American gas supply – Eunji Oh

Metals and mining predictions for 2024 – Robin Griffin, Nick Pickens and Daniel Carvalho

What’s next for green steel technologies? – Daniel Carvalho

Lithium market faces a transition as demand growth slows

The offshore wind sector doubled down on tangible opportunities in 2023

It is OK to be complacent about Red Sea economic risks – Chris Giles

The coolest thing in climate tech is a super hot rock – Kate Brigham

Quote of the week

“We must spend the year working collectively to evolve our global financial system so it’s fit for purpose, with a clear plan to meaningfully execute the climate transition. Looking at the numbers, it’s clear that to achieve this transition, we need money, and lots of it. $2.4 Trillion, if not more… Whether on slashing emissions or building climate resilience, it’s already blazingly obvious that finance is the make-or-break factor in the world’s climate fight.” – Simon Steil, executive secretary of UN Climate Change, put a spotlight on finance as the focus for international climate efforts in 2024, with the aim of mobilisng capital for investment in low-carbon technologies and defences against the impacts of global warming. He was speaking in Baku, Azerbaijan, which will host the COP29 climate talks in November.

Chart of the week

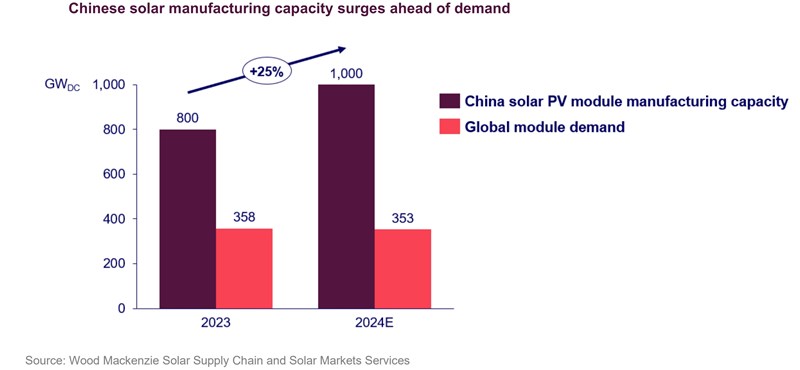

This comes from a new Wood Mackenzie report on five things to look for in 2024 in Asia’s power and renewables industries, written by Alex Whitworth, our head of Asia-Pacific power research. The numbers he shows here for the growth in solar module manufacturing capacity in China are absolutely staggering. By the end of last year, total capacity – shown in the burgundy-coloured bars – had reached more than double total annual global demand for modules, shown in pink. This year, based on announced expansions and investments, China should easily surpass 1,000 GW of annual manufacturing capacity, while global demand for modules is expected to remain roughly flat. The most likely outcome, Whitworth says, is that global demand for solar will remain far below supply capacity, causing an extended price war and driving prices for Chinese solar modules down even further, following their steep declines last year.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today using the form at the top of the page to ensure you don’t miss a thing.