Get Ed Crooks' Energy Pulse in your inbox every week

Offshore wind at a pivotal moment

Supply chain bottlenecks and rising interest rates threaten projects. The policy response will be critical

13 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

There is a great Philip Larkin poem, Wires, about the experience of young steers that believe the open spaces of the prairie are limitless, until they bump up against an electric fence and realise for the first time the constraints on their freedom. New industries suffer a similar experience when they hit their first downturn. Companies that have seen only steady improvement in their prospects are forced to adjust to the reality that the lines on the graphs do not always go up. The offshore wind industry has reached that moment this year.

Surging costs, supply chain bottlenecks, and rising interest rates have caused a succession of setbacks across the offshore wind industry in the US and Europe. Most recently, New York State’s Public Service Commission has this month denied applications for additional funding for four proposed offshore wind projects: Empire Wind 1 and 2 and Beacon Wind, developed by Equinor and BP, and Sunrise Wind, developed by Ørsted and Eversource.

These challenges do not have to be the end of growth in the industry. Other industries that at one time looked like one-way bets, including tight oil producers and internet companies, proved to be subject to cycles like everyone else, but weathered their downturns and then bounced back to sustained growth. Offshore wind could do the same. But politicians will need to strengthen their commitment to supporting it.

“The industry is at an inflection point,” says Søren Lassen, Wood Mackenzie’s head of offshore wind research. “Will politicians be willing to provide the support that offshore wind needs? If they are, the industry could be in a stronger place than ever. If not, it’s going to be in a very tight spot.”

Offshore wind has been supported by many governments because, although it has higher costs than onshore wind or utility-scale solar, it is a way to bypass restrictions on land use. Its big problem now is that capacity in the supply chain (outside China) is not keeping pace with those governments’ targets for growth. In installation vessels, for example, Wood Mackenzie projects that just 25% of the capacity that will be required in 2030 is in operation today.

Facilities to manufacture turbines and components, and to support installations, are large projects that take time to build. A history of poor profitability, caused by excess capacity in the supply chain during 2015-22, along with political and regulatory uncertainty that makes it difficult to be sure of future demand, is restricting suppliers’ ability to invest.

In addition to those global issues, developers in the US face specific difficulties such as the Jones Act, which mandates that only vessels that are crewed and registered in the US can install foundations and tower components carried from the US. In the Northeastern US, where political support for offshore wind is greatest, regulations including local content requirements and community opposition add to the obstacles facing developers.

Meanwhile, soaring interest rates, rising faster and further than was expected a couple of years ago, have also thrown project economics into doubt. The higher cost of financing has created challenges for many energy projects, but offshore wind is one of the sectors that it particularly vulnerable, because it is so capital intensive, and because projects have locked in their revenues in tender awards.

With the benefit of perfect hindsight, we can see now that it would have been better for offshore wind projects to press ahead in the 2010s, when inflation was low and interest rates were near zero. But political support was not strong enough to generate a sense of urgency, and the opportunity was missed. The slow pace of permitting and environmental approvals is still a challenge for developers, and the legal challenges are still coming in.

With prices for their electricity set through power purchase agreements (PPAs), and subsidies agreed in advance, offshore wind projects offer a high degree of transparency as to whether they can be profitable or not. Ørsted said in August that a combination of problems in the supply chain, lack of favorable progress in guidance on the US Investment Tax Credit, and increased interest rates, could lead to impairments on its US wind projects of up to DKK16 billion (US$2.3 billion).

Mads Nipper, Ørsted’s chief executive, told Bloomberg News last month that the company was “still upholding a real option to walk away… [But] we are still working toward a final investment decision on projects in America.”

Developers have already walked away from three large projects in the US. The latest announcement came earlier this month, when Avangrid opted to terminate the PPA for the Park City Wind project off the coast of New England, saying it was “unfinanceable under its existing contracts”.

US policymakers who are keen to build an offshore wind industry are facing a tough challenge. They want to find ways to make sure the investment still flows into offshore wind development, while minimizing the extra cost to consumers.

The day the New York PSC announced its decision, New York’s Governor Kathy Hochul announced a ten-point action plan for renewable energy, intended to demonstrate “our commitment to addressing challenges that this sector is experiencing all across the country.” The plan includes a commitment to announce more offshore wind awards “in the near future,” with an accelerated procurement process intended to “to backfill any contracted projects that are terminated.”

That strategy makes sense. Delaying projects would make the supply chain problems worse, not better: pushing more activity towards the end of the decade mean suppliers would face more years of low activity and then an even sharper ramp-up in demand. The industry needs sustained steady growth to create confidence to invest in the supply chain.

But while New York’s strategy may seem sound, the state still needs to show how it will be implemented. Governor Hochul last Friday vetoed “The Planned Offshore Wind Transmission Act”, which would have expedited the regulatory process for the transmission cable needed for the Empire Wind 2 project, sending a worrying signal for the industry. The American Clean Power association warned: “New York is coming dangerously close to serving a death knell for the promise of offshore wind development in the region.”

The New York State Energy Research and Development Authority is scheduled to announce the winning bids in its latest solicitation for offshore wind before the end of the year, and that decision will be crucial for the future of the industry.

Explaining the PSC’s recent decision on offshore wind funding, the commission’s chair Rory Christian used two arguments. The contract changes sought by the project developers “would have provided adjustments outside of the competitive procurement process [and] such relief is fundamentally inconsistent with long-standing Commission policy,” he said. In other words, it would be wrong for the PSC to reopen contracts signed after competitive processes run in 2018-19 and 2020-21.

He also cited the financial impact of the proposed funding, saying it would have added up to 6.7% to the bills of residential customers in the state, and up to 10.5% for commercial or industrial customers.

The question of reopening signed contracts does not arise with the new solicitation round, or with any further rounds that may be announced to replace cancelled projects. So the PSC’s objections on that score should not be issues in the future. But questions about the financial impact on consumers of the support for offshore wind will remain.

To put the issue in the broadest perspective, it is another example of a common issue in the energy transition: there is widespread support for a shift to low-carbon energy, but much less widespread enthusiasm for paying more it. The decisions made by New York and other states over offshore wind will show how they have chosen to navigate those treacherous waters.

“At the end of the day, it’s the policymakers who have to say whether they want the offshore wind build-out to go ahead. They have to decide whether they want the jobs, and the renewable energy supplies, and the cost reductions. All of those are contingent on having steady growth in the industry,” says Wood Mackenzie’s Lassen.

“If policymakers demand that prices continue to fall, then developers can’t really move forward. If politicians step up and say: ‘we want to see the energy transition happen’, then offshore wind will be able to grow.”

The offshore wind industry globally has made remarkable progress over the past decade. The operating fleet has still grown more than 20-fold since 2010. Although the supply chain build-out has been slower than government targets required, new capacity is being added that will benefit projects for decades to come.

Although permitting has been and continues to be a problem, there are now 1.8 terawatts of active projects making progress. While around 5 gigawatts have failed to be awarded this year, and 4 GW of already tendered projects have cancelled their offtake contracts, worldwide outside China there is still more than 40 GW expected to be awarded in tenders over the next 14 months.

However, Wood Mackenzie’s Lassen says, “policymakers still need to act for this to materialise, and that starts by not only accepting that costs have gone up, but also structuring future tenders accordingly.”

In brief

Just as this post was being published, Chevron announced an agreed US$53 billion takeover of Hess. It is the second big deal in the US oil industry this month, following ExxonMobil’s $64.5 billion acquisition of Pioneer Natural Resources. Talk to your Wood Mackenzie contact or follow WoodMac.com for analysis and insight in the hours and days to come.

The US government is relaxing some sanctions on Venezuela, including restrictions on the oil and gas industry. The easing of sanctions, which will last for an initial period of six months, came after representatives of the Venezuelan government and the opposition agreed on an “electoral roadmap”. Wood Mackenzie analysts cautioned that although the easing of sanctions was certainly a positive move for the Venezuelan oil and gas sector, “it does not guarantee a rapid or permanent recovery of production, given the required investment needed to deal with current infrastructure repairs and bottlenecks.”

Oil prices have stabilised after a sharp rise in the past couple of weeks. Brent crude was trading at about US$91 a barrel early on Monday morning.

A proposed US$3.5 billion US project to transport carbon dioxide for sequestration and utilisation has been scrapped because of regulatory and political uncertainty. The Heartland Greenway project, which would have transported carbon dioxide captured from ethanol plants in Illinois, Iowa, Minnesota, Nebraska and South Dakota, was being developed by carbon management company Navigator CO2. The company said in a statement that it had decided to cancel the project “given the unpredictable nature of the regulatory and government processes involved, particularly in South Dakota and Iowa.”

The Biden administration has announced what it is calling the “largest-ever investment in America’s grid”: an investment package worth US$3.5 billion for 58 projects across 44 states to strengthen electric grid resilience and reliability. Secretary of Energy Jennifer Granholm said: “Extreme weather events fueled by climate change will continue to strain the nation’s aging transmission systems, but President Biden’s Investing in America agenda will ensure America’s power grid can provide reliable, affordable power.” The money, part of the funds committed under the bipartisan infrastructure law passed in 2021, will go for investments in microgrids, battery storage, flood protection, and other projects intended to keep the lights on during extreme weather events and other challenges.

The UK’s advisory National Infrastructure Commission has called on the government to rule out the use of hydrogen for heating homes or other buildings, saying it would increase both costs and emissions. The commission instead recommends that hydrogen efforts should be focused on power generation and industrial decarbonisation.

Glencore has announced that it plans to cease operations at Mount Isa, one of the world’s largest copper mines. The company said recent studies had “revealed the remaining mineral resources are not economically viable due to low ore grades and areas where, due to geological conditions, safe extraction can’t be achieved using current technology.” It added that the mine’s infrastructure is ageing.

Wood Mackenzie analysts forecast that copper demand will grow steadily because “as we move to a more electrified, decarbonised world, copper’s property as an electrical conductor and its lower carbon footprint relative to aluminium, will continue to favour its use.” As a result, they say, new projects will be needed to meet the supply gap that is set to emerge from the mid-2020s.

Other views

Mhairidh Evans — Our top five takeaway messages from Wood Mackenzie’s CCUS conference 2023

7 billion tons per year of carbon capture needed to meet net zero by 2050

Peggy Hollinger — How to make space-based solar power a reality

Femke Nijsse and others — The momentum of the solar energy transition

Quote of the week

“The fossil fuel industry is working to continue our nation’s reliance on fossil fuels by any means necessary - and hydrogen offers yet another possible inroad for Big Oil and Gas to lock in polluting and non-economic uses of gas for decades to come. Decision-makers in the administration and at the local level must be wary of these attempts and ensure as much hydrogen-specific funding as possible goes to green hydrogen and its most efficient end uses to ensure this investment actually addresses climate change.” — Ben Jealous, executive director of the Sierra Club, raised concerns about the Biden administration’s announcement of government support for seven proposed low-carbon hydrogen hubs across the US. Like other environmental groups, the Sierra Club supports the use of green hydrogen, made from the electrolysis of water with renewable energy, for use in sectors with hard-to-abate emissions including steel and cement, but opposes blue hydrogen made from natural gas with carbon capture. For more on Wood Mackenzie’s views on the hydrogen hubs announcement, take a look at this news release.

Chart of the week

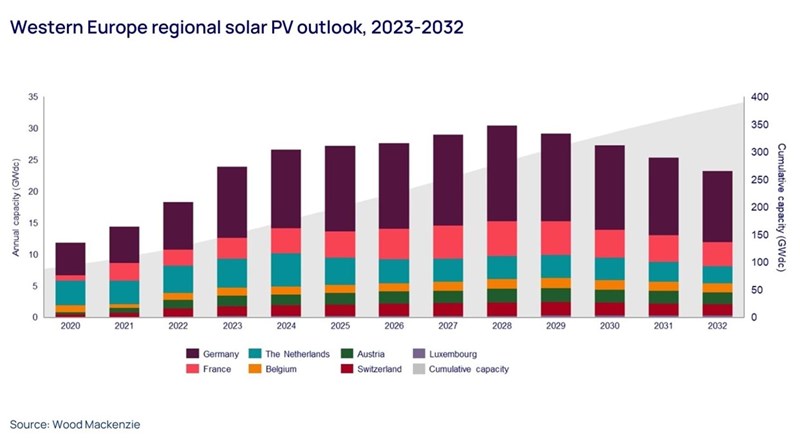

In the energy crisis that followed Russia’s invasion of Ukraine last year, there was an active debate over whether it would increase adoption rates for low-carbon technologies, or drive a new surge in investment in fossil fuels. As it turned out, it has done both. Europe has been signing more contracts to buy LNG, and investing in regasification capacity to support those imports, but it is also accelerating spending on low-carbon energy. This chart shows our forecasts for annual solar deployments in Western Europe, and you can see how they have absolutely soared since 2020. Policy support and growing electricity demand, as well as concerns about energy security and soaring power prices, have driven a surge in investment.

Shares in solar companies plunged last Friday, after SolarEdge warned of “substantial unexpected cancellations and pushouts of existing backlog from our European distributors”, caused by “higher than expected inventory in the channels and slower than expected installation rates.” Even so, the conditions that have supported the industry’s recent growth remain in place.