Is the price rally in energy and metals sustainable?

Post-pandemic economic bounce versus a new supercycle

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Green shoots of economic recovery are bursting through. The world was always going to bounce back in 2021 – it was a question of how quickly and by how much. I asked our team how the unfolding recovery is feeding through to key commodity markets and if we are seeing the early stages of the metals supercycle we mooted six months ago.

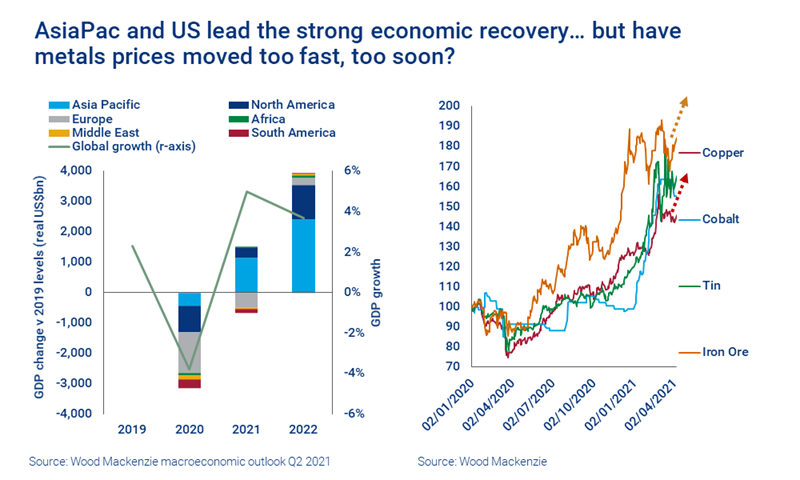

Global economy – Peter Martin, Head of Economics

We’re increasingly bullish about the prospects for 2021 – after global GDP contracted by 3.8% last year, leading indicators point to robust expansion. We’ve just upgraded our global GDP growth forecast from 4.3% to 5.0%. That will lift global GDP back to pre-pandemic levels later this year, 3 to 6 months earlier than we expected in our Q1 forecast.

The US drives the upgrade, accounting for 0.5 percentage points. The sheer scale of the US$1.9 trillion Biden stimulus package is a sugar rush for domestic consumption, triggering a surge in demand for imports that is rippling out across the global economy. We’ve raised our GDP growth forecast for the US for 2021 from 3.6% to 6%. Asia’s recovery remains strong, whereas Europe has been hampered by prolonged lockdowns, and India and Brazil are among those at risk of protracted recovery and perhaps even further downgrades.

We’ve raised our GDP growth forecast for the US for 2021 from 3.6% to 6%.

Peter Martin

Head of Economics, Macroeconomics

Peter is responsible for producing our macroeconomic outlook to 2050.

Latest articles by Peter

-

Opinion

Global economic outlook: GDP growth upgrades, downgrades and sticky inflation

-

The Edge

How higher interest rates could hold up energy transition investment

-

Opinion

Global economy maintains momentum after upside surprise

-

Opinion

Global economy proves robust – but risks remain skewed to the downside

-

The Edge

Can China’s recovery turn the oil market around?

-

Opinion

COP26: The economics of the energy transition

The inequity of vaccine access and rollout means it’s an asymmetric global recovery. The lack of vaccination cover in low-income economies, especially in Africa and Latin America, will hit foreign travel and tourism and inflows of investment – limiting growth.

The broad implications of the global economic recovery though are bullish for commodities, supporting the strong rebound in prices that’s been under way since Q3 2020.

Oil – Ann-Louise Hittle, VP Macro Oils

Demand signals look strong. The acceleration of vaccine deployment and increased personal mobility, at least in the two largest oil-consuming nations, the US and China, will help global liquids demand continue its recovery in H2 2021. We expect global demand to rise 4 million b/d to 99.4 million b/d from Q2 to Q4 2021. That’s only marginally below the peak of Q4 2019, and demand should get back over 100 million b/d in 2022.

The US is seeing a gasoline- and diesel-led recovery. Barring a prolonged shutdown of the Colonial pipeline, we expect a robust driving season to lift US gasoline demand back close to 2019 levels by the end of the year.

Globally, jet aviation fuel is a laggard because of severe restrictions on international travel. But in China, domestic air travel has compensated – total flight volumes for April-October are expected to exceed those of 2019, even with minimal international flights. This trend could play out elsewhere. Oil demand growth in the rest of the world is more muted, with lockdowns still restricting parts of Europe, while India is a downside risk.

With demand firming and OPEC+ continuing to restrain production, we see a risk of Brent rising above US$70/bbl in the coming months.

Ann-Louise Hittle

Vice President, Oil Markets

Ann-Louise directs our Macro Oils Service and is a frequent contributor to numerous industry publications.

Latest articles by Ann-Louise

-

Opinion

Forecasting the future of oil demand: five key questions answered

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why Brent isn’t reacting to escalating geopolitical risk

-

The Edge

What higher oil prices in 2024 could mean for the economy and politics

-

The Edge

Can China’s recovery turn the oil market around?

-

Featured

Global oil markets: another tumultuous year lies ahead

The oil price has risen 70% since October. With demand firming and OPEC+ continuing to restrain production, we see a risk of Brent rising above US$70/bbl in the coming months. But the upside may be limited – OPEC+ agreed to lift output from May to July, indicating an attempt to avoid sharp price increases, while difficult talks continue in Vienna on the Iran nuclear deal and might lead to higher Iranian oil exports in H2.

LNG – Robert Sims, LNG Short-Term

We’re in for a big year for LNG demand. Asia Pacific accounts for 70% of the global total and increased by 7 Mt (3%) last year despite Covid-19. We could be looking at three times as much in 2021 and might even get close to the record 28 Mt increase of 2018.

Most of the demand growth is from China, where clean air policy is encouraging coal-to-gas switching in the power sector and industry. Storage fill after a cold winter in Northeast Asia is another factor.

We’re in for a big year for LNG demand.

Today’s Asian spot prices of US$10/mmbtu are well above last October’s US$2/mmbtu low. The medium-term outlook for gas is strong, but we reckon there’s some downside risk to spot price from supply growth this year and next.

Iron ore and copper – Julian Kettle, Vice Chair Metals and Mining

Mining commodities have taken off. Iron ore is at a record high of US$240/t, and fundamentals have played a part. Record Chinese steel production in 2020 pulled in an additional 100 Mt of iron ore imports, up 8%, a trend that’s carried on into 2021, albeit at a slower rate.

Over 60% of China’s iron ore is sourced from Australia. The freezing of bilateral relations between the two countries last week has ramped up the geopolitical tension. Iron ore miners are printing money; China’s ballooning iron ore import bill and its inability to maintain steel production discipline have led the government to take measures to cool the industry down. This will help reassert fundamentals and prices could halve, but miners will still be in the money.

Copper is near a decade high of US$11,000/t. The metal is central to the infrastructure needed to support the electrification of transportation and the broader energy market over the next two decades.

The money chasing copper has come too fast, too soon.

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Latest articles by Julian

-

Opinion

Metals investment: the darkest hour is just before the dawn

-

Opinion

Ebook | How can the Super Region enable the energy transition?

-

The Edge

Can battery innovation accelerate the energy transition?

-

Featured

Have miners missed the boat to invest and get ahead of the energy transition?

-

Featured

Why the energy transition will be powered by metals

-

Featured

Could Big Energy and miners join forces to deliver a faster transition?

But, with aluminium a genuine substitute in certain applications, not at any price and not just yet. The money chasing copper has come too fast, too soon. We believe in a supercycle – the energy transition will transform demand for copper and other key metals, exposing a lack of supply by mid-decade.

Energy transition-driven demand isn’t taking off yet however – we expect growth in copper demand to moderate in the next few years as economic growth slows. With new supply coming to market, the risk is that high-flying prices hit an air pocket.