Get Ed Crooks' Energy Pulse in your inbox every week

Anti-dumping threat throws US solar industry into turmoil

An investigation into unfair competition in cells and modules has created uncertainty and is already having significant impact on investment plans

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

US anti-dumping procedures are a century old this year. The Fordney-McCumber Act of 1922 gave the president the power to impose anti-dumping duties on imports being sold at below the price of American-made goods. One hundred years later, anti-dumping actions remain bitterly controversial.

In March, the US Department of Commerce launched an investigation into allegations that solar cells and modules produced in southeast Asia were being used to get round anti-dumping duties on imports from China. That investigation could result in a new round of duties being imposed on imports from countries including Thailand and Malaysia that are important sources for modules used in the US. It is not scheduled to deliver its initial determination until the end of August, but it has already had a huge impact on the US solar industry.

The issue has put a spotlight on a conflict at the heart of the Biden administration’s climate and energy strategy, between supporting US manufacturing in low-carbon technologies, and encouraging the fastest possible deployment of renewable energy.

The investigation began in response to a complaint from a company called Auxin Solar, a California-based manufacturer of solar panels. Auxin argued that companies making solar cells and modules in Malaysia, Thailand, Vietnam and Cambodia, using Chinese components, were circumventing the anti-dumping (AD) and countervailing duty (CVD) orders on imports from China that were imposed under the Obama administration in 2012.

Those duties had the effect of cutting the value of US imports of solar cells and modules from China by 86% over 2011-20. But over the same period, US imports from Malaysia, Thailand, Vietnam and Cambodia rose sharply, as Chinese companies invested in increased manufacturing capacity there. Auxin claims that imported solar cells and modules from those countries are “identical” to the products made in China, except for their final assembly.

The aim of anti-dumping and countervailing duties is to protect domestic manufacturers against competition from imports that are sold at “unfair” low prices and / or subsidised by other countries’ governments. President Joe Biden has made the promise of “good-paying, union jobs” a key plank in his case for supporting the transition to low-carbon energy, and ensuring that US manufacturers are not squeezed out of key markets for solar equipment is an obvious fit with that strategy.

The problem is that crucial sections of the solar value chain, including developers and installers, benefit from having access to imported modules at the lowest possible cost. An increase in the cost of those modules would be bad enough. But what is particularly damaging at the moment is the uncertainty over the ultimate impact of the investigation.

The commerce department is scheduled to conclude its work and announce proposed duty rates by August 30. Until it reports, no-one can be sure how the economics of solar in the US will stack up. While the situation remains in limbo, developers will find it very difficult to move ahead with projects unless they have a source of modules that they can be sure will not be affected. Worse, any new duties could be imposed retroactively, back to November 2021, meaning that products already imported could be hit.

“It is an example of how policy uncertainty can have a devastating impact on an industry,” says Xiaojing Sun, Wood Mackenzie’s global head of solar research. “Neither the module buyers nor sellers are willing to bear the tariff risk. So no new supply contracts for modules are being signed.”

A survey of its members conducted by the Solar Energy Industries Association found that 83% of respondents said their supplies of modules had been delayed or cancelled, and 90% expected a “severe” or “devastating” negative impact from the investigation. A story in the Wall Street Journal this week described Auxin as “the most-hated solar company in America.

Wood Mackenzie has not yet fully assessed the likely impact on US solar installations. Before the investigation was launched, we already expected a slight slowdown, from 23.6 gigawatts installed in 2021 to about 22 GW this year, in part because of difficulties in the supply chain leading to rising costs. Sun expects the investigation to have a “significant” negative impact on that outlook.

The seriousness of the situation for the administration as it attempts to cut US greenhouse gas emissions was underlined this week by the Indiana-based utility group NiSource, which warned that “most solar projects originally scheduled for completion in 2022 and 2023 will experience delays of approximately 6 to 18 months.” Because of those delays, the company has had to put back the planned retirement of its Schahfer coal-fired power plant from 2023 to 2025. Other companies have similarly been talking about having to keep fossil fuel plants running for longer.

Concerned about the “massive disruption” being caused in the US solar industry, a bipartisan group of 22 senators wrote a letter to President Biden over the weekend, urging the administration to “swiftly review the case and make an expedited preliminary determination”. Imposing new duties could push up energy costs for consumers, undercut the growth of the US solar industry, and cost tens of thousands of jobs, the senators argued. But they suggested the biggest issue was the uncertainty, and “the longer this situation persists, the more acute the damage will be.”

There are other possible policies that could support US solar manufacturing without having such damaging effects on developers. The Solar Energy Manufacturing Act, passed in the House last year, would provide additional tax credits for manufacturers in the US. But it is unclear whether those provisions will be able to win sufficient support in the Senate, in particular from the influential Senator Joe Manchin of West Virginia, to pass into law.

His lack of a clear majority in Congress has severely restricted President Biden’s ability to make progress on his energy and climate agenda. Like President Barack Obama, he is being pushed towards using executive actions and regulations to implement his policies, because legislative routes are very difficult if not closed off altogether. The tools that are available often come with significant drawbacks, and the anti-dumping investigation is a case in point.

In brief

The European Commission has proposed a ban on imports of Russian crude and refined products, to be phased in by the end of 2022. Hungary and Slovakia are expected to be given exemptions until end-2023. The EU is also looking at sanctions to stop companies supporting Russian oil exports with services including insurance.

Ministers from the OPEC+ countries held another of their monthly online meetings, and agreed to raise their total production by 432,000 barrels per day in June, again sticking closely to the strategy of steady increases in output that they adopted last summer.

After Russia invaded Ukraine in February, the EU and US announced ambitions for more American LNG to be shipped to Europe. This week, there was significant progress in putting together the physical and contractual infrastructure needed to make that objective a reality. Germany’s government said it wanted to add four floating storage and regasification units (FSRUs) to increase its LNG import capacity, and Uniper held a “first pile driving” ceremony at the planned site for the first one. The aim is to have it operational for the coming winter.

Meanwhile, Engie of France and NextDecade signed the first Europe-US LNG deal since Russia’s invasion of Ukraine: a 15-year contract for 1.75 million tonnes per year from the Rio Grande LNG plant. The same day, Energy Transfer and Gunvor announced a 20-year deal for 2 million tpa from the planned Lake Charles LNG project. Tom Mason, President of Energy Transfer LNG, said Gunvor’s commitment to the project showed that it was making progress towards taking FID by the end of the year. Also this week, Cheniere Energy agreed a deal to buy gas equivalent to .85 million tpa of LNG, from ARC Resources of Canada, to supply Stage 3 of its Corpus Christi project in Texas.

The Engie deal with NextDecade was particularly noteworthy as a sign of how Europe’s attitudes to energy have changed radically in just a short space of time. In 2020, Engie pulled out of negotiations with NextDecade over a possible US$7 billion, after pressure on the French government from environmental campaigners over the use of US shale gas. After soaring prices and concerns about European gas storage being not adequately filled for next winter, those objections appear to have faded.

Rising US LNG exports over the past few months have been one of the factors behind the strength of North American natural gas prices. US benchmark front month Henry Hub this week rose to new highs for more than 13 years, at one point hitting $8.86 per million British Thermal Units. But as discussed in a recent Energy Pulse, increased LNG exports are far from the only influence that has driven Henry Hub higher. The decline of coal-fired power generation and E&Ps’ need to return cash to investors are among the other factors contributing to making US natural gas prices higher and more volatile.

BP and Shell reported strong earnings for the first quarter, helped by buoyant oil and gas prices. BP also announced an aim to invest up to £18 billion in the UK’s energy system by the end of 2030, in North Sea oil and gas fields, offshore wind, EV charging, hydrogen and carbon capture.

UK government ministers have sent somewhat mixed signals over the possibility of a windfall tax on energy company profits. When asked last week about a possible windfall tax, the chancellor Rishi Sunak observed that he could look at the idea, and added: “nothing is ever off the table in these things”. However, business secretary Kwasi Kwarteng this week said he opposed a windfall tax because it would discourage investment.

Other views

Andrew Latham, David Parkinson and Adam Wilson — What is the future of oil and gas exploration?

Europe’s energy mix in the spotlight

Lucy King — The global CCUS pipeline is growing fast – but not fast enough

Iain Mowat — Decarbonising global shipping

Quote of the week

“It will inevitably also require an acceleration of the energy transition for the mid-term. Because there is no way we can just bring more pipeline gas or bring more LNG and somehow replace all the Russian gas we currently consume. That is simply unfeasible. And I think we have to go significantly into energy conservation methods and strategies.” — Ben van Beurden, chief executive of Shell, gave his view on the implications of Europe’s goal of ending imports of Russian gas.

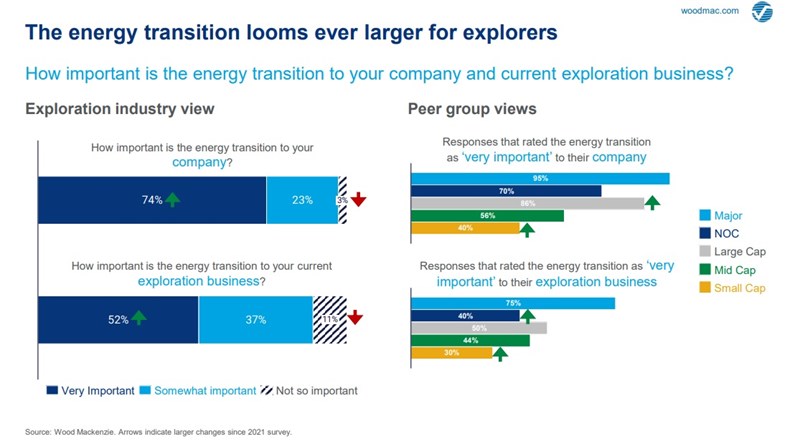

Chart of the week

Wood Mackenzie’s Future of Exploration survey 2022 is full of interesting charts, but this one in particular leaped out at me. It shows views on the significance of the transition to low-carbon energy for respondents, who are leaders in oil and gas exploration from around the world. As you can see, the proportion saying it is “very important” is high, and has risen since the previous survey. It varies according to company size, as you might expect, but in general the idea that people working in exploration don’t need to worry about decarbonisation goals seems to be a thing of the past.