Sign up today to get the best of our expert insight in your inbox.

COP28 preview: five things to look for

Paris reset or Groundhog Day?

5 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

What comes after the Permian for IOCs?

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

Latest articles by Prakash

-

The Edge

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Africa

-

The Edge

COP29 key takeaways

-

The Edge

Is it time for a global climate bank?

-

The Edge

Artificial intelligence and the future of energy

Elena Belletti

Vice President, Global Head of Carbon Research

Elena Belletti

Vice President, Global Head of Carbon Research

Elena leads our carbon research, working with a growing team to help clients accelerate their energy transition journey.

Latest articles by Elena

-

Opinion

Carbon management frequently asked questions part 2: offsets

-

The Edge

COP28 key takeaways

-

Opinion

What could COP28 mean for Article 6?

-

The Edge

COP28 preview: five things to look for

-

Opinion

Debut of the first EU carbon border tax

-

Opinion

How are oil and gas companies using carbon offsets to decarbonise?

Nuomin Han

Principal Analyst, Head of Carbon Markets

Nuomin Han

Principal Analyst, Head of Carbon Markets

Nuomin provides clients with insights into emissions and climate-related development.

Latest articles by Nuomin

-

Opinion

Forecasting carbon offset use to 2050: what you need to know

-

Opinion

4 key carbon policy developments from Q1 2025

-

Featured

Carbon markets 2025 outlook

-

The Edge

COP29 key takeaways

-

Opinion

Can CCUS momentum overcome headwinds to the industry?

-

Opinion

5 things you need to know about carbon offsets in 2024

Stephen Vogado

Senior Analyst, Carbon Policy

Stephen Vogado

Senior Analyst, Carbon Policy

Stephen focuses on carbon policy, taking a data-driven approach to help clients navigate the energy transition.

Latest articles by Stephen

-

Opinion

4 key carbon policy developments from Q1 2025

-

Featured

Carbon policy 2025 outlook

-

The Edge

COP29 key takeaways

-

Opinion

Stepping on the gas: the state of global methane policies and regulations

-

Opinion

Climate transition plans: time for companies to take action

-

Opinion

New rules and frameworks in global carbon policies

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

-

Opinion

What the US attack on Iran’s nuclear installations means for energy

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Fernanda Abarzúa

Senior Research Analyst, Carbon

Fernanda Abarzúa

Senior Research Analyst, Carbon

Fernanda’s primary focus lies in the offset market sector.

Latest articles by Fernanda

-

Opinion

5 things you need to know about carbon offsets in 2024

-

Opinion

2024’s carbon policy so far: four key takeaways

-

Opinion

Carbon offsets: key considerations for corporates

-

Featured

Carbon markets: 5 things to look for in 2024

-

Opinion

What could COP28 mean for Article 6?

-

The Edge

COP28 preview: five things to look for

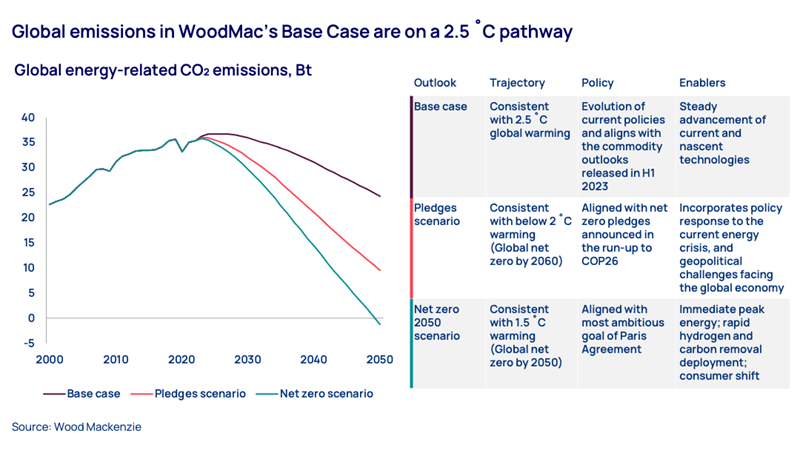

COPs start with high hopes but generally underwhelm on outcome and delivery – such are the complexities of achieving global consensus. The data continues to underline why COP28 is so important – 2023 is set to be the planet’s hottest year on record, while warnings mount of the catastrophic impact of global warming. Wood Mackenzie’s Energy Transition outlook predicts a 2.5°C warming pathway by 2100, well above the goals of the Paris Agreement, which sought to limit global warming to well below 2 ˚C.

Can COP28 deliver or will it be Groundhog Day? Here’s our team’s briefing on what must happen to keep the Paris Agreement alive.

1. Industry on the hook to pay for emissions

The first five-year global stocktake will deliver a comprehensive assessment, country by country, of the progress of individual countries’ nationally determined contributions (NDCs) to reduce emissions. It doesn’t read well – none of the 195 signatories is on target. There’s progress, but it’s not fast enough.

What needs to happen? COP28 needs to secure government alignment on more ambitious targets and effective delivery. It won’t be easy, since some leading countries have this year rowed back from prior targets, reflecting the domestic political sensitivities of pushing the low-carbon agenda following the war in Ukraine.

Assuming collective agreement is achieved, governments in turn must find ways to put the onus on individual sectors in the economy to pay to emit. Carbon taxes and carbon prices are some of the most cost-effective ways to do this but these are far from universal. Alternatives include tighter regulation and reducing fossil fuel subsidies.

COP28 will also host ‘focus streams’ on technologies and natural resources critical to scaling up the low-carbon energy system, including hydrogen, CCUS, nuclear power and key transition minerals.

The big emitting countries and blocs – the EU, China and the US – must take the lead; if not, others can’t be expected to do their bit. Last week’s joint statement by US President Joe Biden and President Xi Jinping of China offers some hope, reviving both the principle and the practice of cooperation between the two countries on energy and emissions.

2. Finance for the developing world

Capital has been dangled by developed nations – US$100 billion a year for mitigation and adaptation of climate change for the developing world was committed in 2009 and reinforced in the Paris Agreement. So far, delivery has fallen well short, though reached US$83.3 billion in 2020 and might hit the mark in 2023. The amount is set to be revised up materially in 2025, with estimates ranging from US$400 billion to US$1,300 billion a year in 2030. The new goal on climate finance is to be negotiated and finalised before COP29 in 2024. The findings of the global stocktake will be referenced to illustrate where countries stand versus their targets and what’s required to step up efforts.

Access to low-cost capital is critical for developing countries, where borrowing rates can be upwards of 10% as opposed to between 1% and 4% for rich nations.

The World Bank and the IMF maintain the special drawing rights (SDRs), a form of global reserve asset that can be swapped for cash at the central bank level for allocation to climate mitigation and adaptation efforts. The IMF used the method during the peak of the Covid pandemic and released US$650 billion; the same method is being proposed to close the climate finance gap in developing countries.

3. Tidying carbon credits markets

Article 6, which enshrined the rules for carbon markets aligned with the Paris Agreement, was a crowning moment of COP26 in Glasgow. Negotiation on COP28 focuses on Article 6.4, unfinished business from COP27 last year. Carbon credits, often generated in developing economies, currently lack clear rules to assess projects and measure emissions. Accounting is a grey area, the current lack of transparency limiting the value of credits and stifling development of the market.

We expect a tightening of the Article 6.4 rules to introduce a new mechanism for greenhouse gas emissions trading. Countries and companies alike will be able to buy international credits that will count towards NDCs. But the drawback is that countries will need to set up administrative structures to participate in the mechanism, and if the host is struggling to meet its NDCs, it could revoke companies’ permissions to trade credits internationally. We also expect that both technological and nature-based solutions will be allowed in the mechanism. Resolution of Article 6.4 should rebuild confidence in the carbon credit market.

4. Oil and gas companies brought in from the cold

The industry has an important part to play in the transition, not least delivering the low-cost, low-carbon oil and gas supply the economy will still depend on for years, and the capital to develop low-carbon energy.

There is also a specific and urgent ask of the industry at COP28. Oil and gas are responsible for up to a quarter of human-caused methane emissions. While some large companies have made commitments to reduce methane emissions, generally governments have not been tough enough – reduction targets are largely voluntary or tied to general emissions goals.

Back in the tent, there’s a golden opportunity for IOCs and NOCs to build credibility as agents for lower methane emissions by embracing more ambitious and binding commitments.

5. How to deliver success

The Paris Agreement was miraculous in aligning disparate countries and agendas to a common purpose. Seven years on, those good intentions are at risk of foundering on economic and political realities. An effective COP28 needs to restore that confidence.

If the UAE can galvanise the same spirit and enthusiasm of Paris, COP28 will be hugely successful.

Thanks to: Prakash Sharma (Energy Transition Service), Elena Belletti, Nuomin Han, Fernanda Abarzua, Stephen Vogado (Carbon Research), Ed Crooks and Gavin Thompson

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.